- Cost-volume-profit analysis

- Relevant Cost in Diversification

- Other Factors to Consider When Establishing Dinefest

- Benefits of Applying Beyond Budgeting Technique

- Acceptance of a Project

- Advantages of Cost-volume-profit analysis

- Disadvantages of Cost-volume Analysis

- Advantages of Net Profit Value

- Disadvantages of Net Profit Value

- Appendix

Cost-volume-profit analysis

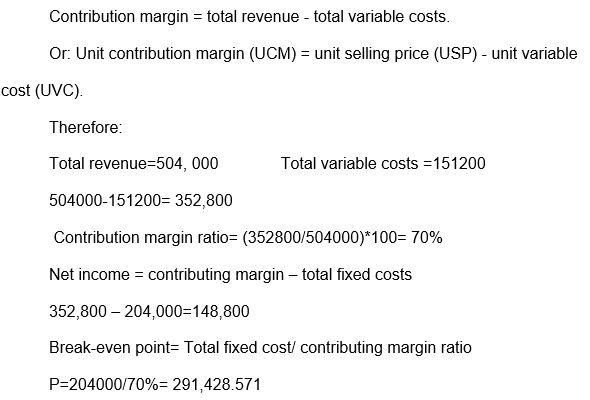

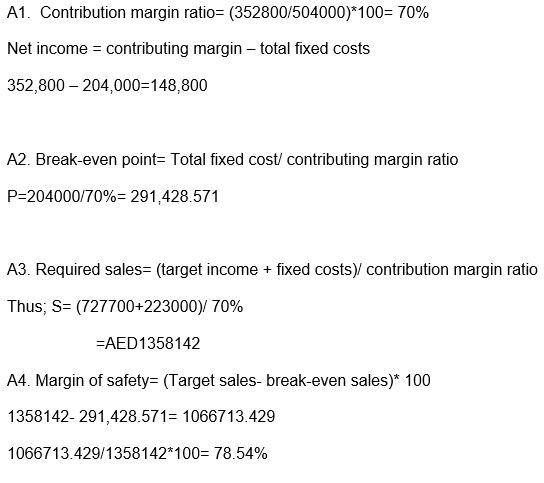

The cost-volume-profit analysis (CVS) is used by companies to predict the future of s business using past experiences. A CVS analysis is also important to entrepreneurs when making various investment decisions, in this case, the expansion of Yalla Momos. To conduct the performance analysis for Yalla Momos, we need to calculate the break-even point for the company. To calculate the break-even point for the company, where total revenue is equal to the total cost, that is no profit or loss made. Using the contribution margin method:

Thus, from the above calculations, Yalla Momos has to make sales of AED291428.571 in the year to sustain the business. Goel estimates to achieve net revenue of AED72700 while the depreciation cost is expected to rise to AED19000. We shall use the CVS analysis in order to be able to find the number of sales needed to achieve the target revenue.

Required sales= (target income + fixed costs)/ contribution margin ratio

Thus; S= (727700+223000)/ 70%

=AED1358142

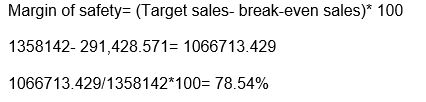

For Goel to achieve his target revenue, Yalla Momos has to make sales of AED1358142. However, when making critical management decisions, organizations should calculate the margin of safety to evaluate how far sales could change before a company makes a loss.

According to the above calculations, Yalla Momos has a safety margin of 78.54% before it can make a loss.

Mr. Goel targets to increase his revenue from AED504000 to AED727700 in the coming year. To meet the target, the company has to make sales of AED1358142. However, the three branches that Mr. Goel operates currently can make sales of 151200, where two of the branches are not productive. On the other hand, the company has a safety margin of 78.54% before it could make a loss. It is hard for the three branches to achieve the targeted revenue even with increased concentration. Hence, referring to the above information, Mr. Goel should open another Yalla Momos branch. If the branch does not turn to be a success, the company has a huge margin of safety and could still be sustainable.

Relevant Cost in Diversification

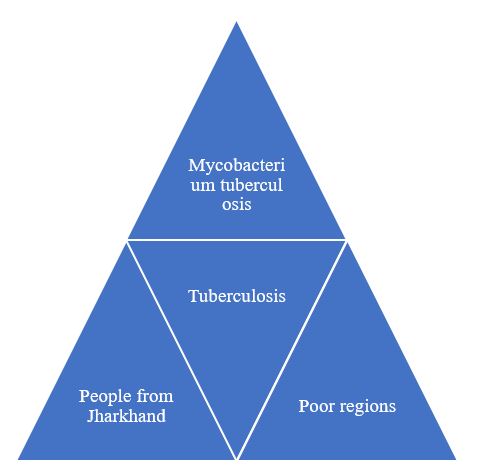

By establishing Dinefest, Mr. Goel shall introduce a new product in the existing Momos market. During the product development process, the company will have to incur some costs. There are various costs that Mr. Goel must consider before developing a new product line. To begin with, Mr. Goel must analyze the financial health of the company. He will do so by analyzing the financial statements of Yalla Momos.

