Competitor’s environment analysis

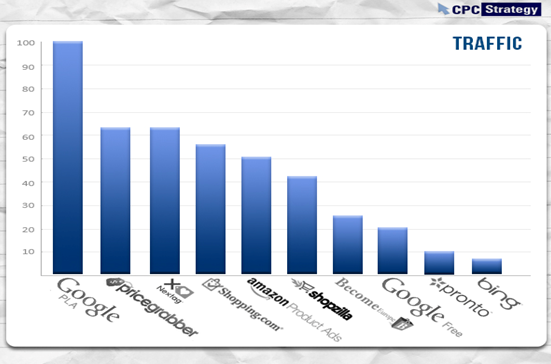

The market share of Amazon.com has been constantly increasing over the years and is expected to reach fifty percent of the total market share in the next few months. In less than three years, the company had tripled its total share of the American book business across all formats. Consequently, this implies that at the end of this year, Amazon.com is expected to control more than half of the American book business for all formats.

In 2007, it owned approximately 15 percent of all American book sales across all formats. This has been followed by a steady increase hence analysts have used the statistics to predict its future market share which is expected to be more than 50 percent (Pettinger 2013). Currently, the company has approximately 30 percent of the market share in book business for all formats. This market share is much higher than of other competitors in the market.

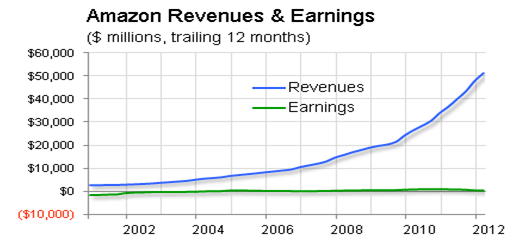

In the most recent period, the company’s working profit margin dropped from 1.5% to 1.1%. This drop was also realized in the previous quarter. On the other hand, its gross margin increased from 24% to 26.6% while their operating profits reduced by 6 percent. This drop was majorly affected by the foreign exchange rates (Bensinger 2013, para 1).

The company has a higher net income ($82 million) compared to other companies in the market. Due to technological advancements, the company has been able to grow at a faster rate than its competitors i.e. Barnes & Noble, Inc., Apple, & Wal-Mart.com. Therefore, the company provides its customers with a wide variety of products and at lower prices than its competitors. This has improved its image both in the local and international market.

Amazon.com is considered to be one of the leading hosting companies in the world taking into account the number of web-facing computers. The company’s share price is valued at $288.79, for a total price of $643,424.12. A number of market analysts have downgraded its shares in a study carried out for investors.

Direct Competitor Comparison.

Through e-business, especially online transactions, Amazon.com ensures that its customers and consumers get timely and qualitative webstores, case studies, books, electronics, webinars and press coverage solutions at their convenience. This, in turn, attracts many customers and consumers to various stores that Amazon.com has strategically placed in websites. The company also offers high quality of services for all customers including the intended e-business (Mennen 2010).

Additionally, Amazon.com is supposed to maintain and adhere to all codes of conducts. For instance, unlike electronic commercial companies, Amazon.com ensures that the right procedures and protocols are followed before an individual is employed or laid off from the company. This encourages many qualified people to seek purchase with Amazon.com.

When such qualified persons are employed in various sectors of Amazon.com, they offer relevant skills and knowledge required for the success of the company through the intended e-business. In a competitive manner, before a worker is laid off, he or she is given the chance to improve his or her work. This encourages the labor force, in Amazon.com, work extra hard in their assigned duties and roles to ensure the success of the company through the mentioned online transactions.

Moreover, the company offers online opportunities to its workers to acquire various up-to-date methods of meals preparation. It also encourages its clients to seek more goods outside the company (Lussier, 2012).

Internal environment analysis

Amazon.com has a number of resources which includes providing solution to Webstore, case studies, Webinars and press coverage. The company has constantly proved its capability and competencies by realizing a 13 percent increase in its sales. Moreover, it had attained a landmark which had been considered to be impossible in the fourth quarter; it obtained a net profit of $5 million.

It also opened its kit store, which comprised of clothing from retailers. Customers are able to connect to the company’s website and make orders for their favorite products (Lussier 2012, p. 47). Therefore, it does not have to sell their products through the wholesalers and retailers.

The exclusion of middlemen in their business has led to the reduction of the cost of their products hence the company is able to obtain more customers compared to their competitors in the local and international market. It has also increased its customer’s data base in the last few years hence their customer accounts are estimated to reach approximately 2.26 by the end of this year.

