Introduction

Internal and external business environments are central to determining shareholders’ value in a particular company. Apple Inc. is among the most successful tech corporations that deals with the manufacturing of consumer electronics and software services. While the company has strong financial muscle, its stock’s value is subject to monetary and fiscal policies. The global economy is recovering from the COVID-19 downturn and is expected to record slow growth in 2024. Economic, industry, and firm analyses are important in determining Apple Inc.’s intrinsic value.

Economic Analysis

2024 Macroenvironment

Although the global economy is recovering from the effects of COVID-19, the macroeconomic environment is expected to remain challenging in the coming years. One of the key issues that negatively impact the 2024 economy is the ongoing wars in Ukraine (Kilfoyle, 2023). Disagreement between Ukraine and Russia has disrupted the supply of essential products such as food and oil (Kilfoyle, 2023). Data by the U.S. Department of Agriculture (USDA) (2023) shows that food prices are predicted to rise by 2.1%. Additionally, the tough economic situation exacerbated by COVID-19 is likely to continue disrupting the global supply chain.

Gross Domestic Product (GDP) Change

Social, political, and economic factors impact the global GDP in various ways. The unstable political tension among the global superpower countries such as the U.S., Russia, and China harms GDP. Similarly, the recent Israel-Hamas war is likely to disrupt the distribution of oil in the international market (Hussein, 2023). Although there are negative forces against the GDP, adopted international and national measures after COVID-19 are bolstering the economy. Therefore, there is a possibility of an increased GDP in the following year.

While there is an expected positive growth in 2024, the change is insignificant. According to the 2024 outlook report by Goldman Sachs (2023), worldwide GDP is forecast to expand by 2.6% in 2024 on an annual average basis. Despite the positive change in the global economy, inflation is estimated to fall from the current 3% to about 2.5% (Goldman Sachs, 2023). The improvements in the overall economic growth are augmented by effective policies and improving ease of employment in the coming months. There is a need to adopt realistic and effective strategies for a rapidly improved worldwide economy.

Fiscal Policy and GDP

Fiscal policies involve the use of taxation and government spending to influence economic changes. Expansionary fiscal policies were adopted by various governments, allowing them to increase their spending while reducing taxes. Consequently, there is stimulation of the overall economy since there is a lowered cost of living. Expansionary policies positively impact GDP by restoring commodities’ price stability (Gaspar et al., 2023).

On the other hand, tightening fiscal policies involves reduced government spending and high taxation (Gaspar et al., 2023). The latter policies negatively affect GDP for the short term before the economy picks up. The improved adoption of expansionary fiscal policies by the majority of global governments is the key driving force to improved 2024 GDP.

Monetary Policy and GDP

Tightening and easing monetary policies are influential on the change in 2024 GDP. The majority of governments, through their central banks, have tightened their monetary policies in response to rising global inflation. Increasing interest rates is one of the tightening strategies adopted to counter inflation. For instance, in the U.S. the Central Bank hiked the rates by 0.25% in February, making them range between 4.5% to 4.75% (Pinter & Walker, 2023). The currently adopted tightening policies are expected to slow down the GDP growth by about 0.5%, explaining the slight change in the 2024 economy (Gourinchas, 2023). Although easing policies positively impact GDP, they are inappropriate following the rising global inflation.

Overall Economic Activity and Stock Market

The Index of Leading Indicators (ILI) is important in predicting the business cycle in the coming year. Purchasing Managers Index (PMI) is among the key ILIs that help in understanding whether there an increasing or decreasing orders for manufactured goods. The latest PMI produced by S&P Global shows that it fell from 50.5 in September to 50.0 in October 2023 (Pan, 2023). The data indicate that there is a slight fall in marketing activities in the manufacturing sector. The PMI indicates stagnant marketing activities in the coming year.

Another key ILI is the S&P 500 Index, which indicates the businesses’ value and stockholders’ nominal wealth. According to the data by Goldman Sachs, the S&P 500 is predicted to end at 4700 in 2024, a 6% rise (Reuters, 2023). Consequently, the stock prices are likely to go high in 2024, increasing business value. Therefore, selling and buying activities in the stock markets may increase in 2024, encouraging more investments. The estimated PMI and S&P 500 stock indices show a slightly positive business cycle in 2024.

