Financial and Cost Assumptions

There are certain core elements for evaluating the financial viability of any new venture. The assumptions that affect the forecast financial results relate to expected income and expenses for the proposed venture. It is important that any proposal for starting a new venture must make reasonable assumptions regarding the likely revenue earning and the associated costs for earning the estimated revenue.

The revenue assumptions are based on the potential sales of the new product, which can be estimated based on a market survey. The market survey should provide the approximate total market value for the product and the market share that the new product can capture considering the off take of the target market segment. The expected growth in the market size will enable framing the assumptions for future expected sales. These revenue assumptions would as well apply for the new hair product – DREAM. Most important cost assumptions include the production and distribution cost.

These costs are based on the proposed volume of production and sales. Information can be gathered from the market on the likely cost of different raw materials and distribution costs. Determination of the appropriate channels of distribution is a prerequisite for arriving at the costing assumptions, as the marketing and distribution costs will depend on the manner the new product is proposed to be reached to the end-user.

The marketing costs are based on the marketing plans and advertising methods of the business. There can be a general estimate of administrative and other period costs depending on the industry figures. Factors affecting the internal and external environment of the proposed venture and industry have large influence on the revenue and costing assumptions (Fahey & Narayanan, 1986).

Task 2 Marginal Costing Cost Statement

Marginal costing system is different from absorption costing. Under absorption costing system, the product cost is calculated by taking into account, the fixed costs. Marginal costing requires the total cost to be bifurcated into fixed and variable cost and the fixed portion are not included in the product costing (Lucey, 2002). Marginal costing method is used for calculating the cost of one additional unit of product or service. The marginal cost of a product is the variable costs in the relevant range of production or sales. It must be noted that within a given volume of production, the fixed costs remain constant and therefore, the marginal costs can be considered as equivalent to the variable costs (Finkler 2001).

The total cost of a product item can be calculated using the quantity of resources consumed and the unit cost of resources used in the production. Therefore costing of a product includes the following steps (Brouwer, 2001; Byford, 2003; Sefton et al., 2002) –

- establishing the objectives of costing,

- detailed description of the product or service,

- classification of the resource items required for production,

- measuring the consumption of different resources, and

- placing monetary values on the required resource items.

According to Waters (2004), it is difficult to choose a reasonably accurate methodology without having arrived at the purpose of costing. Marginal costing can be applied for making business decisions on a short-term basis. The short-term decisions include decisions on acceptance of one-time orders or on discontinuance of a product line. It can also help the managers to take “make or buy” decisions, as there will not be any change in the fixed cost during the short-term. However, during the long-term there is bound to be changes in fixed costs. Under such circumstances, firms may have to use differential costing method (Lucey 2002, Millchamp 1997).

Marginal costing has certain distinct advantages, which include the ease in operating the method, and there is no arbitrary apportionment of overhead costs. Under marginal costing method, there is a display of constant net profit irrespective of the production volume. There will be no under/over absorption of overheads and the fixed costs are handled differently under marginal costing method. Under marginal costing, managers could assess the cash flow from the business more closely. The marginal costing statement of DREAM hair cream is shown below.

‘DREAM’ Hair Care Cream

Marginal Costing Cost Statement

As per the above marginal costing cost statement, the proposed product provides a contribution margin per unit of £ 3.75. Based on the estimated sales of 200,000 units during the first year of operation the total contribution margin works out to £ 750,000. The business is expected to result in a net margin of £ 250,000, when the fixed costs of £ 500,000 are charged off against the contribution margin. The net margin is calculated at 12.5% of total sales.

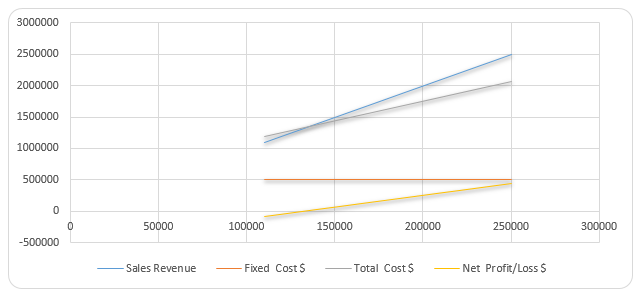

Task 3 Break Even Analysis

The breakeven point for a product is the volume of production/sales where the total revenue from the product is equal to the total cost that needs to be incurred for production or sale of the product (Horngren et al. 2008). The purpose of calculating breakeven product is to make specific business decisions on the manufacture/sale of particular product(s). Management accountants use the technique of breakeven analysis to provide meaningful information to the top management for decision-making. At the breakeven point, the firm will not make any gain nor the operations result in a loss.

