An organizational structure is a framework that specifies how various operations within an enterprise are coordinated to meet its objectives. Joseph and Gaba (2020) enumerated that these operations may include regulations, positions, and obligations. Additionally, the management chart impacts how information moves between firm levels. In a centralized system, for instance, choices flow from the top down, but decision-making authority is spread across multiple organizational levels in a decentralized model.

The firm structure permits businesses to maintain efficiency and concentration. A growth plan enables businesses to extend their operations by adding new sites, investing in client acquisition, and increasing product lines. Thus, a company’s growth plans are influenced by its sector and primary audience. This essay describes the institutional structure of Adidas Company, including details about the type of ownership, corporate hierarchy, and business model. Moreover, the paper discusses some of the opportunities for growth available for Adidas by identifying three external factors that it needs to consider.

Description of the Organization

Adidas, or Adidas AG, is a German maker of athletic footwear, athletic gear, and general merchandise. The corporation abbreviates the name of its founder, Adolf (Adi) Dassler, to get the moniker Adidas (Adidas, 2022). It was the largest sporting goods maker in Europe and the second largest globally, after Nike, at the turn of the 21st century.

Historically, Adidas items bear a three-stripe symbol, which is included in the corporation’s trefoil and mountain emblems. Adidas flourished significantly in the 1950s as association football (soccer) players adopted the institution’s lightweight, screw-in cleat-equipped shoes (Adidas, 2022).

In 1963, the firm created a line of athletic goods by manufacturing soccer balls. Adidas was the industry leader in athletic shoes for several years, but rivalry rose in the 1970s, particularly from smaller companies such as Nike (Schmid et al., 2018).

Adidas’ mission and objective are to be the leading sporting equipment manufacturer worldwide with a distinctive product portfolio ranging from athletic apparel for sports enthusiasts to luxury fashion to suit all customer requirements and grow the customer base from several angles (Adidas, 2022). The Adidas AG Company’s business headquarter is in Herzogenaurach, Germany.

Description of Organization’s Structure

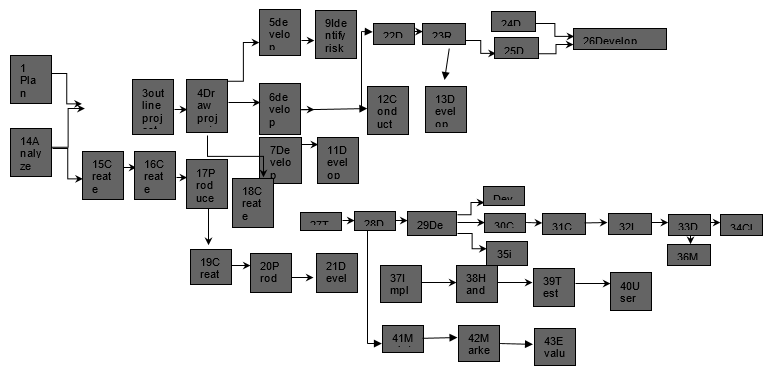

The Adidas Group’s organizational structure is based on a matrix architecture. Adidas arranges its personnel and resources based on its function and product. Consequently, individuals in the programs, engineering, and logistics divisions may have two managers.

After completing the project, the staff will collaborate with other personalities. Matrix organizational structure is a dynamic framework that allows other sectors to collaborate, obtain diverse, innovative solutions from another unit, and gain new competencies and administrative management tasks inside the steering committee (Jin and Cedrola, 2019).

There are three corporate entities within the Adidas Group: the annual general conference, the supervisory board, and the executive management. The executive board controls the organization, including its overall planning, internal surveillance and threat monitoring systems, and adherence. The governing council approves and removes members of the executive board and oversees and informs the executive board of its operations.

Type of Ownership

The type of ownership at Adidas AG Company is general public ownership. In other words, that is to mean that the company is a publicly traded organization. The investors of a public company have an entitlement to a portion of the institution’s assets and income. Through the free trading of stock shares on trading platforms or over-the-counter (OTC) marketplaces, the control of a publicly traded corporation is divided among broad public stockholders (Silitonga, 2020).

Silitonga (2020) insinuated that an initial public offering (IPO) is the procedure in which a private firm’s shares are transferred publicly for the first time. Suppose the IPO entails selling directly to a vast pool of investors, regardless of whether they are small retail investors or significant funds. In that case, this IPO is known as general public dissemination.

Organizational Hierarchy

The high echelon in the corporation is the CEO, who is responsible for all of the corporation’s accomplishments and failures and assumes responsibility for overseeing the entire organization. Second, the finance department is accountable for organizing monetary and accounting tasks, such as producing and submitting appropriation statements and providing management with financial records.

Human resources are responsible for hiring new staff and guaranteeing they are knowledgeable in their respective fields. The sales staff is responsible for the economic achievement of the entity by transforming brand enthusiasm into productive and long-term business growth. The brand’s department is responsible for exploring, creating, and commercializing the group’s sports and lifestyle goods by providing innovative merchandise and unique moments.

IT and mechanical engineering are the two divisions of the engineering faculty. One is responsible for web design and the IT system, while the other is for machining equipment and operations. The primary objective of this section is to aid Adidas in creating innovative technologies that will enable them to be more profitable and efficient. The operations division involves product development, manufacturing schedules, sourcing, and transportation. Its role is to increase the distribution chain’s effectiveness while assuring the highest standards for product excellence, reliability, and dispatch.

