- Introduction

- A Short Summary of World Trade Organization

- Saudi Arabia’s Membership in the WTO

- Positive Impacts Locally

- Negative Impacts Locally

- Positive and Negative Impacts Globally

- The Improvements and Opportunities on the Businesswoman

- Long Term Expectations for the Different Sectors after 5 Years

- Conclusion and Recommendation

- References

Introduction

The purpose of this report is to assess the impacts of the World Trade Organization (WTO) on the economy of Saudi Arabia, and this report concentrates on background of WTO, the positive and negative influence of WTO on different sectors.

A Short Summary of World Trade Organization

Background to WTO

The World Trade Organisation (WTO) is the platform established by the victorious nations of the World War II as a long bargained outcome of GATT to ensure the open opportunity of free market entry for the developed countries in the market of less develop and backward nations. At the conclusion of World War –II, the winner countries urged to establishing some institutions those would negotiate and mitigate the conflicts of the developed nations to capture the global market and to make backward nations bound to provide hindrance free market entry for them. The major motivation of the Great Wars were the competition to capturing foreign markets by the imperialist countries for unfair trade and exploitation and the concluding principles of the WW – II (World War II), were tenacity of resolving and put a stop to war by means of the UN (United Nations) to removing the economic conflicts by founding global organisations for economic negotiation.

Introduction, Establishment, Membership

Crowley (2) pointed out that, though the WTO has formed in 1995 as a new global organisation, it has rooted from the Bretton Woods Conference of the finance ministers of winning nations towards the end of WW – II (World War II), where the ministers urged for a new global monetary system to prop up post-war modernisation, economic conflict resolution, and establishing peace. The outcomes of the BWC (Bretton Woods Conference) at first glance generated two of the most significant international organisations such as ‘International Monetary Fund’ (IMF) and the second one is ‘International Bank for Reconstruction and Development’, which has later shaped as ‘World Bank’ and the third one is ITO (International Trade Organization).

Due to non-cooperation of US government for ITO, ‘General Agreement on Tariffs and Trade’ was introduced in 1947 with twenty-three introductory members to a settle rules of governing trade among the countries in a decreased import tariffs for the members which turned into 123 countries in 1994 until abolish. The GATT had enacted as a treaty without establishing any formal institution, but included a diminutive secretariat in Geneva with very a few institutional tools to bargain, negotiate different dilemmas among the members, and to rising different barriers for the non-members that would motivate them to joining in this accord.

In 1950, USA has withdrawn its membership from ITO demanding major rectification that speeded up the necessity of alternative platform and in the Uruguay Round of GATT in 1994 has urged to establish World Trade Organization (WTO) that came into execution in 1995 by replacing GATT with US support.

All countries or customs territories of the globe that has occupied sovereignty to carry out of its own trade policies and agreed to comply with the terms and conditions of WTO would be qualified to becoming a member of the organization through a four-stage process (WTO, 1). At the first stage, the government of the applying country would place a memorandum of understanding regarding, then negotiate tariff rates, market access commitments with others, get consents from the existing members, signing protocol to joining WTO. All member countries would enjoy the opportunities of the WTO system and must follow the obligatory terms to liberate tariff barrier to ensuring the market access by other members arguing as a means of balance of rights and obligations, no matter how the national economy would be distressed or not.

WTO (1) mentioned that the organisation started its journey with 128 members of GATT who were the signatories of Uruguay Round and the number of current member countries is 153 accounted on 23 July 2008. The organisation also has 31 observer members who are capable to start attainment with WTO negotiations contained by five years of having observers’ member (WTO 1). After a long discussion, like other members, Saudi Arabia gets the member of WTO at the end of 2005.

WTO Profile

The WTO is a single international trade organisation that operated and administered trade affairs among diverse nations globally, born in 1995 after long negotiation of the Uruguay Round (1986 – 1994). Key function of the entity has to negotiate and sign of massive global trade projects and additionally, ratify bin the parliaments. Alternatively, goal and objectives of the WTO is to provide support to the producers in order to export and import of goods and services (Lonympics 1).

Table: Key dynamics of WTO. Source: Lonympics (1).

Saudi Arabia’s Membership in the WTO

Summary about the Saudi economy and the different local sectors

Bertelsmann (13) pointed out that the development plans of Kingdom of Saudi Arabia have emphasised to back up its emergent private sector with significant importance on non-oil sectors along with rising effectiveness in the industrial sector of the country while the concurrent long term planning (Eighth Five-Year Development Plan (2005 – 2009)) has centred on growing FDI inflow, escalating economic diversity, and improving education and human resources. KSA (Kingdom of Saudi Arabia) has announced the largest budget. The kingdom’s ever-prevalent budget of US$ 126.7 billion in 2009 pointing to the increasing job opportunities both in public and private, acceleration of education, social services and technological enhancement as well as Information technology integration while the central bank of KSA aliened to utilise the tools of monitory policy to overcome the impact of global financial crisis.

It is remarkable that the KSA has increased government expenditure for 15.8% while the national budget has sharing out 36% above allotment than the previous year and the budget has also allocated huge amount for housing, social security, non-oil export and agriculture including the improvement of Human Development Index and gender equality. Bertelsmann (14) added that the HDI (The Human Development Index) of KSA is 0.812 and it has placed at the 61st position in the global index and stands at 92nd position out of 93 countries for Gender Empowerment Measure of the country.

However, Saudi Arabia is one of the economic powers of seven members of the GCC (Gulf Cooperation Council) and their economy is purely base on oil and petrochemical industry. More specifically, rapid economic growths of Saudi economy are mostly draw and developed by oil production and import and in addition, globally, Saudi is the largest oil producer as well as importer. Alternatively, 90 % of Saudi national export occupied through the oil industries and almost 75 % annual government revenue earned from this segment. Moreover, one fourth of global oil reserve has kept by Saudi, which is around 263 billion barrels. In describing Saudi economy, here it has to pointed that by constructing and joining in the GCC, Saudi has succeed to foster their both regional economic expansion as well as regional peaceful co–operation. Here are the common economic facts of Saudi Arabia (BNEA 1).

