Introduction

Ajmal Perfume Company is a global cosmetic company that operates in several Middle Eastern countries and specific parts of Asia. The company mainly has a strong market base in key Middle East destinations, such as, the United Arab Emirates, Kuwait, Saudi Arabia, Oman, Bahrain, and Qatar. Other markets include Malaysia and India. The company’s product strategy mainly centers on producing Arabian and French fragrances. It distributes its products through several retail outlets located in its key markets.

This report, takes a keen look at Ajmal’s strategy by focusing on its goal of increasing its market presence and dominance in existing and potential markets. Specifically, this paper evaluates Ajmal’s strategy in the United Arab Emirates (UAE) as a key market in the Middle East. A further analysis that explains how industry dynamics and the external environment influence Ajmal’s strategy also forms an important part of this report. Therefore, this paper evaluates the company’s external environment (macro environment) and industry dynamics (industry life cycle, industry driving forces, porter’s five-force analysis, and the industry profile and attractiveness). These analyses compare with the company situation (financial analysis and SWOT analysis) to show a bigger picture of Ajmal’s operations. Comprehensively, these analyses provide a backdrop of the recommendations that this study provides to address Ajmal’s strategic issues, situational profile, company prospects, and strategic problems.

Strategic Issue

Ajmal’s company strategy has always centered on the sales and distribution of prestige brands. Through this strategy, the company mainly meets the demand of affluent Middle East clientele. Ajmal’s target market comprises mainly of young people. In fact, about 65% of the company’s clientele are young people, below the age of 25 years. Besides the strategy of floating premium brands, Ajmal also embarked on a global strategy of using online communication to spread its brand outreach. So far, the company is modernizing its brand to have a global appeal. The company only recently opened new outlets in Malaysia (as a global strategy to go beyond its GCC market and explore new market opportunities). In the future, the company aims to cement its dominance in the global market by strengthening its market base in new and emerging markets. Nonetheless, even as Ajmal aims to expand its market outreach in these markets, unfavorable industry dynamics, and the hostilities of the company’s external environment pose several opportunities and challenges to the company’s strategy.

External Environment

Ajmal’s external environment has a significant impact on the company’s future strategy of cementing its market foothold in the UAE and other parts of Asia. The external environment contains several environmental dynamics that are beyond the company’s control.

Macro environment

Economic Conditions

One significant attribute about the UAE fragrance industry is the favorable economic conditions of the market. While many developed countries are experiencing unfavorable economic conditions, such as, the 2008 global financial crisis, many developing markets, like the UAE, project favorable economic conditions (supportive of growth). In this regard, many fragrance companies are diverting their focus to the UAE. Key among the companies that are diverting their focus to the UAE are global fragrance companies that intend to compete with local and regional brands in the fragrance market. Many of such companies have posted growth in this market. For example, in 2011, Revlon posted a growth rate of about 4.5%. Most of this growth stemmed from increased net sales of perfumes. This growth rate helped to offset some of the lowest sales witnessed in developed parts of the world.

Due to the economic potential of the UAE fragrance market, the market is quickly becoming a favorite destination for companies intending to launch designer brands. For instance, Hennessey’s Arabian Night is a classic designer brand that launched in the UAE. This brand now attracts the high-end Middle East market. Some companies, which have emulated this strategy, have tried to fuse product attributes from the East and the West. Based on the attempt by global fragrance companies to merge East and West product dynamics, there is a clear acknowledgement among these companies of the need to incorporate local product attributes in their product development process.

Social and Cultural Dynamics

The UAE is one such country that comes from a background of societal values that appreciate perfumes and fragrances. Indeed, in most shopping malls within the country, there is a strong smell of perfume. The high consumption of perfume (per capita) in the Gulf region also complements the strong societal appreciation for perfumes within the UAE. Therefore, perfumes are an integral part of everyday life in the UAE. However, most Arabian perfumes are different from other types of perfumes in the world. For instance, Arabian perfumes are products of oud (a rare and unique ingredient found in selected parts of the world). In fact, this raw material mostly exists in specific parts of India and South East Asia only. In addition, some of the ingredients for developing Arabian perfumes have a deep cultural appreciation. Non-Arabian perfumes are lighter and have a lower staying power.

