Background Overview

The financial research report highlights a potential investment opportunity for a client interested in any publicly traded company in the US. The chosen firm for a possible investment following analysis is Alphabet Inc. Alphabet Inc., the parent company of the former Google and other supposed ‘moonshot’ ventures, which are now independent entities, trades with the ticker, GOOGL at NASDAQ. Alphabet Inc. is now the second most valuable company on the Earth, and it continues to grow without significant challenges.

The parent company established in 2015 has a huge portfolio across various industries, such as technology, investment capital, life insurance, and research. These companies include Google Fiber, Google, Calico, Verily, and others. Alphabet Inc. has demonstrated tremendous growth. That said, this growth alone is not sufficient for investment because no firm is perfect and all investments tend to have inherent risks and, therefore, a thorough financial analysis is necessary to determine potential strengths and downside to making an informed investment decision.

A Rationale for Choosing the Company for Which to Invest

Alphabet Inc. was chosen for a potential investment because it demonstrated a sustained long-term growth trend. Moreover, areas of interest that Alphabet Inc. concentrates on reflect massive opportunities for future growth. The current market value of the company is about $552 billion. Additionally, the company is ever-growing and has not reached its peak. In the recent past, Alphabet Inc. launched other products, including the Google Home (a virtual personal assist) and a wide range of smartphones. The company’s other businesses and moonshots are thriving, but not profitable. It is projected that Alphabet Inc. is most likely to realize a profit of growth of 20% in the fiscal year 2017. Based on the estimated earnings, Alphabet Inc. stock is not expensive.

Economic Significant

Google is a well-recognized search engine globally. Additionally, the company is also known for its Internet advertising prowess. The company generates most of its earnings from the displayed ads shown following a search result across different Web sites, including affiliates. The advertisement tools from Google drive other businesses too. In the year 2015, the company presented conservative estimates of Alphabet Inc.’s economic impact on firms across the US by focusing on AdSense, AdWords, and Ad Grants (Google, 2015).

Across the US, businesses, Web site publishers, and other not-for-profit organizations relying on the company search and advertising tools generated about $165 billion in the year 2015 (Google, 2015). Additionally, the company estimated that 1.4 million firms and not-for-profit entities benefitted from its advertising tools, AdSense, and AdWords in the year 2015 in the US. The Internet supported about 97% of users who were interested in locally available products and services (Google, 2015). Web-savvy small businesses and users created more jobs and generated much more revenues using export channels. Google also observed that firms in the traditional industries realized 75% of the economic value generated through the Internet, while a significant margin of part-time business owners heavily depended on the Internet to conduct their businesses (Google, 2015).

Alphabet Inc. was created to streamline operations and determine how other ‘bets’ of the company are performing. Notably, they are not profitable just yet. Hence, about 90% of the company’s revenue emanates from Google, which is mainly advertisement revenue. Although the company has been touted for innovation, research and development, self-driving cars, artificial intelligence, virtual reality, smartphones, and fiber optic cable networks among others, these ventures are not financially significant relative to Google – the advertisement company. Search advertising has been responsible for driving the company’s revenues and stock since the IPO.

For the last few fiscal years, the number of paid clicks (revenues from advertisers who pay Google when an ad on search results is clicked) has increased steadily. For instance, in 2014, it increased by 29% and 33% in the year 2015. YouTube is also equally responsible for this growth based on increasing mobile traffic and global expansion.

Notably, Google’s revenue from Cost-per-click (CPC) has however declined because advertisers now prefer relatively cheaper YouTube and mobile targeted advertisements. Nonetheless, the decline was only 15% in 2015 and 7% in 2014. This implies that Google will still realize significant growth because of rising paid clicks.

Based on the over-reliance on the ad revenue, Alphabet Inc. now strives to diversify its revenue sources. As such, Alphabet Inc. has focused on getting the best talents to drive its momentum in both strategy execution and business operations. Alphabet Inc. has hired some high-level talents in the recent past, including CFO Ruth Porat pouched from Morgan Stanley, YouTube global head of music, Lyor Cohen, and Google cloud business leader, Diane Greene who founded VMWare. The CFO has instilled discipline spending in Alphabet Inc. by focusing on return on investments, an approach that the company previously lacked (Fathi, Zarei, & Esfahani, 2012). Since Porat was recruited, the company’s share has increased from about $550 to above $800 in less than a year – reflecting about $74 billion in market capitalization gain (Atrill & Hurley, 2012). This outcome reflects the role of management in driving the financial success of the company.

