Executive Summary

For more than three decades, Africa was termed as an unattractive destination for international business. However, in the past 18 years, there has been a renewed focus on the continent because many MNCs are flocking to the continent to exploit emerging business opportunities. Consequently, there has been an increase in FDI flow in many African countries. However, it is unclear whether the continent has made significant governance gains to maintain a renewed interest on the continent as a long-term investment destination. This paper seeks to understand whether there have been significant governance gains in Africa to support the current wave of MNC entry in the continent. After analyzing data from the World Bank, which was gathered between 2012 and 2016, it is established that the gains made on the continent are insignificant. Therefore, it is difficult to claim (authoritatively) that Africa will remain a viable investment destination. Based on this finding, recommendations are made to use other economic measures (besides) governance to assess the continent’s readiness for international investments.

Introduction

Throughout the 19th and 20th centuries, many people thought of governments as having the key to economic prosperity. However, in the 21st century, conventional thinking has changed and many people see markets as being the key to economic prosperity (Ietto-Gillies 2014). Indeed, governments that once privatized their corporations are now looking up to multinationals for investment in their economies to boost their social and economic growth (Ietto-Gillies 2014). Typically, corruption, political stability (violence, insecurity, and terrorism), government ineffectiveness, and the lack of rule of law (among others) are indicators that define poor governance. These measures of leadership affect the operations of multinational corporations (MNCs) because they increase the cost of doing business, promote unfair business practices and increase political instability (among other factors) (Nwanne 2014; Zhu 2014).

Generally, poor governance affects different aspects of economic development, including the mobilization of capital, accountability standards in state and national corporations, and the uneven distribution of resources (among other factors) (Bratton & Logan 2014). Although many research articles have painted MNCs as victims of poor governance in host nations, a select group of researchers has also noted that the same corporate entities are responsible for some of the poor governance indices reported in developing nations (Momoh 2015a; Osumah & Aghedo 2013). Concisely, it is a known fact that some of the world’s biggest governance failures have been happening in the developing world. This study strives to investigate whether Africa has made significant governance improvements to support the renewed interest of MNCs on the continent. Control of corruption, government effectiveness, political stability, and the absence of violence are some variables that underlie this research investigation. A justification of the research idea is presented in the section below.

Research Idea and Justification

The research idea for this study is premised on understanding whether there has been a general improvement in political and economic governance structures in Africa to support the current wave of MNC entry on the continent. The justification for this research idea is premised on the rapid increase of foreign direct investment (FDI) flow in African economies in the past 10 years (Bojang 2017). However, it is unclear whether the African narrative of development will remain true in the next few years against a history of war, corruption, and instability, which has been keeping multinational corporations away from the African market for a long time (Abu, Karim & Aziz 2014). The idea for this research topic is premised on understanding whether this new wave of development will sustain the operations of MNCs in the long run. The importance of this topic and the corresponding literature gap that informed its justification are outlined below.

Importance of Topic and Gaps in Literature

Poor corporate governance is deemed an enemy of progress at corporate and national levels (Reitano 2014; UN 2013). As highlighted in the first section of this study, corruption, political stability (violence, insecurity, and terrorism), poor government effectiveness, and the lack of rule of law are key tenets of poor corporate governance. They could stifle the growth and development of international business. The control of corruption is generally defined as the extent to which public power is misused for private benefit. Both petty and grand forms of corruption fit within this definition. The capturing of the state by elites and private individuals is a documented fact in many African countries. Similarly, it has been explored in several research studies, including those authored by Momoh (2015b) and Osumah and Aghedo (2013).

However, the narrative of state failures in Africa has ended. This is particularly true because there is a new narrative emerging in many African nations about the “reinvention” of the continent (Masau 2017). This change has not only been limited to the social and political development of the continent but also on its economic development. However, few studies have captured the impact of this new change in the economic development of Africa and on its attractiveness as a viable business destination. Already, there has been a growing interest among many western multinationals on the continent because the economies of many African nations are opening up for investment as relative peace and growth take center-stage in the once war-torn continent. However, it is still unclear whether these assumed changes are real or even sustainable because there have not been enough research studies done to explore the impact of new reforms on the continent’s business viability.

