Article 1

Hiermeyer, M. (2019). An Improved IS-LM Model To Explain Quantitative Easing.

Summary

IS-LM is a macroeconomic model that shows how the aggregate financial and real goods interact with the total output of the money market. The model interprets the characteristics of the financial markets and investigates the stability of a country’s economy. Therefore, the context highlights the effect of monetary policies on a stable or unstable economy. It shows how using the IS-LM model is vital to solving the financial crisis.

Macroeconomics Issues Discussed

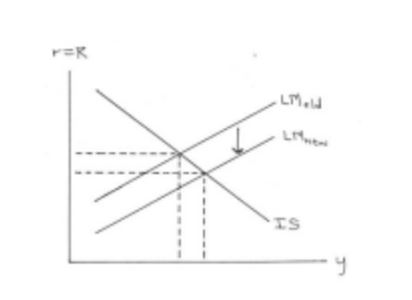

The article stresses the importance of government interventions to enhance financial stability. The model allows using fiscal strategy tools through expansionary and contractionary policies. If there is an increased money supply, the government needs to regulate it; hence the LM curve shifts to the right or downwards. An increase in money demand moves IS line to the right. Notably, the policies lead to increased or reduced money supply in the economy.

Economic Model Used to Explain Concepts

The IS-LM model explains the financial markets and how policymakers enhance stability by comparing the GDP to interest rates. It highlights how the perspectives affect the demand and supply in an economy toward an equilibrium point (Hiermeyer, 2019). In the graph, the Y-axis is the GDP, while the interest rates make up the x-axis. The IS curve indicates the interest rate levels at which the investment is total to the savings.

Therefore, a country achieves a change in aggregate demand at lower rates. It reaches high investments making the country attain more output. Thus, the curve inclines to the right or downwards. The LM curve indicates the GDP output levels where the money supply is equal to the demand. The curve slopes upwards because high incomes result in increased transactions. To keep the money supply in equilibrium, it is expected to increase the interest rates. The expansionary monetary policy shifts the curve LM down. Hence, the interest rates reduce, making the money supply in the economy rise.

How Economic Model Helps to Understand Concepts

The article is educative as I identify that managing the money supply in the economy is essential for its growth. Similarly, it is vital to enhance employment and change while considering long-term effects like inflation and deflation. As a future policymaker, I should choose the right monetary policy. Lastly, I need to anticipate the policies’ impact to maintain stable prices.

Article 2

Watanabe, T. (2020). Reconsideration of the IS-LM model and limitations of monetary policy: a Tobina Minsky model. Evolutionary and Institutional Economics Review.

Summary

The article describes bank behaviors through its control of the rates of returns. Therefore, it needs to be sensitive to lending as it significantly affects the equity price and the volatility of profits. Notably, how it issues, loans can make the economy unstable in the long run. Hence, the government should formulate loan regulations to ensure a stable economy.

Macroeconomics Issues Discussed

The article stresses the importance of proper interventions to prevent inflation. In the short run, setting lower interest rates promote borrowing. Therefore, many people request loans and use the money to invest. When many businesses are a start-up, more people will secure employment; thus, there will be an increased money supply in the long run (Watanabe, 2020). Commodities will be expensive; hence the employed will demand more wages as the available finances cannot meet their demands, implying it will cause inflation.

Economic Model Used to Explain Concepts

The Keynes and Fishers model clearly describes the concept by proving that an economy will experience a financial crisis if the government does not consider how people receive debts. Bank loans are essential, but they affect volatility and the real economy. Monetary policy influences inflation if the policymakers do not anticipate the effects of its actions. The Central bank needs to control how they set the real interest rates by checking the duration to avoid inflation.

How Economic Model Helps to Understand Concepts

The article makes me realize that monetary policy can affect inflation. Therefore, the policy maker’s decision influences the overall liquidity of the money, causing inflation. For example, if it increases money in the economy by reducing interest rates and reserve requirements, the prices of items rise, and people ask for higher wages. Adjusting interest rates is vital for a stable economy to ensure money maintains its purchasing value.

