Introduction

Research Topic Introduction

Australia is a country and a continent where more than 23 million people live today. Its citizens adore and respect their land and are proud of being the members of such a huge community (Australia in brief 2014). The constant growth of the population is usually explained by migration from some regions of Asia and Africa (Crossley, Hancock & Sprague 2015).

Ethnic mix and increase in population are two crucial reasons why the system of Australian education has been changed considerably (Crossley, Hancock & Sprague 2015). Sydney is one of the largest cities in the country where plenty of universities and colleges are available to people. Education remains to be one of the largest services export in Australia (Australia in Brief 2014). More than 410,000 international students study in Australia, and more than 50% of these students study and live in Sydney (Australia in Brief 2014).

Such a huge number of international students has already added more than $15 billion to the Australian economy (Australia in Brief 2014). Therefore, education and the economy are the two industries that cannot be separated. Students, universities, colleges, and other people who are involved in the sphere of education have to understand that accounting services have to be properly chosen.

In this business capstone project research, the topic of the provision of accounting services to university and college students by a Sydney accounting firm is chosen for discussion to understand if it is profitable for university and college students to use the services of an accounting firm if accounting firms gain their benefits when they agree to cooperate with college and university students, and finally to describe the processes of how accounting services could be offered to people.

Background Discussion

Australia introduces itself as a crucial and constantly growing financial center (Australia in Brief 2014). It means that a certain group of people could introduce high-level financial services, and another group of people could use the opportunities available to them. Reforms and improvements occur in the country’s economic system and influence the way of how education could be offered to people and the requirements university and college students should take into consideration.

Education is one of the core government services in Australia (Cooper, Funnell & Lee 2012). This area is difficult to judge because students have their approaches and attitudes to the system of education they have to be involved in, and accounting organizations are free to create their conditions and prove the correctness of their choices. Accounting services include tax and audit services, business consultation, sponsorship, etc. (Cooper, Funnell & Lee 2012).

There are three main legal accounting bodies in Australia including the Institute of Public Accountants, CPA Australia, and Chartered Accountants Australia and New Zealand (Cooper, Funnell & Lee 2012). These organizations support accountants and creating the standards according to which accounting services could be offered.

However, in addition to these legally approved bodies, there are several accounting organizations and firms that could offer their services and prove the importance of their accounting help (Australian Accountants Directory 2016). Students have to know their options with accounting firms, and accounting organizations should understand their abilities and responsibilities when they cooperate with university and college students.

There are three main research questions to be answered in the project:

- What are the main stages in the process of providing accounting services to university and college students?

- What are the benefits and threats of accounting services available to university and college students that could be introduced by a Sydney accounting firm from the points of view of students and accountants?

- Why do students want to cooperate with accounting firms?

Research Methodologies and Techniques

Research methods cover the nature of human experience during an investigation on a chosen topic (Bryman 2012). Researchers reveal the required level of knowledge on a group of people appropriate for a project with the help of properly defined research methods (Bhattacherjee 2012).

Bryman (2012) offers to consider different contexts of research to make the right choices and follow the correct directions and supports the idea to divide research into qualitative (when action research is chosen), quantitative (when experiments and surveys are considered), and mixed (when the combination of qualitative and quantitative methods is appropriate). Research methods vary considerably: focus groups, interviews, questionnaires, etc. (Bhattacherjee 2012).

The project is developed with the help of mixed research methods. Mixed methods are based on the integration of quantitative and qualitative methods to identify an issue for consideration, interpret and explain the meaning of the main ideas, explore the chosen phenomenon, and analyze the situation. Qualitative and quantitative approaches should be chosen (Bhattacherjee 2012). This combination helps to increase the breadths and depth of the investigation and the understanding of a topic (Doorenbos 2014).

Mixed methods help to prove the correctness of the discussed topic using statistics and explanations. A questionnaire helps to clarify how many students need accounting firms’ services and how many accountants have already worked with students and to use interviews with several students, accountants, and university/college representatives to understand the essence of the accounting process that could be available to students in Sydney.

This method aims at providing survey information and numerical data (Cohen, Manion & Morrison 2013). The numbers show that the chosen topic has to be discussed and explained from a theoretical point of view. “Yes” and “No” questions identify the urgency of the topic. The Likert scale could help to measure the issue and identify the level of the participant agreement (Remenyi 2012).

Interviews explore and define the opinions of different people on a certain research question (Bryman 2012). The main shortage of this research method is the necessity to plan interviews and questionnaires, search people, who could participate in interviews, create schedules, and have enough time to talk and then analyze the information got (Bryman 2012). There are also ethical considerations to be underlined. Researchers have to inform the participants about the purposes of the project and their roles in the work. People should agree to participate and share their personal information for academic purposes.

Research Process

The project covers a topic that contains several variables: the opinions of students, the knowledge and experience of the representatives of accounting firms in Sydney, and the peculiarities of the process of provision of accounting services. Due to the presence of several research questions and variables, the project should be divided into several steps.

There are four main stages of the work on this project: preparations, gathering information, writing, and editing. First, it is necessary to create a plan for the project and set the goals that should be met at different stages. Then, it is necessary to set the deadlines according to which the work should be done. Finally, it is important to make sure that a researcher has access to the required portion of information.

To succeed in this capstone project, a researcher has to gather credible and up-to-date information. It is suggested to visit several accounting firms and ask if they can help to cover this topic. It is also possible to involve several students and ask them about their personal opinions about different accounting operations they have to take during their education. Interviews and questionnaires are methods that should be used by a researcher. Finally, it is also necessary to conduct library research to describe the details of accounting services. The evaluation of education in Australia helps to explain why accounting services are crucial for students.

The information should be properly recorded and introduced in the project. Then, the analysis should begin. The results and findings have to be properly described in the last chapters of the project.

Chapters’ Outline

- The introduction provides a clear overview of the project and explains the choice of the topic;

- Literature Review contains the background information on the chosen topic and the latest studies that could be used as the basis for the current project;

- Data Collection and Analysis discusses the methods of gathering information and the ways of how the data should be analyzed;

- Discussion of Results is based on the evaluation of the chosen hypothesis, the explanation of the findings made in research, and the recommendations that could be offered to other researchers;

- Conclusion and Future Work summarises the project and the achievements made and explain what kind of work could be done more to improve the already obtained results.

Literature Review

Introductory Items

Education in Australia is a frequently discussed topic worldwide because this country offers a diverse range of study opportunities for local and international students, who are free to choose their future relying on more than 1000 institutions and more than 22,000 courses within them (About Australian education n.d.). Australian students are free to visit their primary and secondary schools and choose colleges and universities as a form of tertiary education in regards to their interests and developed skills (Australian education system n.d.).

