Introduction

This feasibility report is based on a controlled study of identifying opportunities, market niches, economic obstacles, and as cost versus benefits approach to providing solutions for problems identified during the study. The report is a market feasibility report for WM Morrison Supermarkets seeking to open up a new branch near the university.

The purpose of this research is to identify problems and opportunities, determine objectives, describe situations, define successful outcomes, and assess the costs versus benefits associated with satisfying the market niche in the new area. The advent of the declining trade barriers and the liberalisation of trade have made it easier for supermarkets to open up new chains (Dibb & Simkin 2013; Wright 2012). Random distribution of the supermarkets associated with new market entries across geographical regions helps in the restructuring process.

The increase in demand in the food retail sector has presented the firm with an opportunity to establish new branches across the nation. Furthermore, the UK retail industry is characterised by an increment in the rate of mergers and acquisitions (King 2010).

This aspect has led to significant reduction in food retailing in different parts of the UK including the university and its environs (ValueExplorer.com 2014). This report presents the results of a feasibility study that explores the situation at the university and its environs coupled with the marketing objectives of the supermarkets’ retail chains in a bid to ensure that the business will become sustainable within the competitive environment.

Research questions

For the purposes of adequate collection of information from the field in the process of testing the hypothesis, a number of research questions will guide this research and they include-

- What products do youths often buy from convenience stores and supermarkets?

- Is Morrisons a lovable brand in the area?

- What is the image and effect of Morrisons’ policy on age verification before the purchase of alcohol?

- Does advertising play a big role or is buying influenced by peer pressure?

- How beneficial will opening up a new branch be for the residents and students in the area?

- What products should be stocked in the supermarket?

- What other services can be offered at the supermarket?

- What is the competition? Who is the competitor? What does the company need to do to gain a competitive advantage?

Company Analysis

The retail chain ensures that staffing requirements are excellent in order to mitigate costs and maximise profits while serving the interests of consumers. The firm appreciates the importance of product diversification in meeting the customers’ needs and expectations (Bloomberg Businessweek 2014). MRW specialises in the provision of food products, cloth lines, grocery, and kid’s products. MRW operates both superstores and convenience stores (The Financial Times 2014).

The company also endures a strong online network and a large online customer base, and thus it has an established brand that is recognisable across the nation (Neumeier 2009). Consequently, the supermarket is ranked amongst the fastest growing retail chains in the UK (Hegarty 2012). Furthermore, the firm is committed to ethical operations (Stonehouse 2009).

For purposes of this feasibility study, the retail chain wishes to open up a convenience store, as the population in the area does not meet the required demand to establish a superstore. However, the convenience store in this scenario will aim at satisfying the needs of the market based on the findings gathered. The new store is part of a project of expansion and restructuring in order to increase its profit levels.

Table 1. Source: (Morrisons 2014a)

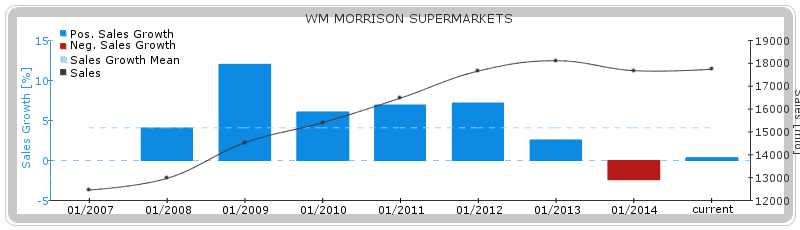

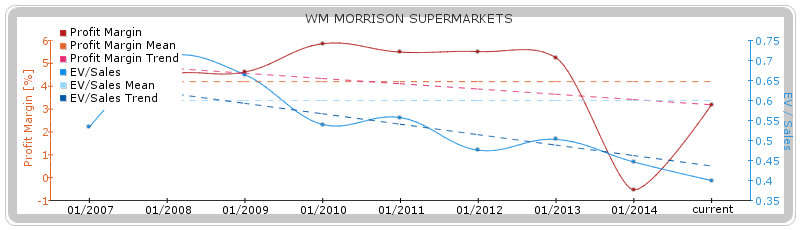

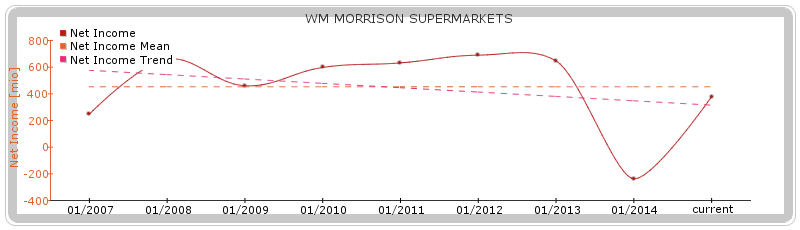

The graph shows that the firm’s effort to expand led to some huge losses in the last financial year. Currently, the company enjoys 12.2% market share, which represents a 0.1% decline relative to its 2013 financial year. Therefore, it is appropriate for the retail chain to expand and reach out to a wider market, seize new opportunities, and establish a sustainable business that will gain a competitive advantage over actual and potential competitors.

