Abstract

This paper demonstrates the use of real financial data in capital structure analysis in decision making for potential investors. The objective is to carry out a broad capital analysis for two actual companies dealing in the same line of business: grocery retail. It explores the various techniques and tools used for capital structure analysis. In the analysis, we use financial data for Tesco Company and Sainsbury Company.

The study is based on a comparative analysis of historical data on the capital of the two companies. The study concentrates on statistical highlights of these Corporations’, ratio analysis (debt to equity, and gearing levels) and their relationship to financing. Also, percentages are used in the analysis to monitor changes over time. Graphs are also used to portray the trend of various variables in the study over the period of analysis. Finally, the results are interpreted based on ideal situations and recommendations are made based on potential investors’ findings.

Introduction

This research paper examines analytical tools vital in understanding the capital structure of a company and determining the position of the same as a prerequisite for decision making science. Businesses across the globe engage in transactions to maximise profit at minimal cost constraints. A capital structure as a function of business establishment determines chances of survival, optimal functionality, and the possibility of expansion depending on its magnitude. Besides, investors generally aim to optimise returns from investment by carrying out informed investment choices influenced by the liquidity, return on equity, and debt ration of a potential investment venture.

Capital structure directly influences a company’s ability to expand (Helfert, 2001, p.67). Therefore, this aspect calls for comprehensive analysis of capital structure as an important decision-making tool in investment. To understand real analysis and application of derivatives of a company’s capital structure, this research paper examines the capital structures of Tesco Company and Sainsbury Company to comprehensively understand how capital structure influence debt ratio, Return on Equity, financing, and dividends payable after a successful financial year.

Thus, this research should help answer the question regarding capital structure decisions and how it matters to investors. It is also specified on the analysis of capital structure, which has to do with debt on capital structure. From results obtained, it will be possible to determine whether or not businesses need more equity capital or debt capital structure. Besides, the paper highlights reliable and important factors of capital structure that affect the UK grocery retail industry for the existing UK market share leaders such as Tesco and Sainsbury. Generally, this paper reflects on portfolio balance in decision science for investment.

Background of the study

A business organisation is set up to actualise its primary objective of maximising profits at minimal cost constraints and risks. This is done firstly by gathering production resources financed through different sources. The different sources of finance available to firms depend to a very large extent on their legal status, their size and the management risk-taking ability (Helfert, 2001, p.79).

The UK grocery retail sector worth around £124.84bn in 2008 (Deieda, 2007, p. 02) is a very competitive business environment where new ways of increasing revenue and profit are constantly developed. Sector growth is estimated at 5.7% comparing with 2007 (Deieda, 2007, p. 02). Capital structure decision in the UK grocery determines which factors are reliable and important to companies to increase revenue. Capital structure is also related to a company’s financial risks.

Financing business operation through the use of preference shares is also risk-free because preference holders are only paid a dividend at a fixed rate when the business makes a profit. However, financing business operation by debt instrument increases its risk though most times is aimed at increasing the earning per share (EPS) of the business giving that the rate of returns on investment (ROI) exceeds the rate of borrowing (Deieda, 2007, p. 02).

Financing business operation through raised equity attracts no risk as shareholders are co-owners of the business risk owners. However, a highly geared company with revenues that vary overtime like Tesco and Sainsbury may find itself in a situation where it cannot afford to pay its fix cost which arises from contractual agreements with its debts providers.

Both Tesco and Sainsbury capital structure seems to be the same. Their financial strategies include equity, debt, financing, and capital investment in determining their weighted average cost of capital (WACC) (Deieda, 2007, p. 02). According to the statement of Tesco, their capital gearing ratios was 49.21% it means that it was used as leverage and, they also use the revenue to invest more diversification to fund general operations. Their interest paid on loan was 42.52 while Sainsbury’s gearing was 43.61%. Besides, their debt was at 3.84, which means that their own break-even and the capital structure were not reliable over the years (Deieda, 2007, p. 02).

