Introduction

With increasing health awareness, in respect to increasing education levels, consumers are paying more attention to the ingredients of the drinks they consume.

The consumption of healthier drinks is increasing in a considerable rate. Consumers are now demanding more healthy and natural products.

Fruit/vegetable juice suffered as a result of the economic downturn, with this product area seeing marginal total volume sales decline.

However, sales proved more resilient than many product areas due to the health and wellness trend, with many switching from carbonates to fruit/vegetable juice as a result of its healthier and more natural image reconstituted 100% juice saw a better performance than more expensive not from concentrate 100% juice or nectars.

Market Growth rate of fruits & Vegetable juice industry

With economic disturbance all over the world, the disposable income of per person has decreased. The price has become one of the deciding factors in many countries. Due to which the buying capacity is adversely affected. Many companies are striving for the survival and the big companies are going for competitive strategies to maintain their sales level.

Consumers are preferring fruit and vegetable juice market over aerated drinks on the basis of health and price. This makes increased market growth rate for fruits & vegetable juice.

Competition in fruits & Vegetable juice industry

There is a cut throat competition going on in all over the world among all the major market leaders and the local companies. To survive it has become essential for them to come out with new competitive strategies.

With consideration of the Government policies of that particular country companies are taking different strategic decisions such as new product development, innovation in new flavors, new packaging, distribution etc.

Companies fighting for the market share in the juice market are:

Orangina Schweppes, Maspex Czech, Linea Nivnice, General Bottlers CR (PepsiCo), Kofola, Rauch, Coca cola co., Albi, JW childs, García Carrío, Eckes AJ, Dana dd,

Minute maid, Hain, Kraft foods, Tcx, Gat foods, Summer pride, Hiwa, Citrovita, Fructa.

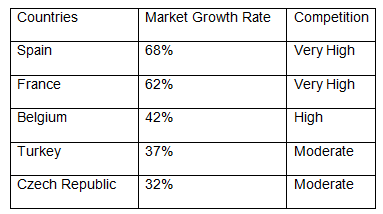

Country wise market growth rate analysis & competition

Spain

In Spain, Unemployment level is high and there is an impact on disposable income level due to Government measures. As a result, price is the deciding factor. With health and price in consideration fruit and vegetable juice market share is been increasing.

The retail share has been increased to 35%. The market growth rate in juice industry has gone up to 68% with very high competition amongst the companies.

(Country Report. Fruits/Vegetable Juice in Spain 2011)

France

In France, to increase the volume share the companies are heavily investing in new product innovation and communication campaign. With intense innovation it is very difficult for the company to launch new product development and at the same time maintaining the interest of consumers while pushing the sales.

The with all the marketing strategies the companies managed to increase the market growth rate up to 62% giving rise to a very high competition.

(Country Report. Fruits/Vegetable Juice in France 2011)

Belgium

In Belgium, Fruit and Vegetable industry is very fragmented. Many companies compete with each other. In 2010, Coca Cola was the market leader but with the innovation in new flavors and new packaging, the Minute Maid Brand had shaken the root of Coca Cola. Following same strategy Friesland Foods België has introduced new brands.

In fruit juice market private label companies accounted for 44% market share in Belgium. The market have reached to maturity level yet the market growth rate is 42% with high competition.

(Country Report. Fruits/Vegetable Juice in Belgium 2011)

Turkey

With increasing awareness of health and wellness, the fruit and vegetable market share is definitely increasing but still the market growth rate is at moderate level of 37%. The competition level is also moderate.

(Country Report. Fruits/Vegetable Juice in Turkey 2011)

Czech Republic

In Czech Republic, due to the unstable economic conditions consumer have reducing expenditure on non – essential products. When buying fruit juices, consumers prefer to buy juices with higher content of fruits. They constitute 68% of retail volume share in Czech Republic.

The fruit juice market may decline in coming years since the financial crisis have negative impact on the Czech Republic which in turn, will make the consumers more price sensitive. As a result, fruit juice will lose out to aerated drinks.

All the above factors lead to slow down the market growth rate to 32% with moderate competitiveness.

The table below summarizes the market research on market growth rate and competition among 5 countries.

Works Cited

Euromonitor International (2011) Country Report. Fruits/Vegetable Juice in Spain. Web.

Euromonitor International (2011) Country Report. Fruits/Vegetable Juice in France. Web.

Euromonitor International (2011) Country Report. Fruits/Vegetable Juice in Belgium. Web.

Euromonitor International (2011) Country Report. Fruits/Vegetable Juice in Turkey. Web.