Steps in Planning the Audit

Audit plans are usually developed to review a company’s financial statements and assess their credibility and reliability as accurate depictions of a company’s financial position. As a senior partner for Deloitte, in this report, I outline the critical steps inherent in planning an audit of Aramark Inc., which is a multinational company that specializes in the provision of food, facilities, and uniform services to different clients who operate in (but not limited to) the education, health care, and leisure sectors around the world. The steps outlined in this paper are based on general audit planning procedures undertaken by companies in the US and Europe.

According to Kerr (2013), the audit process should comprise of three main phases that include planning, fieldwork, and reporting. For purposes of this report, we only focus on the planning phase, which includes five main steps – understanding the organization’s internal control processes, assessing the risk of material misstatements, planning the materiality level, developing a response to assessed risk, and overall audit strategy, structuring the administrative framework for implementing the audit strategy and assessing the need for experts. These steps also outline the critical and inherent steps we will use in planning and designing an effective audit program for Aramark. These steps appear below.

Understand the Organization’s Internal Control Processes

Aramark, being a global organization, has several internal control processes that could affect the company’s potential for reporting financial misstatements. Modar (2013) supports this view because he says that an organization’s internal control processes could increase the risk of financial misstatements, if not properly supervised, or decrease the risk of the same if management allocates enough resources to the process. Evaluating the company’s internal processes should be a critical step in developing the audit program for Aramark because it would assist Deloitte (later on in the audit process) to design effective auditing procedures. In understanding the organization’s internal control processes, we would look at different aspects of the company’s internal control processes, including understanding its general nature and characteristics, investigating existing controls that are relevant to the audit strategy, assessing the nature and extent of the relevant controls, and reviewing the components that are relevant to the organization’s internal controls. Broadly, these steps would help us to understand the organization’s control processes.

Assess the Risk of Material Misstatements

Assessing the risk of material misstatements is also a key step in developing the audit program for Aramark because it would help us to review the risk of material misstatements at different financial and assertion levels. When assessing these risks, it would be pertinent for the auditors to understand the impact of inherent and control risks in the assessment process. By doing so, it would be easy to determine the acceptable level of detection risk. The same process would also dictate the kind of audit procedures to follow, which would ultimately add to the process of formulating the general audit strategy. The risk of material misstatement may be assessed based on different criteria, including assessing the possibility of misstatements due to fraud, or the failure to comply with specific laws and regulations (Kerr, 2013). Comprehensively, this step would help us to assess the risk of material misstatements.

Plan the Materiality Level

Planning for materiality will also be an important step in the audit planning process because it will provide an indicator of how financial misstatements could affect how users make decisions regarding the company’s financial direction. The process will be a product of what is already known about the audit planning process, plus an assessment of risks that are associated with the process. This step of the audit process would also include the process of formulating procedures on how to calculate materiality (here, materiality includes both planning and performance materiality). This step is critical in helping us to understand the significance of the risks we will evaluate.

Develop a Response to assess Risk and Overall Audit Strategy

This stage of the audit planning process involves the development of an appropriate response to review assessed risks. The response could be to counter challenges in the development of the overall audit strategy or the detailed audit plan. The process should typically involve documenting decisions about the timing and scope of the audit tests (Modar, 2013). It should also involve a compilation of important details surrounding Aramark’s business processes, corporate strategies, and organizational objectives. In the process, we will document how the company is managing its risks and how such processes would affect the overall audit strategy.

This way, we will be able to understand the linkage between the client’s risk management process and our overall audit plans. This process will also lead to the development of an informed audit plan, which will help us to comprehend the resources needed in executing it. The audit strategy would contribute to the development of the audit plan. In other words, the results of the risk assessment process would help us to gain a better understanding of the financial practices of Aramark. Some additional steps we may consider in this process include assessing the business risk to establish materiality, assessing the need for experts, evaluating the possibility of non-compliance with existing laws and regulations, identifying related parties, conducting preliminary accounting processes, and considering additional value-added services (Modar, 2013).

Plan the Administrative Structure

The process of planning the administrative structure refers to the need to form a qualified audit team to implement the audit plan. This team should have adequate knowledge, skills, and experience of doing so. The team may also involve experts who may be versed in different specialized fields of auditing. The specialized areas may include information technology or actuarial science sectors. However, such professionals need to be booked in advance; otherwise, they may be unavailable when undertaking the actual audit process for Aramark. Since the activities of the company are spread in different countries, travel and accommodation plans may also need to be made in advance to facilitate the movement of the auditing team across different audit centers.

