Abstract

The paper studies the strategic position of Kellogg Company and the strategies it may take in future. In this paper we study the history of the company, the financial and marketing history of the company. The study is based mostly 2007 financial data of the company as well as the industry. We first trace the history of inception of the company with a novel product and then find out how its strategies have evolved to remain a market leader. Then with the present available data we conduct a strategic analysis of the company. This analysis is divided into three different parts: the input stage, the matching stage and the decision stage. In each step we conduct different analysis using different matrices such as SWOT analysis, BCG or GSM and in the end QSPM to complete the analysis. We come across different recommendations for Kellogg’s which will help the company retain its present market leader status. These recommendations may be summed as: diversification, market development, product development and market penetration.

Company History

Kellogg’s is the number one US breakfast cereal maker (a mere corn flake ahead of General Mills). Among its well-known brands are Frosted Flakes and Rice Krispies. As on-the-go consumers grow impatient with the traditional cereal-milk combo, Kellogg increasingly relies on snacks and convenience foods such as Eggo waffles, Nutri-Grain cereal bars, and Pop-Tarts to buff up its bottom line. Furthering its non-cereal offerings, the company bought cookie and cracker giant Keebler Foods (Fudge Shoppe, Cheez-It), which became its Kellogg Snacks Division. The W. K. Kellogg Foundation, one of the world’s largest private charities, owns about 25% of the company.

Kellogg Company was formed when production of Kellogg’s Corn Flakes began at W.K. Kellogg’s newly formed Battle Creek Toasted Corn Flakes Company in 1906. The ready-to-eat cereal innovation would change the way people eat breakfast worldwide. W.K. Kellogg’s product innovation and drive for market expansion influences the Kellogg Company and the food industry around the world today. A quarter of a century at the San taught W.K. that people may be attracted to a food because it’s nutritious, but they continue to eat it because of flavor, freshness, value and convenience.

With 2006 sales of nearly $11 billion, Kellogg Company is the world’s leading producer of cereal and a leading producer of convenience foods, including cookies, crackers, toaster pastries, cereal bars, fruit snacks, frozen waffles, and veggie foods. Kellogg products are manufactured in 17 countries and marketed in more than 180 countries around the world.

Kellogg Company’s business is broadly divided into two divisions: Kellogg North America and Kellogg International. Kellogg North America includes retail cereal, retail snacks, and frozen and specialty channels businesses in both the United States and Canada. Kellogg International is divided into businesses in Europe, Latin America, and Asia and Australia (Asia Pacific). The Kellogg International business focuses almost exclusively on the cereal and wholesome snack categories within the respective regions.

Current Strategies and Objectives

Kellogg’s management believes that the secret to their business success is their ready-to-eat (RTE) cereals. So Kellogg’s believes in continuing to achieve sustainability through a strategy focused on growing their cereal business, expanding the snacks business, and pursuing selected growth opportunities. Their business strategy emphasizes on profit maximization, sustainability in sales growth, as well as cash flows and return on invested capital. The management believes that a steady growth of earning and a strong cash flow will ensure a strong and flexible business model.

Current Vision and Mission Statement

The present vision statement of Kellogg’s is to be the chosen food company. And the mission statement of the company states that Kellogg’s is a global company committed to building long term growth in volume and profit and to enhancing its worldwide leadership position by providing notorious food products of superior value.

Revised (or new) Mission Statement

Kellogg has undergone a change in its mission statement in 2007 which now says: “We build Great brands and make the world a little happier by bringing our best to you.” The change was meant to better reflect Kellogg’s strategic focus.

Kellogg’s Vision and Mission statements define the company’s focus on sustainable growth, its definition of social responsibility and the pulse of the company, the employees and the brands. The vision statement encompasses the full spectrum of our stakeholders including shareowners, employees, customers, consumers and communities and the mission statement articulates where the company stands today and where it wants to be in the future. The vision and mission statements are integrated with the company’s focused strategy and operating principles as well as the foundations of the business i.e. the company’s “K Values, people and commitment to social responsibility.”