Market Demographics

Another issue that affects the dynamics of the UAE fragrance market (especially with respect to Ajmal) is the demographics of the market. Considering Ajmal focuses on marketing premium brands, many people who characterize the fragrance market for such products are young people (mainly below 25 years). This youthful demographic normally spreads across all genders. Indeed, both men and women in the UAE apply multiple layers of perfume (part of their tradition and culture). Most of the perfume wearers like the product because it gives them a touch of class, confidence, glamour, and mystery.

Technology

The technological environment is also an important factor in the UAE fragrance market. More importantly, the rate of technology penetration in the UAE is relatively higher than other Gulf States. For example, the number of Facebook and Twitter users in the UAE is high. Generally, 70% of the UAE population uses the internet, while 60% use Facebook. Consequently, most fragrance companies have embarked on an ambitious effort of using online marketing strategies to increase their market presence in this region. Some companies (like Carrefour) are also testing their products online (by introducing online shops in Dubai). Indeed, E-commerce is among the fastest growing economic sectors in the UAE. The high internet usage in the UAE complements Ajmal’s strategy of reaching the youth (which form the majority of its target market). Indeed, since the market is mainly reliant on a youthful demographic, the internet acts as an important tool for reaching this population group.

Legislative Environment

Legislatively, fragrance manufacturers are subject to both local and global legislations. Most of these legislations are supposed to protect the customers and the environment. Legislative changes have the most significant implications for fragrance manufacturers because a legislative change may require a company to re-manufacture its products, thereby causing additional costs in manufacturing. For example, in 2012, there was a legislative change that altered the technical regulations for manufacturing fragrances sold in the UAE. All fragrance manufacturers had only six months to comply with the new regulations. This legislative change greatly inconvenienced many perfume companies that had to comply with it.

The external environment of the fragrance market in the UAE depicts the enabling and the disenfranchising nature of the industry that may pose a challenge (or opportunity) for fragrance manufacturers to succeed (or fail) in the market. For example, the legislative environment and the limited market demographics are limiting factors in the environment. However, the positive economic prospects and the vibrant technological environment pose significant opportunities for fragrance manufacturers like Ajmal to succeed in the market.

Industry Analysis

Industry Lifecycle

According to the growth reported by most industry players in the UAE fragrance market, it is safe to say the industry is in its growth stage. Between 2009 and 2010, the total percentage change in premium perfume brands was 3.6%. This percentage change includes other changes in premium women’s fragrances, premium men’s fragrances, and premium unisex fragrances. The grand total change in premium fragrance brands (plus mass) was 7.7%. This change includes percentage changes in men, women, and unisex fragrance brands. An average sales growth of less than 8% shows that the industry is in its growth stage. Other evidences showing that the industry is in its growth stage includes the increased entrance of new players in the market. Therefore, unlike the introduction stage, where there are only a few players in the industry, and few customers, increased competition characterize the growth stage

Driving Forces

Considering the UAE fragrance industry is in its growth stage, competition is the most defining characteristic of the industry. Indeed, the intensity of market activities of new fragrance manufacturing companies in the UAE outweighs the activities of other companies in the region. This fact is especially profound because global companies are quickly defining the competitive landscape of the industry, based on their introduction of new global brands in the market (predominantly characterized by local and regional brands). Indeed, observers perceive the UAE fragrance market as a melt-point for western glamour and Middle Eastern culture. Therefore, many fragrance manufacturers have launched new brands in the region.

Based on these new characteristics, the UAE fragrance market is now very competitive. In addition, based on the increasingly competitive nature of the market, fragrance-manufacturing companies are adopting more aggressive and innovative marketing campaigns. Such strategies include the use of online marketing techniques to reach a wider audience and the restructuring of their supply chain strategies to increase operational efficiencies. Ajmal is one such company, which needs to re-engineer its supply chain strategy to exploit opportunities for supply chain efficiencies and effectiveness. Through such a strategy, Ajmal may create a new and distinctive competency that is difficult to replicate by other fragrance-manufacturing firms in the industry.