Assess the Need for Experts

The last step of our audit planning process involves an assessment of the need for experts because some of the accounting processes of Aramark are detailed and expansive. According to the auditing standards (ISA 620), an auditing expert is a person whose skill sets are not necessarily tuned to fit the accounting field, but whose contributions would help an auditor to make an informed judgment about the auditing process (Gbalam & Ebimobowei, 2013). Depending on the kind of job that the expert may be required to do, he/she may be recruited from within the Deloitte firm or outside it. The expert may be required to help us with several tasks associated with the audit process, including (but not limited to) interpreting international laws and regulations governing the financial activities of Aramark, computing fair values, valuing financial instruments, and such processes. Comprehensively, these processes outline the inherent steps in our audit plan.

Performance Ratios and Analytical Procedures

The analytical tools used in planning the audit will serve as instruments for directing the procedures characterizing the auditing process. They will be important in the audit process because they would help us to understand the timing and scope of the audit process. The purpose of including these analytical procedures in the audit plan is to increase our understanding of Aramark’s processes. It is also supposed to help us identify unknown audit risks that may occur because of unspecified, or unbalanced, relationships in the overall data (Gbalam & Ebimobowei, 2013). There are at least four types of analytical tools in auditing processes. They include regression analysis, computation of ratios using financial and non-financial data, computation of significant ratios, and account balance comparison (Kerr, 2013).

For purposes of this auditing process, we will use three analytical processes – account balance comparison, computation of significant ratios, and computation of ratios using financial and non-financial data. The focus on these analytical methods affirms the views of Modar (2013) who says that most auditing processes are based on simple quantitative techniques, such as ratio and trend analyses. However, our decision to use multiple selections of analytical methods stems from the difficulty in relying on one substantive test as the main basis for the audit process because one test alone does not provide the precision required for such an exercise. We will use the current ratio and debt-to-equity ratios as the main performance ratios for this assignment. The balance sheet and income statements are two accounts that we would use to test the ratios.