Alphabet Inc. introduced other products to grow its other businesses not related to advertisement and search. The company introduced its smartphone, Pixel installed with Google Assistant to drive revenues. Pixel is meant to compete with iPhone from Apple Inc. The company also launched a virtual reality headset and Google Home to compete with Amazon.com.

Once Alphabet Inc. subsidiaries start generating sufficient profits, the company will have a significant economic impact beyond the current rates.

Financial Significant

For investors, Alphabet Inc. stock is now above $830 and a low of $672 within the last fiscal year. The company generated $90.27 billion in revenue in the fiscal year 2016 with the projected earnings growth of 20% in 2017.

Alphabet Inc. has realized increased profits when all costs, including costs of expenses and capital, are considered. That is, the economic value added (EVA) of Alphabet continues to rise. Additionally, net operating profit after taxes, cash operating taxes, economic spread, and economic profit margin have also increased between the fiscal years 2014 and 2016. Overall, Alphabet Inc. demonstrates healthy fiscal performance with significant impacts on the economy.

Other Factors of Consideration for the Selected Stock

Alphabet Inc. flagship products and services are the market leaders. Google search controls over 90% and over 93% of both the desktop and mobile search market shares globally. ‘Google’ has occupied the mind of users.

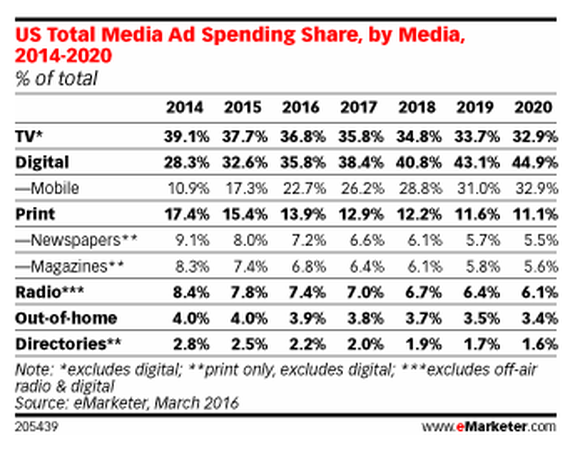

The company also controls the other six important products, boasting more than one billion users. These include YouTube, Chrome, Android, Gmail, and Google Maps others. With these applications, Google collects huge volumes of data and is most likely to thrive in the ‘oil of the information age’. Big data business continues to grow, and Alphabet Inc. will leverage this advantage to generate billions from the advertisement. Today, advertisement is more targeted with readily measurable results, thanks to Google tools. Additionally, digital ads are projected to grow (see figure below), and the company leads in Internet advertising.

Following the restructuring, Alphabet Inc. is focused on return on investments from its traditional sources of revenue while taking multiple moonshot bets on new technologies, such as self-driving cars, artificial intelligence, connected home, high-speed Internet connects, and big data to generate more revenues. It would, therefore, have reliable streams of revenues to make meaningful differences for investors.

Alphabet Inc. is under the management of its co-founders, Page, and Brin, who are board members alongside other senior executives. They control over 60% of the firm’s voting power. The management has instilled a culture that promotes innovation and employee motivation to realize strategic goals. Finally, Alphabet Inc. has over $88 billion in terms of cash, short-term, and long-term investment to finance its investment goals (Stoffel, 2017).

The Primary Reasons Why the Selected Stock is a Suitable Investment for the Client

Three primary reasons why the investor should consider Alphabet Inc. stock are presented. First, while Alphabet Inc. heavily relies on advertisement revenues, the company has other revenue sources. In Q3 2016, the company generated about $2.4 billion from other sources – representing 39% in a year-over-year comparison. This revenue stream continues to grow, and it sourced from Google Cloud, Google Play, and other bets. The company classifies apps and media content revenues as other revenues, and they do not constitute advertisement revenues from Google Play. As the global mobile app market continues to thrive, Alphabet Inc. is expected to generate more revenues from this market. Moreover, the company will now compete aggressively with Amazon.com Inc. for the cloud market.