Amazon.com has a number of value chain activities. For instance, their traditional value chain has a number of support activities including procurement, technology, and human resources. It also carries out marketing and sales of their products. The entrenched system of marketing carried out to their potential customers is considered to be the best approach of increasing their sales. The company has also put a lot of focus on its operational competencies, and low valued procurement.

Their customer center of attention means that a lot of weight is still given to the customer. Consequently, there is a huge balance among the activities. Amazon.com currently has many strategies and objectives to achieve before the end of the year.

The company is planning to establish a great business with an efficient operation by changing from shorter business cycle to longer business cycle. The company’s major strategy is to change their management system to guide it through their current process of revolution and renewal. This is majorly aimed at improving their performance in the both the local and international market (Pahl & Richter 2007).

The major strategy of Amazon.com is to incorporate e-business provisions to enhance its online transactional operations. It also wants to establish retail units at strategic sites in large websites that are commerce oriented so as to expand their customer base. The achievements of amazon.Com originate from a proper understanding of the e-commerce and obviously this is its main competitive advantage.

Their major strategy is based on the knowledge of online transactions, conserving customers, providing significance and quality to their services. Rather than just offering discounts, they offer services linked to privatization of accounts, secure payments, fast service delivery, and e-mails, providing reliable customer service. Amazon.com aims at placing these e-business provisions at strategic online sites.

According to Pettinger (2013), the company will then offer marvelous services, after proper establishment of brand e-business. Following this, all food products from Amazon.com Company will be ferried to customers who have paid online. Another strategy that Amazon.com utilizes is the use of offers of various franchise opportunities. These opportunities will help Amazon.com to widen its e-business coverage and acquire additional revenue stream.

According to Bensinger (2013), e-business further requires a strong management team that has adequate information and knowledge on business management, hospitality and advertising (Hitt, Hoskisson & Ireland 2013). Through e-business, it intends to set up operational office in major towns in the world to be used as the business hubs. Later, Amazon.com intends to target franchise customers, who are in need of self-employment but can access internet and order and pay for goods online.

Such customers will ensure constant growth of the company with minimal disturbances. Amazon.com also intends to target university campuses as potential franchises. The company will further expand in order to incorporate customers, who seek low cost products to support e-business. E-business has increased the efficiency of the company (Bensinger, 2013).

As a result, Amazon.com is able to offer new niche spark in various static markets. There are also low development risks; hence, the company is able to sell its products without fear of incurring losses. The success of Amazon.com Company is also enhanced by similarities in the United State culture and trends of various ways that are used to sell electronic products in the streets.

This, in turn, helps create a proper and successful transferable business model. Amazon.com is also able to make maximum use of brand and the expansion of various markets segments, like online stores. Additionally, the company has well-organized management team, team ensures little or no management risk in the context of e-business (BÖhm, 2009). Customers can buy qualitative webstores, case studies, books, electronics, webinars and press coverage solutions from Amazon.com Company.

Through online transactions, these types of services attract many customers since they have a high level of customization to suit a purchasers’ taste. The online reading tools, within Amazon.com, also attract many customers. Through e-business, this can be enhanced by enabling quick online transactions (Morden 2007). This will help in proper and timely preparation for individual demands. Amazon.com aims at diversifying its revenue stream, in the coming years.

SWOT analysis of Amazon.com

When subjected to SWOT analysis, Amazon.com has numerous strengths in its business endeavors. The company has several competitive advantages compared to its rivals in the electronic commerce industry. Additionally, it has established right products for its clients. This is evident in the online publications, reliability, and variability in the services it offers. Additionally, it embraces technology and innovation to ensure that it remains competitive.

According to Lussier (2012), the company has trained competent human capitals hence capable of achieving customer satisfaction. Amazon.com has equally enhanced its customer services and changed business processes in order to attain the desired competitiveness.

Strengths

The Company has cost leadership strategy which is aimed at delivering products and services at a cheaper price compared to that of their competitors in the market. This plan is achievable via economies of scale. Therefore, the company has to provide a variety of products and services to their customers to attain the economies of scale and make profit on the cheaper cost of presenting its products in its online market (Mennen 2010, p. 7).

Amazon.com provides its customers with the most excellent quality services and products. Additionally, it is dependable, convenient, and sells its products at cheaper prices. Therefore, it has dominated the market for many years and is still expected to be one of the leading companies across the world.