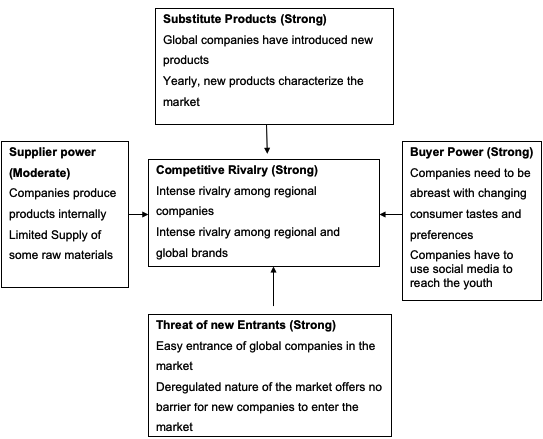

Porter’s Five-Force Analysis

Supplier Power

The supplier power refers to the ability of owners of market inputs to influence a company’s strategy. Since several fragrance-manufacturing companies have their internal manufacturing systems, they have a firm grip on the product development process. They are therefore not excessively reliant on suppliers to provide them with finished products. However, the use of some crucial raw materials (oud) increase the supplier power because oud is a crucial raw material for making Arabian perfumes, and it is in low supply. The demand for oud therefore outstrips its supply. However, besides oud, there is no significant market challenge to existing companies. Comprehensively, after considering the limited supply of some raw materials and the extensive control that most of the fragrance manufacturing companies have on their supply chain processes, it is fair to say, the supplier power in the industry is moderate.

Threat of Substitutes

The threat of substitute products in the UAE fragrance market is very strong. The increased strength of substitute products in the UAE fragrance market is especially profound because global companies have introduced new perfume brands in the market, which compete favorably with local brands. Therefore, while the presence of popular perfumes, such as, ouds, ambers, and musks characterize the Middle Eastern fragrance market, the threat of global perfume brands (like Sara Jessica parker’s Lovely, and Justin Beiber’s Someday) remain vivid. Consequently, global companies introduce new perfumes in the market (yearly) and it is very difficult for one Perfume Company to be comfortable with their market share (because the threat of substitutes is strong).

Threat of New Entrants

The UAE fragrance market has attracted many new players. Since the industry is deregulated, global players have given local companies stiff competition in the market. Broadly, no market limitation stops new players from entering this market. Consequently, existing companies are investing in innovation and marketing to cut an edge above their competitors. In addition, the deregulated nature of the industry has led to increased competition among industry players. Comprehensively, the threat of new entrants to the industry is strong.

Buyer Power

The UAE perfume market has a strong buyer power. This strong buyer power stems from the youthful demographic of the market. Notably, this paper shows that a youthful population, which has a changing taste and preference for perfume products characterize the market. Therefore, companies always have to keep abreast with these changing tastes and preferences. In this regard, buyers influence company strategies by forcing them to adjust to their new preferences. For example, since the market is largely youthful, most fragrance manufacturers have to use social media to reach this target market. Comprehensively, based on the influence of consumer behavior on company strategies, the buyer power is strong.

Competitive Rivalry

There is a strong competition in the UAE fragrance market. As mentioned in this paper, the competition mainly stems from the entry of global companies that introduce new products in the market every year. However, competition also plays out at the regional level, where regional fragrance manufacturers, such as, Ajmal compete for the same market share as other companies in the market (like Arabian Oud, Swiss Arabian perfumes, Royal Diwan group, and Zahras perfumes). Since there is a lot of competitive rivalry among these fragrance manufacturers, the competitive rivalry among these companies outweigh any other. Appendix one shows a summary of Porter’s Five-Force Analysis.

Industry Profile and Attractiveness

Based on the porter’s five-force analysis described above, the industry profile of the UAE fragrance market is unattractive for new and emerging brands. The buyer power, competitive rivalry, threat of new entrants, and the threat of substitutes are all strong. The supplier power is the only moderate force. The strength of these forces are unattractive to the industry because they show that the industry is fiercely competitive and even if one company manages to command a substantial stake in the market, it cannot be comfortable in this position because other companies may destabilize its position.

The macro-environment also shows that unpredictable legislation and increased competition add to the unattractiveness of the industry. The favorable economic conditions (and the technological vibrancy of the market) however pose positive prospects for the industry, but they can only improve the operational aspects of company operations (like using technology to improve the supply chain efficiency). To this extent, the macroeconomic and industry analyses of the UAE fragrance market shows that the industry is only moderately attractive.