The Australian Government takes responsibility for funding some forms of education (Australia in brief 2014). Still, there are several accounting operations that students have to take care of independently. To succeed in reorganizing, an accounting firm has to evaluate all its services, investigate the sphere of education that is developed in Australia, and identify the conditions under which students can study (i.e. paid education for different levels of study, free education, living in dorms, scholarships, grants, etc.) (Education costs in Australia n.d.).

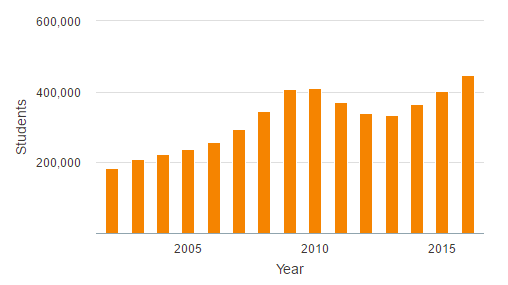

Nowadays, in Australia, there are many international students, who do not have much information about the financial aspects that are appropriate in the country they choose for study (The University of Sydney: living costs 2016). The current statistical data proves that students from different parts of the world want to continue their education in Australia. The number of international students has been changed during the last several years:

Some students want to develop their attitudes to accounting services, and some students do not even think about the details of payment for education.

The main hypotheses of this project include the following issues for consideration:

- Students have to pay their attention to the payment conditions and investigate their options in Australia;

- Accounting firms should reorganize their work or develop new accounting services that could be helpful and interesting for students;

- Accounting business has to grow, and accounting firms have to gain a better understanding of the Australian system of education to make new offers to university and college students;

- A variety of services offered to college and university students by an accounting firm could influence the studying process and promote important improvements personally to students and the education system in general.

All these ideas and hypotheses should be discussed in terms of the credible literature available that could be used while describing different topics chosen in the current literature review.

Education in Australia and Sydney in Particular

Australia takes the fourth place among the countries where international students want to learn and give the way to such countries as the United States, the United Kingdome, and France only (Australia in brief 2014). Such interests of students make the Australian Government improve its educational sector by any possible means and think about the development of appropriate services and various opportunities for students and academic institutions. Griffin (2013) underlines that education is the sphere that enriches human lives and promotes the development of social, intellectual, and even economic values.

People should never neglect the importance of education because it could open several doors and view the world from various perspectives (Crossley, Hancock & Sprague 2015). In Australia, much attention is paid to educational reforms and the provision of choices for all students. Many researchers and activists support the idea that education has to be free and available to all students in Australia (Griffin 2013). Still, free education could have negative outcomes from the economic point of view. Therefore, the educational reforms are developed to meet the needs of students and the government in the same period.

Australian schooling had its roots at the end of the 1700s when first British and Aboriginal settlements started the promotion of education to their children (Campbell & Proctor 2014). The cases of inequality and the intentions to promote free education for all people were discussed during the next centuries. Even now, the Australian system of education cannot be called as a perfect one. Still, the Australian Government makes certain improvements in terms of funding, financial aid, and other important details that could influence the system of education and improve the attitudes of students to their studying (Crossley, Hancock & Sprague 2015).

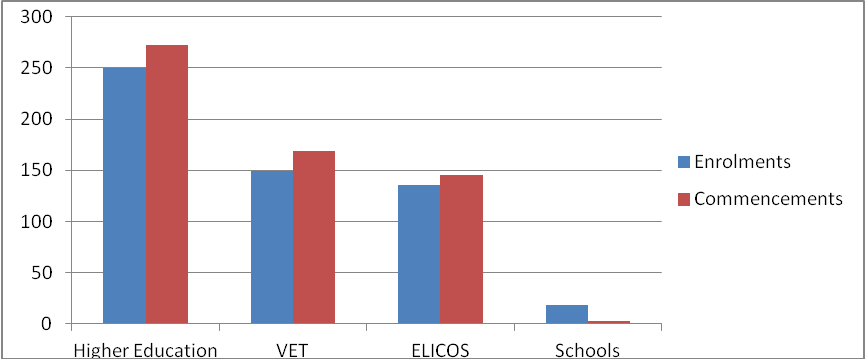

In Sydney, students can find many prestigious colleges and universities in various directions. In addition to primary and secondary education, this city focuses on tertiary education and further employment according to the degrees, levels of education, and even personal interests (Crossley, Hancock & Sprague 2015). The enrollment and commencement data have been considerably changing each year. In 2015, the results were as follows:

In Sydney, schools and colleges focus on presenting modern and coeducational curriculums for local students and the students, who come from other countries, and the investigations show that the Australian system of education has several similarities with the education system developed in Britain (Offer et al. 2013). The most popular universities in Sydney are the University of New South Wales, the University of Sydney, the Australian Catholic University, etc. (Crossley, Hancock & Sprague 2015). Sydney schools vary considerably including the Sydney Distance Education High School, German International School Sydney, North Sydney Boys High School, etc. Colleges in Sydney are open to all students as well. People can pay attention to Sydney Community College or Taylors College Sydney.

All these educational institutions have their peculiarities and standards that should be followed by students. Though some institutions in Sydney are free, there are also many situations when students have to pass through certain financial operations. Accounting firms could help students to facilitate transactional processes that cannot be neglected by international students.

In fact, in Australia, international students have to be ready to investigate their opportunities and use the services in regards to the current rules and order. It is not enough to know the law. International students should understand that Australian law could support them as well as blame in a certain period. Though accounting firms cannot be defined as the organizations that deal with law, these companies could help international students to understand how to succeed in financial operations and not to break the law.

Accounting Firms in Sydney

The role of accountants remains to be crucial in the world of business (Weil et al. 2007). On the one hand, they introduce their interests and the interests of the government when they organize different financial operations and take responsibility for auditing, taxes, and other financial control services that help to keep money and transactions in a certain order (Gay & Simnett 2015). The list of accounting firms in Sydney is long indeed, and each of them has its own goals, specific conditions for customers, and personal benefits.

For example, there is a team that is called Kelly+Partners. It is a chartered accounting firm that aims at helping people to achieve the required personal and business benefits and succeeds in employment, financial planning, and building services (Kelly+partners: difference 2016). The peculiar feature of this organization is the possibility to combine the personal and business needs of clients and deliver the services according to the deadlines.

Kelly+Partners is focused on the coordination of brokers’ work, insurance policy, lawyers and client cooperation, and accounting that cannot be understandable for all people (Kelly+partners: difference 2016). However, the competition between accounting firms in Australia are impressive indeed, and such reasons as the importance of international business and globalization could be defined as the main explanations (Patel 2006).

