Evaluating TEC’s financial position

Knowing financial position requires that fundamental financial analysis be carried out. Ratio analysis provides the best form of quantitative analysis since it gives reliable proportions of the firm’s financial performances. Ratios that are used to indicate the firm’s financial performance are the profitability and liquidity. Profitability ratios indicate how the firm is using its limited resources to generate returns. Higher profitability ratios show that the firm is effective and efficient in turning its resources into gains.

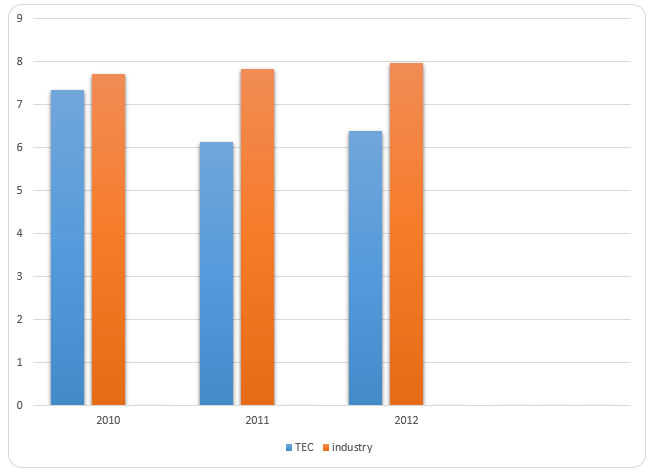

TEC shows some instability in its financial position in terms of profitability. Over the last three years, TEC has shown a slowing growth in its returns as indicated in the profitability ratios. The decreasing trends in the profitability ratios indicate that the firm cost of operations have increased since sales have remained constant throughout. For instance, the most imperative productivity ratios are lower in relation to the industry.

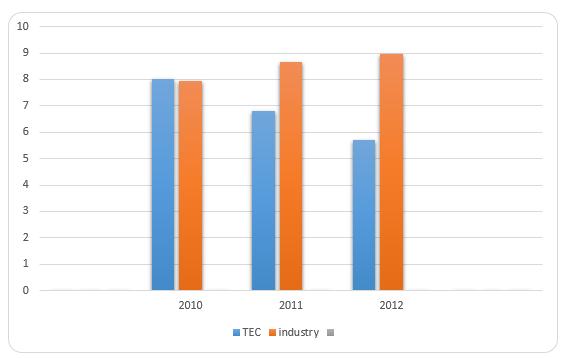

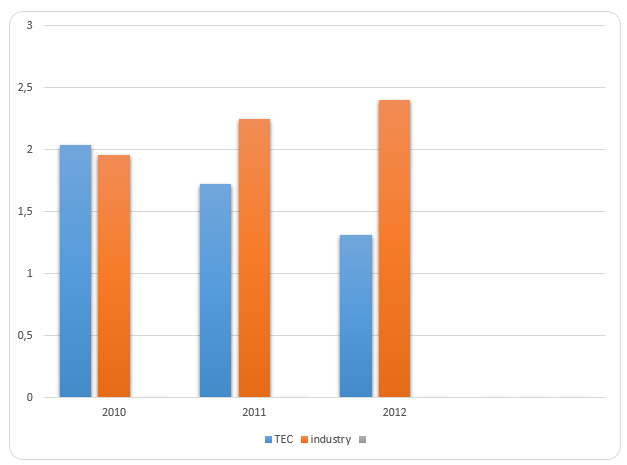

The TEC company has experience a steady decrease on the return on its assets over the past three financial years. The results signify that the TEC company has reduced financial stability and low expansion opportunities as well as low profits for its shareholders. Conversely, the industry has registered increasing trends over the past three financial years. The indication is that the firms has limited future prospects. As a result the financial instability, the firm is unable to cope with expansion prospects and competition within the industry.