Financial statements include analyzing the cash flow statements, income statements, and balance sheets. The costs most relevant in these statements are assets, liabilities, sales revenue, amount of income, and operating costs. By use of a balance sheet, Mr. Goel can determine the current book value of the company. A balance sheet calculates the value of a company by calculating the assets which are, total liabilities added to shareholders’ equity. Income statements compute the operating costs, depreciation, net income, and income per share. It is critical that Mr. Goel also evaluates the company’s margin of safety before commencing a new product development process. Evaluation of financial statements is a critical step when making critical managerial decisions such as new product development.

Moreover, Mr. Goel should establish the cost of the establishment of the new product line compared to its subject financial returns. The establishment of Dinefest will require Mr. Goel to make a huge investment in its development. Most of the financial burden will go towards purchasing assets, rent, hiring costs, development of a new information technology system, and purchasing of raw materials. Mr. Goel should calculate the projected sales of the new product line to evaluate its profitability and long-term sustainability.

Other Factors to Consider When Establishing Dinefest

The primary objective of an investment is to increase income levels. Thus, before deciding to invest in the development of a new product line, Mr. Goel must analyze the attractiveness of a market. The attractiveness of an industry is evaluated by analyzing the state of competition in the industry, statistics of demand and supply, and the future trend of the business including technological advancements. Also, evaluating a market analysis helps an entrepreneur to discover the sustainability of the industry. An entrepreneur’s objective is to invest in a long-term sustainable business. In addition, Mr. Goel must weigh the costs of the establishment against the financial returns of the new investment. The attractiveness of an industry is established by conducting a market analysis. Mr. Goel might discover new opportunities after conducting a market analysis of the industry.

Additionally, Mr. Goel has to analyze customers’ needs and pain points. Mr. Goel must conduct market research to identify what his customers need. Customers’ needs should anchor the establishment or investment of any business. Mr. Goel should evaluate if his customers’ need is to increase the vegan menu or to open a new vegan brand.

Businesses are also affected by external factors such as economic, social, political, and technological factors. Mr. Goel should evaluate how these factors affect the growth and success of the new product. Although these factors are beyond an entrepreneur’s control, Mr. Goel can mitigate the risks using various risk management strategies.

Benefits of Applying Beyond Budgeting Technique

Mr. Goel proposes to adopt a beyond budgeting technique in the financial management of the new Dinefest product line. Beyond budgeting, the technique requires the managers to submit weekly and monthly financial statements rather than an annual or semi-annual budget. Also, the technique provides managers with the authority to make quick decisions according to the available resources and customer requirements. Mr. Goel is among many entrepreneurs who propose to replace the traditional budgeting systems with beyond budgeting techniques. Beyond budgeting techniques provides organizations with numerous advantages.

First, the beyond budgeting technique shifts the managerial efforts from pressurizing managers to dealing with competition. The traditional budgeting technique pressurized managers to work within and meet strict budget requirements. Conversely, the beyond budgeting technique makes use of a KPI to measure a manager’s performance using a balanced scorecard. Thus, the technique establishes an environment that is anchored on competitive success.

Additionally, the beyond budget technique motivates managers and employees to work to achieve set targets. The technique requires the management to set clear-cut-out responsibilities and actions. When managers and employees are allocated various responsibilities to achieve set targets without being micromanaged by the administration, they feel responsible and motivated to achieve. Unlike the traditional budgeting system, beyond budgeting techniques delegate authority to managers to make a timely budget decision in different circumstances.

Also, the techniques allow the establishment of more customer-oriented teams. Customer-oriented teams perform a task according to the specification and requirements of a particular customer. Teams become more customer-oriented by having the authority to customize a product or service according to the customer requirement without consulting the administration. Due to the delegated authority, employees are motivated to meet targets.

On the other hand, the beyond budget technique establishes an information system that allows health communication throughout the organization. The communication between the management is more frequent and open as they report their progress regularly. Also, the technique allows the prevalence of a democratic managerial system where open information can easily be transmitted. Information also travels quickly along with the organization due to established systems.