Table: Saudi Economic Profile. Source: BNEA (1).

Since, Saudi Arabian economy grounded on oil-based industry, their economic planning has rather emphasise on foreign investors in order to diversify their economic sectors. Following are the most significant local economic segments of Saudi economy. (OSEC 4)

Oil & gas

With direct involvement of government Saudi always intent to make proper use of Nation’s natural gas, petroleum and petrochemical sectors and as a result, they achieved tremendous oil production capacity of 10 – 12.50 million BPD (Barrels per day) with an investment of US $ 50 billion. Though during global economic recession, petrochemical projects cost had little bit slowdown but the Saudi Aramco efficiently perform to continuing new ventures and these generates three (Khurais, Nuayyim and Shaybah) new oilfields during June 2009 commencing oil production.

Financial service sectors

Saudi capital market is a significant sector of their local business areas and recently they have approved new Capital Markets Law to encourage more foreign investments. This law has more emphasised on the Stock Exchange where non–banking financial intermediaries has already issued by the CMA (Capital Market Authority).

Engineering services

Being a member of GCC and the WTO, Saudi Arabia has already captured major portion of the engineering services market of GCC members. Alternatively, foreign consulting firms have flexible scope of establishing their service centres with or without local partners but in this case, foreign equity should not exceed 75 % of the partnership of the total investment.

Health care and medical equipments

Local healthcare sector of Saudi has earned satisfactory growth in recent years, and meet increasing demand of medical equipment as well as superior healthcare services, Saudi intend to increasing their investment within 2013 from US $ 2.64 billion to US $ 3.48 billion with an expectation of annual growth of (7–12) percentage within 2012.

Pharmaceutical products

Consciousness for better pharmaceutical products of Saudi people has radically developed greater than before, Saudi local pharmaceutical market condition is not yet satisfactory since 98 % of medicine, and other pharmaceutical products needed to import.

Insurance sector

Within last decade insurance market specially health insurance and motor vehicle of Saudi has developed and improved as a safeguard against risky workplace and the end of 2011 total market value of this sector has expected to grow US $ 40 billion.

Transport

In the area of construction especially at transport system (roads, marine ports, rail network and airports), Saudi has superior efficient network to connecting their core commercial plans and projects. In recent years, SARO (Saudi Arabian Railway Organisation) has taken initiative to constructing new railway networks in order to modernize their current local business track.

Electrical power generation equipments

Globally, Saudi is one of the strongest as well as attractive markets for consuming highest volume of per capita power. A recent government circular announced that within 2012, Saudi industry consumption would demand 50,000 MW for the next twenty years and to meet the increasing demand government policy planned to invest US $ 30 billion State’s power generation projects with 7.0 % annual growth rate.

Water resource equipment

Like other natural resources, pure water supply is another demanding local sector of Saudi and government has efficient to produce daily 2.20 billion litters (Annually more than 1 billion cubic meters) form their 30 desalination water supply plants and in addition, to reassess water tariff government has already taken policies to encouraging State’s water projects.

Telecommunication services

A local telecommunication sector of Saudi is another dynamic local business segment since through privatisation in 1998 and additionally, the STC (Saudi Telecom Company) has currently handled major local telecommunication projects. However, now Saudi telecommunication cannot achieve absolute market growth but entrance of more local and foreign operators would make Saudi the global second largest telecom operators by growth rate and market volume.

Building construction market

With a fierce local competition, Saudi construction market is enough robust for building construction and supply of building products and services.

Processed food and beverage

Locally, Saudi has large scale of processed food (dairy products, meat processing, snack foods, beverages, bread, biscuits and confectionery) manufacturing plants and with their trade partner UAE; several famous foreign companies export those worldwide.

Foreign education and training institutes

Recent Saudi government ruling has paid attention on international education curriculum and training infrastructure by issuing nineteen licences for the international school, 36 college and other higher education campuses here.

The governmental aim of joining the WTO

13 December 2005 Saudi joined in the WTO as their 149th member after long negotiation of twelve years. Common function of the WTO has to deal with inter-regional trade-offs and additionally, execute as a chief arbiter of global trade clashes. Whenever it was ideal time for Saudi to participate in the global free economic system, Saudi had face great challenges and crisis of business standards to improve their productivity as well as professional efficiencies. Regarding this dilemmas, Saudi government has defined the accession into WTO as an evaluation of turning towards global economy with aspiration of greater range of transparency and accountability. Alternatively, motivation to join in WTO has also considered as generating of higher investment flow as well as vacant of significant number of job scopes. On the other hand, local investors and business holders have also optimist about State’s economic reformation through radical economic changes. Here are the two major governmental motivations of joining WTO (Saudi Arabia News 1).

Higher inflow of FDIs (Foreign Direct Investments)

Government’s first motivation to positively respond towards entrance of WTO to attract higher FDIs for the development of existing oil production and oil industries as well as expansion of Kingdom’s diversified economic sectors. More specifically, expansion of export sectors through prioritizing State’s local petrochemical industries. On the other hand, competitive price of Kingdom’s natural gas is also an attractive market for the foreign investors and in addition, government has already accounted that Saudi energy sector has grown exponentially with 7 % annually to meet global supply of both principal and intermediate petrochemical products and services.

Expansion of Banking Service Options

Expansion of foreign baking service is another prime motivation of Saudi government to be member of the WTO and current scenario of Saudi foreign sectors has exhibited that there has significant number of foreign licensed banks branch with a foreign equity of 60 % with was 40 % before finalization of WTO membership. For instance, BNP Paribas of France has already established their branch in Riyadh and in addition, announced to open additional new two branches in Saudi as soon as possible for more competitive market.

