Introduction

Financial planning is a critical aspect of management since it determines the feasibility of a business (Nunes & Machado 2014). In the dynamic business environment, it is important to integrate financial management tools (Myerson 2015). This report presents detailed financial projections of an automobile repair business. Specifically, the analysis focuses on fixed and variable costs, budgeted profit, cash flow, and breakeven analysis. In addition, the paper outlines the potential risks that the business might face.

Summary of the Business Idea

Gary Automobile Clinic is a modern motor vehicle service centre located in Tyson region and exists within the Automobile service industry. The company specializes in repairing vehicles and general service. The business targets saloon and SUV vehicles. Among the notable service charters include body repair, engine work, upholstery, and suspension. Although there are several competitors in the market offering the same services, the proposed business offers customized and bundled services in the form of standard and premium options for car repair (Sostrin 2013). The customization and bundled service charter is part unique competitive advantage (Oakland 2014). Another critical success factor is competitive pricing with the average price set at SAR15.06 per service bundle (Singh & Singh 2014). In addition, the company offers a series of after sales services such as free car wash and general waxing (Osterwalder & Pigneur 2013).

Outline and Discussion of Key Fixed and Variable Costs

Variable costs are expenses that change depending on the level of production output while fixed costs do not change whether productivity increases or decreases. In relation to Gary Automobile Clinic, the fixed costs are utility expenses, insurance, salaries, taxes, and rent. The variable costs are machinery, spare parts, production supplies such as oil and grease, utility costs, and sales commissions. The business will plan for fixed costs such as annual rent, the insurance premiums, annual salaries for employees, and fixed utility expenses such as electricity and water. At the same time, the company will experience changing costs associated with the number of service bundles sold. For instance, the cost of utilities such as gas, sales commissions, grease and oil, machinery, and spare parts will vary depending on the level productivity. The fixed and variable costs were estimated based on the expected productivity level for the first year of operation (see table 1).

Table 1. Fixed and variable costs.

The highest cost will be incurred in procuring spare parts. The most volatile costs are loan repayment and rent since they are fixed within a specified timeline (Osterwalder & Pigneur 2013). This means that the business has to balance its books to ensure that these two costs are met in a timely manner. In order to minimize costs, the business will manage the variable costs for each bundle of output from specific units of inputs.

Several assumptions were made in generating the values for fixed and variable costs. The first assumption is that the initial capital was set at SAR 154,000 with the intention of arranging a long-term bank loan of SAR 534,000. The loan will be taken at an interest rate of 10% payable after every three months (Monks & Minow 2014). The loan repayment will take four years. In calculating the cash flow, sales will be made on credit and cash with a 15-day outstanding account payable (Nobes 2014). The business intends to invest SAR 348,000 in property, equipment, and plant. This investment includes costs such as fittings, furniture, interior design, and office equipment (Marshall, McManus & Viele 2016). The business will be done in a rented premise with a fixed rental advance estimated at of SAR 99,600 for the period of 12 months.

Budgeted Profit for the First Year of Operation

For the year ending on 31st December.

Budgeted Cash Flow for the First Year of Operation

For the year ending on 31st December.

Balance sheet statement. As at 31st December.

Calculation of Breakeven Point and Margin of Safety

Calculation of the breakeven point was done by dividing the fixed costs with contribution for every unit of sale (Kiran 2016). In the case of the Gary Automobile Clinic, breakeven analysis was computed as follows.

Fixed costs

SAR498, 000

Contribution per unit SAR15.06

Breakeven point = Fixed costs/ Contribution per unit

498,000/15.06

33,068 units

The resulting value implies that for the revenues to match with the fixed costs, the company should sell at least 33,068 units of service bundles. At this point, there will be not losses or profits.