Business Model

Adidas’s business model relies heavily on creating creative, consumer-driven items. Instead of engaging in sponsored posts, the firm strives to show its value by developing a high-performance brand portfolio that caters to the unique needs of professionals and shoppers (Shah, 2018). It accelerates product creation and manufacturing by continually enhancing technology, procedures, and tools. In addition, they stress considerably reduced group-level fragmentation by reducing the worldwide product portfolio, unifying the storage base, and standardizing above-market service.

The goal is to provide the greatest branded retail experience across all client connections. Innovative distribution channel concepts accelerate the response time to consumer demands. This technique has prompted investors worldwide to acquire Adidas’ common stock, and the corporation has maintained constant expansion over the years (Shah, 2018). The public ownership framework of the business has been a vital component of long-term success.

Discussion of External Influences that Impact Growth

Competition

Adidas faces severe rivalry from its conventional rival Nike Inc. in the sportswear and clothing industry, which significantly impacts its potential development. Nike Inc.’s brand is valued at $122.3 billion, contrasted to Adidas’ $20.19 billion (Ennis, 2020). Nike’s luxury pricing approach, best cost provider methodology, offers Adidas severe competition since it pursues customers who build a unique level of familiarity with the commodity, eventually forming brand loyalty. Nike makes use of the fact that brand trust has been developed to link purchasers with their prices. Therefore, Nike knows buyers will be willing to pay for its branded merchandise.

In addition, Nike notably emphasizes a broad differentiation approach beating Adidas’ corporate-level approach. Based on this philosophy, Nike creates its athletic merchandise in three mechanisms (Ennis, 2020). Firstly, the company produces for three distinct demographic groups: men, women, and children. Secondly, it distinguishes its goods by providing a selection of gear and peripherals, such as shoes, gym bags, mittens, and skates.

Thirdly, Nike has the license to produce and market non-athletic commodities such as school supplies, broadcast media gadgets, and smartwatches under the Nike name (Ennis, 2020). This plan is superior to Adidas’ corporate strategy, which concentrates on creativity and attempts to create new goods, solutions, and procedures to compete.

Political Uncertainties

The most significant political challenges affecting Adidas are shifting trade policies and political turmoil in numerous nations. Adidas must address these concerns to maintain its worldwide presence and economic performance. The Trump administration implemented trade restrictions and levies (Ennis, 2020). Regarding price increases, US tariffs on Chinese commodities continue to be a significant source of worry for Adidas and other athletic apparel manufacturers.

Germany is a significant exporter, and US import restrictions and taxes could cost the country as much as 20 billion euros (Ennis, 2020). Adidas’ global activities include the shipment and delivery of items and offerings. Adidas cannot fulfill its ultimate targets and objectives without enhancing its multifaceted distribution network to adhere to worldwide and political regulations. Therefore, this will negatively impact Adidas’ sales, revenue, and brand recognition.

E-Commerce Platform

Following the popularity of its online operations, e-commerce allows Adidas to expand its digital capabilities. Performance in digital sales outlets is also reflected in the net sales growth of the institution’s highest-ranked online vendors. The three largest online retailers by net sales, adidas.com, adidas.co.uk, and reebok.com, have all significantly improved their net sales compared to 2019. Reebok.com recorded the highest year-over-year growth of 125%, with overall net sales exceeding €262 million (Russell, 2021).

Therefore, it is reducing the gap with adidas.co.uk, which produced improved net sales in 2020 (€322 million) (Russell, 2021). By integrating offline and online interactions into an app-centered digital environment. The corporation is also expanding its direct-to-consumer sales avenues by utilizing a new premium subscription app, among other strategies. Consumer studies and similar tactics other major retailers employ demonstrate that the novel integrated online-offline strategy hits a chord.

Conclusion

In conclusion, the corporate structure enables organizations to maintain efficiency and focus. A growth strategy allows firms to expand their operations through the addition of new locations, investment in customer acquisition, and expansion of product lines. The organizational structure of the Adidas Group is built on a matrix architecture. The staff and resources at Adidas are organized according to their purpose and product.

The Adidas AG Company is owned by the general public, indicating that it is a publicly traded organization. The apex of Adidas is the CEO, who is accountable for all of the corporation’s successes and failures and assumes oversight responsibilities for the entire business. Adidas’s business model depends significantly on developing innovative, consumer-driven products.

Instead of participating in sponsored postings, the company aims to demonstrate its worth by developing a high-performance brand assortment that serves the specific demands of professionals and consumers. The external variables that affect Adidas’s expansion include rivalry, political uncertainty, and e-commerce.

Reference List

Adidas | Company Overview & News. (2022) Forbes. Web.

Ennis, S. (2020) ‘Formulating and implementing sports marketing strategy‘. In Sports Marketing (pp. 129-151). Palgrave Macmillan, Cham. Web.

Jin, B.E. and Cedrola, E. eds. (2019) Process innovation in the global fashion industry. Palgrave Macmillan US.

Joseph, J. and Gaba, V. (2020) ‘Organizational structure, information processing, and decision-making: a retrospective and road map for research‘. Academy of Management Annals, 14(1), pp.267-302. Web.

Russell, C. (2021). Adidas or Nike? Which retail giant is winning the sneakers war?Forbes. Web.

Schmid, et al. (2018) ‘Adidas and Reebok: is acquiring easier than integrating?’ In Internationalization of Business (pp. 27-61). Springer.

Shah, A. (2018) ‘The Adidas brand: climbing up or decelerating?‘ Forbes. Web.

Silitonga, N. (2020) ‘The moderating effect of independent commissioners on financial policy and public ownership toward corporate financial performance’, International Journal of Contemporary Accounting, 2(2), pp.139-154. Web.