Objectives and Structure of the Report

The objectives of this report are as follows:

- To estimate whether there has been an improvement in the rule of law among African states.

- To find out whether there is a marked improvement in political stability and the absence of violence/terrorism among African states.

- To establish whether there has been an improvement in government effectiveness among African states.

- To investigate whether there is an improvement in the control of corruption among African states.

The hypotheses of the study are described below:

- H1. There has been no significant improvement in the rule of law among African states.

- H2. There is no significant marked improvement in political stability and the absence of violence/terrorism among African states.

- H3. There is no significant improvement in government effectiveness among African states.

- H4. There is no significant improvement in the control of corruption among African states.

This report is divided into five key sections. The first one is the introduction part, which provides a background of the study and a justification for the research idea. The importance of proper governance in the growth and development of multinational corporations is also explained in this section of the paper as well as the gaps that exist in research, which need to be filled. The second section of the paper is the literature review part. In this section, a critical overview of the conceptual international business literature on governance is provided as well as an explanation of its relationship with the successes and failures of multinational enterprises. In the same section of the report, there is a critical overview of the empirical literature, which is presented as an industry report on political governance and multinational growth.

The literature review section will also contain information regarding the conceptual framework of the paper. The third part of this report is the methodology section, which specifies the data collection strategy adopted in the study. It also draws a link between the data collected and the objectives of the study to help the reader understand what type of data is collected for the investigation. Alongside the description of the data sources is an explanation of the main variables that were explored to answer the research question. The last subsection of this part is the data analysis strategy, which explains the techniques used to analyze the information relied on for data analysis. The fourth section of this paper presents the findings that emerged from the data analysis process. It provides descriptive data as well as the findings for inferential analysis. The last section of the report presents the findings and conclusion of the study. Here, there will be a brief reflection of the preliminary findings and data trends.

Literature Review

Critical Overview of Conceptual Literature

According to studies by Okafor, Smith, and Ujah (2014), corrupt leadership has denied Africa and its citizens an opportunity to benefit from its vast natural resources and business opportunities. Ineffective government bureaucracy and underdevelopment have been the products of such a corrupt system. The entrenchment of corrupt practices usually paves the way for more serious underdevelopment, which in turn brews discontentment among populations and creates a larger security issue, which often manifests as instability and violence (Aisen & Veiga 2013; Cubitt 2013). Most studies that have investigated the relationship between mismanaged nations and business growth have drawn attention to these facts. Particularly, they have highlighted a link between the growth and development of multinationals and the state of governance in the selected countries (Schumacher 2013).

As highlighted in the introduction section of this paper, these studies have mixed reviews because some of them have blamed multinational corporations for the state of despair in some developing nations, while others have presented the same entities as victims of the same injustice. For example, a study by Momoh (2015c) and Nay (2014) demonstrates that MNCs have been responsible for political instability through the overthrow of governments in Sudan, Nigeria, Iraq, Chile, and Nicaragua (among others). The power of these multinationals to influence the political and economic stability of their host nations stems from their ability to transfer huge sums of money from their home countries to host nations. Furthermore, some of these corporations have vast sums of money that could influence public officials and governments. For example, the gross turnover of Ford Corporation is equal to the Gross Domestic Product (GDP) of Ireland, Kenya, Namibia, and Chad (Momoh 2015c). In this regard, MNCs wield a lot of power in the political and economic governance of their host nations.