Objective of the study

This paper aims to comprehensively carry out capital structure analysis on the financial statements of Tesco Company and Sainsbury Company based in the UK. From the financial statements, the objective is to draw relevant inference on the capital status of these companies and how they status augers well with possibilities of increasing investment or realising dividends. This analysis will capture the Return on Equity, Debt, Financing, and other relevant ratios used as tools of financial analysis of the capital structure. Besides, this analysis concentrates on the performance of capital investments in these companies between the year 2003 and 2007.

Thus, this analysis endeavours to answer questions regarding capital structure decisions and how it matters to investors. It is also specified on the analysis of capital structure, which has to do with the level of debt on capital structure. From results obtained, it will be possible to determine whether or not businesses need more equity capital or debt capital structure. At the analysis segment, the paper will be able to present justifiable figures and diagrams that respond to the actual scenario.

At the end of the study, it will be possible to accurately and conclusively locate ideal capital structure module and define a financial position of these companies in terms of liquidity, efficiency, and profitability and their relevance in the investment matrix and compare the relationship between these ratios. Further, research-backed recommendations will be issued to potential and actual investors based on the inference obtained.

Associated Methodology

In order to comprehensively draw an informed inference on capital structure analysis, it is important to investigate the relationship between capital structure and investment decisions. Thus, the first question would be, why does capital structure matters to investors and business? The term capital structure refers to the percentage of capital (money) at work in a business. Therefore, the two main capital structures are equity and debt capital. Helfert (2001) also defines capital structure as the proportionate combination of various long term sources of finance used by a business to finance its capital expenditure and determine its capital structure (Helfert, 2001, p.69). Therefore, capital structure mainly consists of sources of finance in the long term used to finance expenditure form capital. According to Mervin (1958):

“The use of fixed charges sources of funds, such as debts and preference capital along with the owner’s equity in the capital structure, is described as financial leverage of gearing or trading on equity. The use of the term trading on equity is derived from the fact that it is the owner’s equity that is used as the basis to raise debts, which is the equity that is traded upon. The supplier of debts has limited participation in the company’s profit and, therefore, he will insist on protection in earnings and protection in a value represented by ownership equity” (Mervin, 1958, p. 166)

The protection in value and that in earnings play a major role in determining management of debt and controlling Return on Equity. At ceteris paribus, the equity that is traded upon will have minimal leverage when the long term capital expenditure finance is within debt and equity ratios. When these factors interact optimally, the result will be a balanced level of returned earnings as management will have complete control of capital expenditure. Besides, they will be in a position to monitor returns from capital expenditure. Therefore, a steady level of returned earnings should be maintained within a company in order to enable management to finance all its projects with positive NPV (Mervin, 1958, p. 169).

Literature Review

Tesco and Sainsbury companies often prepare audited reports on financial performance on a quarterly basis, that is, after every three months. This practice is an adherence policy to laws of the UK for both internal and external perusal by government agencies, interest groups and potential investors. Besides, shareholders use these statements to project the viability of their investments in terms of expected dividend. Comprehensively created financial statements provide an insight into the capital structure of a company (Tesco Annual Report and Financial Statements 2011).

Besides, it simplifies the concepts and determinant ratios that translate into complete capital structure. Thus, the capital structure provides an in-depth insight into the sustainability, weaknesses and strength of a business (Tesco Annual Report and Financial Statements 2011). Therefore, the capital structure will determine the possibility of expansion over a period of time and provide envision into factorial matrix computation of the decision criteria (Bettman, 1979, p. 76).

As a matter of fact, the capital structure can be understood from the financial statements presented. It depicts business function in terms of performance and possibilities of expansion either through internal financing or external financing through equity and debt financing (David, 2003, pp. 190). Therefore, capital structure analysis provides an in-depth view of an important aspect of business performance which in turn influences decision making criteria by top management.

These decisions are translated into actual business opportunities of maximising performance (David, 2003, pp. 193). To potential investors, the performance of a company is measured by its capital structure since it gives adequate and accurate information that aids decision making science on best alternative investment (David, 2003, pp. 196). Capital structure analysis evaluates the viability of projects, and co functioning entities within a financial organisation (David, 2003, pp. 197-203). Besides, the results form a comprehensively done capital analysis is directly proportional to the magnitude of investment.