Nowadays, in Sydney, it is possible to find several accounting firms that could offer their services to different people and impress them with options and opportunities. Accru Felsers is the Sydney accounting firm that offers its clients with accessible services and accurate accounting pieces of advice that could help to promote a safe future (Australian Accountants Directory 2016).

Worrells Solvency + Forensic Accountants is that organization that helps people with their solvency management and financial investigations and promises to offer fast and straight answers. Jag Ludher & CO competes with other companies in providing people with financial services, taxation suggestions, small business organizations, and advisory details that are crucial for ordinary people (Australian Accountants Directory 2016).

According to the list defined in the chosen source, accounting firms of Sydney as well as of any other city in Australia have the same goals (Australian Accountants Directory 2016). Besides, they want to gain the benefits and promote their growth. Therefore, some accounting firms think about the opportunities to improve their business and gain profits from possible cooperation with college and university students.

Types of Accounting Services: Overview

From the examples of Sydney accounting companies, it turns out to be clear that such organizations are ready to provide different people and companies with plenty of services that could facilitate the processes called financial transactions, accounting consultations, and business financing (Australian Accountants Directory 2016). Still, the number of possible accounting services is huge indeed. Accounting companies that try to develop their cooperation with college and university students have to evaluate all possible options and choose the services that could be interesting and necessary for students, who study at the universities and colleges of Sydney.

Several international students and ordinary students, who do not want to investigate their financial opportunities, still believe that accountants’ main job is to gather and report person’s or company’s financial activities and consult people on how to understand the importance of taxes in their lives (Chatzoglou et al. 2011). However, the scope of activities and duties of accountants is broader than it seems and more helpful to students than they could even think.

Bookkeeping, analysis, and evaluation of past and present conditions of an international student, support in making financial decisions in regards to the requirements of a new country, investments, rental agreements that are important for international students, payments for various operations, business efficiency improvement, cost quality, and control, auditing services, etc. (Weil et al. 2007). All these types of accounting services could be offered by different companies to different groups of people including native and international students.

Globalization has been already identified as the reason why so many accounting firms have to compete and think about a variety of services that could be offered to clients (Rajasekaran 2011). Students have a chance to visit new countries and even study as foreign students to improve their knowledge and practical skills. Because of globalization, accountants should also think about the formulation of some new types of accounting and development of the branches that could be necessary to people (Rajasekaran 2011).

Financial accounting is a type of accounting services that produce information using the financial statements available. Financial statements usually include profit and loss accounts and balance sheets (Rajasekaran 2011). The main users of such type of accounting are shareholders, creditors, and investing companies. International students could be identified as a type of creditors, who want to stabilize their financial position in a new country. There are Generally Accepted Accounting Principles (also known as GAAP) that should be known by every student, who wants to organize their financial operations. These principles introduce a framework with the help of which accountants and their clients could discuss the standards and regulations that should be followed.

Management accounting services include the exchange of information about budgets, forecasts, effectiveness, and other facts that could influence the performance of a company or particular people, who address an accountant (Rajasekaran 2011).

Tax accounting services cover all types of operations that are connected with taxes, duties of customers in regard to the government, and obligatory payments that cannot be neglected by citizens (Gay & Simnett 2015). International students have to pay for their education in a new country. To avoid misunderstandings and extra payment, they could use accounting companies and get a clear picture of how much money could be required (Rajasekaran 2011).

Accountants provide people with professional help in case they want to learn more about their employment opportunities and responsibilities, investments, funding, accounting, business development, etc. (Weil et al. 2007). International students are interested in such opportunities because many of them want to stay in the countries where they study and find a practical application to their theoretical knowledge.

Nowadays, several students from different regions choose Australia as their second home to gain benefits and succeed in employment. The citizens of the following countries study and live in Australia at the moment:

The services are frequently used by international students, who want to start working, and native employees, who want to be in good terms with the government, earn fair money and be far from illegal mistakes that could influence their future. However, nowadays, not many students understand that they always have the right to become the clients of accounting firms and ask for professional help to deal with their financial operations and transactions (Rajasekaran 2011).

Financial Operations for Students: Types and Importance

In Sydney, education could be free for students (Australia in Brief 2014). However, there are also situations when students have to pay for all services and experience offered. Australian people believe that education has enough power to change human lives and make improvements that cannot be even expected (Australia in brief 2014).

Still, the fact that students have to pay for their education and the importance to solve various financial aspects may confuse students or make them think about the details that have nothing in common with education. Therefore, students have to understand that if they start educating in Australia, they have to get involved in various financial operations and make the decisions that could influence their financial situation (Campbell & Proctor 2014).

On the one hand, students have all chances to learn the peculiarities of accounting and consider the theories and investigations in this sphere (Deegan 2014). On the other hand, even if students learn something about accounting, they cannot be provided with 100% guarantees that they can understand the nature of the accounting services and financial operations they have to be involved in. Therefore, students should use the opportunities available and pay attention to the services and suggestions offered to the accounting company.

At this moment, the evaluation of the colleges and universities of Sydney shows that students have to deal with several financial operations on their own (The University of Sydney: finance office 2016). For example, the University of Sydney offers rather clear and definite information about the financial aspect of the studying process for its students. There are certain tuition fees that students have to understand and clarify in regards to a list of certain factors such as the degree type, the course chosen by a student, and even the residency status (The University of Sydney: tuition fees 2016). Domestic and international students face different conditions under which they could continue their education. Besides, students have to calculate their fees and possible loans using a certain system developed by the university (The University of Sydney: tuition fees 2016).

Another important financial aspect of the chosen university is the attention to scholarships and the intention to reward talented students and those students, who have a potential but could require some portion of help (The University of Sydney: scholarships 2016). Certain living costs could be identified for students at the University of Sydney.

On its official site, it is stated that a student could spend between $1400 and $2000, and the majority of expenses cannot be avoided (The University of Sydney: Living Costs 2016). The evaluation of the financial operations completed by international students shows that some operations have a regular basis, and some operations are done from time to time. The most frequently used services include

Though schools have other policies and financial needs, students have to understand that certain payments could be required as well. Colleges have a different system of payment, and students have to spend their time to learn all the requirements and make the correct choices.

In general, university and college students have to get ready to deal with such accounting operations as (The University of Sydney: finance office 2016):

- Operational accounting;

- Taxation;

- Insurance;

- Rental payment;

- Financial reporting;

- Credit cards, etc.

All these operations and services are important for students because some of them could help to earn some money, and some operations cannot be avoided because education cannot be free for everyone. Unfortunately, not all students can deal with the requirements and understand the nature of all financial operations. They could trust their worries to the hands of the universities and colleges. Still, it is also possible for students to consider the possibility of relations that could be developed between an accounting firm and a student.