Acceptance of a Project

Net Present Value

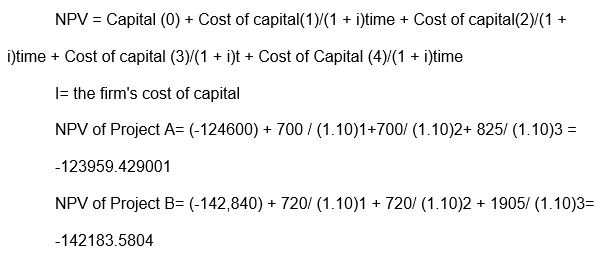

The financial value, in this case, includes; the cost of marketing research (15000), the cost of equipment (1555000 for bottle sauce) (2555000 for Momos shell kit), and depreciation value for the three years.

It is important to point out the fact that the cost of capital is equal to 10%, whereas the project’s period for payback is no more than two years.

In addition, for the Momos shell kit and Momos sauce bottles, the net present value is equal to 142,840 and 124,600, respectively.

A net present value method is used by financial managers to evaluate the worth of a project before investing capital. It is one of the most popular capital budgeting methods. According to the Net Present Value analysis conducted on projects A and B, projects will result in a loss since the results of the calculations are negative. Negative results indicate that the project will fail while positive results show that the project will be profitable to the business. Therefore, Mr. Goel should not invest in the projects.

Advantages of Cost-volume-profit analysis

The cost-volume analysis is an essential tool used in the planning of a business. It aids managers to identify how many units they should produce to sustain the business, where to invest, and how to utilize scarce resources. Also, the financial tool helps managers to identify how many units they should sell to achieve the set profit target. To substantiate and make management decisions, individual enterprises use indirect methods to answer the question of what will happen to profitability or loss if a selected set of four other parameters is adopted, which means that the company uses direct calculation at a selected point. By a certain choice of optimal options for managerial decisions, a rational solution is selected, which, however, does not give a vision of a completely assembled picture of the information field.

Disadvantages of Cost-volume Analysis

Although Cost-volume analysis is essential in financial management, it carries some disadvantages. Some of the disadvantages include; the assumption that only two types of costs exist, that is, the fixed costs and the variable costs. Also, the method assumes that fixed assets remain constant over a certain scope of activity. Thus, the main task of economic management is to determine and achieve such a mutual correspondence of the resources used, the volume of output, the wholesale price of a unit of production, at which the achievement of the optimal size of profitability and profitability, sufficient for the continuation of the stable functioning and development of the enterprise, creating conditions for the expansion of production, is ensured. However, in the management of production and economic activities, not all organizations use such tools.

Advantages of Net Profit Value

Net present value (NPV) is a useful tool in financial management as it provides an essential way of quantifying a project’s net value. An organization can predict the income contribution of a project in the future. NPV is also more precise than other accounting methods as it uses discounted values, making the calculations to be more precise. In addition, the method considers both the time and risk variables of a project making it realistic to achieve. Tactical management of production costs of an enterprise should be aimed not only at obtaining the required strategic results of management of production costs, but also at achieving the established strategic goals of the enterprise. Considering the content of tactical management of production costs of the enterprise, it is necessary to point out the need to solve the following main tasks, such as identifying the role of management of production costs as a factor in increasing the economic results of the enterprise.

Disadvantages of Net Profit Value

Despite its advantages, the Net Present Value technique also has its disadvantages. One of the major limitations of the method is that it uses estimated values to make future projections. When using estimated values, a project suffers from the risk of suffering from unseen events in the future. Also, the discounted value of discounts used in the calculation of NPV does not cover all the potential risks of a project. To increase the effectiveness of the financial and economic activities of the enterprise, the stability of its functioning and the competitiveness of the products, it is necessary to pay great attention to the management of production costs. Effective management of production costs is one of the most important targets of any business entity, as it ensures the achievement of the formulated mission of the enterprise.

Appendix

Calculations

Part A: Cost-volume-profit analysis

- Contribution margin= total revenue- total variable costs.

D. NPV = Capital (0) + Cost of capital(1)/(1 + i)time + Cost of capital(2)/(1 + i)time + Cost of capital (3)/(1 + i)t + Cost of Capital (4)/(1 + i)time

I= the firm’s cost of capital

NPV of Project A= (-124600) + 700 / (1.10)1+700/ (1.10)2+ 825/ (1.10)3 =

-123959.429001

NPV of Project B= (-142,840) + 720/ (1.10)1 + 720/ (1.10)2 + 1905/ (1.10)3=

-142183.5804