Industry Analysis

Apple Inc. Primary Industry

Technological advancements have led to the development of smart devices for improved communication. Apple Inc. operates in consumer electronics as its primary industry. The sector is involved in the manufacturing of smartphones, laptops, personal computers, and other electronic devices (Lu et al., 2022). Consumer electronics is a cyclical industry and is affected by various internal and external conditions. Therefore, external economic changes affect the industry, fluctuating the demand for electronic goods such as laptops and mobile phones (Lu et al., 2022). COVID-19 and other natural pandemics negatively affect the operations in the consumer electronics sector.

Stage of Industry Life Cycle

Introduction, growth, shakeout, maturity, and decline are five stages that industries undergo. The initial phase, introduction, involves the emergence of new businesses in the market as they try to exploit new opportunities (Bodie et al., 2022). Growth is the second and one of the most significant stages of a particular industry. During this stage, sales rapidly take off as new entrants come into the market. At the shakeout phase, there is stiff competition among businesses with the majority adopting strategies to allow them to remain afloat in business. Maturity and decline stages involve sales leveling out and the industry’s end, respectively.

The consumer electronics sector in which Apple Inc. operates is at the maturity stage of the industry life cycle. Dominating companies such as Apple Inc. and Samsung Electronics have achieved economies of scale. The corporations have a well-established loyal consumer base who solely depend on their services (Bodie et al., 2022). Additionally, the competitive landscape is clear in the industry, with giant companies setting value-based prices for their goods. Furthermore, new entrants and small competitors are hampered from entering the market since Apple Inc. and Samsung Electronics have a giant market share (Bodie et al., 2022). Investing in Apple Inc. stocks can be profitable, given the stage of the industry life cycle.

Financial Ratios Trends

Financial ratios are crucial in determining performance in a given industry. The consumer electronics industry presents some key ratios that can be used in understanding its future outlook. Return on equity (ROE) helps in determining an industry’s net income divided by the shareholders’ equity. According to CSIMarket (2023), the sector is among the best performers in terms of ROE. For instance, in the third quarter of 2023, the industry recorded an average ROE of 23.48% and was ranked number 8 among other sectors (CSIMarket, 2023). Additionally, return on investment (ROI) determines the performance of a given investment in a particular industry. The consumer electronics sector’s 2023 ROI was averaged at 9.02% (CSIMarket, 2023). ROE and ROI are important ratios when making investment decisions in a particular business.

Although the sector’s ROI and ROE show that it is worth investing in the business, they have been declining in the past reporting months. For instance, during the third quarter of 2022, the ROE was at 45.85%, while the ROI was at 17.4% (CSIMarket, 2023). The declining trend of the two financial ratios is associated with tough economic conditions exacerbated by the fiscal and monetary policies adopted to counter post-COVID-19 effects (Lu et al., 2022). Additionally, the sectors seem to perform better than in 2021, when the pandemic emerged. On average, the ROE and ROI are above the industry average, making the consumer electronics sector profitable.

Competitive Forces

Various social, political, and economic factors shape competition in the consumer electronics sector. Firstly, there is an increasing bargaining power among the suppliers due to the decrease in the raw materials needed in the industry (Nygaard, 2022). One of the key causes of stronger supplier power is the ongoing debate and government legislation on circular economy. Consequently, many electronics companies, such as Apple Inc., are finding it difficult to source cheap raw materials. Secondly, there is a threat of new entrants in the industry who are attracted to the rapidly advancing technologies. The emergence of intelligent technologies and improved communication systems is outdoing the traditional ones.

