Introduction

The selected company is Damac Properties, which is one of the leading luxury construction companies in the UAE. The company’s main business is located in Dubai, UAE. However, it also operates and carries out construction projects in other parts of the UAE. The company was set up in 2002 by Damac Group, which is owned and chaired by Mr. Hussain Sajwani. The company’s stocks are listed on the Dubai Stock Exchange. It is also the first UAE-based construction company that launched a successful IPO on the London Stock Exchange and raised almost £379 million. The company’s main strategy has been to provide unique and luxurious designs. The company charges a high price for its properties and in return offers excellent quality and services to its customers. The key performance highlights of the company are as follows.

- The company has undertaken construction of more than 40,000 units since its inception.

- The company was also awarded the Hospitality Excellence Awards 2017 (Appendix A).

- It was also awarded at the 11th Annual World Luxury Awards (Appendix A).

- The company is listed among the top 100 real estate companies in 2017.

- The company has a strong brand reputation, and its projects are highly popular among investors.

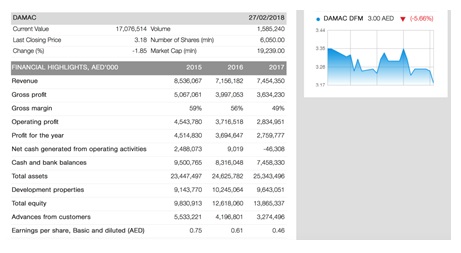

- The company also has a strong liquidity position as indicated in Appendix B, which implies that the company is less likely to have financial problems in the coming periods.

- It is considered to be the market leader in the Dubai region and has several ongoing projects in the country.

- Customer loyalty is high because of the high quality of construction provided by the company.

- In recent years, the UAE property market has experienced a slowdown despite the announcement of the 2020 UAE Expo, which has also affected the company’s business.

- The default on payments by customers has caused a decline in the prices of properties by the company, which is causing problems for sellers.

Strategic Posture

The company’s current strategic posture is determined by presenting and evaluating its mission statement, objectives, and strategies.

Mission Statement

The company’s mission statement is “DAMAC Properties, as a leading luxury real estate developer, strives to provide dream homes and unique living concepts to customers from all over the world.”

Strategic Positioning

The company’s strategic positioning is “DAMAC Properties prides itself on its uncompromising commitment to service excellence, whether we are helping a young couple choose the perfect family home or advising investors on properties offering the best investment returns.”

Objectives

The company’s objectives include:

- To be the leader in the real estate market of Dubai and UAE.

- To design and develop the architecture that is unparalleled and highly appreciated by property buyers.

- To ensure that the quality of constructions remains uncompromised.

- To match all global standards for commercial construction.

- To adopt new and innovative methods and techniques in its processes to reduce the environmental impact of its business activities and its constructed properties.

- To make an entry into other markets that could help it diversify its revenue sources and also reduce risks associated with operating in a single market.

Strategies

The company’s management report indicates that it has not been possible to achieve all of its underlying objectives completely. The company’s management took several initiatives to improve its position in the market. The analysis indicates that the company has adopted the differentiation strategy based on its designs and quality of construction rather than focusing on pricing strategy or cost differentiation strategy. The differentiation strategy is a strategy that allows the company to create demand for its properties by customers who are willing to pay a high price for them. In return, they expect high-quality construction without any problems and an increase in the property value. It could be stated that the company’s strategy is suitable for the growing demand for high-end, luxurious property designs, and high-quality finishing. The company works with the best designers and architects to provide unique property designs.

The company has also contracted with suppliers who ensure that the quality of supplies remains uncompromised. Furthermore, the company invests heavily in the training of its employees including engineers, contractors, and laborers, etc. to ensure that they all contribute positively to the company’s success and its projects. It has helped the company to differentiate from its competitors and provide excellent services to its customers, which has strengthened the company’s brand recognition and reputation. The company is successful in creating a positive response for every project that it launches and investors from the UAE and other countries invest in its properties willingly to attain capital gains. Furthermore, the company’s strategy is focused on retaining the human capital that could play an important role in the success of the company.

Strategic Directors

The company’s board of directors includes seven directors. There are four non-executive directors and one independent director. It shows that the company’s corporate governance practices are according to the ethical standards accepted globally. The role of non-executive directors in different committees ensure that the decisions made by the company’s board are suitable for its business and does not affect the company’s investors’ interest in its equity. The profiles of key individuals on the company’s board are provided in the following.

