About Organisation

Amazon is a Seattle-based Fortune 500 company that was founded in 1994 by Jeff Bezos and launched the next year. Back in the day, the company has become one of the first large Internet sellers. Looking at the industry giant that Amazon has grown to be over the last 25 years, it is difficult to believe that the business had humble beginnings. It started as an online book store; however, thanks to Jeff Bezos’ thoughtful guidance, the range of goods offered on the platform was quickly diversified (Rossman, 2016).

Soon, Amazon’s customers were enjoying DVDs, electronics, video games and clothing. In 1998, Bezos became Time’s “Person of the Year” for his contribution to online shopping. The client’s interests take front and centre of the company’s strategies which capitalise on using every opportunity to harness the unprecedented tech revolution. The passion to serve the customer and gain a competitive advantage over numerous contenders was the impetus to innovation and resulted in the creation of such products as Alexa, Dash Button and Amazon Prime (Robischon, 2017).

About Decision

On the 2nd of February 2005, Jeff Bezos and the team launched a service that set the bar for the entire industry, Amazon Prime. Initially, it was designed as a paid subscription service that allowed users to gain access to services and benefits that would otherwise be unavailable or require an extra payment (Consumer Reports, 2019). For two years, from 2005 to 2007, Amazon Prime offered two-day free shipping for a flat annual fee exclusively to the United States citizens. As the popularity of the service was tested in the domestic market, Bezos embarked on aggressive expansion politics. The CEO of Amazon followed through with his plans and launched the product in the United Kingdom, Germany and Japan in 2007. By 2008, the service emerged on the French market under the name “Amazon Premium” and reached Italy by 2011. Canadian citizens got to enjoy fast shipping in 2013, whereas India and Mexico joined in 2016 and 2017 respectively (Statista, 2019).

During the 2010s, the company made available a monthly subscription so that potential customers could check the perks of the service before making a year-long commitment. Amazon diversified the range of products under the Amazon Prime brand, adding Prime Reading with access to Kindle library and Amazon now with one-to-two hour delivery in New York. The success of Bezos’ decision back in 2005 gets continuously proven by hard data. Between 2016 and 2018, the number of Amazon Prime subscribers almost doubled: from 54 million to 100 million users (Statista, 2019). According to some reports, in 2016, half of United States households used the services offered by Amazon Prime (Statista, 2019).

Key Conclusions

Amazon is a company that prioritises innovation and takes customers’ changing expectations into consideration. Since 1994, the company has been revolutionising the logistics industry and the world of online shopping. Amazon owes its rise to its true visionary and genius business mogul Jeff Bezos who was the heart and the mind behind many new products and services. Amazon Prime is arguably one of the most successful ventures that the company has ever undertaken. As of now, the service is used by a whopping 100 million users worldwide, and the company is actively expanding the product’s geography.

Outline

This paper aims at investigating the process behind the creation of Amazon Prime. All claims and conclusion will be supported by data from official books about the company’s history, the founder’s interviews and relevant statistics. The first part of the body of this essay will focus on explaining the decision making process from the standpoint of the company’s vision. The second part will discuss the external and internal factors that pushed the company to pursue this goal. To attain this, Porter’s Five Forces Model will be applied.

The Decision Making Process

Stakeholders

In 2005, the launch of Amazon Prime was meticulously planned by a talented team under Bezos’ guidance. The names behind the world’s popular shipping service were all employees that joined the company early on, shortly after it was founded, and grew to be officers and directors. To name a few, Stanford’s School of Business graduate, Blackburn became part of the team in 1994 and was Vice President, Business Development, at the time Amazon Prime was in the making. Some other people who made it happen were Harvard Business School’s Rassy, CEO of Amazon Web Services and Princeton University’s Wilke, Senior Vice President of Worldwide Operations. All these people were united by the shared vision and the desire to change the very phenomenon of online shopping.