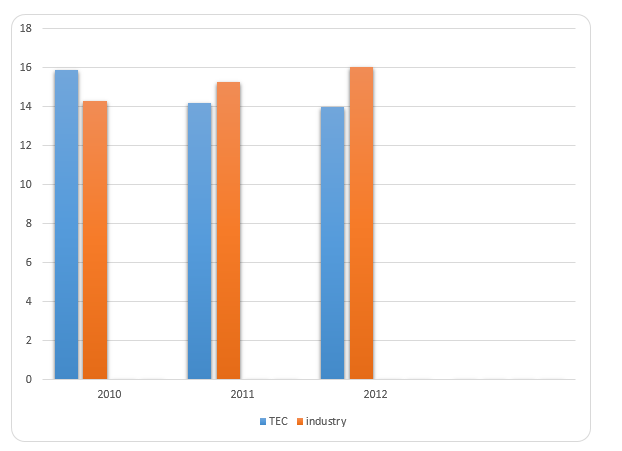

Return on equity shows the amount of revenue that a company generates from the shareholders’ capital. TEC shows high returns on equity than the industry in the 2010 financial year followed by a tremendous decrease over the subsequent financial years. The trend exacerbate the financial instability as the firm cannot generate enough revenue to compensate for the employed share capital. Declining trend on the returns in equity is risky for the firm.

Further, the firm returns on equity is even performing below the industry average. The meaning is that investors will be looking for competing companies with greater financial position. From the trend analysis, It is evident that investors are unlikely to receive high returns on their investments.

Generally, profitability ratios are very vital in giving an insight in the overall efficiency of the organization due to the returns achieved on sales as well as investment. From the analysis, the firm is not financially stable and therefore risky for investments.

The strength in financial position is also not depicted in the liquidity ratios. In fact, the acid-test ratio that measures the financial stability shows a decreasing trend in the last three financial years. The current ratio indicate that the firm is not capable of meeting its short-term needs in the 2012 financial year when compared to the previous years.

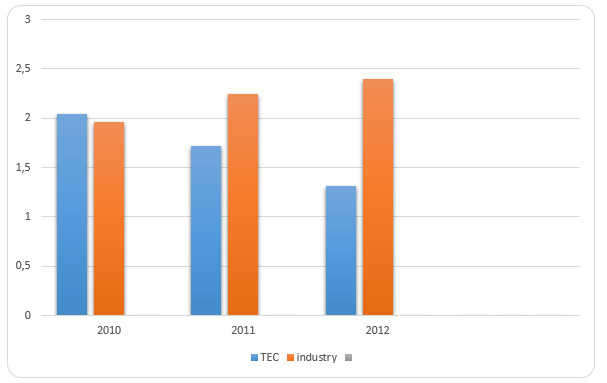

The ratio can also be used to calculate the firm’s financial conditions. The ratio is significant in identifying the amounts of liability and capital that a firm uses to finance its assets. The trend indicates that TEC’s debt to asset ratio is increasing while that of the industry shows a decreasing trend. In other words, the TEC company has been utilizing its liabilities in achieving its expansion. Consequently, the firm’s revenue have been unpredictable due to the extra charges incurred as interest. The pattern is disturbing since the firm’s expenses on liabilities might overshadow the revenue received on the ventures. Further, TEC company exhibits high risks of insolvency due to high costs of debts as compared to the industry.