Methodology

Research design

This study adopted qualitative research design by conducting a survey on the target market. The decision to adopt this design arose from the explanatory nature of the study (Creswell & Creswell 2009). In order to provide the target audience with an opportunity to understand the research findings easily, the researcher also integrated quantitative research design.

Random sampling technique was used in selecting the study sample in order to eliminate bias. A sampling frame of one hundred respondents was picked randomly within the university and its environs. Fifty five percent (55%) of these respondents participated in the focus group discussion. According to Morgan (1997), focus groups are advantageous as adequate information is collected through discussion and it is not resource-intensive.

This study utilised primary and secondary sources of data in order to collect credible information from the field (Kopsova 2012). Using primary sources of data would improve the likelihood of establishing the existing market gap in the area and the available business opportunity. Qualitative interviews and questionnaires were used as the core data collection instruments in order to collect sufficient data (Rubin & Rubin 2005). The questionnaires were open-ended as illustrated in the appendix and focused on evaluating the respondents shopping habits, preferences, and shopping needs.

Findings and results

The forty five-minute to one-hour focus group discussions enabled the research to establish that the most highly demanded products were consumables, leisure items and services, trendy, and fashionable items. Out of the one hundred students, only two were below 18 years of age, the majority of the students were 20 years old and above, and the mean/ average age was 22 years across the university.

The age group was between 17-30 at the university and over 30-60 years in the neighbourhoods. Secondary sources of data showed that there were few small retail outlets around the university, thus increasing the likelihood of the firm succeeding in the area. Thus, the university and its environs provide a good market for consumables and a more complete line of products based on the estimated demand. The table below represents the final breakdown of goods based on data collected through primary research. It is an estimate of the potential demand, based on potential customer requests and needs.

Sixty percent (60%) of the respondents preferred to have groceries for the preparation of vegetarian dishes, salads, and as side dishes. On the other hand, 80% of the respondents in the focus groups said that they would prefer delicious items and frozen foodstuffs on weekdays to fresh produce such as meat due to lack of enough time to prepare one’s food in between classes.

As seen from the table, alcohol, tobacco, and candy are at a bare minimum due to the restrictions in the school environs regarding smoking and drinking in public. Most of the respondents (57%) in the questionnaire would like to have access to a food court that serves food, coffee, alcoholic beverages; an environment that makes them feel as part of the public, outside school.

Eighty-five percent (85%) of the respondents said that they are influenced by peer pressure. Therefore, their decision to shop for designer brands made them feel classy by giving them an identity above those who wore common things. This desire for a sense of importance is very common amongst youths.

Below is an analysis of the current market trends at Morrisons by value explorer on 9th May 2014 that clearly depicts that the growth, net income, and profit margins of the company are improving. The graphs show that customers are beginning to accept the improvements that the retail chain is implementing and that tapping into the new market will enable it to increase its market share, and thus increase in net income.

Conclusion and recommendations

The above analysis shows that the area is replete with a large number of potential customers especially the youth. Furthermore, the study shows the existence of positive perception towards the MRW amongst the target customers. Subsequently, establishing a retail outlet around the area will enable the firm to improve its sales revenue, hence its profitability. However, the firm should consider the following.

- It should diversify its product portfolio in order to increase the likelihood of customers developing a high degree of store loyalty.

- MRW should conduct a comprehensive market communication campaign in order to create a sufficient level of market awareness.

- Morrisons should ensure the health and safety of their customers.

Reference List

Bloomberg Businessweek: Wm Morrison supermarkets 2014. Web.

Creswell, J & Creswell, J 2009, Fast fundamentals; mixed methods research, development, debates and dilemma, Berrett-Koehler, San Francisco.

Dibb, S & Simkin, L 2013, Market segmentation success; making it happen, Routledge, New York.

Hegarty, R 2012, Grocer of the year; Morrison’s forges ahead despite blips. Web.

King, B 2010, Bank 2.0; how customer behaviour and technology will change the future of financial services, Marshall Cavendish Business, Singapore.

Kopsova, M 2012, Feasibility study report writing; PricewaterhouseCoopers Academy.

Morgan, D 1997, Focus groups as qualitative research, Prentice Hall, London.

Morrisons: Stories behind what matters; annual report 2014a.

Morrisons: Preliminary results for the year ended 2 February 2014b.

Neumeier, M 2009, The designful company; how to build a culture of non-stop Innovation, Peachpit Press, New York.

Rubin, H & Rubin, I 2005, Qualitative interviewing; the art of hearing data, Sage Thousand Oaks.

Stonehouse, C 2009, Mother is refused wine at Morrison’s – in case daughter, 17, drinks it 2014. Web.

The Financial Times: WM Morrison supermarkets; about the company 2014. Web.

ValueExplorer.com : simply the web’s best value stock screens and analyses; wm morrison supermarkets 2014.

Wright, C 2012, Tesco slides again in latest Kantar rankings. TheGrocer. Web.