Bezos’ Way

The CEO’s right hand, Dalzell, reported that Bezos was always exceptionally good at doing two things: accepting that the truth is ever-changing and refusing conventional wisdom when it comes to business (Majia, 2019). Amazon Prime was the product of its time: it answered the questions that customers used to have in the 2000s: they were concerned about a delivery, safety and confidentiality. At the same time, Bezos was well-aware of the fact that while in 2005, Amazon met the buyer’s needs perfectly, it could no longer be true in the matter of as short as one year. Hence, he knew that the value that he could put into the product was not set in stone, and Amazon Prime would have to evolve constantly to stay afloat. As for the second claim, Amazon’s CEO wanted to surpass people’s expectations. As online shopping only embarked on the world conquer, Bezos was ambitious enough to offer a flat annual fee – and a fairly affordable one.

Interestingly enough, Bezos relied heavily on intuition on par with hard data. As he describes his approach to decision making today, it is a combination of a gut feeling and research. One should also add the ability to take time and be patient to the mix: Bezos jokingly calls himself “chief slow down officer (Weil, 2015, p. 106).” For his company, the CEO distinguishes between reversible and irreversible decisions, and something as disruptive for the entire industry as Amazon Prime belongs to the second category (Sumner-Rivers, 2015). If for smaller decisions, it is enough to have 70% of data, Amazon Prime required 90%. Perfection was unattainable: as Bezos admits, data is unable to bring one closer to the solution, if the end goal is to build something that has never been built before.

Institutional Analysis

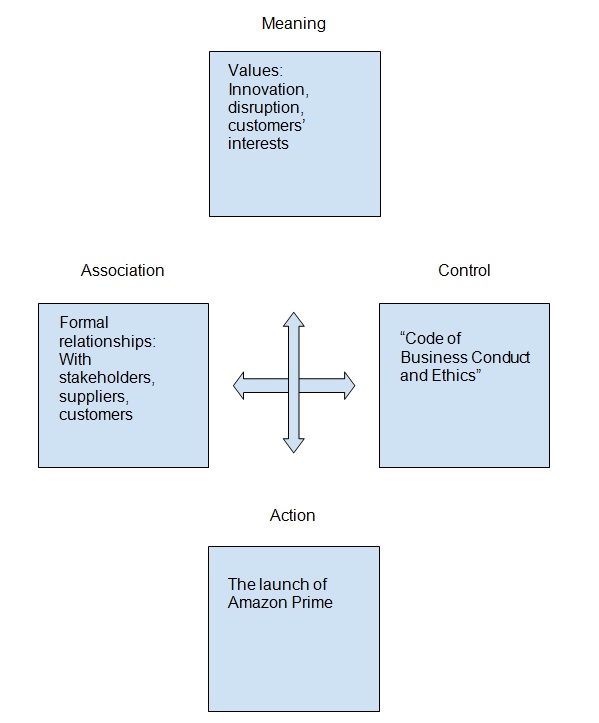

The institutional theory encompasses a broad range of concepts that help to understand the complex nature of social institutions be it formal or informal, state or private (Wendt, 2016). In relation to businesses, the institutional analysis might explain how policies are implemented and decisions are made. In the case of Amazon, the layout of the institutional model might look as follows (Fig. 1):

Internal and External Factors and Power Relations

Now that the decision to launch Amazon Prime is defined as irreversible, disruptive and groundbreaking, it is critical to analyse key internal and external factors that contributed to the change. Each company exists in the context of its time, and at times, it is challenging to explain how exactly inner power relations and the specifics of the business environment impacted its development. To make the case of Amazon more clear in relation to the outlined issues, Porter’s Five Forces model will be applied to discuss five key aspects (industry competition, new entrants, suppliers, customers, the threat of substitute products) (Dobbs, 2014).

Competition of the Industry

The key statistics required for analysing the competition of the industry is the number of other contenders given that they can stand comparison and are equally influential (Dobbs, 2014). A company that is one of a kind in the respective market niche has more leverage and leeway to take risks and make irreversible decisions. If it is not the case, every rushed or poorly planned decision can be detrimental to a company’s status and ranking since competing businesses grow and develop simultaneously.

