Exchange rates are used to facilitate business transactions between different economies with different legal tenders in terms of money. An exchange rate,“is a measure of how much of one currency may be exchanged for another currency” (Fischer, Taylor and Cheng, 2011 p.551).

The fact that each country has its own economy and the emergence of globalisation, there was need to come up with a way in which business transactions had to be done. As the world grew older and communities had to depend on each other, they exchanged what they had to get what they didn’t have and trade emerged.

This type of trade was known as batter trade. Batter was done by people taking to the market goods they had anticipating to get a person in need of the same commodity as well having the commodity that one wants. Looking at this critically, a serious challenge is posed in the sense that people were not able to get matching commodities. Take an example of one person going to the market and he/she has a goat and needs maize grain while another needs a goat but has wheat grain, technically these people cannot do business.

Due to this problem, Altamore (2012 p.243) indicates that, “money was only invented to facilitate commercial transactions that in ancient times, were mainly made by exchanging products. After the invention of money, it was easier for a person to sell one commodity and buy another.

The problem of lacking a match of what one wanted ended however; there were still problems with measurements. The problem of measurement was adjusted with the demand and supply of the commodity. The price of a certain quantity of a commodity was determined by the amount of the commodity in the market and how many people needed it.

As population increased, trade expanded from the villages to trade between countries. There was emergence of stronger economies and production of different types of commodities. Petroleum became the main fuel in the world and yet it was available in some countries and others didn’t have. Due to this, it was difficult to exchange goods and services because each country printed and minted its own money. The exchange rate concept was conceived and came into use.

Each economy had to control the way money was exchanged with reference to the world’s strongest economy, the United States of America. Cypher and Dietz (2004 p.504) indicates that, “exchange rates can be regulated by the free market and the forces of supply and demand, called floating exchange rate, or determined by a government set value relative to other currencies”.

Floating exchange rate regime is the most common in most countries of the world. However, the central reserve bank sets mechanisms of controlling this rate in the event of speculations and hoarding of the rate determining currency. Exchange rates can be detrimental to the economy of the country especially one that does more imports than exports because it will weaken the local currency if not controlled.

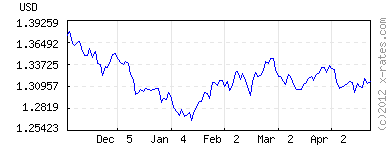

The graph below shows USD to 1EURO.

Again, each sovereign country has a central bank or rather a federal reserve that controls business activities and the flow of money in and out of the market. Currency can be classified to either domestic currency or foreign currency.

Domestic currency is, “Legal tender issued by the monetary authority of a country while domestic currency is the accepted form of money in the economy but not necessarily the exclusive currency” (InvestorWords 2012 p.4). Whereas foreign currency “is that which is not legal tender in the economy and issued by the monetary authority of another economy and not the common currency in an area to which the economy belongs” (Fiévet 2004 p.2).

There are various types of exchange rates that can be used to adjust the rate at which a currency is exchanged. For example, Grossman and Rogoff indicate that, “a self imposed fixed exchange rate can be ephemeral and is often a fig leaf for an inveterately inflationary government” (1997, p.69).

The fixed exchange rate is fixed in a way that enables the central government to control the prices of foreign currencies needed in the country. In this type of exchange rate control, the factors of demand and supply are studied over some time and the rate is set for a particular period of time. It is then structurally adjusted from time to time depending on the market situation and what it is supposed to achieve.

The other thing that is put into consideration is the government monetary policies put in place and the world economy in general. It should be fixed in a way such that as much as it is beneficial to the government, it encourages growth and development of the economy by encouraging foreign investments. In the long run, one will find that even though the rate is fixed, it is variable though over fixed period of time. It would be rather uncouth if the rates are fixed without considering the market and the effects of the policy.

A country’s exchange rate policy is usually depended on the requirements of the country for the foreign currency. For instance, the number of people immigrating to another country, the number of foreign tourists, the amount of imports and exports, and foreign activities like infrastructure development and works by a foreign country. These are the market variables that may influence whether to fix or not to fix the currency exchange rates.

