Introduction

A cruise is a company that operates ships either for transport purposes or for leisure activities. Ships are described as those that can also be exclusive for both purposes: transport or leisure. Cruising in particular requires very massive capital expenditures with high operating costs as indicated by Klein (65). The cruise lines keep on upgrading their services to ensure that they do not get eliminated from the market, and that their value continues to rise over time. This case study considers the operations of reputable cruises namely Carnival Corporation &Plc and Royal Caribbean Cruises Ltd. These two cultivate an image of classical elegance.

With regard to this case study and the computation of variable costs using the high-low method, we consider change in capacity levels and that of cost expenses. This method involves the use of data from a high-level activity and periods of lowest activity. From the case study, 2011 is considered a high-level period while 2009 is a low-level period. To get the unit variable cost, we divide change in expenses from high level to low level by change in capacity levels (Williams, 156-8).

Variable cost = high level expenses-low level expense / high capacity-low capacity

We can, therefore, get Carnival Corporation cost function by calculating the variable costs for payroll, food, operating expenses, depreciation, marketing and administration as follows.

Payroll; wages paid for services affects the cabin crew and as seen in the study 100% capacity is 1000 crews and 3000 passengers. In 2009, the capacity rose to 105.5% while that in 2011 was 106.2%. The ratio of composition is thus, 1:3’ to get the number of cabin crew in 2009, we multiply 105.5%by 1000 and divide by 100%. This gives us 1055, which represents crew capacity in 2009. Crew capacity in 2011 =106.2% x1000/100%

=1062 crew capacity

Variable cost per unit payroll= $ 1,723,000,000-$ 1,498,000,000/1062-1055

= $ 225,000,000/7 = $ 32,142,857

Therefore, fixed cost of payroll= total cost-variable cost

=$ 1,723,000,000 – $ 32,142,857 =1,690,857,143

To get the variable cost for food, we consider both the crew and passengers in capacity.

100% is comprised of 4000 people, in 2009 therefore we get the number by 105.5% x 4000/100% =4220. Computation for 2011 is 106.2% x 4000/ 100% = 4248 people.

Variable cost for food= $ 965,000,000- $ 839,000,000/4248-4220 = $ 4,500,000

Fixed cost for food =$965,000,000-$ 4,500,000 =$ 960,500,000

Operating activities affects everyone on bond.

Variable cost =$2,247,000,000 -$ 1,997,000,000 / 4248-4220 = $8,928,571

Fixed cost will be =$2,247,000,000- $8,928,571= $2,238,071,429

Selling and distribution expenses affects the passengers thus in 2009 we had 4220-1055 =3165 while in 2011 we had 4248-1062 =3186

Variable cost =$ 1,717,000,000- $1,590,000,000 / $3186-3165= $6,047,619

Fixed cost is thus = $1,717,000,000- $6,047,619 = $1,710,952,381

Depreciation is the other cost we calculate which affects the ship capacity

Variable cost =1,522,000,000- 1,309,000,000/4248-4220 = 7,607,143

Fixed cost= 1,522,000,000- 7,607,143 =1,514,392,857

From the variable and fixed costs realized we can derive the cost function for Carnival Corporation which is Y= a+bx where Y is total cost, a is fixed cost, b is variable cost and x is capacity levels. Total variable costs =8,144,000,000-7,233,000,000/4248-4220

Variable cost =33,607,143

Cost function is 8,144, 000,000=8,114,773,810+33,607,143x

For royal Caribbean capacity increased to 102.5% in 2009 and 104.8% in 2011. At full capacity the ship has 6000 passengers and 2000 cabin crew, ratio of 3:1. In 2009 thus the ship had102.5% x 8000/ 100% members on board =8200. In 2011, the ship had 104.8% x 8000/100% =8384 members on board.

Variable cost for payroll which affects crew =$ 826,000,000- $682,000,000/2096-2050

= $3,130,435

Fixed cost= total cost – variable cost = $822,869,565

Calculating the variable cost for food we consider all members on board.

