Executive Summary

The process of acquisition is associated with a plethora of changes that cover organizational structure, financial performance, and the importance of different departments. With the help of Agthia’s example, it was revealed that the acquisition of Al Bayan not only contributed to the growth in revenues but also increased the need to underline the significance and include different entities such as shareholders, VP Strategy, and external audit in the process.

Apart from the need to include executives of different departments, a pivotal role of CEO could not be underestimated since he/she can be discovered as an intermediary, who ensured a connection between shareholders, managers, and Board of Directors, integrity, and transparency of the processes in the company. It could be said that the decision-making mechanism related to the acquisition of Al Bayan supported the company’s philosophy and complied with its organizational structure.

Introduction

Agthia specializes in producing beverages and food with its headquarters in Abu Dhabi (Agthia, 2017). Apart from being one of the leaders in the market and having offices in different countries in the Middle East, the enterprise prioritizes a continuous expansion of its locations and takes advantage of vertical and horizontal acquisitions to strengthen its position in the market. To support its growth, Agthia acquired Al Bayan in the recent past (“Agthia signs agreement”, 2015).

Thus, this merger was reflected by changes in the corporate culture of the company and caused the development of a specific managerial structure. Consequently, the primary goal of the paper is to conduct the analysis of modifications in the organizational chart before and after the acquisition, describe the departments in charge of the takeover, and introduce the reporting mechanism of the developed entity and its compliance with the existent structure.

Current Organizational Structure of Agthia

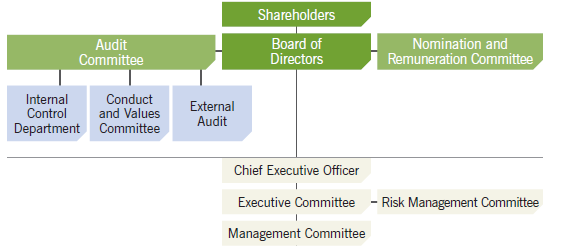

To understand the working mechanism of the company and modifications that took place after the acquisition, it was essential to describe the current organizational structure. In this case, Figure 1 clearly portrayed the general principles of corporate governance that were present in the company in 2015. Thus, a similar structure continues to exist today, as Al Bayan becomes an essential definer of organizational performance. The company’s focus on the value of transparency and integrity allows reviewing organizational structure in details while applying the principles of its key philosophies and concepts (Agthia, 2015).

At the same time, one of the critical policies of Agthia is to ensure that all components portrayed in Figure 1 respect corporate values and act in compliance with their duties, responsibilities, and ethics of the enterprise (Agthia, 2015). The aspects of the decision-making process that exists within the organization help the departments work as interdependent components towards the common goals.

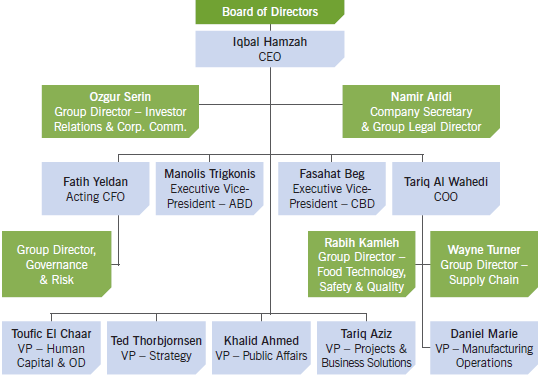

Nonetheless, it is crucial to review this structure in detail and discover different professionals responsible for various parts of organizational growth and decision-making. In this case, the Board of Directors is in charge of effective policymaking that not only complies with the corporate strategy but also helps identify the required pool of talents, proposes strategic initiatives, and takes advantage of effective leadership approaches (Agthia, 2015).

At the same level with the Board of Directors in the organizational structure, Audit Committee and Nomination and Remuneration Committee are present. These entities are responsible for designing policies regarding human resource management, developing remuneration packages for senior executives, and monitoring organizational financial performance (Agthia, 2015). Thus, to ensure the sufficient control of the internal operations Auditing Committee consists out of Internal and External Audit and Conduct and Values Department (Agthia, 2015).