Strategy Analysis

In this section we will do a strategy analysis step wise. First we will consider the input stage, matching stage and decision stage. The input stage has the competitive profile matrix, external factor evaluation and internal factor evaluation. The matching stage consists of SWOT analysis, BCG matrix, SPACE matrix, and Grand Strategy Matrix. And in the decision stage we will analyze the Qualitative Strategic Planning Matrix (QSPM).

Competitive Profile Matrix (CPM).

Competition in the RTE cereal industry is oligopolistic in nature. Kellogg’s is the global market leader in the market. The other competitors in the US market are General Mills, Nestle, Kraft Foods, Post, and Quacker Oats. For this analysis we consider, Nestle and General Mills as the largest competitors and do a CPM analysis. The analysis shows that that in the RTE cereal market, the Kellogg’s is the leader with more global presence and portfolio diversity than General Mills and Nestle.

External Factor Evaluation (EFE).

The external environment analysis shows Kellogg’s score to be 1.98. The firm’s position does not seem to be in a very compatible position with the external environment. The core strategy that comes out of this analysis is diversification to be the strength of the company.

Internal Factor Evaluation (IFE).

The internal factor analysis shows that the company’s financial and marketing status are strong. The company has shown strong financial links. Net sales growth has been increasing from 7.2 percent to 8 percent from 2006 to 2007. The company showed a double-digit increase in advertising investment, significantly higher commodity, fuel, energy, and benefit cost inflation and up-front investment charges. Incremental increases in fuel, energy, commodity, and benefit costs adversely impacted earnings by 32 cents per share. Further Kellogg recently acquired Bear Naked, Inc, Gardenburger brand in the U.S and The United Bakers Group in Russia. In 2006, Kellogg spent $916 million on advertising and $191 million on R&D. Marketing innovation and product differentiation help keep consumers interested and translates directly into higher revenues. In the latest quarter, the company reaffirmed the company’s commitment to advertising, announcing that advertising for new and existing brands increased at a double digit rate for the last half of 2007. Further the company’s management of its human resources in commendable. So the strategies that we have to discuss in this area are to improve the product development of new products which will attract newer markets.

SWOT/TOWS

Table 2.

While doing a strength and weakness analysis we come across the following characters of the company. The strengths of Kellogg’s are identified to be its leadership in the RTE market. It has a global share of 42 percent of global market share for Pre-sweeter cereal, which is more than triple the market share of any of their competitors. Further, Kellogg’s has the strongest brand recognition and advertising recollection of all the cereal manufacturers. Kellogg’s has a strong alliance with its retail partners like Wal-Mart. In 2006 Wal-Mart accounted for 18% of net sales and the top five retail customers of Kellogg accounted for 33% of net sales. The weaknesses that we have identified in Kellogg’s are as follows. First it has not aggressively developed many new cereal lines in the past four years. Slow erosion of their U.S. market share in the past few years. And another major problem that we see is that Kellogg’s has been a follower in price strategy. The opportunities that Kellogg’s has are its international market and its dominance in it. No other competitor has expanded globally as Kellogg’s. Kellogg can continue to slowly diversify, while still remaining in their core business area, which will increase their profitability. Recent acquisitions of Kellogg’s, that of Bear Naked, Inc, Gardenburger brand in the U.S and The United Bakers Group in Russia are imminent opportunities that the company has to expand as well as diversify its business.

The threats that Kellogg’s’ faces can be from the government who may increase the tariffs or taxes on food items or FTC imposing a new regime on the RTE market. The use of price competition and product proliferation by General Mills, Post, and Quaker Oats is specifically aimed to erode Kellogg’s share of the market. Retail companies, with whom Kellogg’s has alliance for the sale of its products, are consolidating and in doing so increases their ability to negotiate lower prices with cereal producers. Lower prices for goods sold translate into lower margins for Kellogg. The continuously rising cost inflation is a problem. This is so because the primary ingredients of Kellogg products are wheat and corn, representing 9.4% and 2.6% of Kellogg’s sales, respectively and the continuously shifting commodity prices due to the ever rising demand of agricultural products. Higher commodity costs continued to weigh on Kellogg’s earnings throughout the third quarter of 2007, when it lowered full year earnings per share guidance based on higher wheat and corn costs. Kellogg is vulnerable to fluctuation in oil prices compared to its competitors due to its direct-store/door-delivery (DSD) system. Oil prices, along with plastic prices, affect production costs and packaging as well.