This is because at this point the total cost of production or sales will be the same as the total sales realization. The association between the three factors of cost, volume and profit gives rise to breakeven analysis, which is helpful to managers for taking important business decisions. (Finkler, Ward and Baker, 2007). Breakeven analysis is done based on certain major assumptions. First important assumption is that there will not be any change in the selling price based on changes in sales volume (Abraham et al. 2008).

It also assumes a linear relationship between sales volume and costs incurred. Costs are segregated generally into fixed and variable components and contribution is the excess of sales price over unit variable cost. It must be noted that according to breakeven analysis, all contribution received beyond breakeven point automatically becomes profits for the business (Ahamad & Chauhan, 2010). However, the managers have to be careful to expand the production beyond the normal or existing volume, since at that point; it may become necessary to spend disproportionately large expenditure to achieve a higher level of production.

The breakeven point for the proposed product is arrived by dividing total fixed cost incurred by the business by contribution provided by each unit of productions/sales. Based on the figures from the marginal costing cost statement under Task 2 the breakeven point for the product for the first year:

Fixed Costs

= £ 500,000

Contribution per unit = £ 3.75

Breakeven Point = Fixed Expenses/Contribution per unit

= £ 500,000/£ 3.75 = 133,333.33 = 133,333 units

When the new hair product is sold to meet the breakeven volume of 133,333 units, the total sales revenue will be equal to the total cost. At this point the business will not earn any profit or loss. Any sales beyond the breakeven point will provide profits from the sale of the product. Based on the breakeven volume in units, the breakeven point in sales value or percentage of capacity can be calculated.

Breakeven point in sales value = Breakeven Volume x Sales price per unit

= 133,333 x £ 10.00 = £ 1, 333,330

Breakeven point as a percentage of capacity = Breakeven Volume x 100/Total Capacity

= 133,333 x 100 /200,000

= 66.67%

Break Even Table

Task 4 Financial Documents

The financial documents form the basis of presenting the estimated financial results of the proposed business venture. Income statement, balance sheet and cash flow statement are the three financial documents, which are normally prepared as part of any business plan. The forecast income statement will present the amount of profits, the business is likely to earn out of the operation in the first year of operation.

The purpose of forecast balance sheet is to inform the readers the financial status of the proposed business as at the end of the first year. Forecast cash flow statement shows the amount of cash that the business is capable of generating out of the business during the first year of business. The cash generated will form part of the working capital of the firm to meet the short-term financial obligations of the business. The forecast financial documents of the new hair care product DREAM are presented in this section. For preparing the financial documents, introduction of own capital of £ 200,000 is assumed. The financial year for the business of the new product is assumed to start in July 2011 and end at 30 June 2012.

For carrying on the business, the business assumes that a bank loan of £ 500,000 at an interest rate of 12% will be arranged. The interest payment is to be made every quarter. It is assumed that the bank loan will be repaid over a period of 4 years. The forecast cash flow statement is prepared with the assumption that there will be cash and credit sales made during the year and part of the credit sales realizations will be made during the next month. Another assumption is that the business will also enjoy certain credit period from the suppliers for paying the bills.

There will be an investment of £ 300,000 in fixed assets and this amount will include the cost of machinery, furniture and fittings. It is also assumed that the production will be

carried on from rented premises involving monthly rent of £ 10,000 and a rental advance of £ 120,000.

DREAM Hair Care Cream – Forecast Cash Flow Statement.

According to the forecast cash flow statement, the business will generate an amount of £ 446,000 at the end of the first year of operations. From out of the cash flow, an amount of £ 125,000 will be paid to the bank in part settlement of the bank loan. The cash flow statement indicates that the business will be cash rich and the surplus cash can be used to expand the existing business in the immediate future. Income tax due will be settled out of the cash generation.

As per the financial performance, results shown by the estimated income statement, at the end of the first year of operations, the business will earn a net profit after interest and depreciation of £ 166,000, which accounts for 8.30% of the sales turnover. The estimated operating profit of the business is £ 256,000, which is 12.8% of sales. The operating profit is arrived after deducting the sales, administrative, and advertising and promotion expenses from the gross profit. However, the net profit of the business is calculated after deducting interest and depreciation. Income tax is assumed at 30% of the net profits.

