Introduction

This paper seeks to discuss the financial health of Krispy Kreme based on the analyses conducted, including depreciation analysis, company stock analysis, cash flow statement analysis, income statement trend analysis, and management analysis. In each case, the paper explains what the information conveys to management and will talk about how each tool is used to be analyzed Krispy Kreme’s financial statement. This analysis is expected to know how the company invests and manages its assets that would tell its financial stability prospects and the future. In addition, valuable information to investors and analysts is also expected to be generated from this exercise.

Analysis and Discussion

Depreciation Analysis

This part will evaluate how the company is depreciating its property plant and equipment on whether it is overstating or understating it. Overstating depreciation could be done by making life shorter while understating is doing the opposite. Doing, either way could misstate the financial statements or will not result in becoming a reliable basis for decision making.

The company claims that its property plant and equipment are to be stated at cost less accumulated depreciation and that the major renewals and betterments are charged to property asset accounts. It also provides depreciation on its property and equipment using the straight-line method over the estimated useful lives of its assets. The has the following life of its assets as follows: 15 to 35 years for Buildings; 3 to 15 years for Machinery and equipment—3 to 15 years; and the lower of useful life or lease term for its Leasehold improvements (A Financial Statement Information, 2004). Based on industry standards, it may be stated that the company is doing its depreciation fairly.

Company stock analysis

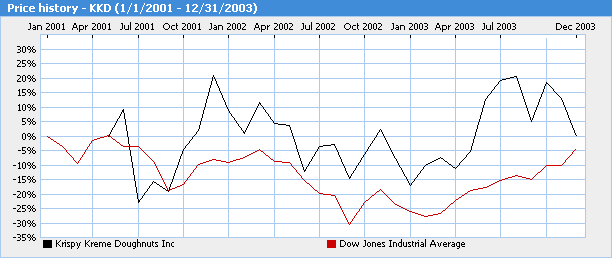

The company stocks have shown more increases than decreases for thee years 2001 through 2003. The following graph shows how the company has behaved in relation to Dow Jones Index.

It may be observed that in October since 2001 up to the end of 2003, the company’s stock price has performed better than those other firms in the industry using the Dow Jones Industrial Average.

Cash flow statement analysis

The main tool used in this analysis is the operating cash flow ratio (Meigs and Meigs, 1995), computed by dividing cash flow from operations by the current liabilities. As computed, the operating cash flow ratio amounted to 0.69 and 0.86 for the years 2002 and 2003, respectively.

The ratio is used to measure how well currently maturing obligations are covered by the cash flows coming from operations. It is another way of measuring liquidity in the short term. Liquidity will also form part of management analysis by measuring liquidity in terms of current ratio and quick assets ratio.

Income statement trend analysis

Income statement trend analysis pertains to the way of gauging the behavior of revenues and expenses for the company. As found, the company’s revenues exhibited continued growths with revenues of $300,715, $394,354, $491,549 for the years 2001, 2002, and 2003 respectively. See Appendix A. The behavior of the expenses may be taken from the net profit margins of 7% and 7% for the years 2002 and 2003 respectively in relation with the operating margins of 11% and 12% for the same years respectively. What could be deduced is that revenues are increasing, and yet operational efficiency is improving.

Management analysis

In this aspect, the paper will discuss how management is evaluated in terms of how it delivers for the financial health of the company in terms of profitability, liquidity, and solvency.

Profitability

The company is profitable in terms of its net profit margin and operating margin, as explained earlier. The company showed no change in net profit margin at 7%, but it improved in its operating margin. It could be deduced that the company may have performed more efficiently in 2003 as against 2002 if the operating margin, which increased from 11% t0 12% is used, but net profit margins were made equal because of a better result for nonoperating activities of the company.

The company’s return on assets (ROA) for the years 2002 and 2003, however, deteriorated although it was already too low compared with the return on equity (ROE), which also exhibited a 2% decline from 2002 and 2003. In terms of evaluating management, it may be inferred that the company has indeed performed a little better in 2002 than in 2003 using ROA and total asset turnover, which decreased from 1.54 to 1.20 for the same period under review. However, the ROE, which is more useful to investors, has shown better results compared with the industry average because of the related increase in stock prices, as shown earlier in Figure I. As far as the stockholders are concerned, the stock price is a better measure than ROE. What explains, therefore, the seeming slight deterioration between ROA and ROE may be in positive information about the company, which are not reflected in the books.

Liquidity

The company is also liquid, with the quick ratio improving from 1.49 to 1.73. This is still reinforced by the increase in the current ratio from 1.94 to 2.36. As stated earlier in the cash flow statement analysis, the company is indeed liquid.

In theory and practice, a company should have good liquidity by having a ratio of current or quick assets to current liabilities (Meigs and Meigs, 1995) to be at least one (1.0). This would mean that a company must be able to match 1 dollar from its current assets to every dollar of its currently maturing obligations.

Failure of a company to do this could result in bankruptcy and may force the company to stop operation. To illustrate, the salaries of its employees, which must come to every payday, cannot wait longer for people need to have their living expenses. The need for ready quick assets to match maturing obligations that normally include cash, marketable securities, short-term investments, accounts receivable, and notes receivable should be there. The company appears to have complied with this.

Solvency

The company debt to equity ratio deteriorated from 0.36 in 2002 to 0.5 in 2003, but the company may be said to be stable. This is confirmed by a slight change in the debt asset ratio for the same period. See Appendix A

Finance theory provides that solvency, like liquidity, also has something to do with the ability of an enterprise to pay its debts with available funds like cash which is presumed. This time solvency must be long-term, not short term as used in liquidity. Solvency, therefore, speaks for the financial stability of the company to survive short-term problems at it has sufficient investment from stockholders (Brigham and Houston, 2002) to match long term debt of the company together with currently maturing obligations.

Conclusion and Recommendation

Based on the analyses made, this paper recommends possible investment with if the Krispy Crème’s stocks as shown by based on the company’s profitability, liquidity, and solvency under the management analysis subsection and other positive indications using the other analytical tools. The depreciation analysis also showed that the company is not possibly overstating or under-depreciating hence information on depreciation expense as part of operating expenses is reliable for decision making. The company stock analysis showed that the company’s stock price is increasing, and this was supported by the result of management analysis, where the company was found to be profitable, efficient, liquid, and solvent. The cash flow statement also showed the capacity to meet currently maturing obligations by a positive operating cash flow ratio. The income statement trend analysis showed a continued increase in revenues and improvement of operational efficiency.

References

A Financial Statement Information (2004) Krispy Kreme’s Financial Statements, the McGraw-Hill Companies.

Brigham and Houston (2002) Fundamentals of Financial Management, Thomson South-Western, US.

Meigs and Meigs (1995) Financial Accounting, McGraw-Hill, London, UK.

MSN (2008) Graph of Stock Price, 2001 to 2003,Web.