A different school of thought has emerged in several research studies, which show that many developing countries are victims of their own mismanaged political, economic, and social systems (Campbell & Saha 2013). For example, the economic crisis in Venezuela is partly blamed on the poor political governance of the state, despite it having huge reserves of oil. The general theme in most studies that have explored the impact of weak institutional governance structures on business performance has focused on this point (ILO 2014). They portray MNCs as business entities with fluid capital that could be transferred from countries that are poorly managed to those that have effective governance systems that will protect their business interests. This narrative has been adopted by studies that have explored the effect of mismanagement on corporate performance in Africa (Kjær 2014). However, a new school of thought gives credence to the reinvention of the African continent amid claims there is a new leadership wave, which is correcting some of the governance issues that have affected the continent for more than two decades (Carmody 2013). Some corporate entities that are giving Africa a “second look” include BMW, General Electric, Vodafone, Standard Bank Group among others (Masau 2017).

Critical Overview of Empirical Literature or Business Analytics

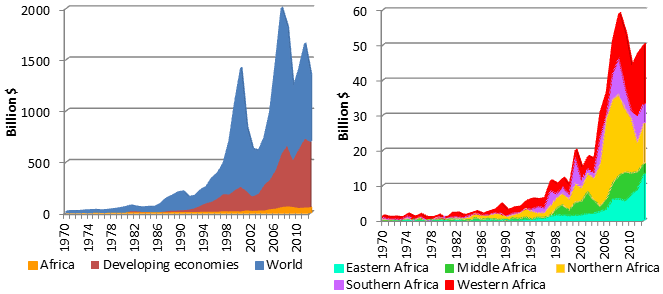

According to the graph in Figure 1 below, foreign direct investments in Africa have been on the increase.

According to the above graphs, there has been a steady increase in FDI inflows into Africa from the start of the 21st century. The proportion of FDI flow in East Africa, Central Africa, North Africa, Southern Africa, and Western Africa are almost the same.

This narrative supports the claim that MNCs are already looking to invest in Africa. However, the gap in literature lies in the failure to understand whether this renewed focus on Africa will be supported by the current governance structure on the continent.

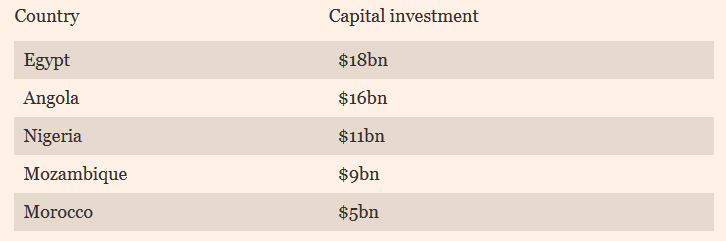

This narrative is supported by a report on the Fingar (2015), which shows that Africa is among the fastest-growing recipients of foreign direct investments. The top five destinations for this FDI flow and the amount of money received in each country appear in figure 2 below.

Conceptual Framework

Based on the nature of this study, the conceptual framework will be premised on the endogenous growth model. It posits that endogenous forces (and not external ones) primarily influence economic growth in developing nations (Voyvoda & Yeldan 2015). It also argues that investments in human capital and innovation are the main contributors to economic growth (Voyvoda & Yeldan 2015). In this regard, the endogenous growth model dictates that the primary long-run growth rate of an economy is dictated by its policy decisions and choices (Voyvoda & Yeldan 2015). This conceptual framework fits the topic of this discussion because it focuses on the governance and policy choices adopted by African states, relative to their economic growth prospects. This way, it is possible to understand the link between the governance structures of African states and their prospects of economic success.

Methodology

Data Collection Strategy

Data were collected from the World Bank (2018) database. The group of statistics that contained the research variables under investigation is called the “Worldwide Governance Indicators.” From this data pool, information relating to the corruption, political stability (violence, insecurity, and terrorism), government effectiveness, and the lack of rule of law (among others) of five African countries (Kenya, Ghana, South Africa, Algeria, and Ethiopia) were sourced. The selected countries were chosen for the analysis because they are among the top economies in Africa and account for most of the social, political, and economic reforms that have occurred on the continent in the past two decades. A detailed description of the variables underlying the study appears below.

