Introduction

Widget Company in Ohio manufactures and supplies widgets in the USA and other parts of the world. Globalization has made the world a global village, and companies expand to other countries to maximize profits. It is, however, imperative to note that profitability depends on multiple factors, and a comprehensive investigation must be conducted to invest in a region/country with the highest competitive advantage.

China and Mexico have traded with the USA for the past two decades. However, changes in geopolitical tension and proximity to the USA are emerging factors that need to be investigated before deciding whether to invest in China or Mexico. China is the second-largest economy globally, while Mexico is the second-largest in Latin America.

This investigative comparison distinguishes the two countries in terms of GDP, infrastructure, population, policies, and political stability. Investment can only be profitable with a stable government. Whether the expansion is done as a foreign direct investment (FDI) or a partnership depends on the specific economic policies in a country. Multinational corporations expand to areas that are profitable and conducive to business.

Country Description

China

China is the second largest economy in the world after the USA and is one of the most lucrative investment destinations for MNCs worldwide. The country has a population of 1.4 billion people, the second most populous country in the world after India (Fajgelbaum & Khandelwal, 2022). The population serves as a massive market base, and any business investing in China will likely have ready customers because of the large population.

The USA has had a long trade relationship with China, and despite the political tensions, it has maintained its business relationships. As of 2021, the country’s FDI inflow was $149.3 billion, which offers an effective environment for investment in the discourse (Cavusgil et al., 2020). The government has an employment rate of 5%, which means that ready labor is available in the country for any company to invest (Fajgelbaum & Khandelwal, 2022). The Chinese government has one of the lowest inflation rates, meaning that when investments are well managed, they can significantly impact profitability.

The vision of the political leaders impacts a country’s economic dispensation. China made tremendous economic reforms in 1979 after many years of economic stagnation (Cavusgil et al., 2020). Once President Deng Xiaoping signed the Change in 1979, it encouraged investors from other nations to channel their investment in the country (Wȩziak-Białowolska et al., 2019).

Consequently, there was a miraculous economic increase, and the World Bank described it as the fastest and most sustainable expansion in world history. The government made innovation and manufacturing an essential part of the economy and manufactures forty-five times as many computers as the rest of the world (Fajgelbaum & Khandelwal, 2022). The tremendous economic growth in China made it a limelight, and the USA Congress was especially interested in business ties with the country. China has free trade area agreements and operates with more than 26 countries globally (Cavusgil et al., 2020). The free trade agreements enable a country to trade without limitation, increasing its economic viability.

Mexico

Mexico is the second largest economy in Latin America, and the World Bank has termed it the fastest growing economy. The growth rate is 4.8%, which is higher than any country in Latin America, and it is likely to be an economic superpower in the region (Wȩziak-Białowolska et al., 2019). The county has a population of 130 million, proving to have a substantial market for products (Cavusgil et al., 2020). Mexico has been in the limelight for the last ten years as the country with the most favorable manufacturing terms.

Many businesses have been moving their businesses from other parts of the world to Mexico. The country is the second-largest trade partner of the USA and has existing favorable policies that can help American companies invest in the country. In the first quarter of 2019, the trade between the USA and Mexico rose by 14.5% (Cavusgil et al., 2020). The country is a member of the World Trade Organization and has up to twenty-three countries with which it can freely trade at any time.

Mexico’s favorable policies have allowed MNCs from all over the world to invest in it. Its FDI inflow is $31.6 billion, which has increased exponentially as many manufacturing industries enter the country (Wȩziak-Białowolska et al., 2019). The primary industries in the country are mining, manufacturing, agriculture, automobile, and electronics.

It must be noted that Mexico has been trading with economic giants such as China, the US, Canada, South Korea, Germany, and Hong Kong (Cavusgil et al., 2020). The shared experience with the different economic giants makes the country competitive. The government has fashioned a secure and open environment for external investors to establish manufacturing firms in the country. In 2022, the Mexican government, through the business ministry, launched a business center named Invest in Mexico, where FDI proponents received special assistance and tax holidays from the government.

Form of Government and Political Stability

Political stability is where the nation’s government operates smoothly without threats of coups, violent resistance, and sanctions. A conducive business environment requires that people can trade without fear. International politics and geopolitical tensions may further lead to a difference in investors’ perceptions of the country. A country with high levels of terrorism and political tensions during elections will likely lack investors to invest in the country (Cavusgil et al., 2020). The form of government and political stability are crucial to the decision-making regarding investment in a country.