Company Situation

The importance of understanding a company’s situation (through the macro-economic environment and its industry dynamics) surface when understanding how internal company dynamics complement (or clash) with environmental/industry dynamics. Therefore, depending on how well, or poorly integrated, the company dynamics are with the external environment, or industry dynamics, a company may succeed, or fail, to sustain its business activities in the future.

Financial Analysis

There is little information provided to assess Ajmal’s financial situation. However, there is a general agreement that the company’s financial position depends on the successes of its core brands. So far, most of the company’s 70 brands are selling well in the market because observers regard Ajmal as a key regional player in the perfume market. The company’s factory (located in Dubai’s warehouse District) is also valued at $200,000,000.

According to industry statistics, brand differentiation, as pursued by Ajmal, accounts for most of the company’s total revenue. Even though there are insufficient statistics showing the company’s sales growth, industry statistics show that the company should post between 3% and 7% growth rates. The implication of such sales growth estimates show that the company should invest more in the marketing and advertising strategies to exploit the new opportunities for increasing its overall sales. Comprehensively, Ajmal has a strong financial position, which it can use to leverage its products above the competitors’ (through better marketing and innovation strategies).

SWOT Analysis

A SWOT analysis mainly evaluates the company’s internal environment. In detail, this analysis incorporates the assessment of the strengths, weaknesses, opportunities, and threats of a company.

Strengths

Innovation

EA’s company strategy centers on adopting innovative practices. Indeed, the company has circumnavigated some of the most pressing problems of the industry (like unfavorable economic conditions) to emerge a strong regional player in the industry. Ajmal’s deputy general manager recently admitted that the company’s innovative strategy (coupled with the quest to strike a careful balance between ethnic ethos and modernity) informs the company’s success for the past 60 years of operation. In this regard, the company has posted significant profits in some of its key brands. Most of these brand successes stem from the company’s innovative strategies of creating a perfect Arabian perfume that positions the company as the leader in the sale of ethnic chic brands. These internal company competencies affirm the company’s vibrant innovation strategies.

Brand Superiority

Ajmal has built a name for itself by appealing to a unique market segment – affluent Middle Eastern Clientele. Notably, the company has made a name for selling prestige brands as a niche in the fragrance market. Consequently, the company’s brand appeals to the high-end Arabian market. Comprehensively, the company’s brand superiority improves its competitive edge in the market as a top-notch prestige brand seller.

Weaknesses

Short Product life cycle

Since Ajmal appeals to the affluent Middle East society, it suffers a notable weakness of its brands having a short shelf life. This is a notable attribute of prestige brands because experts view such brands to have a short life span. Moreover, such products are often vulnerable to the risks of having a minority market (affluent people) because ordinary people, who may perceive such products as expensive or replaceable, shun such products. The company needs to expand its market reach to appeal to a wider market (possibly middle-class people as well)

Opportunities

Digital Marketing

This paper already shows that a vibrant technology market characterizes the UAE fragrance market. This environment complements one key opportunity of Ajmal’s company strategy – digital marketing. The introduction of the digital marketing platform is part of Ajmal’s innovation strategy, which aims to update its retail store designs and improve the efficiency of its supply chain. These are just a few advantages enjoyed from the adoption of the digital marketing platform. More opportunities exist regarding the adoption of this digital marketing platform. Redesigning the company marketing and product strategy outlines possible areas that could potentially benefit from this development. These improvements could potentially enhance the company’s efficiency.

Threats

Competition

Since there are many players in the UAE fragrance market, competition is the major threat to the sustainability of Ajmal. Not only does the company experience stiff competition from regional companies, it also experiences the same competition from global companies that have set base in the UAE. A key implication of this threat is a reduction of profitability and the increase in production costs (especially concerning the adoption of aggressive market strategies needed to compete with other products).

Poor Market Profile

Expatriates form the bulk of the UAE’s perfume consumers. In fact, about 90% of the total percentage of retail consumers in the fragrance market is comprised of expatriates. This market profile is a threat to the sustainability of Ajmal’s operations because expatriates are often temporary residents of a country. Therefore, while they may provide a good market for perfumes, their temporary stay in the country provides an unstable market, especially if they leave. Appendix two shows a summary of the SWOT analysis.