Analysis of the Capital Structure for Tesco and Sainsbury Companies

Nature of the capital structure of both companies

Tesco has been in the market since 1919. It is the third-largest retailer in the world dealing with general merchandise. The company operates in Asia, America, and Europe. The company deals in a range of customer-tailored products. Therefore, due to brand preference and popularity of their products, Tesco has endured being the most successful in expansionary policy to get a good share of the international market. In achieving this goal, the company has fully embraced technology through online sales and discounts to reliable customers (Tesco Annual Report and Financial Statements 2011).

On the other hand, undisputedly one of the top retail food stores, Sainsbury plc Company has been operational since 1869. The company has chains of stores and offers financial services. The group currently runs 350 supermarkets besides 300 shops. The customer base stands at 14 million per week in these stores. In order to affirm presence in the market, the company sold shareholding for its bank and currently owns half of it. Generally, the company is considered among the top five best performing grocery store in the world. Due to stiff competition, Tesco took over the mantle of market leadership from Sainsbury. Sainsbury has survived the competitive momentum in UK market while Tesco has emerged to be a world leader in the market within and without the UK.

Several interacting determinants can be credited to their continued popularity and control of market share in the retail business. Among these reasons is the comprehensive capital structure analysis that facilitates support and revitalisation of inventive business plan for expansion since both ventures are proven experts in the management of cash (Tesco Annual Report and Financial Statements 2011). Besides, these companies have properly tailored and research-based financial systems that help to improve efficiency through monitoring flows. Interestingly, besides retail business, Tesco has a banking business to its chain of operations.

The financial structure and management of these ventures have clearly indicated critical decision making science in business operation. For instance, these ventures have definite financial strategies that include debt, equity, and mixed capital investment financing. Capital structure analysis for these companies captures a period of five years to include key risk and cost capital, purchase and demand for each financial year, and corporate cash flows (Brealey, Stewart, and Franklin, 2008, p.40). These aspects are vital in determining the Weighted Average Cost of Capital (WACC).

Weighted Average Cost of Capital calculation for Tesco and Sainsbury Companies

These calculations are from the period between 2003 and 2007. The outcome is important in determining the capital structure for each company by comparing capital cost and gearing levels.

Capital Gearing = Long Term Debt/ Shareholders funds.

Income Gearing = Oprtating Profit/ Interest expenses

The table below shows the Gearing for Tesco Company.

(Deieda, 2007, p. 05).

The graph below indicates the relationship between income gearing and capital gearing for Tesco Company.

The table below shows the Gearing for Sainsbury Company.

(Deieda, 2007, p. 07).

The graph below indicates the relationship between income gearing and capital gearing for Sainsbury Company.

Comparison of Weighted Average Cost of Capital between Tesco and Sainsbury Companies

From the observation made on the above graph, it is apparent that Tesco is more stable and has managed to maintain its current debt level at approximately 39%. On the other hand, Sainsbury’s 2005 performance was dismal, increasing the level of debt in the immediate consequent year. In order to stabilise, Sainsbury must consolidate it is debt position and improve its capital structure (Campbell, 2005, p. 11).

Income Gearing Comparison between Tesco and Sainsbury Companies

The graph below shows Income Gearing Comparison between Tesco and Sainsbury Companies.

As indicated in the above graph, it is also apparent that Tesco’s performance is above that of Sainsbury. Specifically, Tesco’s income gearing is higher than that of Sainsbury across the five year period. This position indicates that Tesco is in a better position to comfortably service its liabilities than Sainsbury. Despite having higher volatile income gearing for the same period, Sainsbury is faced with the challenge of optimising debt level and increasing operating income to improve its standing on income gearing.

Weighted Average Cost of Capital calculation for Tesco Company

Equity

Number of shares outstanding = 78.24 m

Current Market Price per share= 460.25 p

Number of Warrants Outstanding= 0

Current Price per Warrant = 0

Current Beta = 0.7221

Risk-free Rate = 4. 61%

Market Return = 14. 36%

In this calculation, the calculation for market return is based on FTSE INDEX returns for this the last ten years. Also, an assumption is made on Risk-free rate to be yield of current UK bonds maturing in five year period (Deieda, 2007, p. 08).