Positive Impacts Locally

WTO membership has many positive Impacts on the different sectors of Saudi economy; such as, Saudi market is now fully open to external markets, establishment of the Supreme Economic Council, and other similar councils, and the government has passed a number of legislation to organize the Saudi market for implementation to the agreements laid down by WTO. However, Saudi Industrial Development Fund stated that KSA’s accession with WTO is usually expected to assist the amalgamation of the Saudi market into the global market, and intended to increase foreign direct investment, reduce unemployment rate, and develop the industrial sector of this country by escalating Saudi products and services’ capacity to reach global markets.

- The KSA’s membership of WTO would create the scopes to increase earning from exports in external markets and this accession will protect Saudi Arabia against unilateral measures, anti-dumping duties as well as biased commercial policies implemented by other countries;

- Though, Saudi customers would also enjoy the advantages of competitive prices, high quality products, and freedom of choice from diversified product line, but open market makes the local companies to be more careful and efficient in the production department to compete with foreign companies;

- Saudi Arabia has maintained stable regulatory system and followed international financial standards, which strengthen banking sector;

- In addition, joining with WTO will encourage to reform the present financial program to develop Saudi economy (SIDF 1);

- Saudi Industrial Development Fund reported that implementation of the investment related agreement would form favourable situation to attract investment inflows, and according to the WTO report, Saudi Arabia was the top recipient of FDI in the GCC countries;

- In addition International and local companies will enjoy greater flexibilities and diversification opportunities, improvement of accessing monetary assets, composition of greater competitive advantage, opportunity for both partners for meeting goals, sharing of modern technologies with raw materials, achievement of economies of scale through size facility, scope of offering preemptive competition, potential influence on government policies, and so on.

However, the accession of WTO has positively influenced the following sectors to shape the Saudi Economy, for instance

Oil and Gas Sectors

Saudi Arabia is the largest oil producer and major suppliers to the US, Europe and Asia and it has already discovered more than 21.0% of the world oil reserves or possessed about 264.1 billion barrels, which considered light, extra light or super light grades of oil; moreover, it has 110 major oil and gas fields along with nine operating refineries. In addition, it is important to mention that oil revenues constituted 85.2% of total revenues in 2009, which influence to develop the operation of other business sectors, for example, a large number of foreign banks started their operation in this country to take the advantages carried out by the expansion of Saudi economy resulted from growing oil revenues.

However, the World Trade Organization has influenced the Saudi authorities to set up a guiding principle that would support the foreign companies to collaborating with of Saudi oil companies to increase production, for instance, long-term joint venture agreement between Sinopec (50%), ExxonMobil (25%), and Saudi Aramco (25%) worth $3.60 bn would held to supply crude oil for the new plant.

On the other hand, Saudi Arabia has been enjoying stable growth in the natural gas sector by successfully utilizing 15% of its total gas reserves and it would be possible to increase the gas production if the oil production is increase gradually; therefore, the accession to WTO would help to boost both oil and gas segments and develop national economy.

Aljarallah conducted a survey to assess the impact of WTO on oil economy, and he found that 50% of total respondents believed that oil-producing countries including KSA had not experienced any particular advantages, 30% respondents stated that it would increase trade, and only 20% respondents said that agreement with WTO provides the opportunity to create new market for the products.

Petrochemical Sectors

Saudi Basic Industries Corporation (SABIC) is the largest petrochemical producers in the Middle East, which established as a non-oil company in 1976 by means of royal declaration alBong with the explicit aim to accumulate value to the hydrocarbon wealth of KSA because byproducts of oil and gas have no direct consumption or market value but left as waste. SABIC also supports the concept of internationalization to return highest value to the stockholders or maximize profit from global operation and it has already captured share in world’s most lucrative market including Europe, America, and Asia.

However, This company had to develop its technological infrastructure due to accession of WTO, for instance, it integrates advanced PP Ziegler-Natta catalyst (TiNo) in polymer plant in 2009, and it uses α-SABLIN® technology to commercialize Linear Alpha Olefins (LAO) in chemical market by taking help from Germany. SABIC would like to diversify its product line by sharing raw materials and taking technological help from other foreign companies, for example, acquiring 100% stake in Huntsman Petrochemicals (UK) Ltd by $685m in cash help SABIC to enter UK market and capture the European petrochemical market, and assist to reduce operating cost and minimize business risks from expropriation and nationalization. However, the following examples show the achievement of SABIC after Saudi membership in WTO

- SABIC generates more than 85% of total sales profit from international petrochemical market, particularly in the Far East, where the company is capable to supply its plastic with other items more cheaply than the local competitors;

- In addition, SABIC had signed an agreement with Sinopec Corp to form 50:50 equal share joint-venture company to enter into the Chinese market, which will enhance the function of this petrochemical company because it would like to establish a manufacturing centre for Asia Market;

- Moreover, it has contracted with a famous Italian company Technip in order to share engineering and construction services, and it entered a contract with Japanese company named “Toyo” to develop supply chain management in ethylene and propylene segment.