Variable cost= $424,000,000-$345,000,000 / 8384-8200= 429,348

Fixed cost = $424,000,000- $429,348 = $423,570,652

Variable cost for operating activities =1,093,000,000-957,000,000/8384-8200

=$743,169

Fixed cost =$1,093,000,000-$743,169= $1,092,256,831

Marketing, selling and distribution expenses are affected by passengers.

V.C =961,000,000- 762,000,000 / 6288-6150= 1,442,029

Fixed cost= 961,000,000- 1,442,029=959,557,971

Depreciation variable cost =702,000,000-568,000,000 / 8384-8200

=728,261

Fixed cost =702,000,000-728,261= 701,271,739

Total variable cost =4,006,000,000-3,314,000,000 / 8384-8200 = 3,760,870

The cost function for Royal Caribbean is given by y=a+bx

4,006,000,000=3,999,526,758+ 3,760,870x

From the given financial accounting income statement we can format into management accounting as follows (Maher, Lanen &Anderson, 48).

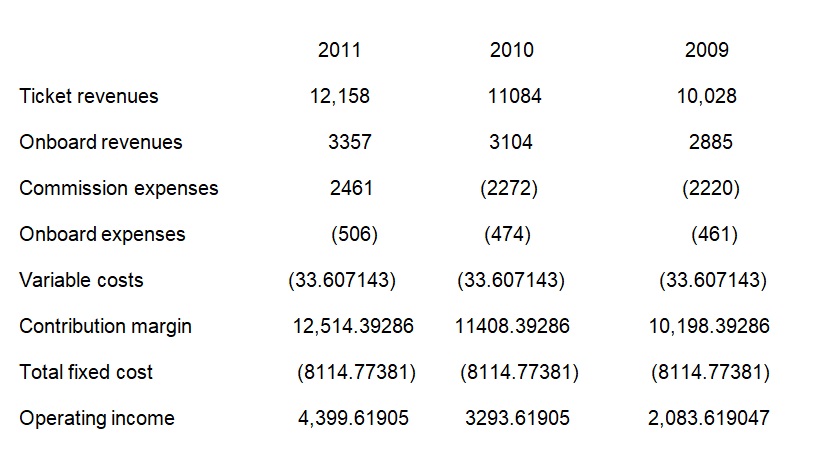

Carnival Corporation Management income statement for the year, 2011, 2010 and 2009

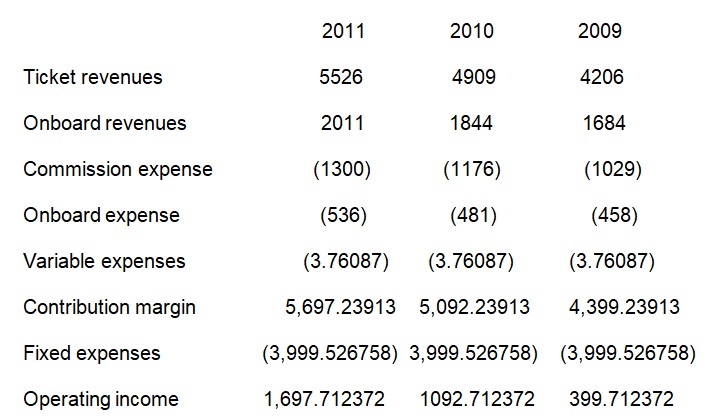

Royal Caribbean Management income statement for the year ended 2011, 2010 and 2009

From the case study, we can be able to calculate contribution margin ratio which is expressed as a fraction of revenues contributed (Kieso, Weygandt & Warfield, 9-22). Contribution margin helps us to get break even dollars by dividing total fixed expense with the margin value (Pindyk, 31-9). Also, we can get the margin of safety which is the difference between total sales and break even sales (Bragg, 137).