The other strength of the company is that it has been effectively purchasing new firms. This will guarantee that their new-fangled commodities, services, competencies, and possessions are brought to the company. Considering the premeditated accomplishments, the corporation hardly enjoys the ability to offer cloud services to its customers, but also improve its Information Management abilities.

The corporation has a regimented logistics as well as supply networks. In addition, they are geographically located in every country to increase the speed of distribution and at a cheaper cost. Through the use of more advanced IT skills to provide various products online, the company has been able to practice economies of scope (Pahl & Richter 2007, p. 271).

Amazon.com intends to use its e-business to gain broader exposure to the market world. Indeed, presence or existence of such technologies makes Amazon.com stand out as a merger proposition or attractive acquisition. Amazon.com will eventually ripe its success in the world. This is because its owners and management team has the appropriate skills and knowledge to ensure its success.

Through e-business, Amazon.com pricing model involves the production of electronic commerce products that are of high quality in order to offer competition to other companies. It also offers online transactional provisions as mentioned earlier. This encourages many consumers, customers and investors to buy its products online (Hitt, Hoskisson & Ireland 2013). Similarly, the company produces affordable products, which most people can afford.

Amazon.com is a corporation greatly involved into the scientific arena, and has been successful over the past decades since its commencement in 1995. Even though there are many challenges, Amazon has tackled them, and finding appropriate inventive methods of staying ahead of its competitors. According to Morden (2007), this has made it a preferred site, thereby boosting Amazon.com sales.

Another powerful tool in analyzing a business situation is the porter’s five forces tool. It is beneficial since it assists in understanding not only the strengths of the present competitive position but also issues influencing the strategy development.

Being among the first corporations to offer e-commerce, Amazon.com enjoys certain level of serenity into the market. They remain strong in the market because of their continued innovation to reach maximum consumer satisfaction. This gives them a competitive advantage over their rivals.

Weaknesses

One of the weaknesses of the company is that it is only present online. Unlike other retailers like Wal-Mart and target, the physical occurrence of the company cannot be felt by its customers. Therefore, their customers are not able to see and touch their products and services before buying them. A number of their products are also traded at zero margins (Morden 2007). Their main aim is to increase their market share and reduce competition, but it is considered to be a short term move.

Consequently, this move will affect the company’s profits in the long run. For instance, their competitors can adopt after sometime and regain their market share by using a different approach. The other flaw of the corporation is that it has an off-putting hype.

According to BÖhm (2009), the instances where it was accused of evading tax in America and UK has led to the negative publicity across the world. Poor warehouse conditions for their employees are also being condemned by many people globally. Moreover, the entity is usually under siege due to its price inequality and anti-competitive actions.

Opportunities

The Company has an online payment system and this is considered to mostly benefit mobile buyers who always purchase their products on the go hence are not able to give their personal information. Moreover, the services can also be used by a number of other online traders at a small charge. Since Amazon.com discharges a number of its native brand commodities. The company is planning to improve the assortment of their products and services through purchases.

For instance, it has purchased a number of companies to effectively increase the rate at which it provides it products and services to the customers. Amazon.com enjoys what it takes to establish numerous online stores in all the countries internationally. Consequently, this will help in sustaining the current levels of development (Depamphilis, 2012).

Basically, opportunities available for Amazon.com are numerous. The growing demand for webstores, case studies, books, electronics, webinars and press coverage solutions in the world pose great opportunities to the company. Amazon.com also strives to remain competitive and embrace novel business strategies in its endeavors’ to lead the market despite the challenges.

The provision of affordable webstores, case studies, books, electronics, webinars, press coverage solutions and professional services are core opportunities the company can exploit. Another opportunity incorporates favorable legal provisions in the regions, the company’s brand name, as well as the attained market trust (Lussier 2012). It is upon Amazon.com to resolve its marketing hiccups and cease all the business opportunities it has in the region.

Accordingly, the business models initiated Amazon.com to restructure its market approach created critical opportunities for the company. Amazon.com also enjoys the trust and services offered by the affiliated specialists and other associated electronic commercial companies. Such opportunities should be utilized by the company to outdo other competitors.

Basically, there is a growing market for webstores, case studies, books, electronics, webinars and press coverage solutions offered by Amazon.com (Morden 2007). This is a critical business opportunity for the company as mentioned earlier.

Threats

The Company keeps their customers’ vital personal information which has become a target for the online burglars. It is also at risk of being fined by the UK and American authorities for evading tax. Accordingly, the threats that Amazon.com faces are numerous as mentioned earlier.