Market Return =14.36

FTSE Index for 2007 = 6397

Debt

Book Value of Debt = 5553

Interest Expense on Debt = 216

Average Maturity = 8.77

Pre-tax Cost of Debt = 5.31%

Tax Rate = 30%

Book Value of Convertible Debt=0

Interest Expense on Convertible Debt = 0

Maturity of Convertible Bond= 0

Market Value of Convertible Bond =0

Debt Value of operating leases =147

Preferred Stock =0

Number of Preferred Shares= 0

Calculating Cost of Debt for Tesco Company

Cost of debt = Risk free rate + Default spread

However, Risk free rate= 4.61 and Default spread = 0.7

Thus, Cost of Debt (Kd) = 4.61+0.7=5.31%

Estimated Market Value of Debt of Tesco Company

In calculating the estimated market value of debt, the present value of interest expense is added to the present value of debt discount book value at n value of 8.33 and r at 5.31%

Thus,

=216 + 5553/1.0531 8.77+ value of debt of operating leases

=5014+147= 5161£

Cost of Equity

Ke = Rf + β (Rm – Rf) = 4.61 + 0.7221 (14.36 – 4.61)

= 11.65 %

Market Value of Equity

= Outstanding shares x share price

= 7870.24 * 460.25

= 36222.8 m pounds

Therefore, the WACC of Tesco Company is

=11.65 (36222.8/41236) +5.31 (0.7) (5161/41236)

= 10.23 + 0.46

=10.7%

WACC of Tesco = 10.7%

Weighted Average Cost of Capital calculation for Sainsbury Company

Equity

Number of shares outstanding = 1742.05 m

Current Market Price per share= 425.5 p

Number of Warrants Outstanding= 0

Current Price per Warrant = 0

Current Beta = 1.21

Risk-free Rate = 4. 61%

Market Return = 14. 36%

In this calculation, the calculation for market return is based on FTSE INDEX returns for this the last ten years. Also, an assumption is made on Risk-free rate to be yield of current UK bonds maturing in five year period (Deieda, 2007, p.10).

Market Return =14.36

FTSE Index for 2007 = 6397

Debt

Book Value of Debt = 2463

Interest Expense on Debt = 107

Average Maturity = 15.13

Pre-tax Cost of Debt = 5.61%

Tax Rate = 30%

Book Value of Convertible Debt=0

Interest Expense on Convertible Debt = 0

Maturity of Convertible Bond= 0

Market Value of Convertible Bond =0

Debt Value of operating leases =51

Preferred Stock =0

Number of Preferred Shares= 0

Calculating Cost of Debt for Tesco Company

Cost of debt = Risk free rate + Default spread

However, Risk free rate= 4.61 and Default spread = 1.0

Thus, Cost of Debt (Kd) = 4.61+1.0=5.61%

Estimated Market Value of Debt of Tesco Company

In calculating the estimated market value of debt, the present value of interest expense is added to the present value of debt discount book value at n value of 15.13 and r at 5.61%

Thus,

=107 + 5553/1.0531 8.77+ value of debt of operating leases

=2150+51= 2201£

Cost of Equity

Ke = Rf + β (Rm – Rf) = 4.61 + 1.21(14.36 – 4.61)

= 16.40 %

Market Value of Equity

= Outstanding shares x share price

= 1742 * 425.50

= 7404.6m pounds

Therefore, the WACC of Tesco Company is

= 16.4 (7404.6/9605) +5.61 (0.7) (2201/9605)

= 12.64 + 0.9 =13.54%

WACC of Sainsbury = 10.7%

Capital structure analysis

Between 2003 and 2007, Tesco recorded capital leverage of 49.21 and most of this was used in expansion via diversification investment. Besides, the income leverage indicated 42.52 per cent for paid interest on loans. In addition, part of this was used in securing balance for repaying obligatory debt. In comparison, Sainsbury’s financial statements for the same period indicated capital leverage at an average of 43.61% and income leverage at 3.9% (Deieda, 2007, p. 11).