Student-Accounting Firm Relations: Possible Development

Nowadays, many accounting organizations offer students special programs and employment opportunities (Kelly+partners: difference 2016). Students can develop their relations with accounting representatives as an employee and an employer. Still, not much information is given on the ways of how students could cooperate with accounting firms as clients. For example, Kelly+Partners Chartered Accountants is the organization that helps its clients to get their business organized, get insurance, investigate income taxes, organize management reports, and develop financial reports during different periods (Kelly+partners: difference 2016). The majority of these services are not necessary for students. Still, students are always in need of:

- Professional financial consultations;

- Opportunities to get loans and funds;

- Comparison of different colleges and universities and their financial operations in regards to a particular situation of a student;

- Explanations about the financial peculiarities of a certain country that international students need

- Personal support and explanations that could be offered at a professional level; and

- Promotion of safety and guarantees in terms of a personal financial situation.

The peculiar feature of the possible development of the relations between a student and an accounting firm is the necessity to understand personal needs and concerns. Students do not possess the required professional knowledge and understanding of what should be done with their money. Students want to know that their education is their contribution to their safe future.

Though universities and colleges are eager to attract the attention of many students and explain that all their payments and fees have certain purposes and reasons (The University of Sydney: tuition fees 2016), students could think that all those promises and advertisements are made just to gather the required number of students and achieve the required financial benefits. In other words, students cannot be confident that all universities’ and colleges’ promises are beneficial for them and that there are no other options for them to rely on.

At the same time, if students could get enough guarantees that accounting firms could be helpful to them, accounting firms have to understand the nature of their cooperation with students and identify if there are some benefits and challenges in such a new kind of professional relations. In other words, it is necessary to understand if it is beneficial for accounting firms to offer new accounting services and professional support to students of universities and colleges in Sydney (Gay & Simnett 2015).

Provision of Accounting Services to University and College Students: Positive Aspects

If an accounting firm wants to develop a new line of services and think about university and college students as their possible clients, it is necessary to comprehend the nature of such relations and the opportunities that could be available.

An accounting firm could be interested in students as its clients because of the possibility to increase the number of regular customers that could begin their services with payments and insurances and continue using the same organization to succeed in tax services, bookkeeping, auditing, etc. In other words, it is necessary to develop trustful relations with people of different ages (Muhl 2014), and young people could be easily convinced and supported.

At the same time, students do not have many demands and financial problems, and such clients, as well as the representatives of small businesses, are preferable by small accounting organizations (Prince 2015). The majority of their needs include professional suggestions, overall evaluation, comparison, and control of personal finances. Students can use the services of a certain accounting firm and share their experience with other people. Such a connection means that several people could get to know about a chosen accounting company. As a result, a free and effective advertisement is also possible because of the cooperation with university and college students.

Finally, there are not many accounting companies that decide to cooperate with students and provide them with accounting services. Some companies just do not want to consider students as their possible customers, and some companies do not want to make changes in the already developed system. A company that decides to start working with students, who study at universities and colleges, could differ from other companies and gain several benefits in a business competition. Still, it is also necessary to remember that new offers and approaches require several changes and possible challenges (Chatzoglou et al. 2011).

Provision of Accounting Services to University and College Students: Negative Aspects

The provision of new accounting services to college and university students may differentiate a company among the rest accounting organizations. At the same time, a company should get ready to work hard and make the changes that require certain time, money, and efforts. For example, it is necessary to hire a person or even a group of people, who could investigate the conditions under which financial operations are offered in universities and colleges. Change management is usually impossible without the appearance of new figures or new people (McCalman, Paton & Siebert 2015).

New people and changes in an organization require new investments and expenses. It is hard to predict possible losses and challenges and control the level of job satisfaction (Chatzoglou et al. 2011). Finally, an accounting firm should develop a new price and quality strategy with the help of which students could allow using the services of a company constantly, understand the benefits, and formulate their needs and expectations properly.

The main challenge that could be dangerous for an accounting company in case it accepts the idea to cooperate with students is the justification of the choices and personal financial benefits. It can happen that the services and needs of such customers should have higher prices than they are set at the moment. Still, such a situation may be called as a required change control loop when a particular intervention cannot be acceptable, but it is still possible to control the cause and just stop offering the services (Longest & Darr 2014). However, the presence of such a type of control loop is a threat to a company. Therefore, an accounting firm needs to understand if it has enough sources and time to implement the chosen change and deal with the deviations that could occur with time.

Changes in an Accounting Firm

Working with students has its benefits and challenges. An accounting firm is free to choose if it is necessary to support a new change or if it is better to think about other options available for the company (McCalman, Paton & Siebert 2015). Still, the provision of accounting services to university and college students in Sydney remains to be an innovation for many Sydney organizations. It is also possible to underline the number of educational institutions and the number of possible clients.

A deep investigation of colleges and universities could also help to comprehend what kind of innovations should be expected (McCalman, Paton & Siebert 2015). Finally, accounting organizations are not obliged to do what is not beneficial to them. A firm could try to attract the attention of students, start cooperating under specially developed conditions, and clarify if the changes are acceptable or not. If the harm of deviations is bigger than possible income, this type of service provision could be rejected. Still, at this moment, the preparations should be a priority for an accounting firm that wants to be one of the first that develop professional relations with students and prove that accounting services could be offered to students on rather attractive terms.

Data Collection and Analysis

Introduction to Data Collection and Analysis

Mixed research methods were used in the project to gather the data on the required topic. Mixed research includes the combination of qualitative and quantitative approaches to identify the core issues under consideration, interpret the information, and create a solid background for the project (Bhattacherjee 2012). Interviews were used as the main qualitative research methods in the project, and questionnaires were introduced as the main quantitative research methods with the help of which it was possible to gather numerical data on the project.

Questionnaires aimed at clarifying how many students needed accounting services, how many services had been already offered to students, international students in particular, by accounting companies of Sydney, how many people believe in the importance of accounting services for the students of Sydney. At the same time, questionnaires introduced the picture of what accountants and college/university workers know about accounting firms-students cooperation.

Interviews, as the examples of qualitative data collection methods, aimed at the exploration and definition of the opinions of students, accountants, and the representatives of colleges/universities. In addition to the numerical data obtained from the questionnaires, interview data helped to clarify the situations when accounting services could be offered to students.

Data collection was as important as the data analysis section. It was important to clarify data analysis methods as soon as the information was gathered. Qualitative data analysis included the identification, examination, and interpretation of the themes in the interviews. Quantitative data analysis helped to evaluate the facts, measure the interval data, and underline the logical order of the answers. Interviews were audio-taped and transcribed so that the information could be interpreted. Questionnaires were in the written form so that the number of Yes/No questions, as well as the answers in the Likert scheme, could be calculated and used as evidence in data analysis.