In regard with Carnival Corporation; total revenues amount to,

Year 2011= $12,158,000,000+ 3357,000,000 = 15,515,000,000

Contribution margin ratio= contribution margin / total revenue

=12,514,392,860 / 15,515,000,000= 0.81

Break even dollars for 2011= fixed expenses /contribution margin ratio

8,114,773,810 / 0.81 =1,001,823,927

Margin of safety for 2011= total revenue-break even revenue

=$15,515,000,000-1,001,823,927= $1,451,317,607

% margin of safety= 1,451,317,607/15,515,000,000 x 100 = 93.5%

Year 2010; total revenues= 14,188,000,000

Contribution margin ratio = 11,408,392,860 / 14,188,000,000 = 0.8

Break even dollars= 8,114,773,810 / 0.8 = 1,014,346,726

Margin of safety = 14,188,000,000 – 1,014,346,726 = 1,317,365,327

% margin of safety = 1,317,365,327/ 14,188,000,000 x 100 = 92.9%

Year 2009; total revenue = 12,913,000,000

Contribution margin ratio = 10, 198,392,860 / 12,913,000,000 = 0.79

Break even dollars= 8,114,773,810 / 0.79 = 1,027,186,558

Margin of safety =12,913,000,000 – 1,027,186,558 = 1,188,581,344

Margin of safety % = 1,188,581,344 / 12,913,000,000 x 100 = 92%

For royal Caribbean calculation for as follows

Year 2011; total revenues =7,537, 000,000

Contribution margin ratio = contribution margin / total revenue

= 5,697,239,310 / 7,537, 000,000 = 0.76

Break even dollars = 3,999,526,758 / 0.76 = 5,262,535,208

Margin of safety = 7,537,000,000- 5,262,535,208 = 2,274,464,792

% margin = 2,274,464,792 / 7,537,000,000 x 100 = 30%

Year 2010; total revenues = 6,753,000,000

Contribution margin ratio = 5,092,239,130 / 6,753,000,000 = 0.75

Break even dollars = 3,999,526758 / 0.75 = 5,332,702,344

Margin of safety = 6,753,000,000 -5,332,702,344 = 1,420,297,656

% margin = 1,420,297,656 / 6,753,000,000 x 100 = 21%

Year 2009; total revenue = 5890,000,000

Contribution margin ratio = 4,399,239,130 / 5,890,000,000 = 0.75

Break even dollars = 3,999,526758 / 0.75 = 5,332,702,344

Margin of safety = 5,890,000,000 -5,332,702,344 = 557,297,656

% margin = 557,297,656 / 5890,000,000 x 100 = 9.5%

In relation to the marginal income contribution we can compute the operating leverage which is a ratio of contribution margin and operating income. These two are directly proportional to each other an increase or a decrease will on the same note affect the other. For Carnival Corporation operating leverage for year 2011 is given as follows;

Operating leverage = contribution margin / operating income

= 12,514,392,860 / 4,399,619,050 = 2.8

For year 2010 operating leverage =contribution margin / operating income = 11,408,392,860/3,293,619,050 = 3.5

For year 2009 operation leverage = 1 0,198,392,860 / 2,083,619,047 = 4.9

From the case study we can also obtain operating leverage for Royal Caribbean as follows.

Year 2011 operating leverage = contribution margin / operating income

=5,697,239,130 / 1,697,712,372 = 3.4

For 2010 operating leverage = 5092239130 / 1092712372= 4.6

For 2009, operating leverage was = 439923913 / 399712372 = 1.1

We can therefore say that operating incomes changes at the same percent as the contribution margin changes (Kinney & Raibon, 337).

In regard to this case study we can derive that a 5% increase in revenue increase the income of Royal Caribbean at a greater margin than Carnival Corporation. This is because it is a large ship and enjoys economies of large scale operations. On the other hand, a decrease in revenue by 5% equally affects both companies’ income but carnival corporation income decreases at a greater rate. This is because a reduction in revenue does not equally reduce the expenses. Consequently, the contribution margin is reduced and in turn the income is seen to decrease. On the same note, Royal Caribbean enjoys large scale economies and thus income does not reduce at a gradual pace.