Second, Alphabet Inc. also has the so-called other bets. These are other companies, such as X, Verily, and Access among others and they demonstrate the company’s innovative strategies. Nonetheless, they do not generate profits at all. In the last fiscal year, for instance, Alphabet Inc. lost about $3.8 billion in these companies. However, other bets have started to generate revenues. They generated $595 million in three quarters of the fiscal year 2016, reflecting 85% year-over-year growth. Other bets have focused on innovation, but the company now wants them to be profitable. While investors may not understand the relevance of investment in other bets without any meaningful returns, Alphabet Inc. requires them to diversify revenue streams because the legacy source may be challenged in the next decade.

Finally, Alphabet Inc.’s management team is crucial. Specifically, CFO Ruth Porat has instilled financial discipline in the company and reorganized multiple companies under Alphabet Inc. Since Porat joined the company, its stock has risen 45% (26 percent on an annualized basis). The CFO has focused on expense reduction to create free cash flow for investment, which is about $23.5 billion today relative to $11.4 billion in 2014. This free cash flow is good for Alphabet Inc. considering its capital spending that is almost $10 billion yearly. While innovation may suffer, the CFO recognizes that restructuring is necessary to create a stronger foundation for future growth. Thus, Porat has created better positive cash flow for operations.

A Description of the Client’s Profile

The investor prefers a buy-and-hold approach for high yields. Thus, the most important factor is to leverage the long-term potential of Alphabet Inc. profitability through a buy-and-hold approach. The company’s stock price is poised for further improvement. The investor has a long-term investment focus and is growth-oriented.

The stock is considered for an affluent investor whose main objective is to create wealth. Immediate income generation is not the primary objective of choosing the stock. Thus, it will be necessary for the long-term growth-oriented investor to hold off on the stock until Alphabet Inc. starts to generate more revenues from other moonshot bets.

Additionally, the investor is patient. They must understand and support the company’s moonshot bet strategies in driving innovation and reshaping future investments. The investor should believe in a long, growing future of Alphabet Inc. and the current restructuring efforts.

The investor is regarded as a long-term value-oriented one and, thus, they should find Alphabet Inc. stock more attractive compared to other technology firms, such as Apple Inc. that are seen as at their peak. Hence, the investor should purchase, earn dividend yields, and hold for a long time as the share price of Alphabet Inc. rises. The company currently has better-operating margins and free cash flow and, hence, it presents low investment risks, which may not pose any critical investment challenges to the investor. This stock is, therefore, an important bet for such an investor.

Analysis of Financial Ratios

The current ratio is necessary for gauging the company’s ability to repay its short-term debts through its short-term assets (Drake & Fabozzi, 2012; Warren, 2014). The current ratio for the last five fiscal years is as follows.

Source: (GuruFocus.com LLC, 2017)

The ratio has been increasing steadily, depicting that Alphabet Inc. is efficient in its operations and, therefore, no major challenges are expected. This ratio is high by any standard and, therefore, it implies that Alphabet Inc. is not likely to face bankruptcy.

The quick ratio depicts whether the company will be able to meet its short-term obligations using its liquid assets rather than inventories.

Source: (GuruFocus.com LLC, 2017)

For the last five financial years, Alphabet Inc. has recorded an increasing quick ratio, which depicts that the firm is highly leveraged, and it does not grow sales. Therefore, the increasing trend is good, and the company may not struggle to meet its financial obligations.

Earnings per share ratio show the value of earnings per outstanding share of Alphabet Inc. stock. The dividend required has been deducted to isolate some forms of manipulation using non-recurring items, depreciation, or amortization rate. This approach reflects the good performance of the firm.

Source: (GuruFocus.com LLC, 2017)

The earnings per share is an imperative tool for demonstrating the current share price performance, and it is vital for investors who want to assess the overall profitability of the firm. Alphabet Inc. is profitable.

The current price-earnings ratio of 28.44 shows that Alphabet Inc. is making profits, and it has positive earnings and posts profits, which are increasing year-over-year, but with fluctuation.