China

China is an authoritarian one-party state with the Chinese Communist Party running the government. It is a communist state with a dictatorial political system where the executive arm of the government ensures that all the appropriate laws are followed. The socialist democracy encourages other countries to invest in it.

Since the outbreak of the COVID-19 pandemic, there has been geopolitical tension between China and the USA when US President Donald J. Trump accused the latter of deliberately misleading the public about the pandemic for personal gains (Fajgelbaum & Khandelwal, 2022). Further, the territorial dispute between China and Taiwan, Indonesia, and Vietnam will likely spark disputes and political tension between the USA and China, jeopardizing trade relations (Wȩziak-Białowolska et al., 2019). The upcoming geopolitical tension between the two countries will likely affect the USA-China trade relations.

Mexico

Mexico is a federal republic where power is divided into three main branches: the courts, Congress, and the president, which means there must be collegiality when deciding on an investment. The presidential system of government leads to political instability, especially when elections are approaching. According to the World Bank, Mexico ranks 23.58% on violence and political instability (Medeiros, 2019). Multiparty democracies are prone to electoral violence and are expected to experience it during transitions. However, Mexico has conducive policies supporting foreign direct investment to increase its per capita income.

International Trade Risks and Methods of Offsetting Them in China and Mexico

Widget is an American company intending to expand to Mexico or China, depending on which country has the most advantage. Standard business risks are likely, and the company must be prepared to offset the trade risks. One of the most common trade risks in foreign countries is political instability and unannounced political violence (Cavusgil et al., 2020). As Widget operates in a foreign country, changes may be experienced, such as a referendum, armed conflict, and unfavorable policies resulting from geopolitical tensions. The critical methods of offsetting the political risk include political risk insurance by central banks in the country of operation.

China and Mexico have insurance companies that insure businesses against political risks and ensure they are reimbursed if the business is destroyed due to political instability (Wȩziak-Białowolska et al., 2019). Further, it is also essential to use local banks with subsidiaries in the host country to cover all the political risks. Because of the geographical difference, more American banks operate in Mexico than China. Mexico is more strategic than China in offsetting the political risks because it is geographically close to Mexico.

Cultural factors are the most common form of risk affecting international business. There is a significant difference between the Chinese and Mexican cultures. Mexico is closer to America, and they share cultural perspectives. Therefore, whenever there are cultural disparities between the two countries, the antidote is to conduct training and ensure that an American with classical Mexican culture training is in charge of the operations. However, when a similar case happens in China, the best method to offset the risk is to ensure that the Chinese culture prevails (Fajgelbaum & Khandelwal, 2022). The international trade risks can be quickly sorted in Mexico compared to China.

Economic Comparison between China and Mexico to Determine the Greatest Profit Potential

The economic and financial situation in a country determines profitability. A nation whose economic growth rate is negative cannot be expected to be a better investment destination. An economic analysis is an important aspect when investing in a new country. The analysis is completed by completing three key areas: national output, unemployment rate, and inflation.

The national output is measured as the gross domestic product, which is a summation of all the resources generated by the country’s citizens. When a country shows a higher GDP, it means that people have higher buying power, and therefore a business is likely to thrive in the new country. China has a GDP of $17.7 trillion and a per capita income of $12,551 (Wȩziak-Białowolska et al., 2019).

On the other hand, Mexico has a relatively lower GDP and per capita income of $1.29 trillion and $10,066, respectively (Liang, 2019). The GDP and per capita income show that China is more favorable to invest because the people have more money, so their buying power is also higher. Comparing the two economic possibilities means China would be the most favorable destination for higher profit margins.

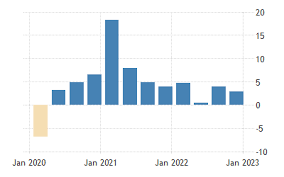

GDP trends are essential in determining a country’s economic environment. China’s GDP has been growing exponentially and is expected to continue growing as the country strives to be a world economic superpower. Figure 1 below shows the fluctuation of China’s GDP between 2020 and 2022. The positive deviations show that China is better placed to invest because economic growth allows every company to thrive.

