Executive Summary

The article reviews the European currency from its inception to date. The introduction underlines the general importance of currencies to various individual countries and their contributions towards the economy. Euro has since become a major currency within Europe, uniting twelve countries.

The paper then describes the history of the euro currency the benefits and disadvantages it posses to the member states within Europe, followed by the analysis on the most significant influences of its value from its inception to-date. The n the discussion on the pressure euro has encountered in the near past, the causes and how the pressure affected the individual countries. Finally there’s the conclusion on the overall effects of the currency to individual member states.

Introduction

Most countries define objectives they use in achieving financial goals based on the kind of environment they operate under. One of the prime factors which dictate the level of profits made by an international corporation is the nature of the exchange rates. This could either strengthen or weaken the level of trade any country enjoys with its partners.

The objectives underline the processes applied together with the advantages which could help in improving any country’s trading status. The objectives revolve around the country’s key strengths and opportunities, and at the same time assist in preventing any form of weaknesses as well as protecting the individual countries’ against threats. However, there is a possibility that they could create competitive advantage through the implementation of appropriate business models (Camardella, 2003, pp. 103-107)

Explanation on the origins of the Euro and the main advantages and disadvantages of a single currency for its member countries

Euro is considered currency of almost twelve countries within the European Union. The euro currency has been in circulation in terms of notes and coins two years after its inception in the year 1999. The history of the Euro could be traced back to the commencement of the European Union which comprised of twelve countries. The countries involved, started by establishing conversion rates that made it possible for them to work between their individual national currencies and the euro.

This led to the creation of a monetary union in January 1999 having single currency known as the euro. Since then, several countries and other territories have generated link between their currencies and euro through agreements of different kinds which includes; exchange rate Mechanism II, bilateral exchange-rate agreements and unilateral exchange rate regimes (Chabot, 1999).

Ambitions for a unified currency were adopted at the Bremen Summit in 1978, where decision was made by Germany and France to establish the so called European Monetary System (EMS). This system could not operate without the Exchange Rate Mechanism (ERM) which ensured that all the countries within Europe were unified by a system of fixed exchange rates.

The ERM system was hence considered a managed float, where currencies were allowed to operate within specified fluctuation band. The differences in variance between currency values were checked by central banks through the foreign exchange market. This was adopted till late 1980s when there was strong global economic growth. The kind of economic progress experienced within these years resulted into pressure which brought about the necessity of creating single internal economic market.

This brought about the adoption of the Single European Act in the year 1986. This was followed by meeting of fifteen member states of the European Union in 1991 where agreement was reached to create single currency which was expected to strengthen the race towards creation of Economic and Monetary Union. This agreement was called Maastrich Treaty which also led to the creation of European Central Bank for the purposes of controlling price stability within Europe (Chabot, 1999).

These inceptions led to the trial of the Exchange Rate Mechanism of the EMS by those who doubted its legibility. This was because some believed that the European currency was only strong as a result of the managed float.

This forced most of the countries to devalue their respective currencies owing to fear of loss. However, this led to the collapse of the ERM system paving way to the enforcement of the Maastrich Treaty which saw the establishment of economic and monetary union within three stages with the last stage commencing in January 1999.

This was the time when the euro currency was launched in form of electronic currency used only by larger monetary institutions such as banks and major companies within the stock market as well as foreign exchange dealers. The European Union has since met lots of challenges surrounding the use of the common currency leading to great fluctuations on the level of exchange rates (Blanchard and Francesco, 2004).

In 2002, the Euro Currency became popular within Europe and hence became cash currency for citizens within the member states. The aim is to make Euro stronger internationally hence help in lowering familiar barriers to trade within member states. The Euro notes and coins appeared for the first time in the year 2002 leading to the withdrawal of individual national currencies (Blanchard and Francesco, 2004).

Advantages of common currency in Europe

One of the benefits of using common currency is that it leads to efficient increase in economy. The benefits could be defined in terms of elimination of transaction costs and elimination of risks resulting from fluctuations experienced in exchange rates. The costs of transactions are identified within various fields such as fixed commission charged on the process of selling individual currencies.

The disappearance of currency conversion costs seem to be beneficial to both individuals and companies on the platform of dealing with foreign partners. The use of common currency further leads towards creation of good grounds for comparing and harmonizing prices across borders.

Elimination of transaction costs and creation of price transparency techniques leads to the creation of a more integrated market within Europe. The use of common currency has led to attraction of more investors since their confidence is boosted by the fact that market integration leads to creation of channels that would easily help in sharing risks in case of any financial set- back (Chabot, 1999).

Uncertainties which go with exchange rates could sometimes be damaging to the trade and investment sector. This can only be checked through the use of common currency which helps in eliminating the situation of currency fluctuations. This leads to creation of positive environment within international businesses.

Fluctuations experienced with exchange rates, threatens sustenance of foreign investments making foreign markets to suffer. This kind of risk could only be eliminated through the use of euro as common currency and it’s of benefit only to member states (Schinasi, 2003).

Disadvantages of using common currency in Europe

Several disadvantages are associated with the issue of having common currency in Europe. These disadvantages revolve around cost of institutions and the level of each countries adjustment to new dimensions brought by new currency. There is also a wide experience on the lack of policies guarding the national monetary which could be used as means of adjusting to economic changes. Lots of money is used in the process of adjusting various tools and documents dealing with monetary issues.

The possibility of the region getting hit by economic shock may cause imbalance in one of the countries though not posing much threat to other member countries. The member countries using euro are forced to look for alternative methods on how they could handle economic shocks, this is since they could no longer use monetary and fiscal policies of their individual countries. These may range from application of capital mobility to labour mobility (Gali and Roberto, 2003).