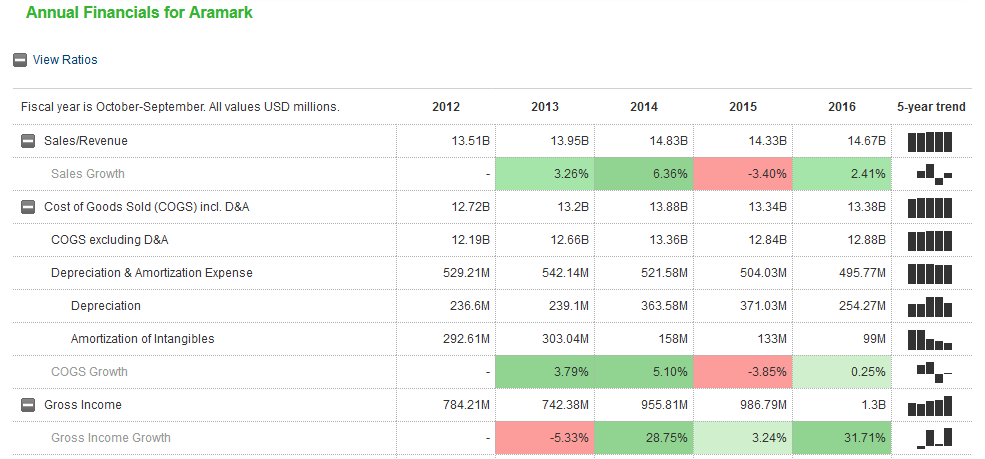

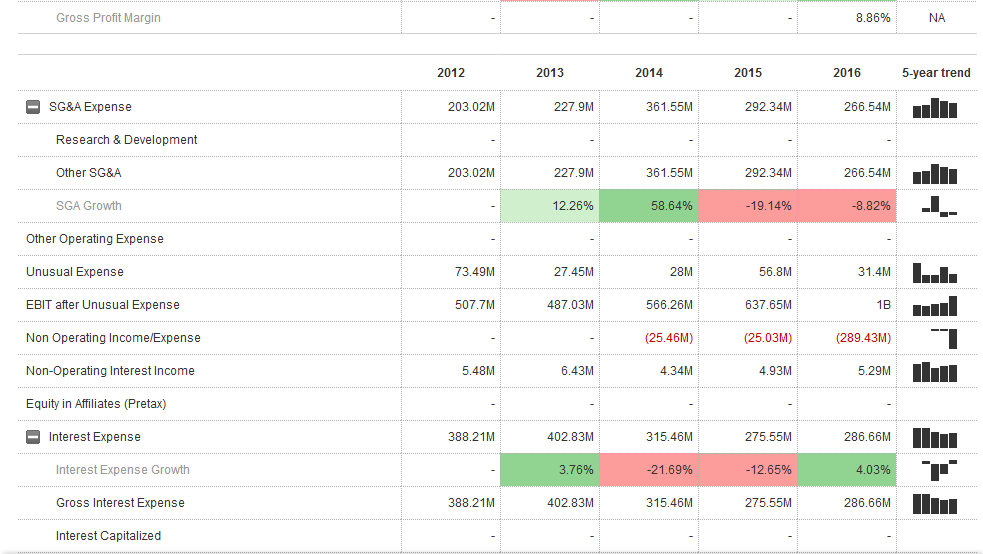

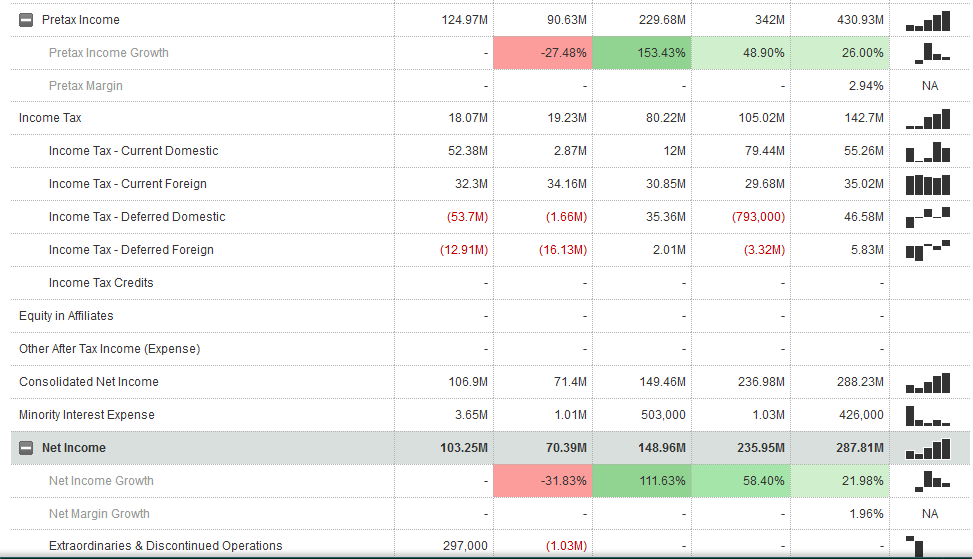

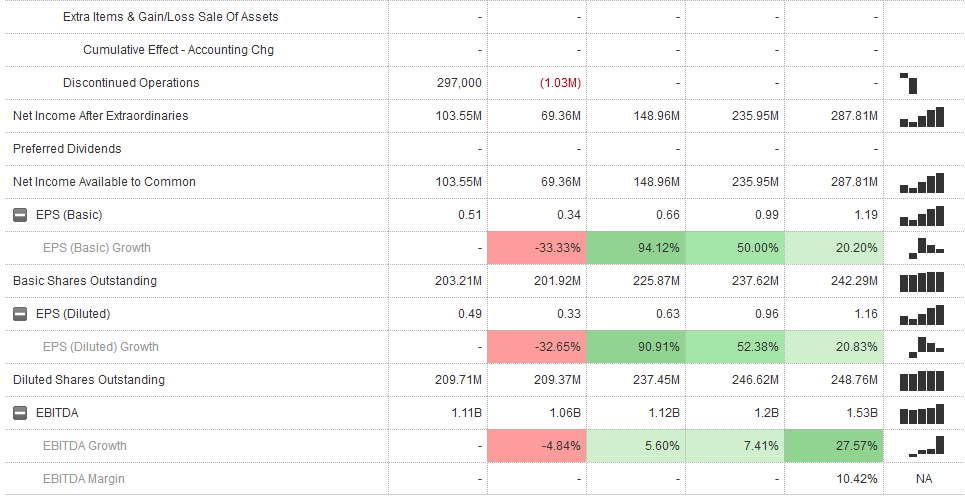

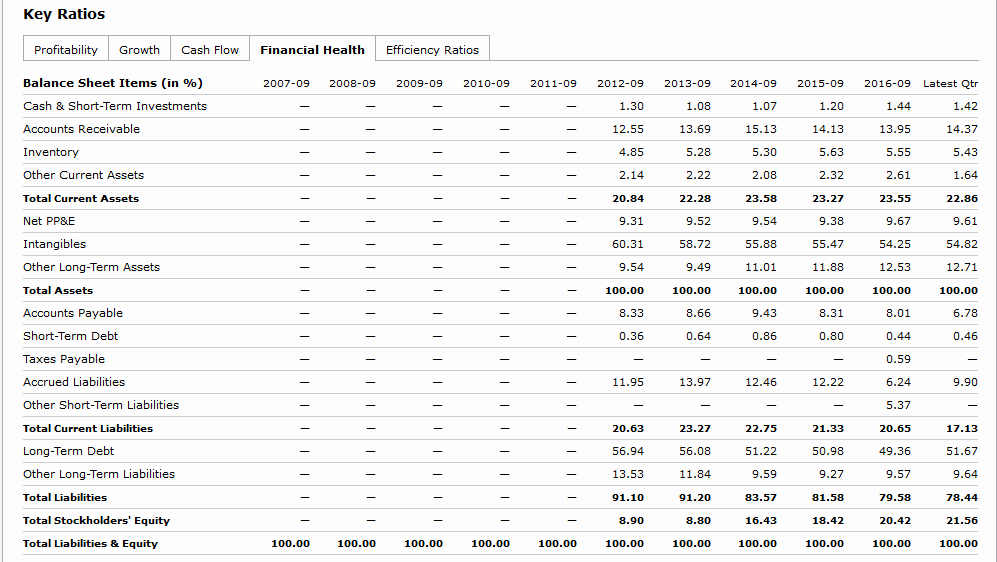

Analysis of Balance Sheet and Income Statement

Based on the information provided in Aramark’s income statement and balance sheet, we find that the company suffers a low probability of going concern risk. An analysis of its asset management ratios also shows that the company is doing a good job managing its assets. A close look at its inventories shows that the company has been correctly using its inventories because the value has steadily increased from 508.42 million in 2012 to 587.16 million in 2016. There have been no sharp increases or decreases in this value in the past five years. This fact is supported by the maintenance of its asset and a slight reduction in its liabilities over the past five years.

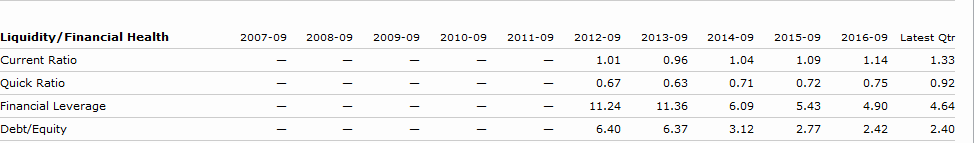

An analysis of the company’s current ratio shows that it has steadily maintained this index within the 0.96 -1.14 range throughout the past five years. For example, the current ratios for 2012, 2013, 2014, 2015, and 2016 were 1.01, 0.96, 1.04, 1.09, and 1.14 respectively. These ratios show a slight variation in the currency ratio numbers throughout the five years under review. They mean that the company may find it difficult to service its debts because currency ratios of between 1.0-1.5 are low and may suggest that the business is not in a good position to pay its debts (Demir & Bahadir, 2014). Nonetheless, as highlighted in the balance sheet, the company’s liabilities are slowly decreasing, thereby strengthening the