With regard to break even sales, operating leverage gives an insight on capital intensity. Capital intensity is the amount of fixed assets in relation to other factors of production. We can calculate the percentage of total assets, depreciation percentage of sales, assets turnover, ship asset turnover and capital spending over depreciation (Williams, Haka &Bettner, 214).

For both companies we consider year 2011 which is most recent thus more applicable. Considering Carnival Corporation; percentage of total assets = revenue realized / total assets x 100

= 15,515,000,000 / 38,637,000,000 x100 = 40%

Depreciation as a percentage of sales = depreciation / total revenue x 100

=1,522,000,000 / 15,515,000,000 x 100= 9.8%

Assets turn over = sales / total assets = 15,515,000,000 / 38,637,000,000 = 0.4

Ratio of capital spending over depreciation = 2,696,000,000 / 1,522,000,000 =1.8

Ship asset turn over =sales / book value of ship

15,515,000,000 / 32,054,000,000 = 0.5

For royal Caribbean the calculation are as follows;

Depreciation as a percentage of sales = depreciation / revenue x100

= 702,000,000 / 7,537,000,000 x 100 = 9.3%

Assets turn over = sales/ total assets = 7,537,000,000 / 19,804,000,000 = 0.4

Ratio of capital spending to depreciation = 1,174,000,000 / 702,000,000 = 1.7

Ship asset turn over = sales / book value of ship

= 7,537,000,000 / 16,935,000,000 = 0.4

From these ratios, we find that royal Caribbean is more capital intensive as compared to carnival corporations. Despite being a large ship, thus a bigger carrying capacity, it accrues more benefits and depreciation does not affect revenue realized as in the case of Carnival Corporation. It is, therefore, an added advantage for ships with wider capacity to operate despite their docking challenges.

In relation to the case study, operating small or large ships has its challenges. To ensure that there is no spread of diseases within the ship; onboard health facilities should be put in place. In the case of large ships reservation on activities is done on prior date thus does not give room for impromptu activities. This trait can scare away passengers. On the other hand, small size ships like Carnival Corporation offers limited cruising activities. This may limit the capacity interested to sail with the ship. With regard to the cost structure, a large size ship is economical to operate. Also, a lot of revenue is collected as it has a large capacity. As an investor, I would settle on Royal Caribbean so as to enjoy the economies of large scale operations.

To conclude, we can say that the cruise industry is a profitable business undertaking and investors should strive to ensure that the comfort of their clientele is prioritized. These companies should also work on getting various sizes of ships to suit the existing market demand and to ensure maximum profit levels.

Works Cited

Bragg, Steven. Accounting for Payroll: A Comprehensive Guide, NJ: John Wiley and Sons, 2004. Print.

Campbell, Harry & Richard Brown. Benefit cost analysis: financial and economic appraisal. New York: McGraw Hill, 2003. Print.

Kieso, Donald, Jerry Weygandt & Terry Warfield. Intermediate Accounting: Working Papers, NJ: John Wiley and Sons, 2010. Print.

Kinney, Michael & Cecily Raibon. Cost accounting: foundations and evolutions, London: McGraw Hill Publishers, 2008. Print.

Klein, Ross. The cost of cruising / The Vancouver observer, NJ: John Wiley & Sons, 2010. Print.

Maher, Michael, William Lanen & Shannon Anderson. Fundamentals of Cost Accounting. NY: Mc Graw Hill Publishers, 2005. Print.

Pindyck, Robert. Microeconomics, Pearson: Prentice Hall Publishers, 2008. Print.

Williams, Danvick. Introduction to Accounting. Pearson: Prentice Hall, 2003.Print.

Williams, Jan, Susan Haka & Mark Bettner. Financial and Management accounting. Englewood Cliffs, NJ: Prentice Hall ,2002. Print.