Introduction

Before the end of the last Century and Millennium, the world witnessed the introduction of a new European common currency (euro currency) and thus the start of Europe central bank. At beginning, only 11 countries who were members of European Union subscribed and they decided to replace their own legal tender with the euro. These countries included Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxemburg, the Netherlands, Portugal, and Spain. Before the introduction of the new currency they had set conditions, which were to be fulfilled, this included; (1) Price stability; Country must have a rate of inflation no more than 1.5 pp above the average of the three countries in the EU with the lowest inflation. (2) Long-term interest rate; country must have a nominal interest rate on long-term government bonds no more than 2 pp above the average of the three countries in the EU with the lowest inflation rate, (3) Government budget deficits; no more than 3 % of Gross Domestic Product (4) Total government debt; no more than 60% of Gross Domestic Product. (5) exchange rate stability ; National currency of potential participant has to join Exchange Rate Mechanism for two years period, the exchange rate has to fluctuate between ±15% band and short term high changes of the exchange rate are not acceptable. (6) Central bank independence; National government cannot influence central bank’s decisions.

This gave birth to Europe central bank. This bank has many advantages and disadvantages.

Advantages of Europe Central Bank

The Introducing of common currency by the leads to gains in economic efficiency. These gains can be divided into two groups. One is the elimination of transaction cost and the other is the elimination of risk, which comes from uncertain fluctuation of the exchange rates. Transaction cost appears in different ways, as a fixed commission or the spread between the buying and the selling prices of any given currencies. The currency conversion costs disappear in EMU and it is important either for individuals or for companies dealing with their foreign partners. One common currency also creates a simple platform for price comparison, makes price differences more noticeable and helps to equalize it across borders. Disappearance of transaction costs and price transparency certainly makes the common financial market in Europe deeper and more integrated. Since the beginning of January 1999, the main financial instruments are being issued and listed in euros what makes prospective investors more confident to invest on different EU members’ financial markets. Financial market integration provides different channels of risk sharing in Central Bank.

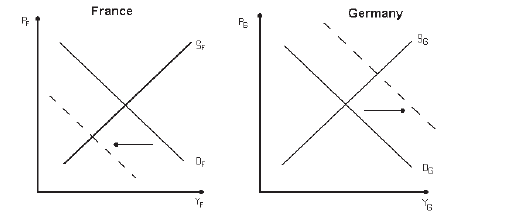

If we assume that the French and German bond and equity markets are fully integrated, it will facilitate the adjustment to asymmetric shocks (see Figure 1).

When France is hit by a negative shock, companies there make losses and that drives down stock prices of these companies. We assume that both mentioned markets are fully integrated so German investors hold stocks of French companies. At the same time there is an economic boom in Germany and stocks of German companies go up what gives profits also to French investors holding German shares. In this case, all EMU members share the risk of a negative shock in one country. A very similar mechanism also works through the fully integrated bond market.

The most important argument justifying the introduction of common currency is that exchange rate uncertainty is inherently damaging to the volume of real flows of trade and investment. It means that entrepreneurs facing investment or trade opportunity are likely to be more enthusiastic when the decision does not involve the risk of currency fluctuations.

The elimination of exchange rate risk affects positively international business environment. The more unpredictable are exchange rates, the more risky are foreign investments (both, portfolio and direct) and it is the least expected that companies are willing to purse growth in foreign markets. This risk is bothersome to all who make economic decision today and expect payoff in a future time. The euro eliminates exchange rate risk between all the EMU members.

Disadvantages of Common Currency in Europe

Although the euro brings substantial advantages, it also has many disadvantages.

There are two most important costs: one is a cost of institutions and individuals adjustment to a new currency and the other is a lack of national monetary policy as an important tool for a member state to adjust to the economic equilibrium when it experiences an economic shock.

Loss of Sovereignty

An independent central bank of Europe is undemocratic. Governments must be able to control the actions of the central banks because the people have democratically elected Governments, whereas a non-elected body would control an independent central bank of Europe. Moreover, there would be a considerable loss of sovereignty. Power would be transferred from London to Brussels. This would be highly undesirable because national governments would lose the ability to control the monetary policy.

References

- Apel E., (1998); there will be a monetary union in Europe or there will be no Europe: European Monetary Integration. Routledge, New York.

- De Grauwe P, (2000); Economics of Monetary Union. Oxford University Press,

- European Central Bank (2004); The European Central Bank: History, role and functions

- Monnel Jean (2006) Advantages and disadvantages of euro currency.