The other type of exchange rate is the, “freely Floating Exchange Rate System. In a freely floating exchange rate system, exchange rate values are determined by market forces without government intervention” Madura (2009 p.173). This system is freely floating however, it is controlled in a way that protects the consumers. Because of these, there are other types of floating exchange rates like the pegged and crawling rates.

Each exchange rate type has its own advantages and disadvantages. One of the most important things of the floating exchange rate is that, the country is protected from the effects of inflation of other countries because the exchange rate will adjust itself due to the market demand and supply.

The other important thing is that the country is insulated from unemployment issues in another country. This is explained by Madura that this is so because the decrease in demand of goods or services from another country directly reduces the demand of the currency of that country making it less demanded.

Thus, in a freely floating exchange rate the effect is expressed on the rates and hence reducing the unexpected awful effects.Thirdly, it allows the central reserve to hold a lower amount of foreign currency because the effects are expected to mitigate themselves.

The other advantage is that it allows a country to re adjust more flexibly to external shocks that may be caused by international policies or changes in demand and supply through unexpected events like war.

It also encourages absence of crises because it automatically adjusts itself through the stretches of demand and supply in economics. Bized (2012, p.9) explains that, “with a floating exchange rate, balance of payments disequilibrium should be rectified by a change in the external price of the currency” freely and quickly hence mitigating its effects.

Despite the fact that it has advantages, it also has its own shortcoming on the effect on the economy. The fact that the currency exchange rate changes from day to day, it may lead to lack of investment because the investors don’t know whether it is safe to invest in that economy.

It also encourages currency speculation which leads to hoarding of the foreign currency which in turn weakens the local currency. This is a bad effect because it may cause inflation which is not desirable. Another thing is that it may lead to lack of discipline in economic management because businesses will tend to work in way that they will benefit from the weaknesses of the free changes (Mishkin 2007, p.8).

The most important thing about it is that, “exporters and importers would engage in international trade without concern of the exchange rate of the country” (Madura 2009 p.172).

Another thing is that, whoever wants to invest in the country will be sure that from the calculations that they have made, the returns will be almost equal hence, foreign investors are encouraged. It as well encourages the investment of the foreign funds in the economy because those people who have money and want to invest will be sure of the returns from the interest rates charged.

The problem with fixing the exchange rate is evident in that, as much as it is called fixed, it is reviewed by the government again and again which means that there is a level of uncertainty. When the government is changing the fixed rate, it may ignore some factors which may affect the investors hence, the fixed rate has its own disadvantages.

The Reserve Bank Bulletin (1985, p.65) indicated that, “once exchange controls were removed in the late December 1984, there was potentially little scope for an independent monetary policy so long as the fixed rate regime was maintained”.

In conclusion, the type of currency that a country uses should be studied carefully in comparison with the market trend. It should also be done to the best interest of the country’s economy bearing in mind international trade ties. The most important thing in the money market is the stability of the local currency and the control of inflation.

Reference List

Altamore, L. (2012) Digging Up the Past Again: The True Manner of Going Back to Basics, AuthorHouse, Bloomington.

Bized, K. (2012) Advantages and disadvantages of floating exchange rates – Further work – Foreign exchange market – Markets – Economics bank – Virtual Bank of Biz/ed. Routledge, New York.

Cypher, J. & Dietz, J. (2004) The Process of Economic Development, 2nd Edition, Routledge, New York.

InvestorWords, (2012) “What is domestic Currency?”

Fiévet, R. (2000) “Definition of Domestic and Foreign Currency: IMF Statistics Department”. Routledge, New York.

Fischer, P.,Taylor, W. And Cheng, R. (2011) Advanced Accounting,11th Edition, Cengage Learning, Mason, Ohio.

Grossman, G. and Rogoff, K. (1997) Handbook of International Economics, Volume 3, Elsevier, Amsterdam.

Madura, J. (2009) International Financial Management, 10th Edition, Cengage Learning, Mason, Ohio.

Mishkin, F. (2007) The economics of money, banking, and financial markets, Pearson/Addison Wesley, California.