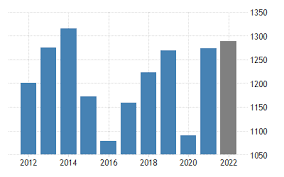

Figure 2 shows Mexico’s economic growth through the GDP per capita. It is imperative to note that although Mexico’s GDP cannot be compared with China’s, it has been growing exponentially and therefore shows the level of opportunities in the country (Liang, 2019). Unlike China, which is almost reaching its economic saturation, investing in Mexico could be more promising because of the growth prospects.

Inflation is the constant increase in the prices of goods and services over time. It is a broad measure that can be used to determine whether an investment can be profitable. Inflation harms the economy because when the prices of goods and services rise, the purchasing power is lowered, and sales are reduced considerably.

In 2022, the inflation in China was 2.0%, meaning that most of the prices of goods and services rose by the stated percentage (Deka et al., 2023). On the other hand, Mexico experienced a higher inflation of 7.82% in 2022, meaning that the prices of goods hiked by the stated percentage, jeopardizing the buyers’ purchasing power (Deka et al., 2023). Based on the inflation rate, it is more commendable to invest in China than Mexico because of the inflation rate.

The unemployment rate is an essential indicator of the economy and must be considered when making investment decisions. A higher unemployment rate indicates human resource waste, an increased dependency ratio, and a depressed economy. Although unemployment would also mean a considerable pool of workforce to choose from, it indicates that a country’s economy is not doing well.

As of 2022, China had an unemployment rate of 5.5%, while Mexico had a lower rate of 4.38% (Deka et al., 2023). The rate shows that the buying power is higher in Mexico than in China because of the difference in the unemployment rate. The Widget should therefore invest in Mexico if the dependency ratio is the critical determinant for decision-making.

Further, the difference in labor force size significantly impacts the decision. China has a pool of 793 million professionals with the required experience to be productive in the corporate domain (Liang, 2019). On the other hand, Mexico has 57 million skilled laborers, most of whom specialize in manufacturing (Basco et al., 2020). The number of skilled personnel in Mexico makes the country more strategic.

Since Widget is a manufacturing firm, it is essential to consider the average manufacturing wage. China and Mexico have average manufacturing wages of $840 and $480 monthly, respectively. Mexico would be a better option because the manufacturing cost is lower, and the aggregate revenue will be higher. Corporate income tax is also critical in ensuring that the company thrives.

China and Mexico have a corporate income tax of 25% and 30%, respectively, meaning that more money goes to taxes in Mexico compared to China (Deka et al., 2023). It is imperative to note that Mexico has a better bilateral trade relationship with the USA than China, which is in constant geopolitical tension (Liang, 2019). Mexico is more economically aligned with the USA, and investing in the country will likely generate more profits. Although China has less corporate tax, it has unfavorable tariffs on American investment and might jeopardize profitability.

Comparison of Infrastructure and Education System

A country’s infrastructure and education system are critical determinants for investors because they directly affect investment. At the same time, infrastructure aids in the logistical front, while the education system aids in producing competent staff. When comparing a country’s infrastructure for investment, the critical factors for consideration are road networks, railways, airports, waterways, and harbors to aid in the movement of raw materials, finished products, and workers. In China, the roadways span up to 5.2 million kilometers, while Mexico has a road network worth 704,884 kilometers (Medeiros, 2019).

China has up to 68,141 kilometers of railway line, while Mexico has 20,825 kilometers. Waterways are essential passage areas for water vessels, and China boasts 110,000 kilometers of waterways, while Mexico has only 2,900 kilometers of waterways. China has over 200 airports, while Mexico has only 67 (Basco et al., 2020). It is, however, imperative to note that the extensive infrastructure in China is due to its large geographical area. Mexico, however, has adequate transport connectivity to allow investors to transport goods and services from one point to another.

The education system is responsible for producing competent professionals to serve in the economic sectors. When investing in a foreign country, it is essential to consider the education system and choose one whose education system is congruent with the organizational needs. In China, the education system allows for six years in primary school, three years for junior and senior secondary, and four years in the university. This ensures that students have the relevant skills to fulfill their industry needs.