Description of Data Sources

The control of corruption index is one variable chosen in the report that helped in understanding whether there have been improvements in governance indicators in Africa, or not. The second variable chosen for analysis is government effectiveness. This variable refers to the perceptions of the quality of public services offered to its citizens. The quality of civil service also adds to our understanding of this variable and so does the degree of its independence from political pressures. The “government effectiveness” variable is also defined by the degree of a country’s independence from political pressures. Its quality of policy formulation and implementation also adds to the understanding of the same variable and so does the government’s commitment to the implementation of the same policies. Political stability was also another variable considered for review in this study. It largely refers to the measured perceptions of the likelihood of political instability and politically motivated violence (including terrorism).

The last variable that underlies this investigation is the rule of law. It simply refers to the perceptions through which people and companies have confidence in the law and the need to abide by it. Particularly, in the context of this study, it draws attention to the quality of contract enforcement and property rights, which are instrumental in the efficient facilitation of multinational operations in developing nations. The role of police and the courts in the enforcement of the same laws is also firmly under review in this variable because their actions and inactions have a significant role to play in determining the likelihood of crime and violence occurring.

Data Analysis Strategy

The data analysis strategy was characterized by the use of descriptive and inferential analysis methods. The main descriptive technique was frequencies and the inferential analysis method was Pearson’s correlation. These data analysis techniques were done using the Statistical Package for Social Sciences (SPSS) software (version 23) and their findings appear below.

Data Analysis

Descriptive Data Findings

Data relating to Ethiopia, Kenya, Algeria, South Africa, and Ghana were gathered. The measures investigated included control of corruption, government effectiveness, political stability, and the absence of violence and rule of law. There were no anomalies, outliers, or extreme skews noted in the data. Changes in these variables were done within 5 years starting from 2012 and ending in 2016 and the findings appear in Table 1 below.

Table 1. Frequencies of Governance Measures (Source: Author).

Results for Inference and Data Modelling

The preliminary results for inference will be done using the person’s correlation method by analyzing governance measures across five years: 2012, 2013, 2014, 2015, and 2016. The results appear in table 2 below.

Table 2. Inferential Analysis (Source: Author).

The findings for the hypothesis test appear in table 3 below.

Table3. Hypothesis Test Findings (Source: Author).

Findings and Conclusion

The findings derived in this analysis show that there has not been much change in the four indicators analyzed (control of corruption, government effectiveness, political stability, and the absence of violence and rule of law). However, this does not mean that there has been a decline in the same indicators. Possibly, these findings mean that changes in the indicators mentioned are insignificant to the extent that it is difficult to understand whether there have been concrete improvements in the governance structures of the selected African nations to support sustainable MNC operations on the continent. Therefore, there needs to be further research to explore other variables that will affect the economic growth and development of Africa.

The findings outlined in this paper support the tenets of the endogenous growth model because it posits that the economic growth of a country should be reviewed based on its intrinsic policies and values. The policies and intrinsic elements of economic growth discussed in this study are control of corruption, government effectiveness, political stability, and the rule of law. According to the endogenous growth model, these elements of analysis should be instrumental in understanding the potential for economic growth and the attractiveness of the mentioned countries to MNCs.

Overall, the findings of this paper show that there have not been significant changes in the governance structures of African countries to draw a conclusive assessment of whether they will be able to remain attractive to MNCs in the end, or not. Lastly, it should be understood that this analysis only sampled five African countries, which are the leaders in economic development in Africa. Therefore, they are indicative. Future research should do a deeper and broader assessment of the same analysis using other countries and indicators as well.

References

Abu, N, Karim, MZA & Aziz, MIA 2014, ‘Low savings rates in the Economic Community of West African States (ECOWAS): the role of the political instability-income interaction’, South East European Journal of Economics and Business, vol. 8, no. 2, pp. 53-63.