Another important actor, who represents the opinions of shareholders and the Board of Directors in front of other departments, is CEO Chief Executive Officer (CEO) (Agthia, 2015). This figure can be discovered as a mediator, and the chosen one to ensure integrity in Agthia and the acquired firms. He/she ensures that the activities of other departments such as Public Relations (PR), Strategy, Human Capital, Projects & Business Solutions, and Manufacturing Operations comply with the organizational strategy and corporate philosophy (Agthia, 2015).

Apart from that, the CEO controls the actions of different members of the Executive Committee, and they are Chief Financial Officer (CFO), Agri-Business Division (ABD), Consumer Business Division (CBD), and Chief Operational Officer (COO) (Agthia, 2015). The title of each executive defines his/her operational focus and subdivision, and each member is responsible for its department to reach the set corporate goals and objectives. Thus, being united under the Executive Committee implies that all units mentioned above and their executives work towards meeting organizational objectives while assuring transparency and integrity as the principal values of the organization.

When reviewing the company’s organizational chart presented in Figure 1, pays vehement attention to the quality of manufacturing processes. These matters are highlighted by the existence of directors for Food Technology, Safety & Quality, and Supply Chain (Agthia, 2015). In this instance, these executives are not only responsible for the quality of the products manufactured and initially owned by Agthia but also for the recently acquired product lines such as Al Bayan’s water.

Thus, due to the complexity of manufacturing, having only these controllers may not be enough, and the last level is introduced by VP (Vice President) Manufacturing Operations (Agthia, 2015). The current stage enhances the efficiency and the working mechanism of the quality control procedures and improves product delivery in a timely manner.

Lastly, the Executive Committee and CEO tend to regulate various departments such as Human Capital, Strategy, Public Affairs, and Projects & Business Solutions (Agthia, 2015). On the one hand, these entities are responsible for different spheres while paying attention to the ability of these units to meet different types of goals and objectives.

At the same time, on the other hand, being monitored by one institution solely unites these departments and implies that they have to comply with the corporate philosophy. Overall, the proposed structure is logical since it pays attention to different working spheres simultaneously and supports the integrity of decision-making in the organization.

Changes after the Acquisition of Al Bayan

Thus, it remains apparent that mergers and acquisitions imply a high level of complexity since the companies have to modify their corporate organization to implement these changes effectively. Generally speaking, the changes targeted at enhancing communication between different entities and underline the significance of various departments in the decision-making process and solution-evaluation. In the context of Agthia, the incurred changes covered external audit, VP strategy, shareholders, and integrity.

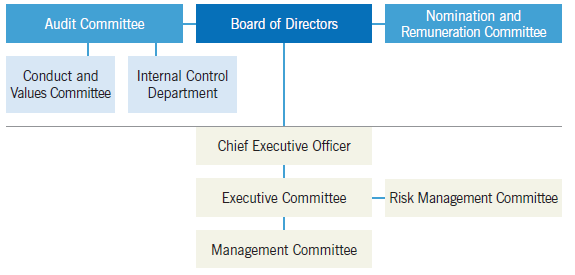

One of the differences that took place due to the acquisition was the fact that recently external audit became of higher importance after the takeover of Al Bayan (see Figure 3 for the organizational chart in 2014). The development of this business entity was rational. For example, one of the reasons for that was the fact that additional control was required to control the financial performance and productivity of Al Bayan since independent and neutral opinion would not only help control these changes but also modify the direction of these activities and ensure the compliance with Agthia corporate philosophy, organizational structure, and strategy.

Another difference pertains to the fact that now, shareholders of the company are considered as important contributors to decision-making (Agthia, 2015). Their presence was graphically portrayed in Figure 1 while in 2014, they were not considered as vehemently significant. The involvement of shareholders in the process and communication with them was also logical since they determined the company’s value in the market and defined the attractiveness of the business to investors (Agthia, 2015). At the same time, these change affected financial performance in a positive way while supporting the company’s mission and vision entirely.

Having a separate individual responsible for the strategy was the aspect that differentiated the current organizational structure from the old one (Agthia, 2015). This role was absent in 2014 while the associated responsibilities were distributed between different executives and decision-making units (Agthia, 2014). Thus, in 2015, this position was identified and represented by VP Strategy, Ted Thorbjorsen (Agthia, 2015).