Breakeven point in terms of in sales value = BEP in Units x Sales price

33,068 × SAR 25.1

SAR 830,006.8

Breakeven point as a capacity percentage = BEP in Units x 100/Capacity in Units

33,068 × 100 / 50,000

66.14%

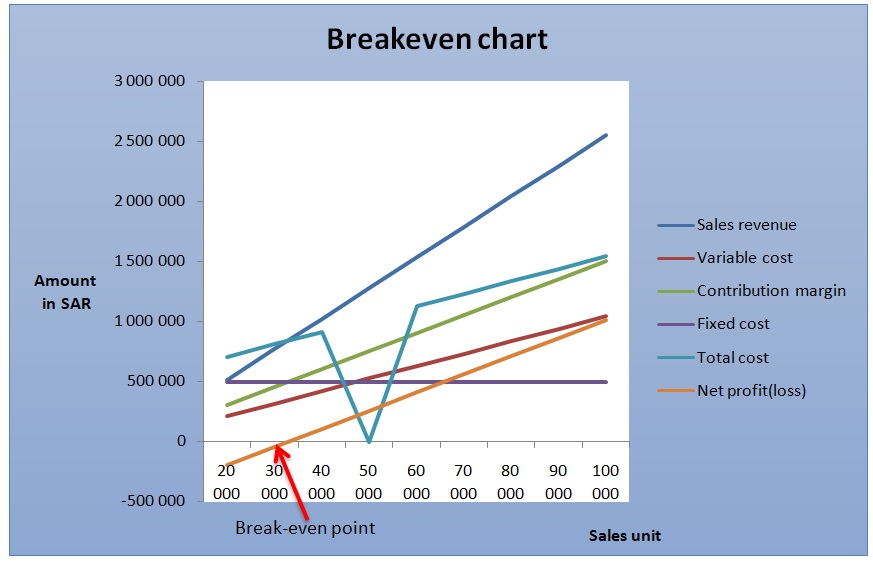

The calculations were used to generate a breakeven table to determine the margin of safety at various levels of cost and sales revenues (table 2).

Table 2. Breakeven table.

The values generated from the safety margin were used to generate a graphical representation of the revenue, value of sales, and breakeven point, which suggests that the margin of safety is low (Kimmel, Weygandt & Kieso 2014) (see graph 1).

Risks the Business Will Face

The business is likely to face risks associated with financial management (Blaxter, Hughes & Malcolm, 2014). The first risk would be inability to repay the loan when the business is not in a position to meet its projections (Brigham & Ehrhardt 2016). Another potential risk is the inability to get the proposed loan (Daft & Marcic 2016). The business might be forced to lower its fixed and variables costs, thus, the breakeven period might be elongated (Horner 2013). The third risk is market unpredictability. The forecasts were made with the assumption that the market will be receptive of this business idea and quickly accept its services (Damodaran 2016). However, in the event that the market develops differently than earlier predicted, the business might be forced to make adjustments that are likely to slow down its growth (Bryman & Bell 2015). The fourth potential risk is the people threat, since the business depends on certain kinds of employees. In the event of a high employee turnover, it may take a long time to recruit competent engineers to take over the operations (Gordon, 2013). For instance, the company will have to spend substantial resources in training its engineers to meet the market demand (Sostrin 2013). These costs might exceed the current allocation.

Conclusion

The proposed financial forecast was created for an automobile repair company called Gary Automobile Clinic. The estimated costs of starting the business were divided into fixed and variable costs. The plan also created a profit and cash flow statements. The values generated were used to calculate the breakeven point and estimate the margin of safety. When all other factors are held constant, the business is expected to breakeven within the first year of operations. The margin of safety is relatively low.

Reference List

Blaxter, L, Hughes, C & Malcolm, T 2014, How to research, Open University Press, Berkshire, UK.

Brigham, E & Ehrhardt, M 2016, Corporate finance: a focused approach, Cengage Learning, Boston, MA.

Bryman, A & Bell, E 2015, Business research methods, 4th edn, Oxford University Press, Oxford.

Daft, R & Marcic, D 2016, Understanding management, 10th edn, Cengage Learning, London.

Damodaran, A 2016, Damodaran on valuation: security analysis for investment and corporate finance, John Wiley & Sons, Inc. New York, NY.

Gordon, J 2013, Project management and project planning, Prentice Hall, New York, NY.

Horner, D 2013, Accounting for non-accountants, Kogan Page Limited, Philadelphia.

Kimmel, D, Weygandt, J & Kieso, D 2014, Financial accounting: tools for business decision making, John Wiley & Sons, Inc, New Jersey, NJ.

Kiran, D 2016, Total quality management: key concepts and case studies, Elsevier Science, New York, NY.

Marshall, H, McManus, W & Viele, F 2016, Loose leaf for accounting: what the numbers mean, McGraw-Hill/Irwin, New York, NY.

Monks, R & Minow, N 2014, Corporate governance, John Wiley & Sons, New York, NY.

Myerson, P 2015, Supply chain and logistics management made easy: methods and applications for planning, operations, integration, control and improvement, and network design, FT Press, New York, NY.

Nobes, C 2014, Accounting: a very short introduction, Oxford University Press, Oxford.

Nunes, C & Machado, M 2014, ‘Performance evaluation methods in the hotel industry’, Tourism & Management Studies, vol. 10, no. 1, pp. 24-30.

Oakland, JS 2014, Total quality management and operational excellence: text with Cases, 4th edn, Routledge, London.

Osterwalder, A & Pigneur, Y 2013, Business model generation: a handbook for visionaries, game changers, and challengers, John Wiley & Sons, New York, NY.

Singh, H & Singh, B 2014, ‘Total quality management: today’s business excellence strategy’, International Letters of Social and Humanistic Sciences, vol. 12, no. 32, pp. 188-196.

Sostrin, J 2013, Beyond the job description: how managers and employees can navigate the true demands of the job, Palgrave Macmillan, London.