Microsoft Corporation is a public company founded by Bill Gates, its chairman, and Paul Allen on the 4th of April 1975 in Albuquerque New Mexico in the United States of America but its headquarters have since shifted to Redmond, Washington DC. The corporation has a worldwide market for computer software, video game consoles as well as consumer electronics. Among the renowned products of the corporation include Microsoft servers, Microsoft Windows, Microsoft office suite, Business software, Microsoft expression, Windows Developer tools, Windows live, Zune, Bing, and Windows Phone. “Among its most strategic products are the Microsoft Windows operating system and the Microsoft Office suite.” (Lemley, Peter & Robert, 2006). In the year 2009, the entity was ranked the third-largest corporation in the world preceded only by Petro China and ExxonMobil. It is undoubtedly the largest technology corporation in the universe.

The corporation is listed in the New York Stock Exchange (NASDAQ) as well as the Hong Kong Stock exchange (HKEX) and its stocks have been fairly stable in the past years since its debut listing on the NASDAQ in 1986. In addition, it has done several stock splits since inception (up to nine stock splits), although the dividend payout has been steady and in fact, reverted from annual dividends payout to a quarterly dividends payout scheme from 2003.

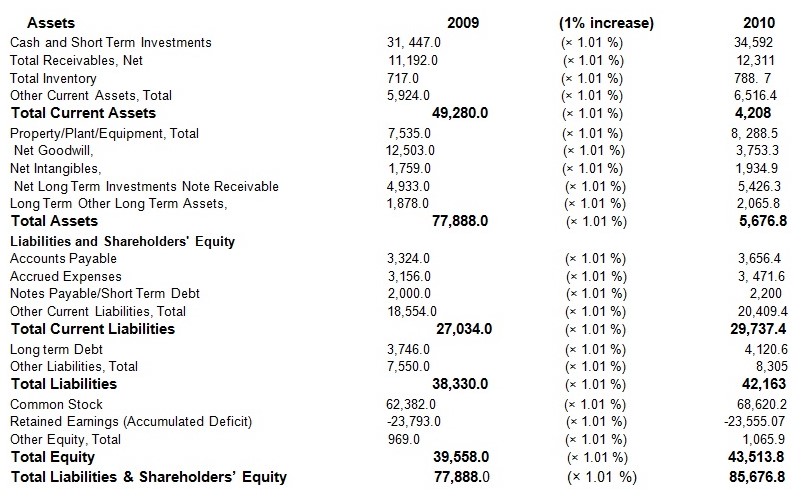

In the fiscal year ended 30th June 2009, the company’s balance sheet indicated a total asset base of $ 77.888 Billion of which the current assets constituted the largest portion of $ 49.280. This was largely attributed to an increase in cash and short-term investments as well as an increase in the net receivables for the year whose summative value came to $ 42.5 Billion. The valuation for goodwill ($ 12 Billion) and property plant and equipment ($ 7 Billion) also constituted a significant increase in the value of the total assets. Total liabilities in the period 2009 increased to $ 38.330 Billion from the previous year $ 36.507 Billion. Current liabilities also formed the bulk of this figure standing at $ 27.034 Billion, long term liabilities largely consisted of long-term debts of $ 3 Billion with the payables and accrued expenses forming the bulk of current liabilities at six billion dollars.

Total equity for the period to 30th June 2009 was $ 39.558 Billion significantly made up of common shareholders equity of sixty-two billion dollars and other equity amounting to $ 962 Million. However, the reduction in total shareholders equity and particularly the earlier stated common shareholder’s equity of $ 62. 382 Billion, can be attributed to the accumulated deficit that saw the corporation’s retained earnings reduce slightly in the year 2009 to $ 23.793 Billion.