The membership of WTO positively influenced petrochemical industry because

- Al-Sadoun (1) pointed out that the removal of trade barriers due to WTO bylaws extremely help the petrochemical producers to export at lower prices in the tariff-protected zone, for instance, European, American, and Japanese markets;

- In addition, producers will increase production considering the demand of external market because EU declined from 12.50% to 6.50% tariff on polymers;

- New business environment influenced the management to reduce production and operation cost, increase proficiency level, reduce profit margin, and so on;

- A number of WTO regulations on chemical tariffs and other connected agreements both positively and negatively influenced the petrochemical industry; for example, HS (Harmonized Commodity Description and Coding System) provided the list of product categories, and uniform tariff classification system, categorize imported goods for functioning the duty and tax collection;

- It is important to mention that the Chemical Tariff Harmonization agreement has positive impact on petrochemical industry though it has no influence on oil industry;

- The Doha ministers-initiated negotiations on the non-agricultural market entrance intended to open trade on non-agricultural products, which incorporate chemicals;

- Over 20 countries have signed CTHA (The Uruguay Round Chemical Tariff Harmonization Agreement) which derived from chemical industry proposal and some nations implemented the provisions of the agreement aimed to reduce the tariff rates below the harmonization level, or remove entire tariffs;

- Aljarallah (108) stated that the government of Saudi Arabia will implement growth strategies in order to develop petrochemical industry; in addition, they would like to diversify product range, enter more joint-ventures with large market competitors, concentrate on the identification of current problem and research projects, and improve the quality of the products;

According to the survey report of Aljarallah, about 80% of the total respondents argued that WTO accession has positive impact on the Saudi Petrochemical industry while only 20% stated that this industry has to face unlimited challenge in the local market. On the other hand, more than 65% of the respondents stated that higher entrance to international market will assist Saudi Petrochemical industry to expand and achieved its goals, but 25% respondents opposed this view because affect on the petrochemical industry is ambiguous while WTO offered no particular concession to this industry. More than 95% of the respondents stated that membership to the WTO will assist the country to boost the exports of petrochemical products, and only 5% respondents said that it has no significant impact on this industry; however, majority respondents gave importance on the low rate of tariff to analyze this issue.

Industrial Sector

Saudi industrial segment would affected by following way

- Saudi Industries will positively enjoy administrative facilities and competitive advantages in case of exporting product in the external market, for instance, Saudi Petrochemical industries has prospect to capture large shares global market due to have availability of hydrocarbon materials from oil and gas;

- As the competition for local industry is too high, they have already took measure in order to provide higher quality at lower price and achieve certificates for maintaining international standards;

- The membership of WTO will increase industrial investment to develop technology, manufacture import-substitution products, and boost exports to compete with international industrial sector;

- The government of KSA has already taken measures in order to encourage and support of FDI inflow in the industrial sectors but the authority should also concentrate on some other factors connected with infrastructure and security;

- On the other hand, construction industry experienced few advantages like Multinational Company can enter in the market only buying minority portion of shares, land price is lower for local companies, minimal rates of utility services, and no duties attributable for exporting construction materials, and machineries.

Service Sectors

Insurance

Due to the agreement with WTO, the government of KSA is committed to permit the foreign insurance companies to enter this market and operate its branches directly or establish locally incorporated cooperative insurance joint-venture companies; in addition, existing companies would be able to carry on their business during the transitional period with new services.

Banking Sector

According to the report of Saudi Industrial Development Fund, the Saudi authority committed to open its banking segment for the foreign competition, so, the government has passed new legislation in order to ensure the optimistic business environment that facilitated these banks to keep 60% ownership by foreign banks and rest for local. SIDF further added that the government had issued licenses for ten foreign banks (like HSBC, French BNP Paribas, Deutsche Bank, Swiss Credit Suisse etc) to start operation by opening direct branches while new legislation would empower foreign banks to keeping original name, engage in financial brokerage, uphold management responsibilities, allow for asset management, and enjoy similar treatment like local banks.

Telecommunication

Mahdi (1) stated that Sudi Arabia has to allow up to 70% foreign equity ownership in the country’s telecommunication segment within three years from its accession but public communication services have to provide by the join-stock company, and Alsayrafi (1) argued that entire telecommunication industry will experience robust growth but earlier government monopoly STC (Saudi Telecom Company) would lose additional market share.

Intellectual Property Rights

Moreover, the protection of intellectual property rights is a key promise for the Saudi Arabia under WTO regulation because this country committed to restore investors’ confidence by protecting their technological investments Intel Corporation and SAGIA (Saudi Arabian General Investment Authority) jointly effort $100.0 million venture capital fund to invest in technological firms, which are operating in or connected to the Saudi market.

Agricultural Sector

The KSA has significantly amplified market entrance for agricultural and processed food products by decreasing tariff, reduced limitations on distribution, and established a new SPS (Sanitary and Phytosanitary) Regime in order to implement the WTO agreement and meet the global standards by withdrawing controversial “Shelflife” standard and replacing it with the broadly used concept of “use-by” dates. The government of this country has also tried to check and take all other SPS measures, WTO recommendation regarding this sector, eliminate contradictory issues, establish a “Standing Committee” on SPS Measures in order to demonstrate the interest of the government to comply WTO regulations.

Negative Impacts Locally

The Negative Impacts on the Different Saudi Sectors are

- Local companies has to face severe challenge with their products as it would be easy for the international companies to enter Saudi Market due to the agreement with WTO; so, many small companies may fail to carry on their operation in such pressure while multinational will offer quality products at low cost;

- Taking the political and economic credence of Saudi Arabia into consideration, its membership of WTO will permit it to work alongside with other nations possessing analogous interests (emerging economies are primary amid them); in such context, the KSA can use economic strength and manipulate to exploit the globalization movements to its own advantages to the extent that is possible.

Oil Sector

SAMA (26) reported that Saudi Arabia has experienced significant development in spite of the recent global economic downturn and the reduction of the oil price in international market; for instance, Saudi economy has not seriously affected though the average price of Arabian Light descended by 35.2%, and the Kingdom’s daily average oil production reduced to 9.2 million barrels per day. However, initial data of the CDSI (Central Department of Statistics and Information) point out that GDP at current prices (include import duties) evidenced a reduction of 21.2% to Rls 1,409.1 bn and actual oil revenues also declined of 55.8% to Rls 434.40 bn in 2009; as a result, the expansion rate of the oil sector GDP has also fell by 37.9% to Rls 671.10 bn.