The development of this department allowed Agthia to distribute its human resources effectively and change its emphasis on the strategy of the company and its organization. The establishment of this department was rational, as the acquisition of Al Bayan not only caused changes in financial performance and organizational structure but also required adjusting its strategy. In this instance, Agthia had to make its water segment profitable with the help of Al Bayan while changing its strategic initiatives and emphasis (Scott, 2015).

It could be said that another change could be reflected by the fact that more entities and the executive responsible for the quality of the delivered products and services were present (Agthia, 2015). In the case of Agthia, this modification was logical since the acquisition of Al Bayan implied expansion and diversification of product lines. Consequently, increasing quality control and introducing additional executives would ensure a high level of profitability of Al Bayan’s water segment.

Overall, it could be said that underlying the importance of various professionals after the acquisition helped not only determine the stages of decision-making procedure but also improved the flow of communication. The changes contributed to internal integrity and enhanced collaboration between different departments such as shareholders, CEO, CFO, VP Strategy, and External Audit. These matters supported the company’s vision and philosophy and ensured a rapid integration of Al Bayan in the business processes and organizational framework of Agthia.

Managerial Structure in Charge of Acquisition

Apart from the alterations in the corporate culture and organizational structure, companies like Agthia tended to unite different organizational entities that would control mergers and acquisitions. One of the reasons for this act was the fact that it would help review the decision from dissimilar angles and assure compliance with the principles of corporate governance (Risberg, 2013). One of the key players of this committee was CEO since he/she played the role of the intermediary between representatives of different departments, the Board of Directors, and shareholders.

It remains apparent that CFO was also in control of the process, as the acquisition caused changes in the company’s assets, financial performance, and related risks (Agthia, 2015). Meanwhile, considering the opinions of other executives such as COO, ABD, and CBD was also necessary since they were in charge of different critical segments that have a direct impact on the company’s success (Agthia, 2015).. Nonetheless, they had other duties and responsibilities to assure the sufficient functioning of the company and its operations before, during, and after the acquisition. Consequently, they only partly contributed to the process since, otherwise, the company’s profitability would be damaged.

As was mentioned earlier, the CEO was one of the critical players, who ensured sufficient networking and communication between the Board of Directors and shareholders (Agthia, 2015). Consequently, including shareholders in this decision-making process was reasonable, as they could be considered as value investors and contributors to the company’s value in the stock market and global arena. The representatives of this group took part in this process and represented the opinion concerning acquisition from an entirely different angle.

Risk Management Committee could be viewed as another player in decision-making regarding the takeover of Al Bayan. The primary focus of this entity was to assess and mitigate internal and external risks that posed a threat to the organization and its financial performance (Agthia, 2015). Including these executives in this process was reasonable since it helped conduct the sufficient risk assessment analysis and identify the threats and advantages related to this acquisition.

Due to the impact of the takeover on the functioning of various departments such as external audit, strategy, HR, and manufacturing, including them in the decision-making team was rational. In this instance, the primary reason for selecting the representatives of different departments in the evaluation of the takeover was to ensure that the decision was weighted and discovered from dissimilar angles (Risberg, 2013). Meanwhile, with the help of the focus on the internal activities, it was possible to determine how this acquisition would be beneficial to the company’s market share and its overall organizational performance.

Lastly, apart from the active contribution of representatives of Agthia internal departments, one could not underestimate the role of Al Bayan’s executives in this process (“Agthia signs agreement”, 2015). To regulate this relationship, Agthia and Al Bayan signed an agreement that not only set the value of the takeover but also controlled actions of these two parties (“Agthia signs agreement”, 2015).

This matter was beneficial for both companies, as it mediated their collaboration and ensured that the rights and needs of each entity were recognized and considered. It could be said that being able to include both internal and external participants contributed to the effective decision-making and was mutually beneficial for both parties.

Connecting Reporting Mechanism to the Organization Structure

It remains apparent that the departments of one organization have to work in unison to ensure the success of merger or acquisition, and a well-developed reporting system is one of the essential components of the company’s success. Effective communication pertains to a high level of integrity and collaboration between different entities while defining organizational direction towards triumph or failure (Verma, 2013).