This incorporates competitions from other printing companies, emerging/competitive online businesses, uncooperative affiliate specialists, management challenges, unstructured merger policies, and other considerable hiccups. Other competitors include Apple Inc., Barnes & Noble, Inc., and Wal-Mart.com. Additionally, some of the acquired marketing strategies are not proficient enough to provide the prospected quality services.

Additionally, international policies in some countries could restrict its operations in those countries thus limiting access of products offered by Amazon.com in those countries. Another political issue concerns regulations. Most web users do not trust internet contents, which could hinder making purchases of Amazon.com products online. Besides, in some cases like online crime, an individual cannot go to legal authorities since they are not available.

Another threat is that variations in currency in different countries where exchanges are exceedingly devalued as compared to the dollar could result into extra costs on the company. Moreover, some costs of products could increase, which could affect consumer demand for those products. Most customers also prefer making purchases through normal commercial dealings rather than buying products online (Depamphilis, 2012, p. 145).

Recommendations

For the company to affectively compete in the local and international market, it should be present both online and physically. Consequently, this will give individuals an opportunity to see and touch the products it is planning to purchase. Amazon.com should also avoid selling its products at zero margins as this will negatively affect its profits. To improve its public image, the company should avoid its anti-competitive actions and be fair on their prices.

The security of their online shoppers should also be taken into consideration by safely storing their personal information. The market environment is very important for a business since it enables a firm to operate effectively. It is recommendable that considerable focus be put in place to manage these aspects of the company. Even though the market environment of the business is relatively complex to control, Amazon.com should try to take control as it is important for its success.

Amazon.com is successful in managing its online market environment; nonetheless, it should strive further for excellence. It is recommendable that much success in their business can be attained (Pettinger 2013). This can be achieved through proper management of online market environment.

However, it is recommended that proper measures be put in place to help in managing unpredictable events that leads to losses of revenues besides causing reputation degradation. It is important to consider the recommendations made in order to enhance the relevancy of Amazon.com in the world market and nonmarket environment.

It is generally recommendable that the company should enhance its marketing strategies through a viable market plan. It is important also to note that Amazon.com should enhance most of its services and enhance the technological aspects for efficiency of its service provisions. This is a critical provision in the quarters of service enhancement and provision of viable online services as demanded by the growing pool of customers.

According to Kotler & Armstrong (2008), the market analysis for Amazon.com would help it to utilize its investments assets effectively. The firm needs to invest substantial resources into customer relationship management in order to build a long lasting relationship with its clients. It needs to develop skills that would ensure that its customers keep returning to their establishments because of the good experience in its services (Kotler & Armstrong, 2008).

Another viable recommendation for Amazon.com is the quality assurance requirements. It is the mandate of the company to cope with the situation in a positive manner as it sources for viable options helpful in this context. The competition problem should not continue to distract the efficiency of the company since there are efforts on the ground to correct it. As indicated before, caution during online transactions can help considerably in the matter.

Additionally, the quality department should ensure that webstores, case studies, books, electronics, webinars and press coverage solutions produced by the company are efficient to use. Consequently, the company will achieve its quality demands stipulated in this context.

It is crucial for Amazon.com to consider this provision in the entire production context in order to remain relevant and competitive in the industry. According to Depamphilis (2012), executing the demanded security provisions will equally contribute to the alleged quality provisions and production efficiencies.

List of references

Bensinger, G 2013. Amazon Grows, and Spends. Web.

BÖhm, A 2009, The SWOT Analysis, GRIN Verlag, München.

Depamphilis, D 2012, Mergers, acquisitions, and other restructuring activities: an integrated approach to process, tools, cases, and solutions, Academic, Amsterdam.

Hitt, M., Hoskisson, R & Ireland, R 2013, Strategic management: competitiveness & globalization : cases, Cengage Learning, Mason, OH.

Kotler, P & Armstrong, G 2008, Principles of Marketing, Prentice Hall PRESS, Harlow.

Lussier, R 2012, Management fundamentals: concepts, applications, skill development, South-Western, Mason, OH.

Mennen, M 2010, Global Corporate Strategy – A Critical Analysis and Evaluation of Amazon.com, GRIN Verlag GmbH, München.

Morden, T 2007, Principles of strategic management, Ashgate, Aldershot.

Pahl, N & Richter, A 2007, SWOT analysis: idea, methodology and a practical approach, GRIN Verlag, Munchen.

Pettinger, T 2013. The monopoly power of Amazon. Web.