Petrochemical Sectors

- It is easy to say that lower tariff will help the petrochemical industry to offer at lower price but practically the number of local petrochemical industry will exit the market if they fail to reduce production cost or offer lower price in this competitive market;

Industrial Sector

Small and Medium Enterprises (SMEs) could confront a large degree of challenges for the reason that interest in these industry-sectors is a comparatively recent development in Saudi Arabia, and the country are still has inadequate marketing and technological development, which is reflected in poor competing capacity both internally and externally. Furthermore, consistency by the means of global principles seems to be an imperative challenge to these sectors, particularly at this time when the regime has devoted to put into practice the deals such as the TRIPS agreement with the World Trade Organisation.

- It would be difficult for high-cost manufacturers in these economies to meet the lower market prices caused by the tariff diminutions and in short-run, they may diminish their production levels and possibly sell at a lower profit margin or at a loss; the petrochemical output in these economies may consequently decline less proportionately than prices. In long run, high-cost manufacturers could egress the industry and thus lessen the number of manufacturers; in reverse, the amplification in demand caused by the lower prices will promote Saudi petrochemical exports.

Service Sectors

MEP (335) argued that the financial service sector of KSA has demonstrated effectual quality and regulation up to seventh dive years planning, but from 2005 by becoming the member of WTO the financial service sector of the county continuously facing the challenges crop up from internal and external forces. They further pointed out that the reality of WTO has thrown the financial service sector of KSA with foremost confronts to address the mounting necessities of financial resources to accelerate private sector and let it to facilitate to creating new job opportunities and financing the local capital market. The implication of the WTO framework of business, KSA needed to amend some existing commercial laws and to some extend it would demand to introduce new legislation such as reformation of Banking sector, effective capital market law for both regulation and operation.

- The services sector (for example insurance and banking) has anticipated to be amongst the first sectors that can confront influences by the KSA’s membership of WTO; on the other hand; the share of foreign partners in commercial banks has programmed to be augmented by sixty percent. In addition, foreigners have expected to be allowed to figure out cooperative insurance companies – as a result, rigorous efforts are required to develop this sector; this can be attained by promoting foreign investment in this area and engaging commercial banks functioning in KSA to modernize their plans and configurations and get occupied in acquisitions to meet challenges of antagonism.

Agricultural Sector

MEP (133) pointed out that throughout the Five Year’s Development Plan up to 1999, the country has gained a real growth of 3.2% per annum in its Agricultural sector including its Forest and Fisheries sector, but it has reduced 5% to 5.3% within 2004 to 2009 and it may considered as a simple impact of KSA’s integration with WTO.

Positive and Negative Impacts Globally

Impact on Asian Emerging Economy

Pérez-Solla (8) argued that the activities of the World Trade Organisation have both optimistic and pessimistic impacts over the Asian emerging economies like China and India. Bhat, Atulan and Mahua (21) stated that according to conformist conjectures, trade liberalization should have benefited the Asian emerging economies more than it benefited leading industrial nations; nevertheless, the trade liberalization actions of the WTO is ought have a greater impact in terms of trade of nations joining the larger integrated global economy than on member nations. It has suggested that the more the change in the terms of trade, the bigger the gain in GDP per capita of the emerging economies – however, the reality is quite different from the proposed theory because since 1940s, the General Agreement on Tariffs and Trade openly exempt low-income nations from the need to dismantle their import-barriers and exchange-controls (Pérez-Solla 14).

The GATT agreement reduced the GDP of today’s emerging economies below expectations, but the permission was unambiguous with the anti global principles customary in former-colonial Asia, where the great depression smacked hard causing the subsequent rounds of liberalization over the first two decades resulting in GATT to bring freer trade and gains from trade mostly to OECD member-states (Dubey 22).

However, Wong (4) suggested that these facts do not demonstrate that late 20th century globalisation preferred developed nations, rather, they demonstrate that globalisation favoured all (industrialized) nations that liberalized and penalized those (pre- industrial) who did not; moreover, some researchers evaluate trade and exchange- control rules in the 1960s and 1970s by considering typical partial- equilibrium estimations of deadweight losses.

It is arguable that in many instances, the emerging economies like China are believed to have benefited from the operational activities of the World Trade Organisation in numerous ways; for example, the country’s attainment to WTO and the resultant declining barriers on import of many foreign products has created extreme concerns to some nations of Southeast Asia (Wong 15). As a new member-state of WTO, China is capable to export more products to the rest of the globe, and these products could contend unswervingly with the ones from Southeast Asia – these worries has based on the proposition that trade liberalization allows China to allocate more of its resources in the exportable segments, leading to development of its exports. According to Bhat, Atulan and Mahua (36), China and many of these Asian countries export similar products and this country, together with some of these Asian regimes compete in similar markets; on the other hand, as the labour costs in China are lower, making the Chinese products competitive (or too competitive) in the third world markets (Dubey 19).

In the Asian emerging economies, trade complementarities can enlarge in two main methods, which are intra- industry trade and inter- industry trade between the two economic territories; in addition, three sorts of indices, to be precise, complementarities index, trade overlap index, and Grubel- Lloyd index, could compute the capacity for trade cooperation as well. All the three indices illustrate that in Indo-China bilateral trade, intra-industry trade seems to play a minor role as there is a huge gap between Chinese import need at individual product level and India’s export to that nation; the revealed comparative advantage index-value demonstrates that India has an advantage over its competitors in primary-products, natural resource, or low-technology manufacturing products. Furthermore, it has identified that India has an advantage over other nations in terms of product groups such as textiles, leather products, engineering, and granite; conversely, India could gain higher market share due to complementarities in product groups of food products as well; nevertheless, India is unable to capture a large share in the Chinese market.