Data Sampling Method

Sampling in mixed research methods should be based on probability and non-probability at the same time because it is important to use and analyze random events could help to generalize the facts and clarify if accounting services have to be offered to students, and, at the same time, it is necessary to use certain and personal experiences of people, who know what they talk about. In this project, it was decided to involve 25 participants to give their answers in questionnaires and to communicate with a researcher during interviews.

Data sampling was identified. To meet the requirements of the study and to make sure that the research questions could be answered, it was necessary to choose an appropriate strategy. It was decided to use a non-probability sample, snowball, to find several people that could be relevant to the chosen topic and ask them if they could share their opinions and knowledge for the project (Fortune, Reid & Miller 2013).

It was necessary to invite 10 international students of Sydney colleges and universities so that they could share their experiences, financial obligations, and intentions to cooperate with or avoid accounting firms’ services, 10 employees of accounting firms so that they could inform about the possible services for students and the expectations from cooperation with students, and 5 representatives of colleges and universities so that they could explain if the financial operations expected from students are complicated or specialized that professional help of accountants is required. In general, 25 participants were chosen. All of them had to be the citizens of or live in Sydney at the moment of the study.

Several places were chosen to find the participants in the research. The University of Sydney, Sydney Community College, Kelly+Partners Accounting Firm, and Accru Felsers Company were four main organizations where the participants were chosen. The first part of the task was to visit educational organizations and talk to the students about the importance of accounting services in their academic lives. It was a free-will initiative to participate in the study. Several randomly chosen students were asked about their past experiences.

Besides, students were asked if they were international students or native students. As a result, several native students directed the researcher to the international students so that both types of students were found. It was also necessary to communicate with the employees of those academic institutions to clarify if the researcher was approved to communicate with students and some employees to gather the information for the study. The permission was obtained in an oral form. The representatives of the University of Sydney and Sydney Community College were eager to participate in the study and agree to answer the questions.

Still, the majority of them underlined the necessity to stay anonymous so that the names of the research participants were changed in the Appendix where the examples of interviews and answers of people were offered. In general, more than 50 students and 10 college/university employees were eager to participate in the study.

Only 15 people were chosen due to such criteria as “to be an international student” and “to be a student of the chosen institutions”. Other candidates were removed because not all of them were able to continue their participation and answer the offered questionnaire, and some of them were not eager to share their personal information about their incomes and financial situations.

Students between 17-21 years were chosen for the study. They were informed that it was necessary to participate in personal interviews and a written questionnaire. Besides, they were informed that interviews had to be audio-taped. Still, their names and other personal information would not be mentioned in the paper. The goal of the project was identified, and the intentions of the researcher were explained. The representatives of the college/university wanted to stay anonymous as well. The overall age of the employees was between 25 and 40 years.

The second part of the task was to visit several accounting firms and clarify if they cooperate with students and what types of services they could be offered to international students. Five companies were visited. They were chosen regarding their location and the direction of their services. One company was closed at the moment of visiting. The managers of two accounting companies, who wanted to stay anonymous, rejected the possibility to participate in the study. The representatives of Kelly+Partners and Accru Felsers were eager to communicate with the researcher and provide the answers to the questions in the interview.

The intentions of the two companies were similar. Both of them wanted to introduce their services and analyze their possibilities to cooperate with students. Today, several Sydney accounting companies try to re-organize their politics and cultures to attract the attention of new clients and help them succeed in a variety of financial operations that should occur regularly. The representatives of Kelly+Partners and Accru Felsers answered five questions posed by the researcher and gave clear explanations about the services they offered and the goals they wanted to put in the future.

The next stage of the project included interviews and questionnaires. First, 25 short interviews were conducted in the frames of the project. 10 students had to answer seven questions. 5 representatives of college/university gave their answers to 5 questions posed. Finally, the employees of accounting firms answered 5 questions offered. Some of the answers are introduced in the Appendix to get a clear idea of what kind of information was offered. It was also offered to answer the questions in a questionnaire form.

The participants could choose two forms of answers: the questionnaire was sent via e-mail, and the printed questionnaire was given to them after the interviews. 80% of the participants agreed to give their answers at the same time, and 20% asked to send the examples via e-mail. In general, one week was spent to find the participants, interview them, and gather the required material.

Data Analysis

All interviews were audio-taped and transcribed. The transcriptions were re-read several times to make sure that all information and details were properly identified in the printed version of the interviews and to gain insight into the real experience of students, accountants, and the representatives of colleges and universities. To clarify the main issues that could help to answer the research questions and hypothesis, it was necessary to read all transcripts carefully and underline the issues that were crucial to building the result section.

The analysis of the information from the interviews was made in the form of tables. Each question had its table and the identification of the issues for consideration. There were three groups of people chosen for the interviews: students, the employees of accounting firms, and the representatives of colleges and universities. The first group of questions was directed to the students, their personal experiences, and their expectations from the cooperation with accounting companies:

Interviews with Students

1. Have you ever used accounting services? If yes, describe your experience

Table 1: Results of Q1

30% of students answered that they had never used accounting services. The reasons for why they did not use them varied: there was no necessity to address a company or no companies worked with students, and parents took responsibility for all financial operations. 20% of students admitted that they had used the services of accounting companies.

One student wanted to clarify if it was possible to get tuition with the help of the company. Another student tried to clarify if international students had to pay some taxes being the resident of the country. 50% of students mentioned that they had already addressed accounting companies to get the answers to their personal questions. Some students wanted to know about the financial aspects of their properties, and some students had to find a person who could follow their financial operations during a certain period.

2. Do you want a professional accountant to take care of your accounts and financial affairs? Why or why not?

Table 2: Results of Q2

30% of the participants declared their negative and neutral attitudes to the idea of accounting firms being used by students for some academic purposes. The reasons for such an answer were the desire to gain independent control of their finances and the intentions to save their money and follow the rules defined by companies.

At the same time, all students underlined the fact that they just did not have enough information about accounting companies and the nature of services that could be offered to students. Still, 70% of students gave positive answers about the possibilities to cooperate with accounting firms to understand how to improve their finances and what kind of professional help could be used.

3. Are you ready to pay an accounting firm for a provision of accounting services?

Table 3: Results of Q3

60% of the students, who participate in the project, underlined their readiness to pay for the services they could get from accounting firms. 30% of students said that they did not want to spend additional money for the services to control their financial operations because their main goal was to save money and meet the minimum they got for education and personal needs. One student was not able to give a clear answer because he was not confident if he was really in need of such services. Still, the majority of answers were based on the fact that students did nothing or a little about accounting companies and their actual worth for students.