Thirdly, there is intensified competition rivalry in the market, disfavoring small corporations. Companies such as Samsung Electronics and Apple Inc. are launching new products almost every year (Nygaard, 2022). Moreover, advanced innovation and differentiation in the industry have led to the setting of competitive prices (Bodie et al., 2022). Lastly, the global and national regulatory environment is putting pressure on the sector to adopt eco-friendly approaches in their operations. Such requirements are costly to fulfill, given the financial and human resources needed to come up with sustainable services. Therefore, strong supplier power, threat of new entrants, intense rivalry, and strict regulations are key competitive forces shaping the consumer electronics industry.

Industry Future Outlook

The consumer electronics industry is expected to continue growing due to the current social, economic, and political factors. As technology advances, there is increased demand for devices such as smartphones and laptops (Bigliardi et al., 2022). Additionally, the increasing adoption of working from home among business organizations is further alleviating product and service demands in the industry (Wang & Liu, 2022). Furthermore, significant efforts by governments to integrate and embrace digitization in various ministries and sectors bolster the positive future for companies such as Apple Inc. Although the sector’s future seems optimistic, there is an increasing fear of the most appropriate sustainable approaches in the industry to curb the effects of climate change on its operations.

Firm Analysis

Apple Inc. Stocks

The positive future outlook for Apple Inc. and other companies in the consumer electronics sector is attractive to investors. As of November 16, 2023, Apple Inc. stock price was at $189.71 (Apple, 2023a). The price had skyrocketed from $145.97, which was the opening price on January 1, 2023 (Apple, 2023a). Factors such as the improving global economy during the reporting period are likely to have positively impacted the high stock value. Additionally, the company’s involvement in launching new products may have increased the value of the stocks.

Stock Valuation

Stock valuation is crucial for investment activities in the financial market since it helps investors know the value of their investments or stocks. Absolute and relative are the two major categories of stock valuation that are used by investors (Bodie et al., 2022). While absolute valuation relies on the company’s information, the relative one compares potential investments in similar companies (Bodie et al., 2022). Apple Inc.’s stock valuation will help in forecasting the company’s dividend per share and the likelihood of attracting potential investors.

Dividend Discounts Models (DDMs)

Quantitative methods are applied to predict the value of a company’s stock for informed investment decisions. DDMs are applied and operate on the theory that a company’s present-day stock value is worth the total future dividends when discounted back (Bodie et al., 2022). Constant growth DDM and multi-stage DDM are two models that can be used to estimate a stock value (Bodie et al., 2022). While the constant growth DDM solves for the present value of future dividends, the multi-stage one builds on the former through the application of a multitude of growth rates to the calculation. Therefore, the multi-stage DDM involves an unstable initial growth rate and is flexible.

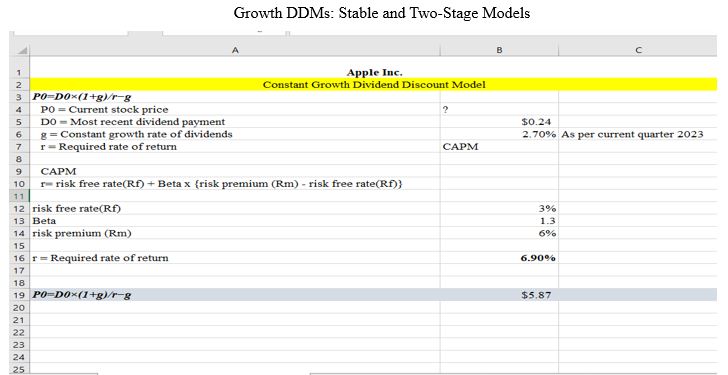

Apple Inc. Stock Valuation: Constant Growth DDM

The application of the constant growth DDM is based on some assumptions. The model assumes that dividends are suitable measures for the company’s stock valuation (Mondello, 2023). Additionally, the formula used in calculating the firm’s future dividend assumes that the required return on equity and the growth rate of dividends will remain constant forever (Mondello, 2023). Furthermore, the dividend growth rate is expected to always be lower than the required return of Apple Inc.’s equity.