Reflectively, this is not a desirable obligatory debt repayment position despite indication of strong determinants of investment. The risk-free rate for Tesco Company is at 4.61% with an average of 14.36% in terms of market returns (Tesco Annual Report and Financial Statements 2011). As indicated above, the cost of debt before tax for Tesco Company stands at 5.31%. In addition, the computed tax rate is predicted to rise to a high of 30%. This analysis put this company in the best position for potential investment.

For Sainsbury Company, the Weighted Average Cost of Capital is the same as that of Tesco Company but completely different in the percentage of debt before taxation at 5.61%. This is an indication of desirable conditions for confidence in the investment. The cost of Debt for Tesco is at 5.31% while that of equity at 11.65% (Tesco Annual Report and Financial Statements 2011). This translates into the equity market value of 36,222.8 million pounds. Tesco’s WACC rests comfortably at 10.7% (Deieda, 2007, p. 06).

In comparison, Sainsbury’s WACC is at 13.54%. Despite the difference in figures of WACC for the two companies, their position is confirmation of favourable condition for investment in both companies. The big percentage of WACC exhibited in Sainsbury is not enough reason to conclude that investors in Sainsbury are likely to if they invest in Tesco. Actually, Tesco has a higher stock preference than Sainsbury.

However, the major risk faced by Sainsbury is the exchange rates, liquidity, and credit risk. Under the risk of interest rates, the company is exposed to fluctuations in the market, considering the fact that some of its stores are outside the UK. In response, the company is laying down strategies aimed at matching interest rates profile and volatility minimising through managing an optimal mix between floating-link rates of interest, inflation, and borrowing.

After the swap of 2004, the net debt and fixed rate of interest rates balanced at 33% (Deieda, 2007, p. 05). Since 40% of its income is remitted in US dollars, the company is faced with the challenge of minimising leverages as a result of exchange rates volatility. Besides, the company is experiencing a liquidity risk, as indicated in the cash flows. However, these can be managed by property asset repayment for series of maturities. Thus, from the analysis, the liquidity contingent can be balanced by debt financing strategy (Collis and Hussey, 2007, p. 23).

Underlying Assumptions

The main underlying assumptions used in the calculation of Weighted Average Cost of Capital calculation for Tesco and Sainsbury Companies are that the government of the UK’s bonds for the analysis period taken to have risk free rate. Also, there is an assumption that there is a linear relationship between beta and return. Besides, Tesco and Sainsbury are assumed to be operating in a perfect market. In addition, the weighted average represents the Debt servicing period. Debt value of leases is represented Present value of operating leases. The annuity of previous year interest expenses determines the present market value of debt. Formulas of default spreads are theoretical from calculations by Prof. Damodaran. Moreover, the FTSE index is assumed to reflect the return on the market for the period of analysis (Eugene and Michael, 2009, p. 89).

Capital structure theoretical Reflections

Several theories exist in capital structure analysis. These theories are aligned on the assumption that capital structure decisions often affect the value of the firm at all levels by changing capital cost and expected earnings. Reflectively, earnings per share increase with an increase in leverage debt (Helfert, 2001, p.67). As a matter of fact, this continuous theoretical perspective fails to capture the conceptual framework of the main objective since leverage on capital cost remains unclear. According to capital structure theories, optimal capital structure only exists when the capital cost is affected by leverages.

According to Modigliani and Miller (1958):

“In the absence of taxes, bankruptcy cost, and asymmetric information, and in an efficient market, a company’s value is unaffected by how it is financed, regardless of whether the company’s capital consists of equities or debt, or a combination of these, or what the dividend policy is” ( Modigliani and Miller, 1958, p. 79)

Reflectively, this theorem functions on the assumption that different scenario is witnesses in cases when there is taxation and when there is no taxation (Brealey, Stewart, and Franklin, 2008, p.46). In the instance where there is taxation, by the interest of tax shield, there accrue certain benefits as leverage increase or is introduced.

