Wireless communication is one sector of business that has undergone phenomenal growth over the past few years. The number of individuals using mobile devices like cell phones, I phones, laptop and palm to computers has drastically increased even in the developing and third world countries. This growth in market has attracted a lot of attention in this sector attracting new entrants to compete with the traditional communication giants.

Monopolies are described in economics as the existence of a firm or corporation that has so much control over the market that they have a significant influence on whether a new entrant in the market will succeed or not and if they do enter, on what terms (Heywood and Guangliang, 2009). Monopolies are generally discouraged in most economies with laws put in place to regulate it. Certain monopolistic behaviour can sometimes play to the disadvantage of the smaller new entrants thus the need of regulation to avoid unfair competition.

Oligopolies on the other hand are markets whereby there are just a few product or service providers. This is normally characterised by stiff competition and marketing strategies that always have the competitor’s reaction in mind. Oligopolies have sometimes been perceived better than monopolies because the end consumer then has a sense of choice and the cost of products and services are self regulated (Heywood and Guangliang, 2009).

The wireless communication industry is probably one of the best examples of oligopolistic markets. For many years there have been just but a handful of wireless communication firms dominating the market. The main players have been Nokia, Samsung, Sony Ericsson and LG; but with growing markets, new entrants have been attracted into the market.

The i phone by apple is probably the best example of a new entrant. Apple focussed on great innovation to take mobile communication to a whole new level. They came up with the I phone that allows the users to get their e mails directly on their phone just like text messages while supporting all the other conventional phone features.

China has also come into the market with phones similar to the ones made by the original players. All these combined have put pressure on the traditional top players both in terms of pricing and innovation. The china phones are a lot cheaper but perform all the functions as the original phones plus extras like TV reception.

I do not however think that the competition can push out some players because despite the cheap prices, the cheap phones have some downsides like shorter lives and poor batteries. The traditional leaders are therefore almost guaranteed to keep the upper class markets.

The stock prices of the big firms are not likely to be affected because if the firms maintain top quality products then their reputations will remain protected. Reseller phones now available in the market are likely to work against the cheaper Chinese phones rather than the large firms because of the prices. The big firms in the market are only likely to change their strategies in separating their markets.

This they can easily achieve by dedicating a department within their firm to cater for the lower end market by providing good quality phones but at affordable prices.

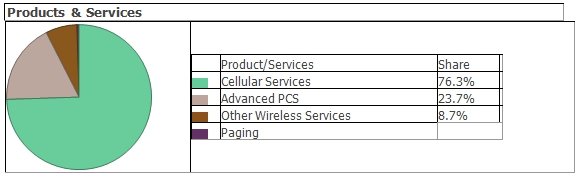

This would take care of the competition from china. They would also need to invest in innovation to counter competition from the ever emerging new technologies. They would also need to diversify their products to include other services. The graph below shows how these services were distributed in Japan (home of the giants in telecommunications industry) for the year 2009.

Products & Services

After all is said and done, it is the end consumer that is bound to benefit from all this competition and innovativeness because they will get quality products at affordable prices.

References

Heywood, J., & Ye, G. (2009). Delegation in a mixed oligopoly: the case of multiple private firms. Managerial and Decision Economics, 30(2), 71- 82.

IBISWorld. (2009). Products and services. Web.