For example, some organizations use social media for internal purposes, as this type of communication is believed to have a vital impact on the internal efficiency and productivity of the company (Young & Hinesly, 2014). Nonetheless, in the context of Agthia, these values were reflected in the reporting mechanism and involvement of various agents in the evaluation of the proposed takeover or action.

To underline the importance of shareholders, it was essential to have a discussion with them concerning the acquisition (Risberg, 2013). Including these members in the decision-making process complied with the company’s values and philosophies related to the transparency and integrity of the enterprise. Simultaneously, it clearly supported the need for changes that took place in 2014-2014, as the attitudes towards shareholders and corporate social responsibility altered while being discovered at the top of the organizational pyramid (Agthia, 2014).

At the same time, it was vital to advise the CEO with the prepared proposal, as he/she was appointed to determine the relevancy and a rationale for acquiring or merging with a particular company such as Al Bayan (Agthia, 2014). In this case, the CEO had the power to review and reconsider the suggested change, as he/she was the one responsible for ensuring compliance with the initial corporate strategy, determining the company’s vision, focusing on its profitability, and selecting the most appropriate leadership practices.

Having the executive, who was in control of the overall process of acquisition, certified that this decision was beneficial for the company and the needs of all entities were taken into account. This matter complied with the organizational structure of the enterprise and the CEO’s primary intention to establish a trusting relationship between shareholders, the Board of Directors, and executive managers of other departments.

Another key player in this reporting system is CFO. It remains apparent that any merger is associated with dramatic changes in the financial performance of the company. For example, upward and downhill shifts tend to incur liabilities, and matters such as ownership, goodwill, costs, and impairment of financial assets (Agthia, 2014). The acquisition of Al Bayan led to the development of changes in the described financial features, as it became one of the definers of productivity.

For example, it increased the company’s revenues from Al Bayan by 20% while strengthening Agthia’s positions in the market and enlarging its market share in bottled water production (Scott, 2015). Consequently, it was reasonable to include CFO in the reporting system since she/he helped not only comply with the corporate goals, strategies, and values but also contributed to effective productivity that it was one of the central attributes of the company’s prosperity and growth.

At the same time, one could not underestimate the role of Risk Management Committee since it was in charge of evaluating associated internal and external risks (Agthia, 2015). Being placed at the same level with Executive Committee gave it a unique right to express its perspectives and show its concerns with the corporate performance when acquiring a particular entity such as Al Bayan. This department had to evaluate the proposed offer since it would review it from dissimilar angles and conduct an effective risk assessment, and including it in the reporting process was logical.

Apart from the paramount importance of departments such as Risk Management Committee, CEO, CFO, and shareholders in the decision-making process related to acquisitions, involvement and contribution of other units such as Executive Committee and Manufacturing Operations were pivotal. The primary reason for this decision and inclusion of these entities in the reporting process was the fact that they supported integrity, transparency, and collective decision-making, and they were of supreme importance in the organization.

With the help of the main responsibility of CEO, they were able to express their opinions and report it from the perspective of their departments (Agthia, 2015). Overall, it could be said that reporting mechanism and selecting specific entities responsible for acquisition of Al Bayan were rational since they assisted in the development of effective solutions, complied with the existent organizational structure, and explained the requirements for particular changes.

References

Agthia. (2014). Annual report 2014. Web.

Agthia. (2015). Corporate governance report. Web.

Agthia. (2017). About Agthia. Web.

Agthia signs agreement to acquire Al Bayan group of companies. (2015). Drinks Business Review. Web.

Risberg, A. (2013). Mergers & acquisitions: A critical reader. New York, NY: Routledge.

Scott, A. (2015). Agthia tightens grip on UAE bottle water market with three acquisitions.The National. Web.

Verma, P. (2013). Relationship between organizational communication flow and communication climate. International Journal of Pharmaceutical Sciences and Business Management, 1(1), 63-71.

Young, A., & Hinesly, M. (2014). Social media use to enhance internal communication. Business and Professional Communication Quarterly, 77(4), 426-439.