Impact on Sahara & sub-Sahara

Mosoti (34) argued that the conclusion of the Uruguay Round of multilateral trade negotiations was a turning point in the history of global economic relations; apart from accompanying in WTO, the member-states approved to 14 substantive-agreements, many of which specified the exposure and appliance of further general-provisions in GATT that conveyed a definite impetus to the course of further economic-liberalization. While GATT enclosed trade in goods and merely applied to a restricted degree on farming and fabric products, the WTO comprises trade in services and academic asset rights, with trade in all goods, comprising other products of Africa; moreover, there have been strong endeavours to enlarge the WTO’s contact into other areas, for instance, investment, government procurement, and trade facilitation. According to Osakwe (12), though the exemption of trade-facilitation above which World Trade Organisation’s member-states have by now decided to consult, suggestions for negotiations in the erstwhile regions have convened with inflexible confrontation from emerging economies; in this context the Africa Group (AG) in Geneva has played a key role in such areas.

The AG is Geneva-based African trade negotiators formed at the end of Uruguay Round to facilitate African nations pool-up their inadequate human resources jointly and shield their common-interests in multilateral-trade-negotiations; configuration of the AG has augmented the bargaining-power of African countries in the negotiations and made it possible for them to discuss with one voice on important issues (Jauch 13).

The group, under the leadership of the African-Union has been relatively effectual in forming alliances to guard Africa’s interests in specific phases of negotiations; for example, during Fifth and Sixth WTO Ministerial-Conferences in Cancun and Hong Kong respectively, AG created the G-90; because of this new alliance, developing nations fruitfully opposed the launching of negotiations on some issue during conference. African nations were mostly absent as players at WTO dispute settlement system in its first decade fueling factors like low-volume trade – 2% of global-trade with export-base characterized by non-contentious single unprocessed-commodities, and complicated and expensive dispute-settlement system; confident assessments of the functioning of dispute-settlement system however cite the superior relative involvement of developing countries when taken as a group. Even though these pretenses off-centered the scenario of developing country partaking, it designates the rising potency of some emerging economies that are energetically utilizing the system to unravel disputes and leverage-influence in enduring Doha-Round of multilateral-trade-negotiations; while confronting peculiarities of developing country attachment, level of participation and articulated concerns of the African Group of countries in the WTO remain absconding.

WTO negotiations influencing fisheries industries in Africa have taken place under a range of courses like tariff negotiations under NAMA and subsidy negotiations under the ‘Negotiating Group on Rules’; the objective of the Doha Round in regard to tariffs is their negotiated diminution on a number of sets of goods, as well as fish and fishery items. In general, one vital issue for African fish-exporting countries is not to obtain lower tariffs in their principal export markets, but to avoid tariff preference-erosion; successful round of WTO-negotiations on reducing or abolishing fishery tariffs would be highly problematic; however, South Africa is an exception as it faces MFN tariff in the EU and might be benefiting from fishery tariff-reductions.

Impact on Developed Countries

Major functions of WTO

Major functions of WTO included, administer WTO trade agreements among different nations by constructing trade forums for trade negotiations. Conversely, the WTO has also assign to mitigate trade disputes regional and international among different nations. Monitoring intra and cross-border trade policies in order to establish member country’s technological support as well as provide necessary support for development training programs and finally, make cooperation among other international trade and humanitarian entities.

Major benefits

Key benefits that provide by the WTO trade programs included that WTO negotiations manners are effective promoting tools for the developed countries to establishing regional and international peace and in addition to handling disputes through constructive strategies. On the other hand, business entities have greater opportunities to enjoy easier life cycle. Alternatively, freer trade has the efficiency to effectively cut costs of trade maintenance and in the area of product and service their trade agreements have offered large scale of product and service line as well as generate larger revenue volume to the producers. Member countries have got benefited through stimulating economic dynamics and consequently growth. Principles of the WTO have great aid to provide higher efficiency to business entity where local government has absolutely free from lobbying and hence, entire system of the WTO has aggregately optimistically encourage good corporate governance. (Lonympics 1).

Major reasons to oppose the WTO

Though there have many more positive implications of WTO deed among nations but following are the significant areas for those developed countries are adversely affected through trade principles of the WTO (Global Exchange 1-2).

Absolute violation of free-trade regulations

Controlling power of the WTO is as much stronger that it can easily affect a developing state’s compel sovereign by changing their domestic constitutional regulations by declaration of violation of the free-trade rules and regulations.

Aid for the rich to be richer

Entire entity of the WTO has operated by the rich nations and as a result, they have worked only for the riches. In this way, they have flexibly weighed up developing nations trade dilemmas. For instance, not yet in this twenty first century solvent nations have not allowed to fully open their trade markets to import products and services from the poor and developing countries.

Violation of human rights

On behalf of the free-trade excuse, WTO has consciously influenced violation of human rights (workers’ rights, child labour, the environment and health) in the developing countries through MNCs manufacturing projects.

Undemocratic manners of reducing democratic accountability and transparency

Regulation of free trade offered by the WTO agreement has dramatically reduced democratic accountability and transparency of a developing member State though trade principles by the WTO had written by the nations who has highly appraised to practice of democracy.

Promote privatisation of essential public services

General agreements on trade affairs of the WTO has enthusiastic to enforcing developed countries governments to flexible MNCs operation in order to promote privatisation of essential public services (education, health care, energy and water) and in addition, GATS (General Agreement on Trade in Services) of WTO has already enlisted more than 160 threatened services (Elder and child care, sewage, garbage, park maintenance, telecommunications, construction, banking, insurance, transportation, shipping, postal services and tourism) those harshly hampered good governance and public services availability and moreover, encourage racism among global working class communities.

Motivate and mobilise inequality

From 1960 – 1998, global function had improved rapidly but not yet free trade facilities are open for poor countries since WTO trade regulations has motivate and mobilise international and domestic inequality therefore, foreign production projects in developed countries is now seek cheap labour zone. Consequently, valuable workforce and environmental resources have exploited drastically as a result 86 % of global resources are currently consumed by 20 % inhabitants of the world’s richest nation effortlessly where as rest of 14 % is for the poorest 80 %.