All of Amazon’s key contenders acquired power by taking advantage of the developing niche of online shopping and the absence of well-established companies with a worldwide presence. First, Alibaba, a China-based online retailer founded four years after Amazon, was becoming stronger. In 2005, Alibaba entered a strategic partnership with Yahoo, hence, gaining access to the American market and at the same time, taking control of China Yahoo’s domestic operations (Erisman, 2015). In 2004, Amazon bought Joyo for $75 million; the largest online sellers of books and electronics, Joyo was supposed to solidify Amazon’s presence in China. As time showed, the strategic purchase of Joyo was not worth the expenses as in the next ten years, it only accounted for 0.7% of online sales (Zhu & Liu, 2018). Amazon’s main competitive advantage back then was its fuller range of goods and utilities as compared to Alibaba.

In the 2000s, eBay was doing extraordinarily well, which could also pose a threat to Amazon’s influence on the market. Around the years 2002-2003, both Amazon and eBay made power moves that showed that they were industry leaders to be reckoned with. Amazon was the first player in the game to introduce one click-purchase, making online shopping easier. EBay purchased PayPal and then went even further by buying iBazar, a European e-commerce platform (Zhu & Liu, 2018). Amazon was yet to tap into the European market, but at the time, focusing on the US customers’ needs made more sense.

Lastly, for Walmart, a Mexican retailer, the 2000s were marked by the launch of an online shopping platform. Shortly before that, Walmart topped the Fortune 500 ranking and was overall a more recognisable brand than Amazon due to its long history dating back to the 1960s (Brea‐Solís, Casadesus‐Masanell, & Grifell‐Tatjé, 2015). Moreover, Walmart introduced a new service, site-to-store delivery, so that clients could pick up their orders right from the store (Zhu & Liu, 2018). Target, on the other hand, despite being one of the first and largest retailers in the United States, was not successful in bringing its business online. Even though it 2001 initiative that allowed customers to register gift cards on the Internet gained some traction, the online sales never amounted to any significant share of all sales (Zhu & Liu, 2018).

Potential of New Entrants into the Industry

Some industries are more accessible; some, however, have strong barriers that a young company might find insurmountable. A new entrant might gain power by providing a viable alternative – a disruptive product or service – that weakens older companies’ positions (Chang & Wu, 2014). In 2005, Amazon was in luck: despite having to compete against other companies, it did not need to face any powerful entrants. To make the analysis more robust, the years 2003 through 2005 were investigated to find out whether any large retailers started around that time. Only around one-third of the 2003-2005 newcomers were US-based, and none of them offered such a variety of goods as Amazon did. Moreover, the majority of the new entrants did not have an online presence, relying on physical stores. Hence, Amazon’s timing was incredible: the company enjoyed the absence of new competitors and created something that its contenders had not yet conceived.

Power of Suppliers

By 2005, Amazon had expanded the variety of goods and utilities significantly and enjoyed popularity among the United States customers. To launch Amazon Prime, given the relatively low subscription fee, the company needed to be sure that it will be able to maintain and increase sales. As an online retailer, Amazon relied heavily on suppliers, and back then, since online shopping was in its early stage, they were sought after and could make their own rules. Jeff Bezos was aware that retaining and enhancing the diversity of the stock would require being compliant with third-party sellers and manufacturers. At the same time, by the early 2010s, the company already attracted more than 400 suppliers, which made the business relationships more equal and two-sided (Sumner-Rivers, 2015). Therefore, Amazon could rely on the power of suppliers as much as they could rely on the platform that presented so many opportunities and favourable terms.

Power of Customers

A client base can dictate its own rules when it comes to pricing and other business strategies. The smaller the number of customers is, the more power each of them has individually. Again, when it comes to this aspect of Porter’s Five Forces, Amazon was in a good position. First, it had enjoyed a steady increase in the number of customers over the last few years before the launch of Amazon Prime (Winn, 2016). Online shopping was only gaining popularity, and some people were still wary of its seemingly complicated mechanics (Folinas & Fotiadis, 2017).