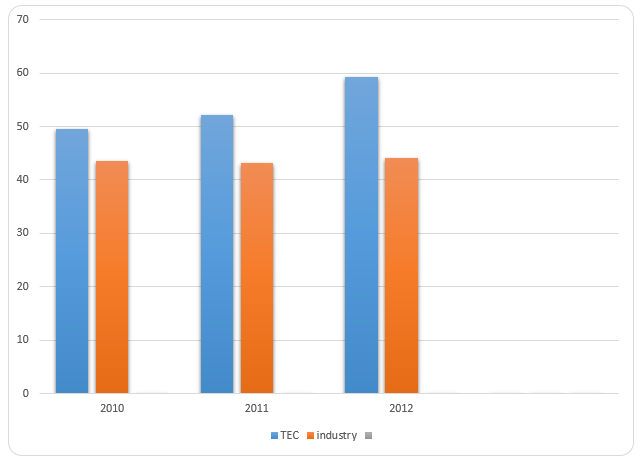

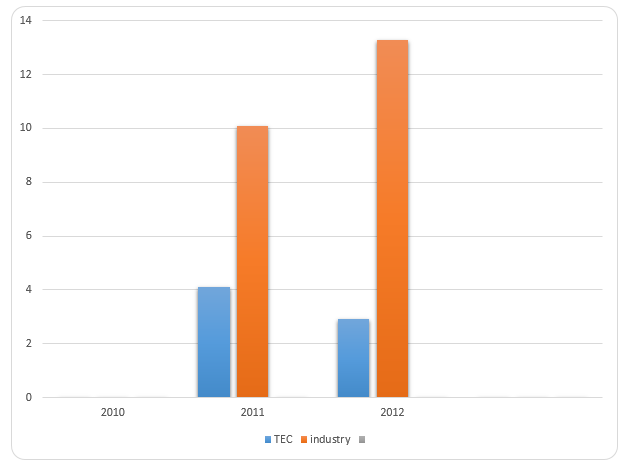

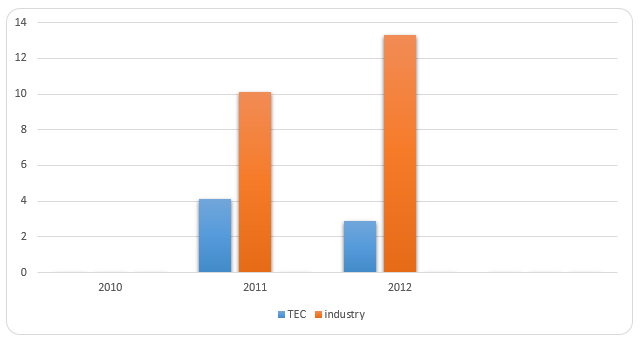

The other important valuation ratio that is important in evaluating the financial position is the earnings per share. The firm has shown a declining trend in earnings per share over the last two years. The decreasing trend in TEC’s EPS shows weak financial strengths for the growth of the firm. Conversely, the trend in the industry indicate reliable venture opportunities and strong financial grounds in other firms. The firm therefore, faces competition from other firms in the industry with reliable investment opportunities.

More financial ratio information needed to put forward an assessment

Though most of the ratios have been covered in the assessment of the financial stability, more information is still needed to confirm the financial stability of the firm. The ratios that can provide this information include the solvency ratios. The firm’s aptitude of meeting its outstanding loans for over a year is measured by the solvency ratio. Most of the ratios used in the analysis include long-term debt in relation to total assets, long-term debt weighed against shareholders equity as well as the interest coverage ratio.

The long-term debt to asset ratio will indicates the proportion of TEC’s assets that are being financed by long-term loans as well as other long-term financial obligations. In addition, the quantitative analysis will also present the broad-spectrum measures of TEC’s financial position together with its capability of ensuring that its monetary requirements for credits are met. The decreasing trends in the ratio show that the firm is becoming progressively less independent of its debt in order to grow its business.

The long-term debt to shareholders-equity is another important ratio that could have been used by the firm to assess its financial position in relation to the shareholders equity. The ratio measures the fraction of the shareholders equity that is being funded by the company long-term obligations. Only the long-term debts with interest attached are applicable in this ratio analysis. Increased long-term debt to equity ratio means that much of the company operations are financed by long-term loans and other financial obligations.

Major reasons to challenge CEO’s statement

The CEO’s statement generally concentrates only on the achievements of the company based on the results as indicated on the income statement and the balance sheet. Further scrutiny need to be done to ascertain the company financial performances in relation to the industry as well as the state of the country economy. The income statement indicate that the company profitability grew by 30%. However, further financial analysis as indicated in the ratios show a considerable declining trends in the general performance of the company. The most noticeable is the company-declining trend in its financial position as indicated by the profitability, and liquidity ratios.

The reasons for the declining trend in these ratios are that the firm has continued to incur increasing debts over the years making it face uncertainties especially on its liquidity. Further, the firm’s revenues on most of its new ventures have been declining. Moreover, the company is unable to invest because most of its assets are in the hands of creditors. All these factors contribute to the declining trends on the firms ratios in the last three financial years.

In relation to the industry, the firm has not been doing well in the last three years. Most of the ratios are below the industry average meaning that other firms in the industry are doing better. Therefore, the company is not competitive enough. The evidence is supported by lack of growth in the company sales in the last two financial years. The return on assets and return on equity that measures the firm’s efficiency and effectiveness in the use of the employed resources in order to generate income are below the industry average are declining. Therefore, the firm should improve on its effectiveness and efficiency in all its operations.

