At the end of the financial year, companies find there are errors in the financial statements either due to overstated or understated expenses and incomes. There may also be changes in some items whose estimated value is different from the actual value. Adjusting entries should be made in order for the financial statements to reflect the correct profit or retained earnings for the year.

The corporation erected its present factory building in 1989. Depreciation was calculated by the straight line method, using an estimated life of 35 years. Early 2004 the board of directors conducted a careful survey and estimated that the factory building had remaining useful life of 25 years as of January 1, 2004.

A company’s assets are supposed to be valued and depreciation of the asset done in the accounts according to the estimated useful life. Different methods of depreciation are available for the company to choose from. The company chose to use the straight line method of depreciation and the building had an estimated useful life of 35 years. The building erected in 1989 was to be depreciated till the year 2024.

In 2004, after 15 years of useful life, the building is revalued and it is estimated that it has a useful life of 25 years instead of 20 years. The company has therefore gained from the revaluation gain. The company accountant has several entries that he has to make in the financial statements of 2004.

A company may choose to keep its accounts in two ways. That is through the cost model or the revaluation model.

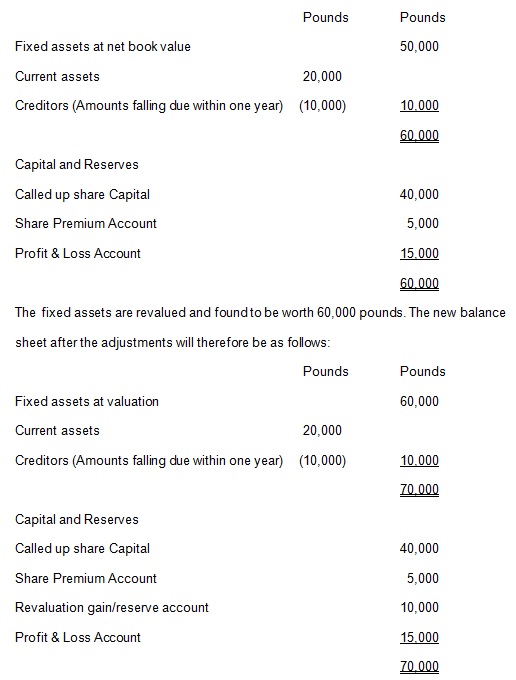

Looking at the revaluation model, the building will be shown in the balance sheet at the revalued value. The amount of the revaluation has to be calculated. The revaluation account being an income account will be credited by the amount. Under the current assets, there will be an entry shown for the revaluation gain or reserve account with the amount of the revaluation. These two amounts will provide a double entry that cancels out (Dodge, 1997, p 264). The following is the balance sheet of a company prior to a revaluation of its fixed assets.

The net book value of the fixed assets is the cost price of the asset less the provision for depreciated that is done yearly. When a revaluation has occurred, the net book value and the revaluation gain are credited to the asset revaluation account. The asset account is then debited with the revalued account to reflect the balance of 60,000 pounds while the credit balance of the asset revaluation account is taken to the revaluation reserve showing a balance of 10,000 pounds.

An additional assessment of 2003 income tax was levied and paid in 2004.

In the calculation of tax, the company estimates the tax payable which is recorded as am expense in the financial statements. The tax however is paid at a later date, at the beginning of the next financial year. Where the company does not pay the full amount, the unpaid balance must be reflected in the financial statements as a liability.

In the next year, the actual tax may be higher or lower than the tax that was estimated or provided for in the financial statements. This leads to an under provision or over provision of tax expense for the previous year. These differences are adjusted in the current year with the company paying slightly higher or lower tax than the estimated expense for the current year.

The tax expense paid in the year 2004 will therefore be higher than 2003, to include the under provision of tax expense in 2003 (Rolfe, 2008, p 289).