company’s financial position. This may mean positive financial outcomes in the future. However, in the short term, it may be prudent for the business to extend its debt-paying period, or seek external sources of finance to pay its creditors. However, it is important to note that there is no ideal current ratio for multinational companies because different organizations work with different current ratios. A current ratio of 1.14 is the highest that Aramark has posted in the past five years and may mean that its ability to pay debts may not be of great concern for now.

An analysis of the company’s debt-to-equity ratios shows the company’s financial leverage, relative to calculations that emerge from dividing the company’s liabilities and shareholder’s equity. It is essential to analyze this index because it shows the company’s reliance on debt to finance its operations. This calculation is relative to the value of shareholder’s equity. A review of the company’s debt-to-equity ratios over the past five years shows a significant decline in this index because, in 2012, 2013, 2014, 2015, and 2016, the company reported a debt-equity ratio of 6.4, 6.37, 3.12, 2.77, 2.42, and 2.4 respectively. An overview of these figures shows that the company posted the lowest debt-to-equity ratio is 2016, meaning that it took the least debt to finance its activities in the same year. This is an indicator of declining aggressiveness in its leveraging practices, symbolizing a reduction in operating risk. Thus, this ratio shows that the company is in a better financial position compared to past years, considering it has reported increased sales numbers and a declining debt appetite in recent months.