4. How much would you pay? $50? $60? $70 and above?

Table 4: Results of Q4

The opinions of students divided into several groups. Regarding the fact that several students were still eager to save their money and keep to their annual minimums, 50% of the participants agreed to pay about $50 for accounting services. 30% of students were ready to pay more and increased their opportunities to $60. Finally, there were 20% of students, who said that it was possible to pay $70 and more for accounting services because the quality and nature of help offered by accounting companies could vary, and it was hard to predict the outcomes of services offered.

5. What do you think is a reasonable amount to pay for accounting services?

Table 5: Results of Q5

In this question, students have equal positions: 30% of students admitted that the price did not matter, and the same number believed that accounting services should be as cheap as possible for students. Two students mentioned the dependence of the price on a service, and two students were not ready to answer because of poor knowledge.

6. What do you expect from the accounting services? Is it additional help, the ability to save money, or the possibility to gain control over personal financial operations?

Table 6: Results of Q6

Additional help (100%), the ability to save money (30%), and the possibility to gain control over personal financial operations (50%) were the main expectations of students. Still, students were not confident in their answers because they wanted to know about the services they could rely on as the clients of accounting firms.

7. Would you prefer to use a local qualified accountant or an accounting firm? What is the reason?

Table 7: Results of Q7

If students could have options, not all of them were ready to address an accounting firm for help. 20% of students thought that the services offered by a local qualified accountant could be more appropriate in comparison to the services offered by an accounting company. Besides, 20% of the participants believed that local accountants and accounting companies offered the services of the same quality. 60% want to believe that the services and opportunities offered by an accounting firm had many benefits for students.

In general, the interviews with students showed that the services of accounting firms could be interesting for students. Still, a poor level of knowledge and the inabilities to study the peculiarities of such services deprived students of the chance to think and estimate properly.

Interviews with Accountants

The interviews with accountants from different companies of Sydney introduced a solid basis for the idea to promote accounting firms’ services among the international students. The answers to the questions helped to understand the attitudes of accountants to students and their true intentions about the idea of cooperating with international students.

For question one (Have you ever worked with students?), more than 50% said “no”, 30% give “positive” answer, and 20% did not remember. The reason why accountants gave different questions was explained that not many accounting firms aimed at cooperating with students. Those, who had a chance to work with students, mentioned that no particular difference was observed because their task was to provide their clients, regardless of their age and occupation, with the credible portion of help.

For question two (Do you think accounting services for university and college students could change the work of a company considerably? If yes, describe the main changes.), ten accountants that were chosen for interviews given opposite answers. Three interviewees said that no considerable changes should occur, five participants believed that their companies had to take certain steps to support a new group of clients, students, and two accountants did not give a clear answer because there was no practice with students.

Question three (Do you want to see students as your regular clients?) had the same answers. 100% of the participants admitted that they would be eager to cooperate with international students, help them, and credible pieces of advice.

Question four (Do you think an ethical aspect is important in accountant-student relations?) caused rather controversial thoughts and answers that are presented in the following table:

Table 8: As to Q4

The reason for such diversity could be explained by the corporate cultures of companies and their understanding of ethics and their ethical obligations. Therefore, ethics in accountant-student relations should not be a determiner of the importance of the development of accounting services for international students. That question proved that employees needed additional explanations and knowledge about the worth of ethics in their work.

In question five (Do you want to cooperate with students or their parents?), all ten participants agreed that the idea to cooperate with students was a good practice that could not be neglected. First, that practice could promote the development of accounting firms. Second, more clients could be attracted to firms. Finally, accountants had to improve their communicative and professional skills to make sure they could work with students and explain to them the basics of their services.

Interviews with Representatives of Colleges/Universities

Five workers of academic institutions agreed to participate in the study. Those interviews helped to create a clear picture of why students had and had not to address accounting companies to find professional support. The analysis of their answers could be given in the form of a table and explained below the table.

Table 9: As of C/U R

Regarding the answers of college/university representatives, it was clear that the college representatives encouraged their students to make use of accounting services and address special companies for professional help. University workers thought that they created the required number of services and support to their students so that international students had not to spend their time searching for an accounting firm but focus on education and the development of their academic and personal skills. The analysis of the information obtained from college/university workers proved that students had the right to address accounting firms for additional help and explanations. Still, the question was if it was that important and crucial to making students address such companies instead of using services offered by their academic institutions.

At the same time, the participants of the interview did not focus on the idea that students could need some accounting help because of their reasons. They could not find the answers to the required questions at colleges and universities. Therefore, they had to address accounting firms. International students face several financial and accounting problems during their academic years. Sometimes, the representatives of colleges and universities do not even know about such needs of students and cannot provide them with the required solutions.

Questionnaires for Participants

There were two types of questionnaires offered to the participants. First, it was necessary to find out what the participants thought about the students’ need for additional accounting help. Second, it was important to clarify their attitudes to accounting services and readiness to use them under the conditions offered by companies.

The first seven questions were offered to all three groups of the participants of the study. The results are offered in the table below:

Table 10: Questionnaires1

All participants did not spend much time to give the answers. They relied on their personal experiences, opinions, and attitudes to accounting services that could be available for international students. The answers of the representatives of all three groups were calculated personally, and the percentage of the answers was introduced to demonstrate the average level of answers.

Table 11: Questionnaires2

The answers of students showed that the idea of accounting services for international students was not that bad. Still, students knew a little about accounting firms and their services. Therefore, students’ opinions could not be defined as thoroughly and properly developed. Their answers could be compared to their intentions to learn more about accounting services and the benefits they could gain.

Conclusion to Data Collection and Analysis

In the project, data collection was organized with the help of interviews and questionnaires specially developed for students of colleges and universities, the representatives of those colleges and universities (i.e. local accountants, cashiers, and tutors), and the employees of accounting firms. Each participant was provided with guarantees and the importance of anonymity. The names were changed, and the records were used just to gather the opinions but not to define the personalities of the participants.

The analysis of the data was organized into three main steps. The answers of the participants were divided into three groups and analyzed personally by the representatives of the research team. First, it was necessary to deal with the interviews: transcript the audio-taped material, read and re-read the text to underline the main issues, and put the results on the tables. Then, questionnaires were analyzed. The replies of all 25 participants were observed, and their answers were calculated accordingly. Finally, the total numbers were introduced and compared.

In general, the collection and analysis of data proved that accounting services could be offered to international students, who wanted to improve their current financial situations and gain control over different financial operations. Each question of interviews and questionnaires was developed to clarify if the participants used similar services, what they knew about accounting firms and the needs of students, and what improvements could be offered to change the situation. Some accounting firms were ready to cooperate with students and offer them special terms for work. Some companies had to spend some time clarifying if it could be beneficial for accounting companies to work with international students.