Example

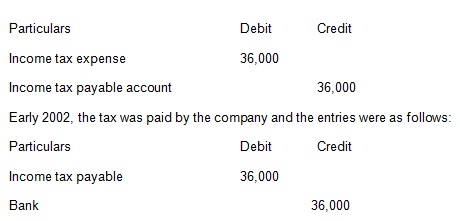

In a certain company, the tax charge for the year 2001 had been estimated to be $36,000. To record the provision in the financial statements the entry will be as follows:

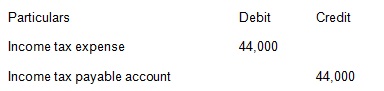

In the year 2002, an additional assessment for tax showed that the tax expense for 2001 would be $40,000. In the year 2002, the tax expense is expected to be at $40,000. The accountant should therefore make a provision of $44,000 so that the company pays the current year tax and the underprovided tax for 2001. The entries will therefore be as follows:

When calculating the accrual for officer’s salaries at December 31, 2004, it was discovered that the accrual for officer’s salaries for December 31, 2003, had been overstated.

This means that the accrued salary expenses that were reflected in the accounts in the year 2003 had been overstated. Overstated expenses affect the profit reflected in the accounts. This shows that the profit for the year 2003 was understated. In accounting, the expenses and income have to be matched to the period in which they were incurred and not necessarily the period in which the cash was paid. When recording an accrual, two journal entries are made.

The accrued salaries account is credited with the amount. When the company pays for the expense, the accrued salaries account is debited and the cash or bank account is credited with the amount of money that has been paid out.

The company will have to correct the overstated accruals in the financial statements for 2003.

Example of Hurley Enterprises

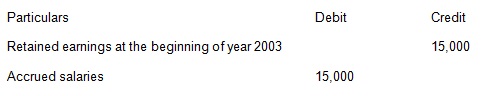

A similar case occurred in Hurley Enterprises. In December, 2012, the accountant overstated the accrued salaries by an amount of USD 15,000. The error was discovered in 2013 when the financial statements for the year had not yet been closed. The retained earnings for 2012 were therefore understated and needs to be corrected. Overstated expenses understate the net profit which ends up understating the retained earnings for the subsequent period. The adjusting entries that the company accountant will be as follows: (Kieso, Weygandt & Warfield, 2007, p 1392)

On December 15, 2004, Acevedo Corporation declared a 1% common stock dividend on its common stock outstanding, payable February 1, 2005, to the common stockholders of record December 31, 2004.

A shareholder in a company expects to be paid dividends in return for his investment in the company. The payment of dividends to shareholders is dependent on the profits that the company will make and the payout ratio of the bank. What percentage of the profits of the year will the company take to the next financial year as retained earnings? This situation refers to cash dividends. However the company may choose to pay to the shareholders stock dividends. Instead of the people receiving cash they will be issued with additional shares to what they are currently holding in their portfolio (Duchac, Reeve & Warren, 2006, p 507). Companies prefer stock dividends for various reasons such as when it has inadequate liquidity to pay the cash dividends.

Example of Hendrix Company

The Hendrix company equity account as at December 15, 2002 is as follows:

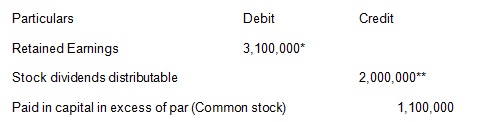

The board declares a stock dividend of 5%. This amounts to 5% of 2,000,000 which is 100,000 shares which will be issued in January 10, 2003. The market price for a share is $31. The transactions will be recorded as follows:

*Retained earnings= $31×100, 000 shares.

**Stock dividends distributable=100,000 shares x $20 par

The stock dividend therefore has transferred the portion of retained earnings to the paid-in capital account.

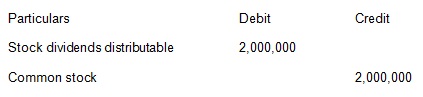

When it comes to January 10, 2003 the company will pay out the stock dividends which will cause an increase in the common stock as follows:

References

Dodge, R. (1997) Foundations of Business Accounting. United States: Cengage Learning Business Press.

Duchac, J., Reeve, J. & Warren, C. (2006). Financial accounting: an integrated Statements approach. Mason: Thomson-Southwestern publishing.

Kieso, D., Weygandt, J. & Warfield T. (2007). Intermediate Accounting. United States: Wiley.

Rolfe, T. (2008). Financial Accounting and Tax principles. Salt Lake City: Elseiver.