On the other hand, in a scenario of no taxation, that is there is no tax shield, there are no benefits attracted such as value creation, by increasing leverages (Brealey, Stewart, and Franklin, 2008, p.46). This theorem best fit the underlying scenario as it aims to compare two companies. In the ideal, the theory best function in the comparison of two companies with one unlevered and the other levered. Should these companies adopt the same inference as identified, the theory concludes that they are the same (Erricos and Cristian, 2007, p. 54).

In the illustration, a potential investor will use this theory in determining the most suitable investment opportunity in two companies that exhibit more or less the same performance in the market. As a matter of fact, a levered company would provide a desirable opportunity for purchasing shares in order to achieve a desirable return on investment matrix. However, Modigliani and Miller (1958) assert that:

“There is an implicit assumption that the investor’s cost of borrowing money is the same as that of the levered company, which is not necessarily true in the presence of asymmetric information or in the absence of efficient markets. For a company that has risky debt, as the ratio of debt to equity increases the weighted average cost of capital remains constant, but there is a higher required return on equity because of the higher risk involved for equity-holders in a company with” (Modigliani and Miller, 1958, p. 89)

The key concepts in this theory are financial leverage (operating leverage, financial leverage, and combined leverage) and cost of debt.

On the other hand, trade-off theory explains the decision rationale for combining equity finance ad debt finance through balancing benefits and costs. Same as the pecking order theory of capital structure, this theory functions on the principle of agency costs, debt financing, and equity financing as tools for determining the capital structure of a firm.

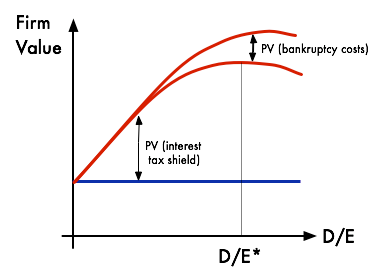

As shown above, optimal capital structure is created when leverage (debt-equity ratio) increases, creating a trade-off position between bankruptcy and tax shield (Helfert, 2001, p.69). Despite criticism by Myers, Trade-off Theory remains a favourite of most analysis since it a relevant interpretation of asset price changes and variations in the structure of capital. Besides, it is flexible in data matching and analysis.

Analysis of the Link Between Cost of Capital and Debt Level

When faced with different choices to make, companies opt for different approaches towards solving this matrix of finance, debt, and equity in financing expansionary goals or balancing assets and liabilities. Often, in the process of financing projects, companies strive to strike an optimal balance in choosing a mix of debt and equity as a remedy towards minimising capital cost for such a project (Brealey, Stewart, and Franklin, 2008, p.50).

The expected minimum return or the cost of capital must be monitored in order to keep the company in a comfortable position in financing debt and expansion. Reflectively, the company’s gearing level signifies the magnitude of debt in service as compared to equity. In application, debt and equity concepts have a series of costs and benefits to a company applying them in financial management.

In the theoretical perspective of capital structure, there is no relevant and quantifiable link between Cost of Capital and gearing level. Specifically, Modigliani and Millar’s theory asserts that gearing level does not affect capital cost in a company (Modigliani and Miller, 1958, p.23). This argument is backed by an assumption that different scenario is witnesses in cases when there is taxation, and when there is no taxation.

In the instance where there is taxation, by the interest of tax shield, there accrue certain benefits as leverage increase or is introduced (Brealey, Stewart, and Franklin, 2008, p.50). On the other hand, in a scenario of no taxation, that is, there is no tax shield, there are no benefits attracted, such as value creation, by increasing leverages. From these assumptions, an inference can be drawn to ascertain that capital structure doesn’t affect the market value of a company (Francis, 2010).

In addition, the MM theory seems to suggest that project cash flows are the key factors that affect the value of a firm (Damodoran, 1997, p. 56). Despite an increasing gearing level, the cost factor may remain constant or change at an un-proportional rate. Therefore, as the leverage of a firm increases steadily, the estimated cost of equity may respond by increasing slightly to balancer or offset the little gain on the increased leverage. However, the assumptions presented by MM theory lack credibility on the grounds of the assumption that calculations are done with no taxes is not the reality (Fahey,1999, p. 17).