Our chosen method for evidence collection is analytical review because we analyzed significant ratios and trends to detect inconsistencies or fluctuations that could imply the presence of financial misstatements or mean the presence of erroneous transactions in the company’s financial books. This data collection technique was instrumental in the audit process because it helped us to compare the financial information with prior periods. This data collection method was also sufficient for our review because it was easy to get all the details regarding the company’s financial operations throughout most of its multiple business sectors on paper (for analysis), as opposed to inspection, observation, or other data collection techniques which would have not correctly captured the scope of the company’s operations.

Discussion of the Audit Risk Model

The audit risk model specifies the types of risks associated with the audit process. It also outlines the appropriate methods to mitigate them. Typically, the audit risk is a product of control risk, detection risk, and inherent risk (Gbalam & Ebimobowei, 2013). The control risk is a product of the failure of the organization’s internal control processes to detect incorrect financial data. The detection risk arises when the auditor fails to identify financial misstatements, while the inherent risks are likely to occur because of omission errors caused by the complexity of the auditing task, or a low skill level of the staff. After applying these audit procedures to Aramark, we find that it has a high inherent risk because it operates in a highly regulated sector, such as the food industry, which is characterized by strict laws guaranteeing the safety of such products. The company also operates in a complex network of related entities, which could cause-related, but different, financial misstatements without strict internal audit controls (Gbalam & Ebimobowei, 2013). Since this is the first audit report of the firm, the failure to comprehend the scope and nature of its operations may increase the nature of the audit risk. This weakness amplifies the inherent risk associated with preparing this report.

The control risk also appears to be high because the company does not have a strong audit committee to oversee its financial operations. Additionally, Aramark lacks a strong audit department that is independent of the manager’s influences, which could detect all acts of financial misdeeds in its reports. Collectively, these facts mean that the company’s audit risk may be high. Assuming that the values of the control and inherent risks are both 60%, we would have to compute the detection risk according to the formula below.

Audit risk = inherent risk * control risk * detection risk

Based on this formula, we find that the detection risk is 27.8%. We derive this figure as shown below.

0.10 = 60% x 60 x detection risk

0.10/0.36 = Detection risk = 0.278 = 27.8%

The audit sampling procedures used here refer to the use of specific audit procedures to less than 100% of the items reviewed in the given audit sample. The goal was to understand the contents of the company’s financial transactions. Two types of sampling techniques often appear in audit risk models. They include the probability sampling technique and non-probability sampling techniques (Gbalam & Ebimobowei, 2013). Both techniques require auditors to use their professional judgment in planning and executing the audit strategy. In our review, we used the non-sampling technique. Non-sampling risks often arise from misjudging the inherent risks. They may also occur if an auditor misjudges the control risk, or makes mistakes when implementing the audit plan. As such, it cannot be measured. In this type of sampling technique, we used the judgment sampling technique, as opposed to the haphazard sampling technique to carry out the audit strategy. In this type of technique, we mostly relied on our professional judgments during the sampling phase. In this process, we used different facts and judgments throughout the sampling process. Backing up this technique was a reliance on our experience in the industry to carry out an effective sampling plan. Indeed, our plan for managing this type of risk was based on adequate planning and supervision of the audit process so that there was minimal probability such types of risk would occur. By doing so, we believe that our preliminary judgment on materiality will be affected by negligible non-sampling risk.

Primary Responsibility of Audit Firm

Our report on Aramark is unqualified because we find that the company’s financial statements comply with internationally accepted accounting standards. Furthermore, we find that the company’s financial records are free from misstatements. In this regard, we assume responsibility for providing a reasonable assurance that the company’s financial information is free from financial misstatements. We also assume that the financial data documented by Aramark is prepared according to international accounting frameworks. Based on this report, we must assume responsibility for the audit report to Aramark’s shareholders. However, this responsibility is only limited to the duties that were expressly agreed on in the initial audit process.

References

Demir, V., & Bahadir, O. (2014). An investigation of compliance with international financial reporting standards by listed companies in Turkey. Accounting and Management Information Systems, 13(1), 4–34.

Gbalam, E., & Ebimobowei, A. (2013). Audit risk assessment and detection of misstatements in annual reports: Empirical evidence from Nigeria. Research Journal of Finance and Accounting, 4(1), 97-109.

Kerr, D. (2013). Fraud-risk factors and audit planning: The effects of auditor rank. Journal of Forensic & Investigative Accounting, 5(2), 48-76.

Modar, A. (2013). Fraud risk factors and audit programme modifications: Evidence from Jordan. Australasian Accounting, Business and Finance Journal, 7(1), 59-77.