Introduction

The contemporary corporate domain constantly evolves, and businesses must always evaluate their performances to make informed decisions. Evaluating a company’s financial capability is key to understanding its ability to adapt, innovate and thrive in a competitive environment. In the realm of e-commerce, Amazon is a powerhouse and has made accurate decisions that made it beat its competitors in the field.

This evaluation report comprehensively analyses Amazon’s financial health and its decisions to enhance productivity. It is divided into four main parts, the overview of the company, the trends in marketing, capital structure and valuation. The company has managed to thrive and remain competitive because it makes financial, conscious decisions that improve its profitability.

Overview

Amazon is a Fortune 500 global technology company that started as a bookstore in Seattle. Jeff Bezos founded the company and started its operations in 1994 (Lai et al., 2022). Over the years, it has managed to diversify its products and thrived because of its customer-centred approach.

It operates in the technology market, and after its diversification, it started offering online retail, web services, and artificial intelligence and has gained popularity in the technology domain. Other common products the organization offers include user electronics, apparel, groceries, books, and available digital content. Its success has been made possible by competitive pricing, meeting customer numbers under one roof by providing a vast range of products and enhancing customer convenience.

The company has a vast range of customers, such as companies and individuals purchasing goods in both retail and wholesale. One of the major sources of the ever-increasing market is its robust research and development, which help the organization understand the customers’ needs and ensure that they are met. Customized products specifically designed to meet customer needs help Amazon to thrive. Despite the growth of Amazon’s competitors, such as eBay, Walmart and Alibaba, the company continues to attract more customers because of its customer-centric approach, which ensures that the customers’ needs are addressed (Lai et al., 2022). Some of the customer preferences that are met to improve the company’s performance are the ability to deliver orders quickly.

One of the main challenges facing the company is the ever-growing competition, which makes it invest more in marketing, research, and development. Besides the competition, the company also faces dynamic customer needs, which require a fast-moving stock to ensure it sells the entire stock before the customer preferences change. However, the highly skilled management team leverages strategies like Amazon Prime to maintain a competitive advantage as customer goods are delivered on time (Lai et al., 2022). On the other hand, the other motivations for customers to choose Amazon are its numerous products, customer convenience and cost-saving options when they buy from the company. The management has successfully analyzed the market and customized the products to meet the needs of the evolving market.

Inputs and resources are crucial to meet the needs of the customer. The main inputs that facilitate the operations in the organization include setting a favorable price and gaining effective ratings of their technology applications (Lai et al., 2022). The source of the competitive price includes economies of scale, while the technological advancements stem from robust research and development. It leverages technologies such as artificial intelligence and the Internet of Things to ensure seamless communication between the centres and the customer delivery wing.

Attaining the input resources presents a challenge to Amazon to the extent that it has to incur training and onboarding costs to ensure that all the staff are productive. Further, the company has to face stiff competition while obtaining goods in bulk to enjoy economies of scale (Lai et al., 2022). Having an effective application to enhance customer experience poses a challenge to the organization as it has to spend a fortune to ensure that the application is up and running. The inputs cause the organization additional expenses, making it more convenient for customers.

Market Trends

Amazon operates in an ever-evolving market, and the management must know the trends to gain a competitive advantage. The technological advancements in the world shifted traditional shopping habits to make many sales conducted in the online domain (Yahoo, 2023). E-commerce is experiencing exponential growth, and Amazon must retain its global position through continuous research and development to enhance innovations for a better environment. The company has managed to remain relevant in the dynamic landscape because failure to innovate will give room for the competitors to thrive.

The increasing digitization influences online transactions as cyber threats increases by the day. Since most operations are conducted online, the company must invest heavily in digitalization to ensure the transactions remain safe. Further, other factors, such as search engine optimizations, must be leveraged to ensure that most people can view the organization’s website online (Yahoo, 2023). The threat of hacking and identity theft poses a challenge for the company, and it must be well prepared to enhance satisfaction in the discourse. Reducing the hacking risks is instrumental in ensuring the company remains relevant in the contemporary corporate domain.