As a matter of fact, taxes exist, and they have a substantial effect on the calculation. Besides, Cash on equity such as dividends cannot be deducted as the proponents of this theory claim. It is interest on the debt, which is taxable (Goldsmith, 2000). Also, the assumption that companies operate in perfect markets doesn’t hold ground as there are a series of temporary and prolonged swings that directly affect the capital structure in short and midterm.

Besides the MM theorem, Professor Durand’s traditional view of capital cost assumes that a variation in the equity-debt ratio directly affect the firm’s value since this variation will automatically change the magnitude of risk bore by shareholders (Damodaran, 1997, p.72). The higher the risks bore by these shareholders, the higher the returns these individuals will require in the form of compensation for bearing such high risks. Therefore, Professor Durand concludes that a company’s capital cost will increase when the equity-debt ratio increases by the same proportion (Damodaran, 1997, p.76).

In application, most companies in the contemporary business environment would rather prefer complete use of internal cash flows in financing their projects than engaging in external financing. Often, external financing would only be opted for when internal financing options are exhausted or not enough. In such a case, external financing would cover a smaller percentage of finances (Harrison & St. John, 2010, p. 56). This is because external financing often takes debit form. In addition, issues of Net Stock are often negatively that is, few shares are created following fresh stock issues than those repurchased (Deieda, 2007, p. 02).

Reflectively, debt ratios are different from one industry to another (Thomas and Lydia, 2003, p. 45). For instance, debt ratios are always low in firms with higher profitability than those with lower profitability. Besides, debt ratios are also lower in industries experiencing high growth and have numerous opportunities for investment. From the above reflection, I concur with the view that there is no direct relationship between capital cost and debt-equity ratio and gearing aspect cannot be proven.

Besides the above theories, is the trade-off theory, which appears more practical and relevant in market functioning. Like MM theorem, trade-off theory supports the declaration that no direct or observable relationship exists between capital cost and gearing (Steven, 2007, p. 24). According to this theory, the firm’s value is optimised by a certain debt-equity ratio. The optimal point is achieved when the tax shield present value is counterbalanced by present value bankruptcy cost (Have, Have, Stevens, Elst, & Pol- Coyne, 2003, p. 21). Though the theory presents a strong argument in optimising a firm’s value, it is silent on the procedure of calculating optimal capital structure or how the same is used in financial analysis (Brealey, Stewart, and Franklin, 2008, p.53). Brealy and other (2008) state that:

“Many opponents to the trade-off theory question how the theory actually explains capital structure decisions because there are many cases where corporate leveraging is much lower than what the trade-off theory suggests. Such opponents argue that many multi-national companies with high-profit margins have operated for an extended period with low debt ratios and achieved solid credit ratings. Trade-off theory would suggest that these same companies could achieve significant interest tax savings by increasing their debt ratios without any remote possibility of financial distress becoming an issue” (Brealey, Stewart, and Franklin, 2008, p. 56)

In addition to the trade-off theory is the Pecking order theory, which discusses a firm’s financial hierarchy. According to proponents of this theory, the underlying assumption is that firms prefer internal financing as compared to external financing as a remedy for minimising risk factor. Like the other theories, pecking order theory supports the declaration that there is no quantifiable link between balancing equity financing and debt financing when a firm has insufficient internal finance for expansion or undertaking projects (Oliver, 1980, p. 78).

Conclusion and Recommendations

From the above analysis and theoretical considerations, it is apparent that there is no quantifiable link between gearing levels and capital cost of a firm. Therefore, the assumption that there is a link between gearing levels and capital cost is irrelevant in studying the capital structure of Tesco Company and Sainsbury Company. However, it is a daunting task to draw a comprehensive and exact relationship between gearing levels and capital cost.