Discussion of Results

Discussion on Hypothesis

The main hypothesis of the project is the importance of the provision of accounting services to university and college students by a Sydney accounting firm. It was necessary to prove this kind of importance through clarifying supporting ideas like the facts that students had to pay their attention to the payment conditions they got in Australian colleges and universities, accounting firms had to re-organize their work to meet the needs and interests of Sydney international students, and the field of accounting had to be expanded to make significant contributions to Australian education.

Accounting firms wanted to know the boundaries of the possible business growth and the services they could offer to students to gain more profit. Griffin (2013) mentioned that education had to be defined as the sphere that contributed to human lives and promoted the development of several values. In Sydney, educational reforms and standards were properly developed to make sure that all students could reach it and choose the direction that was the most appropriate for a student. The students’ answers to the interviews and questionnaires showed that students focused on the conditions under which they had to study.

They are aware of the requirements set by their colleges and universities. Some students still believe that, in the sphere of education, no much attention is paid to the financial operations the majority of students have to be involved in. Therefore, if students got an opportunity to address an accounting firm and asked for professional help, they could use it.

Accounting companies aim at providing various financial control services with the help of which people could keep their money and transactions in a required order (Gay & Simnett 2015). The results of the interviews and questionnaires helped to clarify that students did not have much information about accounting services and the worth of accounting firms in their academic lives. Students did not even bother about their possible involvement in various financial operations.

The investigation helped to understand that accounting companies already had a certain basis according to which they work with their clients. If students have to be identified as a separate group of customers, accounting firms should think about possible re-organization of their services. Still, not all companies are ready to make changes just to make students become their clients. Therefore, the idea of the provision of students with accounting services remains to be open for discussion because each company is free to have its attitudes to serving students.

Employees of accounting firms should consider their own rules and values and clarify if they are ready to work hard to understand what services students could need. At the same time, the results of the investigations could be used as the first step of the chosen need evaluation. Students proved their desire to become the clients of accounting firms to find additional financial help, save their money, and choose the methods that could organize their financial operations.

Still, it is necessary to understand that the main goal of the majority of students in addition to their desire to get professional accounting help is to protect their money against additional costs. Students have to be properly aware of their possibilities and benefits they get with accounting firms. In brief, the needs of students and the importance to deepen their knowledge about accounting services in their academic and personal lives should be underlined.

Interviews and questionnaires with accountants helped to clarify another important issue that was the readiness of accounting firms to cooperate with students. Accounting firms have several clients that address them regularly and occasionally as soon as some portion of help is required. Accountants get used to working with mature clients who know what to expect from the services and how to ask for help.

Students do not usually have the required portion of knowledge and want to learn their perspectives and opportunities. Accounting firms should develop new strategies and approaches to their work to know how to provide students with help and solutions to their problems and concerns. Employees of accounting firms understood that they had to be ready to change their routine steps when they decided to work with students. Though the changes could be minimal, they still had to occur.

Finally, the answers of the representatives of colleges and universities helped to realize that academic institutions implied the importance of students to make regular and one-off payments and the necessity to organize their financial operations properly. Still, the majority of the representative believed that the help offered by their academic institutions had to be enough for students. In other words, those representatives decline the possibility of accounting firms to be used by students to solve their financial concerns. Such attitudes to the possible relations between accounting firms and students could be explained by the poor awareness of the services offered.

Taking into consideration the answers got and the conclusions made, the chosen hypothesis of the project that touches the importance of accounting services for students could be supported. Accounting firms should try to introduce their actual help to international students and describe the directions of cooperation. Still, it is not enough to admit that accounting services have to be offered to students. It is necessary to clarify the steps and suggestions accounting firms could rely on when they decide to develop new special services for students of Sydney colleges and universities. The recommendations based on the discussion and the evaluation of the data collected from interviews and questionnaires could be found in the section below called “Recommendations”.

Discussion on Literature and Research Results

The analysis of the literature of accounting services and their possible connection to the field of Australian education shows that students could ask for plenty of accounting services that include financial transactions and consultations (Australian Accountants Directory 2016). Students may need some financial pieces of advice or the description of financial activities that could not be avoided in real life i.e. taxes or bookkeeping (Chatzoglou et al. 2011).

The results of research proved the fact that students, as well as other clients of accounting firms, could have their interests and needs. Unfortunately, not many students understand how crucial some auditing services or tax payments could be (Weil et al. 2007). Therefore, accounting firms have to pay their attention to the chosen category of clients and make sure that students understand their rights and obligations.

In the review of the literature, certain attention was paid to the issue of globalization and its impact on Australian education and finances (Rajasekaran 2011). On the one hand, several people could visit Australian and decide to continue their education at one of the colleges or universities of Sydney. Accounting firms have to realize that they need to work with foreigners and understand their needs in a short period. On the other hand, globalization promotes the exchange of experience.

Some clients of accounting firms could be aware of new types of accounting and demand for some services that were not practiced at certain accounting companies. The results of interviews helped to identify that Sydney colleges and universities were full of international students with a majority of them being at a loss of the financial operations they had to deal with. Therefore, the cooperation between accounting firms and international students turns out to be a good opportunity to investigate the needs of international students and their abilities to pay for the services they choose.

At this moment, Sydney accounting firms provide their clients with management accounting services and tax accounting services (Gay & Simnett 2015; Rajasekaran 2011). Besides, accounting firms could offer consultations and explanations for international students about how to stabilize their financial situations and make the right decisions in terms of education and finance (Campbell & Proctor 2014).

Communication with accountants and students was used to prove that some students found it helpful to address accounting companies and pay for the services offered to solve their personal, financial questions. Still, students did not understand how such companies could help them to optimize their academic lives and payments they made from time to time.

The results of the research could be used to develop several recommendations for accounting firms to make their services available to students, and international students in particular. There is no need to make crucial changes and think about the development of new accounting services. The main task is to analyze what has been already known about accounting services for students, and how the same information could be introduced so that international students become interested in the offerings of the company.

Students have to deal with tuition fees and academic loans (The University of Sydney: tuition fees 2016), scholarships, and academic rewards (The University of Sydney: scholarships 2016). Besides, several payments include education, health insurance, refunds, rent, etc. Some students explained that they used the help of their parents to organize their financial operations properly. There were also the students, who preferred to make their decisions about accounting services independently and addressed accounting firms as soon as they needed a professional suggestion.

Several current students continued to know nothing or a little about the worth of accounting services and believe that the required portion of could be found any time they could ask for it. The sources of such help could vary from local, independent accountants to the finance offices they could find at their colleges and universities. There was no definite point about the worth and importance of accounting firms for international students directly.