The company’s current market stock price is $189.71, as reported on November 16, 2023 (Apple, 2023a). On the other hand, Apple Inc.’s recent dividend payment (D0), recorded on 13th November and paid on 16th November 2023, is $0.24 (Apple, 2023b). The company’s constant growth rate in dividends (g) of the third quarter of 2023 is 2.70% (Apple, 2023b). The company’s required rate of return (r), as calculated, is 6.90%. The company’s future dividend payment is estimated at $5.87, which is higher than the recent payment. Figure 1.0 (Appendix) shows the application of constant DDM in valuing Apple Inc.’s stock.

Apple Inc. Stock Valuation: Multi-Stage DDM

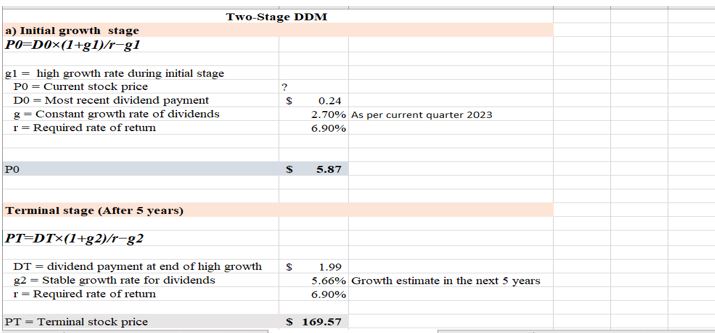

As noted earlier, the multi-stage DDM expands on the constant-growth DDM. A basic two-stage DDM model was applied in determining Apple Inc.’s terminal stock price beyond perpetuity. The application of the model was based on some key assumptions on dividend growth rate and transition period.

It was assumed that Apple Inc.’s dividends would grow at a stable rate during each stage with a higher rate during the first and a lower during the second stage (Bodie et al., 2022). Additionally, a transition period between the stages was assumed, with the dividend rate of growth shifting from a high to a stable low. Upon calculation, Apple Inc.’s terminal stock price is found to be $169.57, which is lower than the company’s market price, as shown in Figure 2.0 (Appendix).

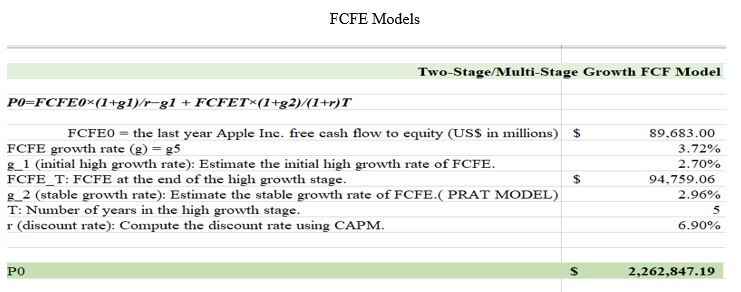

Free Cash Flow (FCF) Forecast

FCF forecast is applied to account for changes in the company’s working capital. Investors can know the amount of cash that Apple Inc. generates and is available to be distributed to the shareholders by applying the free cash flow to equity (FCFE) models. Stable growth and multi-stage FCFE models are applied to Apple Inc.’s stock valuation.

Apple Inc.’s stable growth FCFE shows a rate of 3.72%, indicating that the company has taken various measures to expand its cash flows. Consequently, there is more money available to be distributed to shareholders. For the multi-stage FCFE model, the cash flow during the lowest growth rate is $89,683.00, while during the highest is $94,759.00, as shown in Figure 3.0 (Appendix).