Therefore, identifying a proportional and direct link is without reach. Therefore, it is advisable and practical for a company to dig into other critical factors such as agency costs, bankruptcy costs, default costs, tax implications, business risk, and cost of debt servicing in deciding n the structure of its capital (Brealey, Stewart, and Franklin, 2008, p.56). According to David (2003):

“Both of these methods have their advantages and their disadvantages when examining the structures of capital financing. There is an abundant number of issues which must be explored. The most important aspect is to understand the different structures of capital financing so that it is possible to estimate the future profitability of a company and also, the management strategies in raising differing forms of finance. Information asymmetry does imply that ‘insiders’ will always have a greater knowledge bucket in comparison to external investors of a company, and therefore examining the different methods of capital structure does help to strike a balance in the vicinity of par towards those external to a company” (David, 2003, p.209)

The lower the level of debt with a correspondingly higher equity level, the more positive and reliable a company is in investment equity. Despite the variance in WACC, the two companies are stable and desirable for investment. Besides, both have a steady dividend despite a slight decline in earnings per share. Reflectively, these companies have been able to comfortably meet their financial obligation and have maintained desirable creditor confidence.

Due to some inconsistencies noted in Sainsbury’s performance, extrapolation is achievable through a balance between equity and debt financing with the equity financing taking a higher percentage. Generally, these companies are safe for potential investors since their performance is relatively steady, and they have strong capital structures. However, the aspects of social, technological, political, and economic changes should also be put into consideration, especially in long term engagement for a potential investor.

Reference List

Bettman, C 1979, An information processing Theory of Consumer Choice, New York: Addison-Wesley.

Brealey, A, Stewart, M, and Franklin, A. 2008, Principles of Corporate Finance. 3rd edn, Boston, MA: McGraw-Hill/Irwin.

Campbell, D 2005, Organizations and the Business Environment, 2nd edn, Elsevier: Butterworth- Heinemann.

Collis, J., and Hussey, R 2007, Business Accounting: An Introduction to Financial and Management Accounting, Basingstoke: Palgrave Macmillan.

Damodaran, A 1997, Corporate Finance: Theory and Practice, John Wiley & Sons, Inc.: New York.

David, E 2003, Financial analysis and decision making: Tools and techniques to solve, United States: McGraw-Hill books.

Deieda, L 2007, Capital Structure. Web.

Erricos, J., and Cristian, G 2007, Optimisation, econometric and financial analysis, London: Springer-Verlag.

Eugene, F., and Michael, C 2009, Financial management theory and practice, London: Prince Hall.

Fahey, L 1999, Competitors, New York: John Wiley & Sons.

Francis, J. C 2010, Corporate financial analysis with microsoft excel, New York: McGraw-Hill Companies, Inc.

Goldsmith, R E 2000, “How Innovativeness Differentiates Online Buyers,” Quarterly Journal of Electronic Commerce, vol. 1, no. 4, pp. 323-333.

Harrison, J., & St. John, C 2010, Foundations in strategic management ,Ohio: South Western Cengage Learning.

Have, S., Have, W., Stevens, F., Elst, M,. & Pol- Coyne, F 2003, Key Management Models, New York: Financial Times/ Prentice Hall.

Helfert, E 2001, Financial analysis, tools and techniques: Assessment of business performance, New York: McGraw-Hill books.

Mervin, W 1958, ‘Investment Banking Functions’, Bureau of Business Research, vol.3 no. 6, pp. 164-169.

Modigliani, F, and Miller, M 1958, The cost of capital, corporation finance and the theory of investment, New York: Wiley.

Oliver, R 1980, “A Cognitive model for the antecedents and consequences of satisfaction”, Journal of Marketing Research, vol.2 no. 4, pp.460-469.

Steven, M. B 2007,Financial Analysis a controllers guide: Financial analysis, 2nd edn, New Jersey: John Wiley & sons.

Tesco Financial: Tesco Annual Report and Financial Statements 2011. Web.

Thomas, F., and Lydia, L 2003, Essentials of financial analysis, New Jersey: John Wiley & Sons.

Appendix

List of Abbreviations

ROE………………………Return on Equity

Cp……………………….. Compare

ROA……………………..Returns On Assets

ROE…………………….Returns On Equity

WACC………………….Weighted Average Cost of Capital

Tables

Table 1.0 Gearing for Tesco Company.

Table 2.0 Gearing for Tesco Company.

Formulas

Capital Structure Ratio = long term debt / (shareholders equity + long term debt).