The forecast balance sheet of the business of the new hair care product as at the end of the first year of operations shows a healthy financial position of the business. The balance sheet shows a sound short-term financial position of the company, with adequate cash generation from the business. With the sound cash flow position, the business will be able to settle all its short-term financial obligations with ease. it can be seen that it will enjoy a sound current ratio, implying that the company will be able to meet its current financial obligations comfortably owing to sufficient cash generation out of the operations. The debt to equity position of the company is maintained at 65.2% of debts in the total capitalization of the company.

Task 5 Presenting the Pitch

Business Plan for the Proposed New Hair Care Cream – DREAM

Introduction

The” hair care product” market especially for women has been growing at a faster rate during the past decade, with more number of women becoming conscious of grooming themselves. This business plan is prepared based on a recent market survey of hair care products catering to the needs of younger women. The production process of the proposed hair care cream is simple and does not require sophisticated machinery for its production. The product has passed the required tests for meeting the health standards and on launch, the product will be promoted as unique one, which will retain the shine and smoothness of the hair.

Although there are large number of hair care products are available in the market, there are only few products, which take care of the hair after using shampoos and conditioners to retain the smoothness and shine. Quality of the product is the key selling point, as the price is placed slightly higher than other similar products available in the market. We are confident that promotion of the product will prove the selling point of the higher quality.

Marketing Plan

The new hair care cream will target the customer segment of younger women aged between 20 and 30, who are in employment and have their own earning capacity. The new product will stand out in the market because of its quality and the purpose it meets for the target market segment. DREAM hair cream will be produced using a special preparation formula, which has been designed after considerable research in the field.

The prescribed authorities have approved the preparation for marketing the product. For supporting the marketing plan, a pre-launch market survey was conducted in five major cities among a large sample of women shoppers of hair care products. Based on the survey, the target market segment and the likely demand for the product were arrived. From the survey, it was found that there are only few substitutes available in the market meeting the purpose and quality standards of the proposed new product. The survey findings clearly support the production and marketing of the new product.

Marketing Mix

McCarthy (1964) introduced the marketing strategy of 4Ps for analyzing the marketing mix of a new product in the market (Bennett, 1997). There were new elements introduced in the marketing by later research (Kent, 1986; Low and Tan, 1995; Palmer, 2004; Moller, 2006).

For formulating the strategies with respect to the marketing of the product, it is important to consider the essential quality elements of the product for making the launch successful and the planning for the distribution of the product, so that it reaches the target customers (Kotler, 1986). Pricing is one of the other considerations, which determines the success in the marketing of a new product. Marketing communication for promoting the product is another important factor in the marketing mix to complete the marketing strategies (Longenecker et al., 2009).

Our new hair care cream is named “DREAM,” which symbolizes the dream of every woman to be pretty by grooming her. The product is packed in attractive plastic tubes, which is not only functional but also elegant in design. The proposed new hair care product is certified to the effect that it will not create any harmful effect to the health of the user. Research has proved that the product will meet the advertised purpose effectively so that, there will only be satisfied customers. The product will be produced with a good fragrance to attract the customers.

The product is priced slightly above the other competing products available in the market. This higher price will prove that the product is of superior quality than the available products. Based on the market analysis, the target customers will not hesitate and can afford to pay the slightly higher price for the quality, as the target customers are mainly employed people who are conscious of maintaining their hair throughout the day.

For ensuring the success of the product, it is essential that the product is made to reach the target customers through all available channels of distribution. Therefore, the product will be marketed through large retail outlets, chain stores, pharmacies and convenience stores.

Target customers will be advised of the availability of the product in different points of sale through effective marketing communication. Marketing communication to the prospective customers will be undertaken using electronic means of Internet and email (O’Conner & Galvin, 1997). There will be personal communications sent to the target customers using mailers along with credit card statements and such other communications by making suitable arrangements with specialist marketing organizations. Commercials in television will be one of the prospective means of communication. Depending upon the suitability of this medium based on the cost factors, television ads will be considered as one of the promotion tool.

Reaching the product to the customers also requires fixing an appropriate distribution channel. Making the product available in large areas is the central focus of the distribution arrangements. There will be effective planning in this front and commercially prudent decisions will be taken for the appointment of dealers and distributors for an effective marketing arrangement.