So the strategies that we propose are shown in table 1. On the basis of the given internal strengths and weakness and the external opportunities and threats we com to the conclusion that the overall strategies that Kellogg’s should adopt are:

- New innovation and product development.

- Increasing presence globally so as to establish themselves as a true cereal company.

- Utilize their strong financial and market dominance on competitors as well as alliances to gain price advantage.

Strategic Position and Action Evaluation Matrix (SPACE)

Table 3.

From the above figure of SPACE Matrix it is clear that the strategy that Kellogg’s should opt for is Kellogg’s has the financial strength with a dominating power over the industry. So it needs to diversify and product development to capture the market that is still potent. Further Kellogg’s should go for forward integration and invest into new market opportunities like snack food or other food products.

Boston Consulting Group Matrix (BCG)

To do a BCG matrix analysis of Kellogg’s portfolio is beyond the scope of this paper as they have so many different brands. So we have aggregated the products into product categories namely, RTE cereals, snacks and frozen food. Kellogg’s is the market leader in RTE cereals with a share of 34 percent market share. Kellogg’s market share in snack food market is 12 percent as opposed to a whooping 22 percent of the market leader General Mills in 2007. Frozen Food market share of Kellogg’s is 6 percent but stands second in market share in frozen food market share where Nestle dominates the market with a share of 46.6 percent share. The company posted a sales growth of cereals of 6 percent as compared to 3 percent of the overall industry in 2007. Further 2 percent versus 12 percent growth in the industry in 2007 for snack food. In the frozen food market Kellogg’s posted a growth of 6 percent as opposed to 4.1 percent industry sales growth in 2007. So we construct a BCG Matrix with the aid of the above figures.

From figure 2 it is clear that all the products that Kellogg’s sells are in the star zone which implies that they can undergo further investment into technology for product development and capturing the increased growth potential that the market offers. But they need to concentrate on their snack food business as this has immense market potential, but Kellogg’s is unable to capture it. Further market penetration is possible.

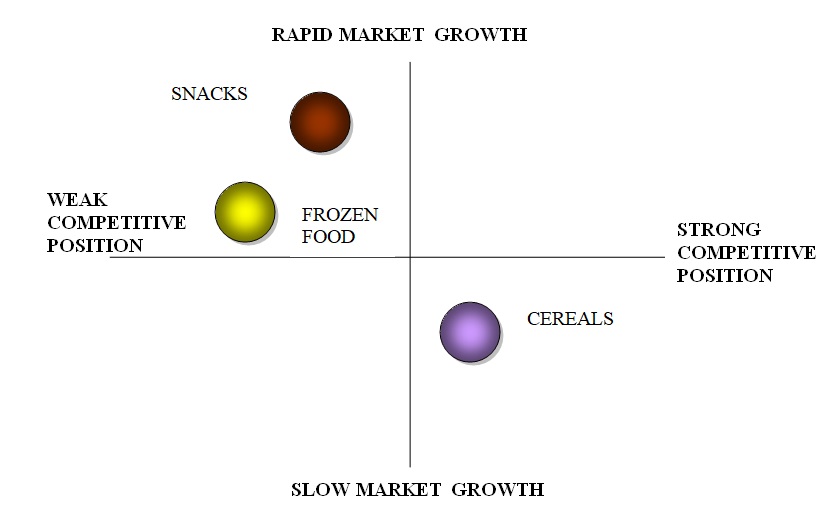

Grand Strategy Matrix (GS)