Some opinions included the necessity of accounting firms to start cooperating with students, and some opinions put the idea of the provision of accounting services directly to students under a question. Still, in general, the representatives of the three groups proved that they do not mind the offered hypothesis and offered their suggestions and ideas on how to make the cooperation between students and accountants possible and what conditions should be taken into consideration.

The workers of such firms supported the idea that such services operational accounting, taxes, rental payment, credit cards, and insurance (The University of Sydney: finance office 2016) did matter in the lives of ordinary students and explained that they could offer such services and additional accounting help for students. Still, the conditions under which such services could be offered could hardly meet the expectations of students because it was unreasonable to promote special terms for students and decrease the prices to attract students. The quality of services offered to students and ordinary clients should not differ as well as the prices.

Recommendations

Nowadays, it is easy to give and find recommendations with the help of which something could be changed, improved, or even removed. However, very often, people need qualified recommendations with the abilities to investigate the situations, consider the needs of all participants, and evaluate the expectations of people. In this section, the recommendations to an accounting firm that wants to introduce accounting services to the students of Sydney will be given based on qualitative and quantitative methods of research conducted at Sydney colleges, universities, and accounting companies.

The work was developed on the answers given by ten students, ten employees of accounting firms, and five workers of the college and universities. Regarding the ways the participants answer the questions and share their thoughts, three main recommendations could be given to support the chosen topic and improve the quality of services offered by the representatives of accounting companies.

The first recommendation includes the necessity to inform students about the services and help that could be offered by accounting firms. Students could not give clear and thorough answers to the majority of the questions because they did not know why they might use the help of accountants. Besides, they could not understand how accounting services could change their lives and facilitate their financial affairs.

Therefore, it is recommended for accounting companies to develop the campaigns at colleges and universities to provide students with the required portion of information about the types of accounting services students could use, the benefits and discounts students can get as the clients of a certain accounting firm, and the lessons that could be given to them in terms of the services offered.

In the answers given by students, one of the common themes mentioned by 70% of the participant was connected with the fact that students would be eager to use the services of accounting firms and solve their current financial problems and concerns. Still, they could not give their positive answers because of the lack of knowledge. A properly developed campaign that would aim at informing students about the worth of accounting services is one of the solutions to be made by a company that wants to start cooperating with students.

Another recommendation touches upon the work of accountants and their readiness to promote changes and improvements. In their interviews, 50% of students mentioned that they were not ready to pay more than $50 per service of accounting firms. At the same time, the representatives of accounting firms admitted that it was not reasonable to decrease the prices on services for students.

Therefore, it is possible to think about a policy with the help of which accounting firms could set affordable prices and students could pay for the services regarding their possibilities and living minimums. To complete this task, employees have to investigate the current needs of students including the statistics of academic support, accommodation costs, utilities, entertainment needs, etc. (The University of Sydney: living costs 2016). Then, they have to analyze the prices established that could be properly accepted by students.

It is suggested to neglect the personal opinions of students, who admitted that they would like to have cheap services only. The point is that almost every international student tries to save their money by any possible means. The creation of an appropriate price policy at accounting firms is the recommendation that should be taken into consideration.

Finally, the impact of college and university workers cannot be neglected. The interviews and questionnaires proved that not many academic workers were eager to promote cooperation between students and accounting companies. The majority of the participants believed that their colleges and universities offered the required portion of services and professional help that could be used by students to solve their financial problems. Such answers and conclusions could be explained as the existing lack of knowledge about the services that are offered by accounting firms.

As soon as colleges’ and universities’ workers learn how students could use such services and what kind of help could be offered to international students, they could re-evaluate their attitudes and introduce different opinions. In other words, to promote a successful cooperation between students and accounting firms, it is recommended to promote the communication between the representatives of colleges and universities with the representatives of accounting firms of Sydney.

Therefore, the recommendation touches upon the collaboration between accounting firms and college/university workers that aims at exchanging information, promotion of financial help, and improvement of students’ financial wellbeing. The presence of open presentations and lectures where accounting firms’ representatives share their ideas and suggestions could be the first step to the promotion of such relations. In their turn, an accounting company has to clarify what kind of information should be presented at such lectures and what outcomes have to be achieved. The analysis of the activities and their impact on the overall work of the company should occur in one to three months.

Conclusion and Future Work

Conclusions and Implications

Striving to understand the idea of the provision of accounting services to college and university students by a Sydney accounting firm, it was necessary to develop a project within the frames of which it was possible to gather the opinions of students and the representatives of accounting firms about the services they could use or offer, analyze the current state of student financial affairs, and clarify what should be known and has been already introduced about such services. The analysis of the literature helped to understand the peculiar features of Australian education and the systems that worked at Sydney academic institutions.

The evaluation of Australian education and the impact of globalization was also developed in the project to explain the number of international students and their need for accounting services. At the same time, the types of accounting services and the quality of help offered by the workers of accounting firms were discussed to describe what international students could strive for. The mixed research methodology was chosen in the project to gather the numerical data about the importance of accounting services for students and the descriptive qualitative data with the help of which an accounting firm could learn what changes and innovations had to be promoted.

The analysis of the interviews and questionnaires showed that students did not have the required amount of information about accounting firms and the possibilities to use their services on a regular background. Still, the majority of students were eager to learn this subject and investigate their opportunities to become clients of accounting firms. Some students found it beneficial to have a chance to cooperate with such companies and get the answers to several questions they have.

For example, the suggestions on how to stabilize their costs and organize their payments could be offered. The investigations showed that many international students did not know the peculiarities of financial transactions that were chosen by Sydney companies. Therefore, they believed that cooperation with accounting firms could help them to clarify several issues and get ready to make regular payments that were crucial in the foreign country.

At the same time, it was concluded that accounting firms wanted to have students as their clients and offer them their services. Still, the price policy and the conditions under which such cooperation could be developed were poorly explained. That is why it was necessary to provide accounting firms with recommendations on how they could start working with students. An accounting firm may not want to re-organize its services but to make little changes to provide students with appropriate professional help.

Finally, certain attention was paid to the role of college and university workers in student-accounting firm cooperation. Some workers did not find it necessary to focus their attention on such cooperation because Sydney colleges and universities had enough services and offices that took responsibility for financial operations and payments of students. Therefore, accounting firms were suggested to provide colleges’ and universities’ workers with a portion of information about their services directed to students only.

Considering the results of the investigation based on qualitative and quantitative methods, it is possible to underline the importance of the activities that promote the worth of accounting services among international students. Besides, additional help from colleges’ and universities’ representatives have to be underlined because this group of people has a considerable impact on the opinions and decisions of students.