Patronize global food crisis

Recent global survey of food distribution reported that world’s 800 million people has suffered from the chronic malnutrition during a year because of the food distribution mechanism has captured by the corporate world. Regarding this issue, agricultural regulations of the WTO has mostly influenced on agricultural policy controlling than food security of a nation and thus WTO patronize global food crisis.

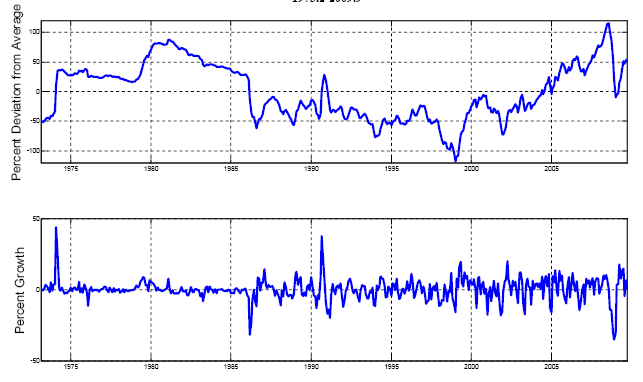

Impact of Oil Economy

Oil economy is the largest market of the Middle East countries where disturbance of oil supply is major cause of political instability. Alternatively, increase of crude oil prices had exognoused regarding to the OECD economies mechanism but significant OECD members have not yet authority of scrutiny in order to crude oil price controlling with the fluctuation of oil demand. Considering this aspects of oil economy and Saudi join to the WTO, there have several robust evidences that WTO oil trade regulations has played a significant role and hence shocks of demand as well as price level of oil composed since establishment of the entity. Hypothetically, oil is a valuable natural asset that unsurprisingly has some prerequisite matter of shocks for demand and supply flow that mobilise real price level during inventory. Conversely, the WTO trade affairs have kept little attention on crude oil inventory therefore, artificial crisis of supply make demand level complex as well as erratic regular oil consumptions.

Recent research on WTO impact has pointed that, global financial recession of 2008 influence to increase of real crude oil prices though growth of OECD members and the Asian region strongly emerging for instance, China and India. At the end of this part, it should to quote that, fluctuation oil economic facts has also great impact on US economy along with other significant importing economics like EU. Consequently, importing economics has recently suffered from severe decline of GDP as well as fluctuation of commodity prices though global economy is radically booming. Additionally, WTO impacts on macroeconomic attributes mislead due to fundamental amendment of oil economic policies and WTO policymakers forceful trade-off among fluctuation of oil price with the major economic outcomes. And here it has also significant to remark WTO joining of emerging Asian countries has also greatly affected industrial commodity prices with the change of oil demand (Kilian 28).

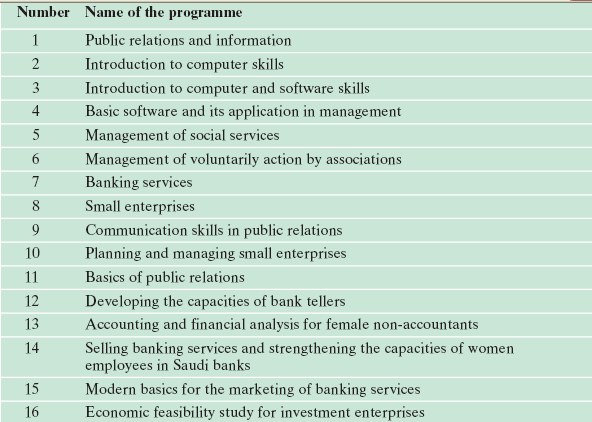

The Improvements and Opportunities on the Businesswoman

The CSCCI (The Council of Saudi Chambers of Commerce and Industry) of Saudi born to work for mobilising private sectors of the state for rapid growth of national economy. In short, aim of the entity is enthusiastic make an effective role by correlating public, private and women entrepreneurship (ILO 14). Consequence of the statement, the CSCCI has appraised that within last two decades improvements of Saudi businesswomen as well as expansion of their work opportunities has radically progressed. Since creation of the CSCCI, the entity has contributed a pioneering role to reducing obstacles of the interests of Saudi businesswomen. Regarding this aspect, Saudi businesswomen has now got the scope of enjoying vast information accessibility as well as friendly atmosphere to establish new enterprises of both small and large. The CSCCI believed that women entrepreneurs are the significant asset to develop national economy of Saudi sand considering this declaration, in mid 2004 Saudi government had issued following announcement to more expand Saudi businesswomen investments (ILO 69).

All categories of public entities should to allow applications of the women as well as deliver necessary support to make the market more competent and expansion of economic progress.

Based on nature of work and work requirements all of the public entities has oblige to make available separate women departments.

Commerce and industrial department of the government has kept the responsibility to allocate and development necessary land properties where should have industrial business quotas for the Saudi businesswomen.

The HRDF (Human Resources Development Fund) of Saudi government has proposed and requested to take prompt initiatives for available training of the Saudi businesswomen therefore; they would more efficient than now to employing their business plan and projects.

Recently, Saudi ministry of labour announced that store holders should have established individual stores selling only for women goods and services with a separate timetable.

Current Constitutional Monarchy is more alert on maternity leave of the Saudi women worker and in addition, government would amend leave duration to preventing their unemployment rate.