Regulatory standards are evolving due to the challenges posed by digitalization. Since Amazon thrives in the internet market, it faces scrutiny from regulatory agencies to ensure its customers are safe. Data privacy, labor practices, and corporate espionage make Amazon undergo stiff scrutiny for success to be attained (Yahoo, 2023). Amazon succeeds in the market niche because it has understood the nature of the market and operated as expected.

Capital Structure

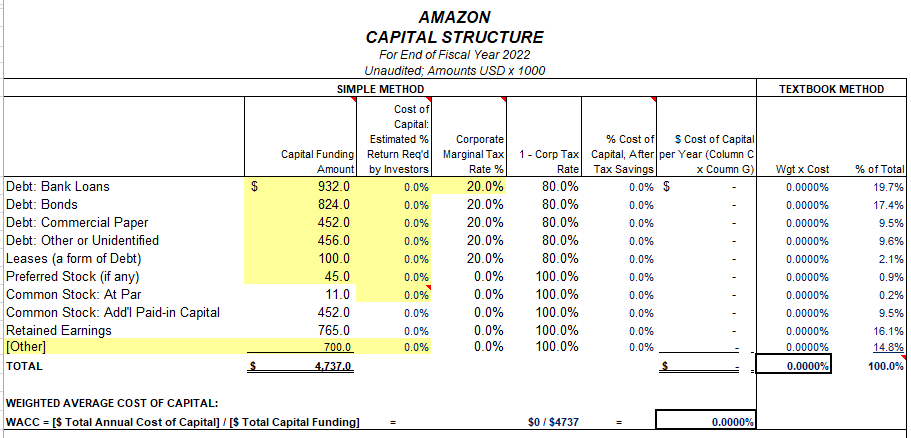

Capital structure is the basis on which the organization is run and how the operations are funded. Amazon relies on equity, debt and total capital to fund all the operations and innovation in the business. In 2022, the company increased its capital base and took more loans to expand its operations and meet customer demands. Shareholding is the most important source of capital for the business to thrive. The company took a debt of $932,000 as a bank loan. Besides the bank loan, the company relied on bonds and commercial paper debts at $824,000 and $452,000, respectively (Yahoo, 2023). The company relies on different types of loans to ensure sustainability. Other than long-term loans, the company also leverages short-term loans to finance its operations.

Besides short-term and long-term borrowing, the company also relies on shares per capital. The price varies from time to time at $16.35 per share in January 2023. The dividend policy encourages many people to purchase shares, increasing its capital base. The dividend policy supports innovation and investments because it encourages reinvestment into research and reduces the repayment period, which enhances expansion. Figure 1 below shows the capital structure of Amazon for the year 2022.

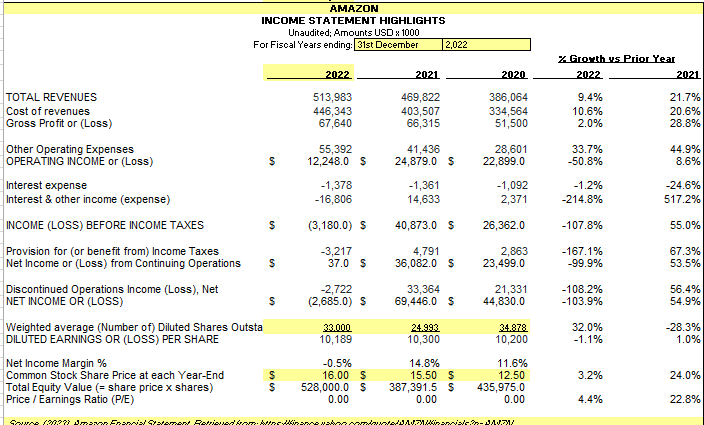

The capital structure affects the company’s risk profile because increased borrowing lowers the overall profits since most of the resources achieved are used to repay the loans. It becomes at risk whenever a company borrows less from external stakeholders. Figure 2 shows that taxes and loan repayment lower an organization’s profitability. As Amazon decides to borrow and reinvest, the relationship is important to consider before making important decisions.