Dramatic shift in the ratios that could justify the comments of VP finance and the financial controller

The declining trend in the ratios is a clear indicator in the poor performance of the company compared to the industry average. Beginning from the profitability ratio, the company has not been efficient and effective in utilization of its limited resources. In fact, the operations cost has increased tremendously in the last three years causing a decline in the profitability since sales remains constant. For the firm to survive, it must come up with effective and growth-focused long-term strategies to increase its revenue generation.

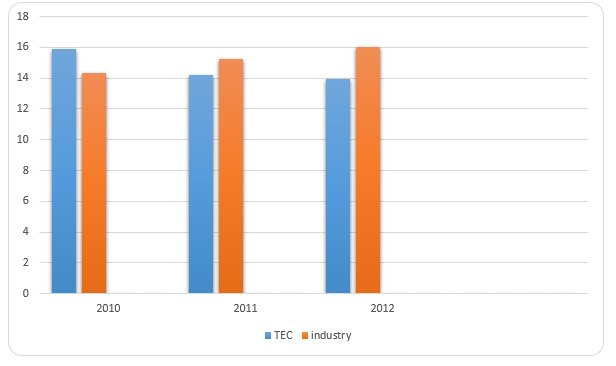

The significant alterations in the measurements are the capability of the firm to settle its daily financial requirements. The capability of meeting the daily financial requirements is declining. All the liquidity ratios show a decreasing trend in the last three financial years. The indication is that the company is incapable of meeting its short-term needs and at the same time have complications in managing its operations.

The Ratio that must be given priority by the investor in evaluating TEC’S financial position

The ratios that are used to evaluate the financial position are the liquidity ratios. In other words, the consistency in meeting the daily financial requirement can be used as a measure for the financial stability. In other words, the ratios indicate the ability of the firm to pay its creditors. Short-term debt obligations are determined by liquidity ratios. The company balances its most liquid-assets to the immediate liabilities.

Generally, greater liquid-asset coverage to current obligations ratio is better for the firm. The greater ratio indicates that the company can easily pay for the due debt within the shortest period and can still meet the ongoing operations. On the contrary, lower coverage ratio shows that the company is incapable of meeting its short-term needs and at the same have complications in managing its operations. Ratios used in measuring the financial stability of the firm include all liquidity ratios.

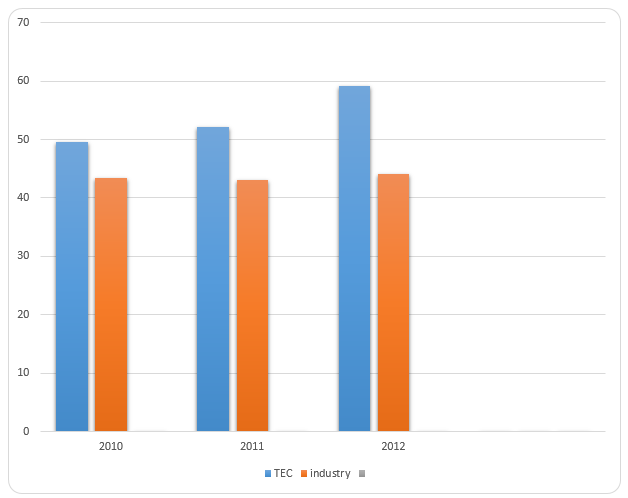

All the liquidity ratios of the company have shown a decreasing trend as shown in (exhibit 3). The indication is not a good sign for the firm since it cannot meet its short-term financial obligations.

Current ratio

As depicted from the pattern, the current ratio of TEC is on the decreasing trend contrary to that of industry in the last three financial years. The results show that the industry’s liquidity ratio decreases , hence investors are likely to be attracted to the firm. On the other hand, the decreasing trend in TEC implies that it is able to cover the short term liabilities due to increase in the firm’s liquidity.

Quick ratio

The ratio also shows that the company cannot pay its short-term liabilities as quickly as possible. The decreasing trend indicate that the company cash balances are declining nd therefore cannot meet most of its current costs. Therefore, the firm should manage its accounts receivable to ensure promt payment of its debts. In relation to the industry, the firm’s performance have declined. Meaning that the firm cannot compete well with others in the industry.