Amazon was competing with Chinese and Mexican-based companies, and yet, as an American business, it seemed more reliable and familiar to many buyers. Second, the growing interest in making purchases online was benefitting online retailers in general. In 2005, online shopping grew by a whopping 33%, which was especially tangible during the holiday season (LeClaire, 2005). Lastly, customers who were getting used to Internet stores started increasing their expectations on prices and shipping (Lewis & Dart, 2014). All in all, Amazon took advantage of its reputation, overall business environment and clients’ wishes when introducing Amazon Prime.

Threat of Substitutes

If a client relies on a company to acquire a good or a service, but later, a competitor offers something similar on better terms, a substitute might pose a threat to the first company’s position. As it appears to be, in 2005, Amazon Prime was one of a kind worldwide or at least, in the United States. While Alibaba, eBay and Walmart were offering great deals in terms of goods’ range and prices, Amazon stood out by introducing a flat annual fee. Moreover, given the state of logistics in the 2000s, two-day shipping within the US was innovative (PwC, 2016).

Conclusion

Amazon is one of the world’s largest online retailers that enjoys increasing sales and customers’ loyalty and in return, offers innovative products and services. Amazon Prime was by far the best business decision that Jeff Bezos ever made, and back in 2005, it was a service that answered the challenges of its era. Jeff Bezos and other stakeholders that had been working for Amazon since its foundation relied both on hard data and intuition. While the numbers and figures hinted at the benefits of launching Amazon Prime, such a decision posed some risks due to uncertainty and irreversibility. Within the institutional theory, the following three components contributed to the launch of Amazon Prime: values (innovation and customers’ satisfaction), business ethics and established relationships with suppliers and clients.

According to Porter’s Five Forces, Amazon had serious competitors but no new entrants to pose a direct threat. Suppliers had an impact on Amazon’s strategies, but the business did not rely on each of them individually. Around that time, customers just started trusting online shopping and raising their expectations, and Amazon Prime was in line with them. Overall, it was a unique product with no available substitutes, which fully justified Amazon’s decision.

References

Brea‐Solís, H., Casadesus‐Masanell, R., & Grifell‐Tatjé, E. (2015). Business model evaluation: Quantifying Walmart’s sources of advantage. Strategic Entrepreneurship Journal, 9(1), 12-33.

Chang, S. J., & Wu, B. (2014). Institutional barriers and industry dynamics. Strategic Management Journal, 35(8), 1103-1123.

Consumer Reports. (2019). Pros and cons of Amazon Prime.Web.

Dobbs, M. E. (2014). Guidelines for applying Porter’s five forces framework: A set of industry analysis templates. Competitiveness Review, 24(1), 32-45.

Erisman, P. (2015). Alibaba’s world: How a remarkable Chinese company is changing the face of global business. New York, NY: St Martin’s Press.

Folinas, D., & Fotiadis, T. (2017). Marketing and supply chain management: A systemic approach. Abingdon, UK: Routledge.

LeClaire, J. (2005). Online shopping grows 33 percent in 2005.Ecommerce Times. Web.

Lewis, R., & Dart, M. (2014). The new rules of retail: Competing in the world’s toughest marketplace. New York, NY: St Martin’s Press.

Majia, Z. (2018). Amazon’s Jeff Bezos: This simple framework can help you answer the most difficult questions you face.CNBC. Web.

PwC. (2016). Shifting patterns. The future of the logistics industry.Web.

Robischon, N. (2017). Why Amazon is the world’s most innovative company of 2017. Web.

Rossman, J. (2016). The Amazon way: 14 leadership principles behind the world’s most disruptive company. Bellevue, WA: Clyde Hill Publishing.

Statista. (2019). Amazon Prime – Statistics & facts.Web.

Sumner-Rivers, R. (2015). Amazon’s Prime ambition.Parcelhero Industry Report. Web.

Weil, J. (2015). Jeff Bezos: Founder of Amazon.com. Edina, MN: ABDO.

Wendt, C. (2016). Max Weber and institutional theory. Berlin, Germany: Springer.

Winn, J. K. (2016). The secession of the successful: The rise of Amazon as private global consumer protection regulator. Arizona Law Review, 58.

Zhu, F., & Liu, Q. (2018). Competing with complementors: An empirical look at Amazon.com. Strategic Management Journal, 39(10), 2618-2642.