From the financial statement and analysis by Amazon, it is clear that there is a direct relationship between the costs of capital, risk and capital structure. Amazon management has made the company thrive by developing a balanced capital structure. A company can optimize its operations by managing risks with a balanced capital structure. Borrowing is done cautiously to ensure it does not affect a company’s financial health.

Valuation

Amazon’s Current Market Value of Equity

Valuation is an important process in an organization because it helps investors see the company’s value. From the data provided by Yahoo Finance for the three years, Amazon’s current market value of equity is valued at $138.41, calculated by the total shares outstanding multiplied by the current price per share (Yahoo, 2023). The higher value means that Amazon is increasing in value, and the investor perception is improved that Amazon is a profitable organization to invest in.

Assumptions Made in Calculating the Current Value

The key assumption made for the calculations is that the company is experiencing a steady growth in percentage. The rationale for the assumption is the historical data which shows that Amazon has witnessed exponential growth in revenue for the past three years. The second assumption is that the profit margins grow steadily, as the historical data shows. The third assumption is that the capital expenditure will grow as the company invest in other ways of improving competitive advantage, such as technology. The rationale for the assumption is that the technology domain is evolving, and the company needs to invest more capital to make inputs more successful.

Amazon’s Estimated Value

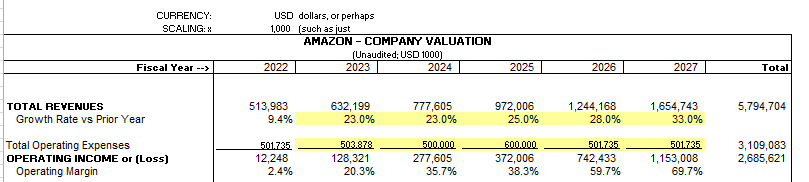

The growth rates and profitability ratios can be used to extrapolate the company’s performance for the future. The company’s forecasting for the next five years assumes that it will experience exponential growth and that the market structure does not change (Yahoo, 2023). Figure 3 below shows the company’s estimated value for the next five years, assuming a steady growth in revenue. Amazon will experience exponential growth, and its revenues will be at their highest in 2027.

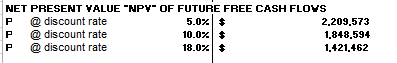

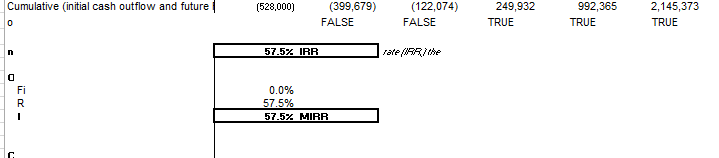

EVA, NPV, IRR and MIRR are important financial metrics determining the business’s profitability. EVA is calculated as NOPAT – (Cost of capital × Invested capital), where NOPAT is net operating profit after tax. From the equation and values given, EVA= -5,619 – (13.56% × 269,358), and the final value is -42,143. From the provided data, the value for IRR and MIRR is 57.5%, as shown in Figure 5 below, meaning that every dollar invested leads to a profit of 0.575 dollars. Similarly, the net present value of 2,209,573 for the best case, 1,848,594 for the base case and 1,421,462 for the worst-case scenario, as shown in Figure 4 below.

Conclusion

Amazon’s market presence and growth rate prove that the management makes better decisions to beat the competition. The global e-commerce giant has evolved from a bookstore to a multinational corporation. Although the company faces competition, it has remained profitable because it enhances profitability and borrows responsibly by focusing on a balanced capital structure. Financial metrics such as the IRR and MIRR are important to make important decisions regarding the business.

References

Lai, G., Liu, H., Xiao, W., & Zhao, X. (2022). “Fulfilled by Amazon”: A strategic perspective of competition at the e-commerce platform. Manufacturing & Service Operations Management, 24(3), 1406–1420. Web.

Yahoo! (2023). Amazon.com, Inc. (AMZN) options chain. Web.