Long Term Expectations for the Different Sectors after 5 Years

Since beginning of the fiscal year 1998, Saudi government had announced the LTS 2025 (The Long-Term Strategy 2025) in order to occupy extensive progress for prompt recover of the State’s economic challenges. Regarding this government announcement, this part of the paper has paid attention on next five years (2009 – 14) outcome from different economic sectors of the Saudi. Before account of five years economic progress here, it has to focus that, the long-term vision of Saudi has stand on three consequent strategic pillars where the first pillar defines strategies of clear articulation in order to direct the destination of consecutive 20 years. Whereas, the second pillar assemble required policies for success on vision and finally, the third pillar has expressed implementation mechanism of the assembled strategies. In short, here these three segments can be expressed through three questions: 1) What are the demands of economic growth, 2) How does government would achieve their target, and 3) What is the success rate of implementing these strategies. Following are the short profile of Saudi government’s expectations from their long term planning (UNDP 17).

- Increase of per capita GDP with growth rate of 4.20 % annually that amounted through SR 1189.10 Billion,

- Change of expenditure pattern through diversified economy by massive increase of both government; private and foreign investments with average growth rate of 9.30 % annually,

- For a sustainable economic growth domestic economic trends switch towards the sectoral shares pattern and through this manner government expect to earn sectoral growth rate of 7.10 % annually till 2025.

- By balancing savings as well as investments, government has anticipated economic growth rate of investment will be 27.99 % during 2014,

- Proper utilisation of workforce as well as available and potential employment opportunities would be reducing Saudi unemployment dilemmas around 1.48 %,

- Radical improvement of daily life standards at every aspect of life index quality (Income and Distribution, Working Life, Transport & Communications, Health, Education, Housing, Environment, Family Life, Public Safety, Leisure and Public Services) with a least value of 119.61.

Conclusion and Recommendation

Recommendation

- The government should accelerate the establishment of a national centre with database to pay attention of WTO affairs and make available related financial, legal, and administrative technical consultancies to assist the private sector in commerce with WTO’s regulations in case of disputes and dumping aspects;

- Though WTO supports SMEs but developing countries many negative impacts in terms of the operation of local SMEs; therefore, the government of Saudi Arabia should focus on the technological development of the local companies and they have to make use of comparative experience to increase production with higher quality;

- The government should arrange training programme to train accountant, legal professionals, managers, and other consultants in order to help he government organisation and private companies to comply the WTO requirements and regulations;

- It is also important to develop the competence of national worker because quality of the products and the future competitive position depend on the skills of the worker;

- In addition, the management team of industrial sectors should executing and developing the industrial integration idea; for instance, large companies should support other small local companies in order to give production facilities;

- National companies in the service sectors should reform their operating system, and develop quality in order to adjust with new business environment and hold market-leading position in own sectors.

Conclusion

The membership of KSA into WTO is supposed to promote the country in many ways; industries like oil, petrochemical, service, and agriculture have proved to be possible areas of profit for the nation, which is proofed from significant contributions to GDP; additionally, the production capacity of petrochemicals is quite high owing to the activities of companies like Saudi-Aramco, and SABIC. In addition, the economic situation of the nation is also optimistic as it has not been affected largely by the recent global financial crisis and the private sector has received its stimulus through the reforms undertaken; moreover, implementing the policies of the WTO would affect all the sectors and promote more liberalization as well as capitalization.

References

Aljarallah, Abdulaziz. Analysing the Impact of the World Trade Organisation (WTO) on the Sustainability of Competitiveness of the Petrochemical Industry in Saudi Arabia.2010. Web.

Al-Sadoun, Abdulwahab. The Impact of Saudi Arabia’s Accession to WTO on Petrochemical Industries. 2008. Web.

Alsayrafi, Faisal. Saudi Arabia’s WTO Membership and the Implications for its Top Firms. 2006. Web.

Bertelsmann, Stiftung Gütersloh. BTI 2010, Saudi Arabia Country Report. 2010. Web.

Bhat, Parmindar., Atulan Guha, and Mahua Paul. India and China in WTO Building Complementarities and Competitiveness in the External Trade Sector. 2006. Web.

BNEA. Country Background: Saudi Arabia. 2010. Web.

Crowley, Meredith. An introduction to the WTO and GATT. 2003. Web.

Dubey, Muchkund. WTO and South Asian Countries: Developing Unison. 2005. Web.

Global Exchange. Top Reasons to Oppose the WTO. 2008. Web.

ILO. Employers’ Organizations taking the lead on Gender Equality. 2005. Web.

Jauch, Herbert. WTO, NEPAD and Social Clauses: a Trade Union Challenge. 2004. Web.

Kilian, Lutz. Oil Price Volatility: Origins and Effects. 2010. Web.

Lonympics. The World Trade Organization (WTO). 2010. Web.

Mahdi, Wael. Kingdom’s WTO Commitments to Help Liberalize Its Economy. 2006. Web.

MEP. Ministry of Economy and Planning KSA: Eighty Five years Development plan 2009. 2009. Web.

Mosoti, Victor. “Africa in the First Decade of WTO Dispute Settlement”.Journal of International Economic Law. 2005. Web.

Osakwe, Patrick. Emerging Issues and Concerns of African Countries in the WTO Negotiations on Agriculture and the Doha Round. 2006. Web.

OSEC. Saudi Arabia Major Business Sectors. 2010. Web.

Pérez-Solla, Emilio. The Role of WTO in the Fight against Poverty. 2003. Web.

SAMA. Forty Sixth Annual Report of Saudi Arabian Monetary Agency (SAMA). 2010. Web.

Saudi Arabia News. Saudi WTO success heralds economic expansion. 2005. Web.

SIDF. The Kingdoms Membership of the World Trade Organization Opportunities and Challenges. 2006. Web.

UNDP. Saudi Arabia: Long-Term Strategy 2025. 2007. Web.

Wong, Kar-yiu. China’s WTO Accession and Its Trade with the Southeast Asian Economies. 2003. Web.

WTO. The 128 countries that had signed GATT by 1994. 2011. Web.

WTO. The WTO: The Organization, Members and Observers. 2011. Web.