Aisen, A & Veiga, FJ 2013, ‘How does political instability affect economic growth’, European Journal of Political Economy, vol. 29, no. 1, pp. 151-167.

Bojang, M 2017, ‘Critical issues affecting Africa’s development: e-government, democracy and democratic principles and governance as an alternative for socio-economic development in Africa’, International Journal of Youth Economy, vol. 1, no. 1, pp. 41-55.

Bratton, M & Logan, C 2014, ‘From elections to accountability in Africa,’ Governance in Africa, vol. 1, no. 1, p. 3.

Campbell, N & Saha, S 2013, ‘Corruption, democracy and Asia-Pacific countries’, Journal of the Asia Pacific Economy, vol. 18, no. 2, pp. 290-303.

Carmody, P 2013, The rise of the BRICS in Africa: the geopolitics of south-south relations, Zed, London.

Cubitt, C 2013, ‘Responsible reconstruction after war: meeting local needs for building peace’, Review of International Studies, vol. 39, no. 1, pp. 55-67.

Fingar, C 2015, Foreign direct investments in Africa Surges. Web.

Görg, H, Krieger-Boden, C & Seric, A 2013, With a little help from my friends – FDI in Africa. Web.

Ietto-Gillies, G 2014, ‘The theory of the transnational corporation at 50+’, Economic Thought, vol. 3, no. 2, pp. 38-57.

ILO 2014, Global employment trends 2014: risk of a jobless recovery, International Labour Organization, Geneva.

Kjær, AM 2014, ‘From ‘good’ to ‘growth-enhancing’ governance: emerging research agendas on Africa’s political economy’, Governance in Africa, vol. 1, no. 1, p. 2.

Masau, Z 2017, Global companies give Africa a second look. Web.

Momoh, Z 2015a, ‘Multinational corporations (MNCs) and corruption in Africa’, Journal of Management and Social Sciences, vol. 5, no. 2, pp. 81-96.

Momoh, Z. 2015b, ‘Corruption and governance in Africa’, International Journal of Humanities and Social Science, vol. 3, no. 10, pp. 99-111.

Momoh, Z 2015c, ‘Globalization and corruption in Africa’, Journal of Management and Social Science, vol. 4, no. 2, pp. 145-158.

Nay, O 2014, ‘International organisations and the production of hegemonic knowledge: how the World Bank and OECD helped invent the fragile states concept’, Third World Quarterly, vol. 35, no. 2, pp. 210-231.

Nwanne, IA 2014, ‘U.S. Multinational corporations in countries with low corruption perception index’, Advances in Economics and Business, vol. 2, no. 3, pp. 148-153.

Okafor, CE, Smith, M & Ujah, N 2014, ‘Kleptocracy, nepotism, kakistrocracy: impact of corruption in Sub-Saharan African countries’, International Journal of Economics and Accounting, vol. 5, no. 2, pp. 97-115.

Osumah, O & Aghedo, I 2013, ‘Challenges and prospects of anti-corruption crusade in Nigeria’s fourth republic’, Journal of Business and Social Science, vol. 15, no. 2, pp. 221-234.

Reitano, T 2014, ‘Comparing approaches to the security-development nexus in the sahel and their implications for governance’, Governance in Africa, vol. 1, no. 1, p. 4.

Schumacher, I 2013, ‘Political stability, corruption and trust in politicians’, Economic Modelling, vol. 31, no. 1, pp. 359-369.

UN 2013, Millennium development goals report 2013. Web.

Voyvoda, E & Yeldan, E 2015, ‘An applied endogenous growth model with human and knowledge capital accumulation for the Turkish economy’, Middle East Development Journal, vol. 7, no. 2, pp. 195-225.

World Bank 2018, Explore, create, share: developmental data. Web.

Zhu, M 2014, MNCs, rents and corruption: evidence from China: a paper for presentation at Princeton IR faculty colloquium. Web.