Debts to total assets

The other important ratio is the debt to total assets ratio. The ratio is significant in identifying the amounts of liability and capital the firm uses to finance its assets. The trend indicates that TEC’s debt to asset ratio is increasing while that of the industry shows a decreasing trend. In other words, TEC has been using most of its liabilities to cover the cost of operations. Consequently, the firm’s revenue have been unpredictable due to the extra charges incurred as interest paid. The pattern is disturbing since the firm’s expenses on liabilities might overshadow the revenue received on ventures. Further, TEC company exhibits high risks of insolvency due to high costs of debts as compared to the industry.

Besides liquidity ratios, investors should also give priority to the profitability ratios while evaluating the company’s financial position. Investors venture in a business with a sole aim of realizing maximum returns on investments. The investor should not go ahead with investment of buying 15% of TEC’s stock because over the past three fiscal years, the firm has registered decreasing trends in profit margins. For instance, in the year 2010 the company had a profit margin of 7.35% followed by 6.12% in 2011 and to 6.38% in 2012. In addition, the firm has also experienced deteriorating levels of revenues generated from investments ranging from a high of 8.0 2% in 2010 to a low of 5.70% in 2012. Further, the diminishing development in share proceeds is a signal of compression of investors’ dividends.

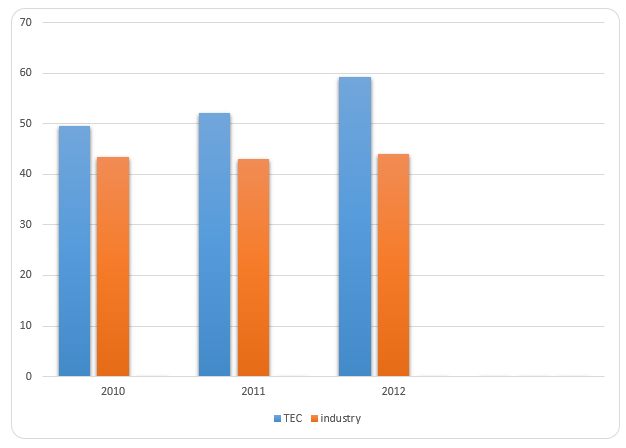

Profit margin

As indicated in (exhibit 3), TEC shows a decreasing trend in its profit margins over the last two years but has picked up in the last financial year. The decrease concurs with that of the industry. As such, TEC has incurred increased expenses in the first two years hence earning less profit. However, in the final year, it is able to control its costs thereby increasing its profits. The industry on the other hand shows increasing trend in profit margin over the last three financial years. The indication is that the firm is not performing in relation to other firms within the industry.

Recommendations

For the firm to improve on its liquidity, it must manage its accounts receivables to reduce the amount of money held by the creditors. In addition, the company should ensure that it negotiate with its debtors for long term payments to reduce amount going out in terms of quick payments. On the other hand, the firm should have long term strategies that would ensure an increase in its profits. One of these ways is reducing overhead costs that squizes the profit margins.

An advice that a potential investor’s analyst would provide on whether to buy or not to buy the 15% stake in TEC

From the analysis, it would not be appropriate to buy the 15% stakes in the company. Ratios that show that the firm is potential for investment including return on assets and return on equity indicate that the firm’s returns are decreasing, a trend that is not appropriate for investments. Also important in the analysis is the earnings per share that also indicate decreasing trend.

Return on equity shows the amount of revenue that a company generates from the shareholders’ capital. Though TEC shows high returns on equity in the 2010 financial year, the returns have declined considerably. The trend in the returns in equity is conversely related to that of the industry. There is a clear is evident that investors are unlikely to receive high returns on their investments. In addition, the returns from the industry are higher compared to TEC. As a result, the firm is unable to withstand competition from other firms in the industry.

The firm has shown a declining trend in earnings per share over the last two years. The decreasing trend in TEC’s EPS shows the presence of unreliable investment prospects as well as weak financial strengths for growth in the firm. Conversely, the trend in the industry indicate reliable venture opportunities and strong financial grounds in other firms. Based on this trend, investors should look for other firms in the industry with reliable investment opportunities.

To any investors, the firm’s productivity analysis, which includes the analysis of the firms return on assets and the return on equity, is very important since the two ratios show the company effectiveness in the use of the employed resources in order to generate income. The ratios are the most vital for the investors since much of the investments are in form of assets, equity, or capital employed in the form of borrowings. Since these two important ratios show a decreasing trend, investors should be wary in buying stakes in the company.