The company’s 2009 revenues were valued at $ 58.437 Billion, this was however a reduction from prior year revenues. The operating income also dropped from the prior year to $ 20.363 Billion and so did the net income which was $ 14.569 Billion in the same year. Microsoft’s total assets in the year 2009 stood at $ 77.888 Billion (an increase from the prior year). The expected revenues for the subsequent 2010 period are expected to increase slightly to more than $ 60 Billion as a result of largely what is being viewed as the stabilization of the world economy that is currently recovering from the worst crunch in recent years. The corporation boasts of employing directly more than 93,000 personnel in human capital operating in more than 100 countries globally as per its 2009 statistics.

Using the percentage of sales method, the percentage increase or decrease in sales is computed in two succeeding years and the results obtained are used to forecast future values for the balance sheet (Chapman, 2002). The future values are obtained by taking one year’s balance sheet results (2009) as the base year and multiplying them by the percentage value obtained. The 2009 revenues expressed as a percentage of 2008 revenues indicate a 0.96 % increase (rounded up to 1%). Using the percentage of sales method, the projected balance sheet for the period ending 2010 will appear as shown below: (values in Millions)

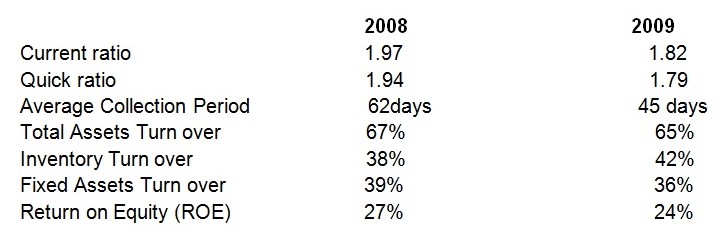

The underlying schedule indicates the computed values for the various financial ratios ranging from efficiency and activity ratios to profitability and investment rations of the entity.

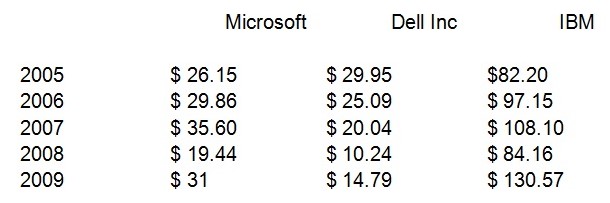

From the year 2005 to 2009, the share prices of Microsoft Corporation’s as well as its competitors Dell Inc and IBM can be summarized as below:

The above performance results in terms of share prices indicate that Microsoft Corporation and Dell Inc are competing favorably, however IBM has a more superior performance record in the computer technological industry. Microsoft performed better than Dell in all years except 2005, but dell performed better than all of them in all years.

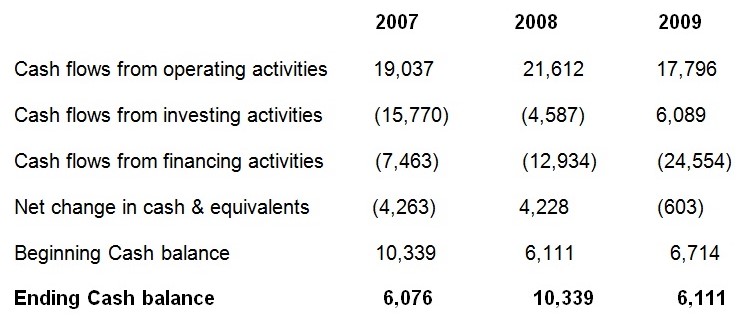

A cash flow analysis of Microsoft Corporation for three years from the year 2009 going backwards appears as summarized in the schedule below:

From the above analysis, no overdrafts were experienced on the company’s cash flow statements t from the year 2007 to 2009 which is a good indicator for appraising an investment. The performance of Microsoft Corporation is generally stable and can set a good investment because of minimal fluctuations and a steady return on investment (Mueller, 2002).

Reference list

Chapman, R. (2002). In search of stupidity: over 20 years of high-tech marketing disasters. New Jersey: Apress.

Lemley, M., Peter, S. & Robert P. (2006). Introduction to computer technology. Intellectual Property in the New Technological Age, 4th Ed. New York: Aspen Publishers.

Mueller, S. (2002). Upgrading and Repairing PCs. Indianapolis: Que Publications.