Financial Forecast

An amount of £ 200,000 will be invested by the promoters, as their own capital. The business is expected to receive a funding of £ 500,000 in the form of a bank loan or private equity. The financial estimates provide for an interest on the borrowed funds at 12% per annum. External funding is required to meet the initial investments on machinery and other fixed assets and to meet the working capital needs.

The offering of interest for the funding at 12% per annum, is quite attractive considering the return that could be expected from alternative investments in the market. The financial documents are attached with this pitch, which show spectacular cash generation by the business even at the end of the first year of operation. After meeting the tax liability of £ 49,800, the business is expected to result in a net profit of £ 116,200, which works out 5.81% of the total turnover. This gives a return on the investment of 16.60% of the invested funds, which is a good rate of return.

Conclusion

The proposed new hair product “DREAM” will compete with other available products in the market based on its quality. Once the product is accepted by the market, which we are sure, the sales are expected to grow exponentially. The most attractive part of the proposal is the cash richness of the venture, which ensures a shorter payback period. The rate of return on investment is also attractive. Based on the financial results indicated by the financial documents, the gross profit, operating profit and net profit are comparable to the industry standards. The product will easily penetrate the market in the absence of large number of competing products. The financial viability of the proposed venture is guaranteed by the sound financial estimates.

References

Abraham Anne, Glynn John, Murphy Michael, Wilkinson Bill, 2008, Accounting for Managers. USA: Cengage Learning.

Ahamad Faraz & Chauhan Hemant Kumar, 2010. Breakeven Analysis of Mining Project. Web.

Bennett, A. R. 1997. The Five Vs – A Buyer’s Perspective of the Marketing Mix. Marketing Intelligence & Planning, 15(3), 151-156.

Brouwer W, Rutten F, Koopmanschap M. 2001. Costing in economic evaluations. In Drummond M, McGuire A (eds) Economic evaluation in health care. Merging theory with practice. Oxford University Press. pp: 68-93.

Byford S, McDaid D, Sefton T. 2003. Because it’s worth it. A practical guide to conducting economic evaluation in the social welfare field. Contemporary research issues. Joseph Rowntree Foundation, York, UK.

Fahey, Liam, and Narayanan, 1986. V. K. Macroenvironmental Analysis for Strategic Management. New York: West Publishing Company.

Finkler S.A. (2001). Financial Management for Public, Health, and Not-for-Profit Organizations. Pearson/Prentice Hall.

Finkler, A Steven, Ward David Marc, and Baker Judith. 2007. Essentials of Cost Accounting for Health Care Organizations, USA: Jones & Bartlett Learning.

Horngren, C. T., Sundem, G. L., Stratton, W. O., Burgstahler, D., & Schatzberg, J. 2008. Introduction to management accounting (14th ed.). Retrieved from the University of Phoenix eBook Collection database.

Kent, R. A. 1986. Faith in the four Ps: An alternative. Journal of Marketing Management, 2, 145-154.

Kotler, P. 1986. Principles of Marketing (3rd ed.). New Jersey: Prentice Hall.

Longenecker, G. Justin., Petty J William. Palich E Leslie., and Moore W Carlos. 2009. Small Business Management: Launching and Growing Entrepreneurial Ventures.USA: Cengage Learning.

Low, S. P. & Tan, M. C. S. 1995. A Convergence of Western Marketing Mix Concepts and Oriental Strategic Thinking. Marketing Intelligence & Planning, 13(2), 36-46.

Lucey T (2002) Costing. Sixth edition. Thompson Learning. United Kingdom.

McCarthy, E. J. 1964. Basic Marketing, IL: Richard D. Irwin.

Millichamp AH. 1997. Finance for non-financial managers. Third edition. Continuum. New York, USA.

Möller, K. 2006. The Marketing Mix Revisited towards the 21st Century Marketing by E. Constantinides. Journal of Marketing Management, 22(3), 439-450.

O’Connor, J. & Galvin, E. 1997. Marketing and Information Technology – The strategy, Application and Implementation of IT in Marketing. London: Pitman Publishing.

Palmer, A. 2004. Introduction to Marketing – Theory and Practice, UK: Oxford University Press.

Sefton T, Byford S, McDaid D, Hills J, Knapp M. 2002. making the most of it. Economic evaluation in social welfare field. Contemporary research issues. Joseph Rowntree Foundation, York, UK.

Waters H, Hussey P. 2004. Pricing health services for purchasers: a review of methods and experiences. HNP Discussion Paper. World Bank, Washington, USA.