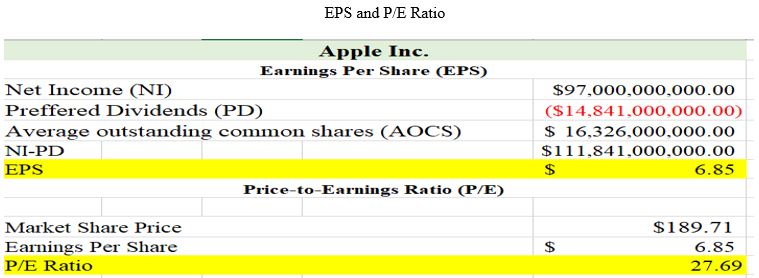

Estimated Stock Price

Apart from the DDMs and FCFE, the firm’s price-to-earnings (P/E) ratio and earnings per share (EPS) can further help in valuing Apple Inc. stock. The company has an EPS of $6.85 with a P/E ratio of 27.69, which is slightly above the average of 20 to 25, as shown in Figure 4.0 (Appendix). Micro-environment factors such as stiff competition and strong supplier power may have the cause for the poor P/E ratio. Apple investors spend more money for each dollar that the company earns. Similarly, the DDMs showed that the firm’s stock fair value is $169.57, which is lower than the market value of $189.71. Therefore, the company’s shares are overvalued and can potentially yield less income., making it unwise to invest in it.

Conclusion

Although advanced technological developments make the sector worth investing in, stock valuation of tech companies can give deep insights. Apple Inc. is one of the tech giants that dominate the industry. The monetary and fiscal policies adopted by various governments have helped counter the effects of COVID-19. 2024 GDP is estimated to be positive but with slow growth. A similar trend is observed in Apple Inc. since indicators such as the P/E ratio show potential losses. The overvaluation of Apple Inc.’s current market stock prices and potential slow economic growth in 2024 makes it unwise to invest in Apple Inc.

References

Apple. (2023a). Apple – dividend history. Web.

Apple. (2023b). Apple – stock price. Web.

Bigliardi, B., Filippelli, S., & Quinto, I. (2022). Environmentally-conscious behaviours in the circular economy. An analysis of consumers’ green purchase intentions for refurbished smartphones. Journal of Cleaner Production, 378. Web.

Bodie, Z., Kane, A., & Marcus, A. J. (2022). Essentials of investments (12th ed.). McGraw-Hill Education.

CSIMarket. (2023). Consumer electronics industry management effectiveness information and trends by quarter, ROE, return on assets, return on investment from 4 Q 2020 to 4 Q 2019. Web.

Gaspar, V., Goncalves, C. E., Mauro, P., & Poplawski-Ribeiro, M. (2023). Fiscal policy can help tame inflation and protect the most vulnerable. IMF. Web.

Goldman Sachs. (2023). The global economy will perform better than many expect in 2024. Goldman Sachs. Web.

Gourinchas, P.-O. (2023). Resilient global economy still limping along, with growing divergences. IMF. Web.

Hussein, F. (2023). Oil prices could reach “uncharted waters” if the Israel-Hamas war escalates, the World Bank says. AP News. Web.

Kilfoyle, M. (2023). Ukraine: What’s the global economic impact of Russia’s invasion?Economics Observatory. Web.

Koyfin. (2023). Apple Inc. (AAPL) Dividend Date & History. Web.

Lu, W., Kweh, Q. L., Ting, I. W. K., & Ren, C. (2022). How does stakeholder engagement through environmental, social, and governance affect eco‐efficiency and profitability efficiency? Zooming into apple inc.’s counterparts. Business Strategy and the Environment, 32(1). Web.

Mondello, E. (2023). Dividend discount model. In Applied fundamentals in finance: springer texts in business and economics (pp. 261-287). Springer Gabler.

Nygaard, A. (2022). The geopolitical risk and strategic uncertainty of green growth after the Ukraine invasion: How the circular economy can decrease the market power of and resource dependency on critical minerals. Circular Economy and Sustainability, 3. Web.

Pan, J. (2023). Monthly PMI bulletin: November 2023. In IHS Markit. Web.

Pinter, G., & Walker, D. (2023). Hedging, market concentration and monetary policy: A joint analysis of gilt and derivatives exposures. Social Science Research Network. Web.

Reuters. (2023). Goldman sees S&P 500 rising to 4700 by year-end 2024. Reuters. Web.

USDA. (2023). Summary findings: Food price outlook, 2023 and 2024. Web.

Wang, C.-H., & Liu, C.-C. (2022). Market competition, technology substitution, and collaborative forecasting for smartphone panels and supplier revenues. Computers & Industrial Engineering, 169. Web.

Appendix