As figure 3 shows, the grand strategy that we get for the products portfolio of cereals, snack food and frozen food shows that the market growth of cereals is slow along with the a strong competitive position that Kellogg’s holds in this category vis-à-vis its competitors. This is due to the growth figures for the past few years’ shows a declining in the RTE cereal industry. So the strategy that Kellogg should take for this segment is diversification. As it is Kellogg’s is already diversifying worldwide, so it has to boost up that process. The snack food market has a high growth potential, but a weak competitive position. So is the situation for frozen foods. This shows that Kellogg’s is unable to capture the full potential of the market. So it should adopt a strategy of market penetration and market development to capture the left out market so that it can increase its earnings.

Quantitative Strategic Planning Matrix (QSPM)

For this analysis we assume that the two alternate strategies that can be adopted by Kellogg’s are profit maximization or that of diversification as it is currently following. We compare both the strategies with the help of QSPM.

Table 4: Strategy 1.

Table 5: Strategy 2.

Table 1 and table 2 shows the QSPM scores for the two strategies which we have compared for Kellogg’s. The first strategy that we employed is profit maximization. The attractiveness has been intuitively computed on the basis of the earlier research done on the company’s financials and market situations. Based on the study of the internal and external environment of Kellogg’s we intuitively computed the attractiveness as well as the weights assigned to each variables. The attractiveness is based on a scale of 1 to 4 where 1 implies not attractive and 4 means highly attractive. From table 1 we see that the overall score for a profit maximization strategy in employed by Kellogg’s will be 3.86 and that of strategy two which aims for diversification is 4.42. Clearly the attractiveness of the second strategy is more than that of the first strategy. So we recommend that Kellogg’s should opt for a diversification strategy.

Conclusions

In conclusion we may state that Kellogg’s being the market leader in the RTE cereal market must opt for a strategy which will provide them long term profitability as well as maintain their image as a market leader. So they have to diversify their business not only geographically but also in their product portfolio. so that any impending surprises that the market may hold can be countered. Hence diversification is the right strategy for Kellogg’s.

Recommendations

To sum up the recommendations that we have come across through the whole strategy analysis process are as follows:

- Diversification, both globally and in their product offerings.

- Become a price leader than a follower.

- New product development.

- Further market penetration for products like snack foods and frozen foods items.

Reference

Kelley Holland (2007) “The Workplace: Revising the strategy of mission statements” International Herald Tribune, Web.

Mehring, Jaime (1998), Kelloggs: Initiating Coverage with a 1-H Rating, Salomon Smith Barney Research Report. December 1.

Kellogg Affirms 2008 Guidance, Reports 2007 EPS Growth of 10 Percent, 8:00 am ET. Web.

General Mills (GIS). Web.

Brown, Gerald, J.B. Keegan, and K. Wood Vigus, (2001) “The Kellogg Company Optimizes Production, Inventory, and Distribution,” Interfaces, pp. 1-15.

Carson, Gerald, (1976) Cornflake Crusade, Salem, N. H.: Ayer, 1976, 305 pp.

“Energy, Diet Bars Show High Growth,”(2002) National Petroleum News, 2002, p. 20.

Gould, William (1997), Kellogg’s: The Greatest Name in Cereals (VGM’s Business Portraits), Lincolnwood, Ill: VGM Career Horizons, 1997, 48 pp.

The History of Kellogg Company,(1986) Battle Creek, Mich.: Kellogg Company.

“Kellogg Company”(2001) Frozen Food Age, 2001, p. 1.

“Kellogg Company,” (2001) Hoover’s Handbook of American Business 2002, 2001, pp. 816-17.

Kellogg Company Q4 2007 Earnings Call Transcript (2008). Web.

Kellogg Company (2007), ANNUAL REPORT FOR FISCAL YEAR ENDED DECEMBER 29, 2007 UNITED STATES SECURITIES AND EXCHANGE COMMISSION.

Kellogg Company (NYSE:K), (8 August 2007) Reuters ProVestor Plus Company Report.