In Mexico, education is divided into three compulsory levels, and people attend them according to age. Primary school is attended between the ages of six and twelve, secondary school is between twelve and fifteen, and high school is between the ages of fifteen and eighteen. When comparing education quality indicators, China has a better education system than Mexico. In the 2021 education ranking, China was ranked 22nd globally, while Mexico was ranked 37th (Czarnecki et al., 2020).

The education system aims to prove that China is better positioned to produce more competent workers than Mexico. Selecting Mexico as the investment destination must be prefaced with additional training to ensure the staff has the necessary knowledge for productivity.

How the Two Countries’ Currencies Change in Line with the American Dollar

Dollar Strengthening and Weakening

Strengthening and weakening the US dollar significantly impacts corporate profits and must be understood for business decisions. The dollar weakens when the global economy is strong and countries’ profits increase. However, when other economies are not doing well, the dollar strengthens. Therefore, a company must decide to invest in a country where the dollar is weak to improve profits. Current valuation and exchange rates determine the weakness and strength of the dollar.

Current Valuation of the Dollar Vs. the Chinese CNY and Mexican MXN

The current valuation of the US dollar against the Chinese currency is 6.7845 CNY and 18.8212 MXN. In China, one dollar is exchanged at 6.7845, while the same is exchanged at 18.8212 in Mexico. The valuation means that when the profits are converted into dollars, China would have higher profits when all factors are constant, assuming all manufactured goods are sold. Although the exchange rates fluctuate, the dollar remains weaker in China than in Mexico.

Impact on Corporate Profits

When the dollar is strong, it lowers the profitability of companies operating in foreign countries. Exchange rate is inversely proportional to the profitability, meaning that the lower the exchange rate, the higher the probability of success in the long run. Since the dollar’s strength is more exhibited in Mexico, corporate profits will likely be reduced. Money earned in Mexico is converted into fewer dollars compared to the money earned in China. Since a strong dollar is the greatest threat to corporate profits, selecting a country with a lower currency valuation than the US dollar will likely increase corporate profits.

Conclusion and Recommendation

Widget’s primary goal is to thrive through investment in a foreign country. China and Mexico are the main choices regarding the best place to invest. However, both countries are economically viable, with China being the second-largest economic giant globally while Mexico is the second-best in Latin America. Each country has economic potential and can be better placed to invest. In the last three years, numerous manufacturing firms have relocated to Mexico from China because the latter is perceived as having the best manufacturing technology.

Further, governmental position and political stability are vital in deciding where to invest. Mexico is geographically and politically feasible because the China-USA wrangles have existed for a long time and may impact business in the future. Risks are unpredictable; the business must be prepared to offset them with the most appropriate technology. However, China beats Mexico regarding economy, GDP per capita, infrastructure, and dollar valuation. Considering all the parameters, China is better placed for foreign direct investment by Widget.

References

Basco, R., Hernández-Perlines, F., & Rodríguez-García, M. (2020). The effect of entrepreneurial orientation on firm performance: A multigroup analysis comparing China, Mexico, and Spain. Journal of Business Research, 113, 409-421. Web.

Cavusgil, S. T., Deligonul, S., Ghauri, P. N., Bamiatzi, V., Park, B. I., & Mellahi, K. (2020). Risk in international business and its mitigation. Journal of World Business, 55(2), 101078. Web.

Czarnecki, L., Juárez Contreras, K. E., & Dong, W. (2020). Measuring education index for China and Mexico. Journal of Applied Social Science, 14(1), 106-122. Web.

Deka, A., Cavusoglu, B., Dube, S., Rukani, S., & Kadir, M. O. (2023). Examining the effect of renewable energy on exchange rate in the emerging economies with dynamic ARDL bounds test approach. Renewable Energy Focus. Web.

Fajgelbaum, P. D., & Khandelwal, A. K. (2022). The economic impacts of the US–China trade war. Annual Review of Economics, 14, 205-228. Web.

Liang, W. (2019). Pulling the region into its orbit? China’s economic statecraft in Latin America. Journal of Chinese Political Science, 24(3), 433–449. Web.

Medeiros, E. S. (2019). The changing fundamentals of US-China relations. The Washington Quarterly, 42(3), 93-119. Web.

Wȩziak-Białowolska, D., McNeely, E., & VanderWeele, T. J. (2019). Human flourishing in cross-cultural settings. Evidence from the United States, China, Sri Lanka, Cambodia, and Mexico. Frontiers in Psychology, 10, 1269. Web.