Article 3

Moyo, C., & Le Roux, P. (2018). Interest rate reforms and economic growth: the savings and investment channel.

Summary

The articles highlight the impacts of interest rate alterations on investment and countries’ savings. It specifies the following key factors. First, the rates have an impact on savings. Second, interest reforms affect investments. Third, it indicates whether the assets in a country have a positive or negative effect on its economy.

Macroeconomics Issues Discussed

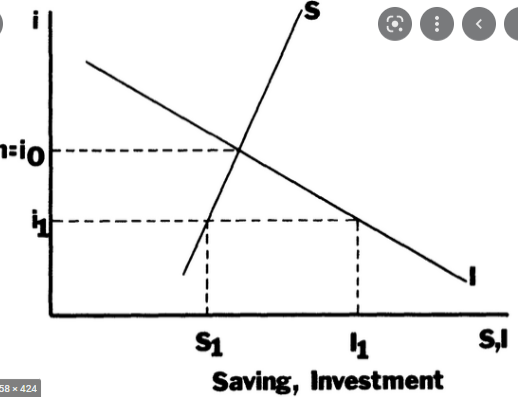

The article relates to the need for authorities in the countries to reduce interest rates to boost demand and growth. Lowering the rates will promote borrowing, encouraging investments in most parts of the world (Moyo & Le Roux, 2018). Therefore, if there is a crisis, the reforms will enhance investments and savings. Similarly, higher interest rates affect borrowing and investments. However, increased investments can improve high standards of living, thus encouraging inflation.

Economic Model Used to Explain Concepts

By using the pooled mean group model, savings positively impact investing. It is through savings that there are enough funds to invest. Similarly, investments increase the supply of money in the economy, thus promoting growth. The government giving credit to the people encourages entrepreneurs to borrow and produce goods. Therefore, it is an indicator of financial development.

From the graph, decreased interest rates promote more investments. Similarly, increased savings ensure that people have enough capital to start investments, thus the country’s growth.

S=I

How Economic Model Helps to Understand Concepts

The article creates awareness that interest rate reforms positively impact a country’s growth. Therefore, it should determine its accurate interest rates and maintain them to avoid harming economic growth. Similarly, even though high-interest rates can damage the stability of a country, it is recommended for a country to reduce. The positive impacts of rate reduction outweigh the negative motives; hence government should promote borrowing.

Article 4

Bagliano, F. C., Fugazza, C., & Nicodano, G. (2019). Life-cycle portfolios, unemployment, and human capital loss. Journal of Macroeconomics, 60, 325-340.

Summary

The paper analyses the long-term joblessness hazard and its effect on social capital. It indicates that unemployment has a consequence on an individual life cycle. Similarly, the human capital losses diminish the portfolio share invested. The article suggests that people who have been unemployed for a long tend to earn less when they find new jobs. Hence, they have poorer health, and their children have worse performance.

Macroeconomics Issues Discussed

The section is related to the effects of unemployment. Working life is expected to enhance high income. However, higher unemployment causes more financial hardship among community members (Bagliano et al., 2019). High poverty levels will be increased, with high debts, housing rates, and high crimes. The loss also affects the psychological well-being of the unemployed; thus, it is an alarming issue.

Economic Model Used to Explain Concepts

Long-term unemployment results in robust changes among retired workers through the life cycle models. The elderly need to be issued pension benefits as the last labor income to enhance meeting needs. Similarly, unemployment benefits should be accorded through the unemployment insurance system. The model indicates that age directly affects labor supply hence flattening the stock return of the aged.

How Economic Model Helps to Understand Concepts

The model makes me understand that getting aged correlates with the amount of energy to labor. Therefore, people should take insurance for retirement to cater to their needs when they age. Similarly, workers should always be aware that anything can happen to cause them to be unemployed. Therefore, I need to build my network and create a job position to avoid vast effects when I am fired.