Source: (GuruFocus.com LLC, 2017)

Gross margin demonstrates that the company is now profitable, and generating enough revenues to meet all costs related to production.

Source: (GuruFocus.com LLC, 2017)

Alphabet Inc. has one of the highest ratios, which demonstrates that the company has created a sustainable competitive advantage. The consistent upward trend of gross margin shows how the company is competing for the last five fiscal years.

Stock Analysis and Risks

Alphabet Inc. investors are most likely to wait for a long period for the next big thing (Abramov, Radygin, & Chernova, 2015). As previously observed, the so-called moonshot bets have continued on their loss-making trend for many years, leading to a steady decline on average return on the invested capital. These bets are yet to yield the next big thing. Self-driving and YouTube subscription attempts are seen as of late strategies because of competitors, such as Uber, Netflix, and Amazon.com among others.

Alphabet Inc. also relies on Google. Google ad revenue is the major source of revenue and a 100% source of profit for Alphabet Inc. Over-reliance on Google for revenues and profits and loss-making moonshot bets could affect the future stock price of the company (Bhandari & Iyer, 2013).

Key Strategies to Use to Minimize These Perceived Risks

The investor is advised to buy and hold for a longer period (Abramov et al., 2015). Nonetheless, inherent risks persist. As such, the investor should also consider other investment options, such as Amazon.com, which compete with Alphabet Inc. in other areas. This strategy would ensure that the portfolio is balanced to mitigate such risks. Additionally, other long-term value-based stocks offered by other companies across various industries could be an alternative for the investor. Thus, low-risk investment options could offer opportunities to mitigate adverse outcomes from Alphabet Inc. Further, the investor should observe the performance of Google (the main source of revenue and profits) and any other next big thing and act appropriately when they do not yield better returns (Kumar, Dixit, & Francis, 2015; Mollik & Bepari, 2015).

Recommendations of this Stock as an Investment Opportunity

The stock is recommended for the investor based on a buy-and-hold approach for a longer period. This recommendation is based on the following observation. First, growth is imminent. The advertisement revenues will continue to grow year-over-year and support a further increase in profit. With the success in revenue and profit, Alphabet Inc. will advance other bets with no financial stress. Second, management is focused on returns on investment. Third, the company’s stock is not overvalued. The current share price is about 20 times the company’s forward earnings, almost the same as other typical stocks in NASDAQ. It shows a fair price for a high growth firm. Finally, Alphabet Inc. is on an innovation path. Other bets are most likely to deliver the next big thing for the company. Initiatives, such as self-driving cars, smart contact lens, high-speed Google Fiber, big data, and artificial intelligence among others, reflect a huge potential from the company.

References

Abramov, A., Radygin, A., & Chernova, M. (2015). Long-term Portfolio Investments: New Insight into Return and Risk. Russian Journal of Economics, 1(3), 273–293. Web.

Atrill, P., & Hurley, P. (2012). Financial Management for Decision Makers, Second Canadian Edition. Canada: Pearson Canada Inc.

Bhandari, S. B., & Iyer, R. (2013). Predicting business failure using cash flow statement based measures. Managerial Finance, 39(7), 667-676.

Drake, P., & Fabozzi, J. (2012). Analysis of Financial Statements (3rd ed.). New York: John Wiley & Sons.

Fathi, S., Zarei, F., & Esfahani, S. S. (2012). Studying the Role of Financial Risk Management on Return on Equity. International Journal of Business and Management, 7(9), 215-221. Web.

Google. (2015). Google’s economic impact. Web.

GuruFocus.com LLC. (2017). Alphabet Inc. Web.

Kumar, M. V., Dixit, J., & Francis, B. (2015). The Impact of Prior Stock Market Reactions on Risk Taking in Acquisitions. Strategic Management Journal, 36(13), 2111–2121. Web.

Mollik, A. T., & Bepari, M. K. (2015). Risk-Return Trade-off in Emerging Markets: Evidence from Dhaka Stock Exchange Bangladesh. Australasian Accounting , Business and Finance Journal, 9(1), 71-88.

Stoffel, B. (2017). 10 Reasons to buy Alphabet Inc stock and never sell. Web.

Warren, C. S. (2014). Survey of Accounting (7th ed.). Stamford, CT: South-Western College Publishers.