Mr. Hussain Sajwani

Mr. Hussain Sajwani is the Chairman of the company’s board of directors. He started his business in 1982 and currently owns Damac Group, UAE. Mr. Sajwani is the main leadership of the company as he manages all key decisions of the company. It is clear that Mr. Sajwani heads the group, and he is responsible for the company’s strategic positioning and its outcomes.

Mr. Adil Taqi

Mr. Adil Taqi is the Chief Finance Officer (CFO) of the group. Mr. Taqi has been with the company after completing his MBA in 2004. He has a diverse experience of working in different markets including the UAE and the United Kingdom. Mr. Taqi is responsible for the company’s financial reporting and managing investors’ relations. He ensures that the company’s finances are well managed and its financial position remains strong.

Mr. Ziad El Chaar

Mr. Ziad El Chaar is the company’s Managing Director and Executive Member of the board of directors. He manages the company’s operations and ensures that its business activities are in line with its objectives set out in the previous section of the report.

Professor John Wright

Professor John Wright is the independent director, who plays a key advisory role in the company. Mr. Wright is responsible for ensuring that the company follows corporate governance practices and all decisions taken by the board are ethical.

SWOT Analysis

Internal Factor Analysis

The internal factor analysis is carried out by examining the company’s strengths and weaknesses.

Strengths

- The company enjoys a strong brand image in the market.

- The company has a strong business position with its revenue of AED 7 billion and total assets of AED 24 billion in 2016.

- The company has a strong cash position of AED 8 billion in 2016.

- The company’s strong market and business relationships assist it in creating a continuous demand for its projects.

- The company’s design and development team are also the strength that allows it to offer luxury properties to buyers worldwide.

Weaknesses

- The hierarchy in the company is very small, which means that there is a high concentration of power at the top-level management.

- There is too much dependency on the Chairman, which means that individuals working in the company do not have much independence to make decisions.

- The systematic way of business restricts the ability of the company to experiment with its methods and processes.

External Factor Analysis

Opportunities

- The UAE real estate market including Dubai offers great opportunities for new commercial and residential properties.

- The investors from emerging markets are seeking investment opportunities in the UAE, which creates demand for both new and old properties.

- The increase in the disposable income of customers and investors is pushing construction companies to offer high-quality properties.

- The global real estate market including China, India, and Russia offers excellent opportunities for companies like Damac Properties to develop property projects.

- There are opportunities related to the development of energy-efficient designs and environmentally friendly properties that have low carbon impact.

Threats

- There are new market entrants including local and international companies that could threaten the company’s business in the UAE.

- The global economic recession could affect the property industry, which would hurt the company’s financial position.

- The delays in the company’s undergoing projects could affect its brand reputation and position in the market.

- The changes in government regulations and legal requirements could affect the construction industry.

- The weakening trade position of the UAE could also be a threat to the company’s construction business.

Porter’s Five Forces Model

The company’s business environment is evaluated by using Porter’s Five Forces Model, which analyzes different market forces affecting its business.

The threat of New Entrants

The threat of new entrants is medium in the real estate industry. Many domestic and international companies offer their services in the real estate development market. As Damac Properties seeks entry into new markets, the threat of new entrants could amplify. However, entry into this real industry requires a significant investment, which makes it challenging for new companies to compete with the existing companies. Therefore, it could be stated that the threat of new entrants is not high.

Threat of Substitutes

The threat of substitutes is low in the real estate industry because there is no or limited substitute for residential and commercial properties. It could be indicated that with the increase in population, the demand for constructed properties is also increasing. The customers are seeking investment opportunities in the global real estate market that supports the growth of real estate businesses.

Bargaining Power of Suppliers

The construction business depends heavily on suppliers of different materials. It could be indicated that there is a large number of suppliers who are operating globally and offer high-quality products and services. The real estate companies including Damac Properties depend on their relationships with suppliers to ensure that they can complete their projects on time and also maintain the level of quality that they promise to their customers. However, there are many choices available to real estate companies to acquire the necessary supplies. Therefore, it could be stated that the threat of suppliers is medium in the real estate industry.