Recommendations

Situational Profile and Prospects

The UAE fragrance market is a promising destination for new investors intending to venture into the Middle East market. Like many developing markets, the UAE poses favorable economic conditions for the introduction of new global brands. However, because of the uniqueness of the market, many global perfume manufactures have to blend local and international production processes to achieve an acceptable product mix that sells in the target market. Nonetheless, because of the entry of many global players and the existence of other regional fragrance manufacturing companies, the stage is set for fierce competition among incumbent and new fragrance manufacturing companies.

Furthermore, because of the deregulated nature of the fragrance market, an analysis of the Porter’s five forces show that the market is open for new entrants, increased competition, unpredictable legislations, and a moderate supplier power. These market dynamics show that the UAE fragrance market is moderately attractive to new and incumbent investors. The favorable economic condition in the Middle East and the vibrancy of the market also supports this fact. Comprehensively, these market dynamics show an unpredictable market environment that may weaken or strengthen a company’s market position. The vibrancy of a company’s strategy therefore determines the success or failure of the company in the UAE market. This is the dilemma facing most incumbent companies, including Ajmal perfumes. However, as this study shows in this section of the report, the company’s prospect of succeeding in the UAE market is poor.

Strategic Problem

How will Ajmal’s strategic competencies overcome the unfavorable market conditions in the UAE fragrance market to increase its shareholder value, profitability, and sustained competitive advantage?

Strategy Recommendations

The strategy recommendations for Ajmal center on maximizing its key competencies and opportunities, while limiting its weaknesses and threats.

Creating Brand Loyalty

Ajmal may take advantage of its key competencies by creating brand loyalty. This way, the company may increase its market share by selling the company’s story to its customer and commanding a strong brand loyalty, even as its competitors pursue aggressive marketing campaigns. Since the company intends to exploit digital communication as its main communication tool, the company should use the same platform to communicate the company’s story to its customers. For example, through social media, the company should highlight personal stories, lessons learned from mistakes, and the overall work that the company does. Broadly, the company should show the “human side” of the company. This way, customers may develop a strong brand loyalty that transcends the competitive pressure from other companies.

Creating a strong brand loyalty poses multiple advantages to the company because it minimizes the impact of competitive pressures (customers ignore products from other companies), exploits the digital marketing platform – social media communication, and exploits the company’s brand superiority (a key strength of the company).

Innovation

Another strategy that the company can use is exploiting its innovative strategy to produce superior products that are distinct from the competition. People already know Ajmal for creating a strong “ethnic” brand that appeals to the Middle East market. The company may further extend this innovation in product development processes so that it is able to create a special product (say using additional raw materials that the competitors do not use) to have an edge above its competition. In this regard, the company should invest more in research and development. This strategy minimizes the competition and maximizes the company’s innovative strength.

Objectives

The objectives of adopting the above recommendations aim to increase the company’s market share (in the short term) and improve the company’s profitability in the long term). Because of the unpredictable nature of the market, it is difficult to establish future profitability targets.

Strategic Justification

By adopting the above strategy recommendations, new opportunities for Ajmal to increase its market share and boost its market dominance in the market manifest. Creating a strong brand loyalty and exploiting the innovative competencies of the company provides a practical channel for achieving these objectives. The main implications for adopting these strategies are the additional resources the company may require to implement these strategies. More importantly, investments in innovation and product redesign require additional financial resources (in research and development) and new technical expertise. Even though the implementation of the new strategies require these resources, the benefits accrued are crucial to the company’s survival.

With a fiercely competitive industry and a market that hosts new products (almost yearly), it is crucial for Ajmal to edge a new identity for itself in the market. It can only do so by investing in research and development. This way, the company differentiates itself from its competitors (and possibly provides superior products in the market that outshines the competition). Exploiting the company’s innovative strategy is however inexpensive because the digital communication platform is the main platform of communication. Few resources are required to undertake an effective marketing campaign that creates brand loyalty. The potential benefits of adopting the above strategies therefore greatly outweigh their disadvantages.

Appendix

Porter’s Five Forces