Analysis on the most significant influences on the value of the Euro over this period

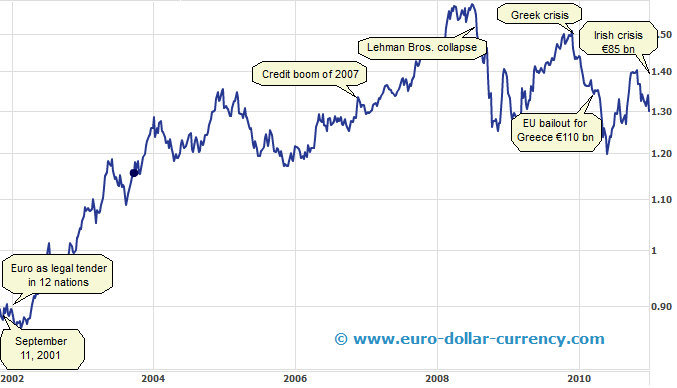

Graph 1; showing variation in euro value since its inception

The graph above reveals the varying trends in the value of Euro since it’s inception to-date. Euro replaced the old national currencies of twelve European member states in the year 2002. The level of increased capital and trade flows between 2002 and 2004 influenced the value of the euro.

These two variables had tremendous effect on the value of the euro since they determined the level of euro demand. Faster economic growth in some countries within Europe was experienced leading to increase in capital inflows which in turn contributed towards financial market integration (Chabot, 1999; Collignon, 2003).

However, there were a number of difficulties experienced since the adoption of euro currency. Despite improving the economic stability of member countries, euro brought lots of challenges including the use of similar interest rates within each member countries.

This presented a big challenge since it made it impossible for individual economies to adjust their own interest rates for the purposes of monitoring their own economic growth. On other sectors, fluctuations in the value of euro in 2006 led to large drop in output showing decline in the rate of investment, consumption and exports.

The period between 2008 and 2009 was characterized by increase in the rate of unemployment which ultimately led to reduced earnings and increased inflation rates. The decline was clearly revealed on the kind of crisis which faced Lehman brothers in 2008.

The Greek and Irish crisis in 2010 led to reduced output levels within the region, trade flows were affected due to difference in the growth rate experienced during this period. This affected the currency exchange and movement of goods and ultimately weakened euro against other strong world currencies like the dollar (Chabot, 1999).

During 2010-11 the Euro has come under significance pressure. Explanation on the causes of this pressure and analysis on how it may affect the individual countries

There has been increased capital and trade flows during this period, this helped in raising Europe’s financial market integration in collaboration with other countries. The pressure within Europe’s financial market has experienced relative increase in demand for the euro and its related investments.

Due to some laxity in 2010 investors were forced to diversify their investments in other regions at the same time preferring to trade with other countries outside Europe. This pressure was caused by the increased demand for European assets by the outsiders which resulted into net capital outflows. Also the kind of lag experienced in the Europe growth rate made most of the investors to seek for investing opportunities in other regions considered to experience higher growth (Bishop, 2003; Padoa-Schioppa, 2003).

The pressure experienced led to slow growth rate which eventually led to decrease in the individual European countries share within the global economy. This made foreign central banks to decrease their incentive levels hence increasing their holdings within the places dominated by euro. Decrease in demand for the euro as a result of increase in the level of imports to Europe led to depreciation in value for the euro.

This led to an experience of decrease trade flows within member countries. The value of the euro depreciated as compared to other strong currencies (DeGrauwe, 2000). Appreciation in value of euro could lead to the adjustment of pricing mechanisms. This could lead to an increase in the level of export values and decrease in import. As a result the ultimate outcome is increase in the level of surplus goods within the market. This process could be maintained over long period of time (Prati and Garry, 1997).

Conclusion

The introduction of euro as a single currency for twelve European member states led to tremendous positive change in the level of economy within Europe. It provided some safety to individual country economies since other countries could easily supplement economic deficit which might arise within member countries.

Each country focused on the quality, cost, performance and the issues on the values at which their goods and services traded within various world markets. The member countries also found it easy to focus on the level of supply of their goods to consumers at different locations. Euro provides an easy way of analyzing consumers in relation to their potential and the channels of marketing.

Reference List

Bishop, G., 2003. The Future of the Stability and Growth Pact. International Finance 6 (2), pp. 297-308.

Blanchard, J. & Francesco, G., 2004. Improving the SGP through a Proper Accounting Of Public Investment. CEPR Discussion Papers (4220)

Camardella, M.J., 2003. Effective Management of the Performance Appraisal Process. Employment Relations Today, 30(1), pp. 103-107.

Chabot, N., 1999. Understanding the euro. New York: McGraw-Hill

Collignon, S., 2003. Is Europe going far enough? Reflections on the Stability and Growth Pact, the Lisbon strategy and the EU’s economic governance. European Political Economy Review 1 (2)

DeGrauwe, P., 2000. Economics of Monetary Union. Oxford: Oxford University Press.

Gali, J. & Roberto, P., 2003. Fiscal Policy and Monetary Integration in Europe. NBER Working Paper, (9773).

Padoa-Schioppa, T., 2003. Central Banks and Financial Stability: Exploring the Land in Between. In The Transformation of the European Financial System. (Ed).Frankfurt: European Central Bank.

Prati, A. & Garry, J., 1997. European Monetary Union and International Capital Markets: Structural Implications and Risks. IMF Working Paper WP/97/62. Washington: International Monetary Fund.

Schinasi, G., 2003. Responsibility of Central Banks for Stability in Financial Markets. IMF Working Paper 03/121. Washington: IMF