Bargaining Power of Buyers

The bargaining power of buyers has increased in recent years. It is due to the rapid growth of the construction industry and now customers have multiple options to buy properties. In the UAE, the supply of the real estate industry exceeded the demand for properties in the last few years, which caused property prices to decline. It gives opportunities for customers to negotiate a favorable price for the properties they want to purchase. Moreover, banks are also cooperative to customers to finance their properties, which makes it easier for them to choose and purchase properties they like. Therefore, the bargaining power of buyers is high in the industry.

Competitive Rivalry

The competitive forces in the real estate industry are high. The companies are not only competing with each other based on prices and locations but also quality. The customers seek companies that offer a high quality finished properties at competitive prices. The situation is also affecting the profit margin of companies in this industry.

Recommended Strategies

S-O Strategy

- The company should undertake constructions in new, emerging markets such as China and India.

- The company should utilize its strong cash position to develop projects that could attract customers seeking luxury properties.

- The company should focus on the niche market, which could help to generate a profit margin.

S-T Strategy

- The company should enter into an arrangement with a financial institution to provide easy finance options to customers at a low mark-up in the UAE market. It would help buyers to purchase luxury properties easily.

- The company should prioritize customer loyalty by offering value-added services and components in properties.

W-T Strategies

- The company should diversify its assets portfolio by including a wide range of residential and commercial properties such as hotels, short-stay apartments, and offices.

- The company should reduce its investment inland.

- The company should introduce new hierarchies in its organizational structure and delegate responsibilities to individuals who can contribute positively to increase its sales and profit.

- The company should focus on developing the ecosystem based on effective processes and management.

Implementation

The proposed strategies are aimed at achieving the company’s objectives indicated in this report. The company’s venture into new markets would help it to generate operating cash flow that could be used to improve its position in the UAE real estate market. In this regard, it could be stated that the company needs to invest in real estate development by targeting markets that have high growth potential. Furthermore, it could be stated that the company needs to follow the following implementation guidelines.

- The company should invest to hire and train new employees who can work according to the best working and ethical standards.

- The company should invest in the development of new and innovative methods and techniques in its processes to reduce the environmental impact of its business activities and finished properties.

- The company should invest to make an entry into other markets that could help it diversify its revenue stream and also reduce risks associated with operating in a single market.

- The company should invest in developing its social media strategy. It would help the company to communicate with its customers and address their concerns and queries. The company can also improve its brand image by providing regular information and updates regarding its current and upcoming projects and promotional offers.

Implementation Budget

The proposed strategies would require a significant investment in the company. However, it is not possible to determine this amount. Therefore, it is suggested that the company could invest 30% of its cash for implementing the proposed strategies, which would achieve its goals and objectives.

Processes and Procedures

The implementation of the prosed strategies must follow a three-stage process. The assessment stage is the first phase in which all these strategies would be assessed for their relevance to the corporate objectives. In this stage, the management of Damac Properties can align its resources for the effective implementation of these proposed strategies. The next stage is the framework development phase in which the company can carry out these strategies in different key areas of business. The next stage is the continuous improvement phase in which the company can evaluate the outcome of its strategies and make changes to improve them. Damac Properties can achieve its goals and objectives by following these steps.

Control and Evaluation

Like any other business, Damac Properties need to perform control and evaluation of its strategies at all levels of the organization. It implies that the company’s strategies should be evaluated by respective committees and groups at the directors’ level, management level, and operational level to ensure that the company’s activities and processes are performing in harmony to achieve its corporate objectives. It is further explained that the company’s strategies at the operational level ensure that the projects completed the match with the quality standards that it has adopted. It would help the company to achieve its corporate objectives of increasing sales and generate a high-profit margin every year. The company’s management must realize that there are high costs associated with control and evaluation processes. However, the management must accept these costs and integrate controls in all business functions. The following Key Performance Indicators (KPIs) are suggested as the criteria for assessing the success of the proposed strategies.

Customer Satisfaction Index

The Customer Satisfaction Index (CSI) is a measure of customer satisfaction achieved by the company. It is an important outcome of the proposed strategy as it affects the company’s sales, brand image, and profitability. The CSI is calculated as the number of satisfied customers divided by the total number of customers.

Employee Satisfaction Index

The Employee Satisfaction Index (ESI) is a measure of the satisfaction of employees working in the company. It is a crucial outcome of the proposed strategy as it affects the company’s ability to complete its undergoing projects according to the expectations of its customers. The ESI is calculated as the number of satisfied employees divided by the total number of employees.

Appendix A – Business Overview

Appendix B – Financial Overview