Introduction

Traditional media houses have transformed their businesses from paper-based newspaper and magazines to the new-age digital content providers for digitally readable devices like smartphones, tablets, and computers. Axel Springer, one of the largest media houses in Europe, too has followed this trend and has successfully transformed its business from traditional to the new-age media company (Hofmann, Mueller, & Bhattacharya, 2014).

However, this transformation has created social responsibility issues for the company that has, from its inception has prised integrity and ethical values. It has shown immense integrity in creating a green value chain when the media houses were under attack from non-profit organizations like Greenpeace for their unbridled exploitation of forest resources for making paper (Hofmann, Mueller, & Bhattacharya, 2014).

However, there are certain problems that the company would face in their efforts to create a green value chain. First, Axel Springer no longer makes the medium on which their content is provided as earlier with their traditional news business where they controlled the supply of the papers. Second, the company has to ascertain how deep in the value chain they can exert their control. Third, the management has to decide how they can go about to make a clean and green value chain.

The purpose of this case study is to understand the corporate social responsibility issues that Axel Springer faces with the upsurge of the concerns regarding conflict minerals used for making the hardware for their content. For this purpose, the paper will use certain strategic management exercises such as SWOT analysis and value chain analysis to understand how far the company has direct control and influence.

Case Analysis

SWOT Analysis

A SWOT analysis of Axel Springer shows that the biggest threat that the company presently faces is their company is the upsurge in the concern regarding the crisis faced by their electronic partners who face charges of using conflict mineral from Africa. The SWOT analysis will try to device strategies that the company can use to leverage their strength and obviate the imminent threats.

Table 1: SWOT Analysis of Axel Springer

The strength of the company is its brand name and their products, which have enjoyed high circulation over the years. Many of the company’s publication such as BILD still enjoy largest circulation in Europe and Germany. In the digital media, BUILD provides the largest amount of German-language digital content through BUILT.de. Clearly, the company boasts of a strong market presence in both German and European market.

The company has also made a successful and smooth transition from the traditional paper based media house to a multimedia company with widespread digital presence. In 2011, the company’s digital media section reaped an EBITDA margin of 16.4 per cent. The multimedia operation of the company provides competitive advantage over its competitors.

However, a few of the weaknesses of the company lie in its inability to control the new value chain to safeguard its stakeholders. The company during its traditional form controlled and bought the paper required for their publications directly from sellers (Axel Springer Sustainability Report, 2013). Therefore, when the controversy regarding the exploitation of forest resources emerged, the company took immediate steps to curb the rampant waste of forest resources and finding sustainable measures to recycle their products.

One reason why the company could easily take such measure was because it had direct control over its supply chain and controlling the suppliers was not a problem as it had competitive power over its suppliers. However, as a digital content provider, Axel Springer has to work with other companies who make readable digital devices.

When these device making companies make their product from raw material derived from unethical sources, for instance from the conflict ridden African countries, Axels’ credibility as a content provider for these companies is tarnished. Nevertheless, Axel is not in a position to directly influence these companies to stop using conflict minerals. This dilemma posses a serious threat to Axel’s corporate ethics and strategic outlook.

Further, Axel faces threat from non-profit groups (NGOs) like Greenpeace who constantly try to make corporates more socially responsible (Young, Fonseca, & Dias, 2010; Epstein & Yuthas, 2011). Increased awareness regarding the conflict minerals exploitatively acquired from the conflict ridden African nations has raised the question regarding the socially responsible action of the electronic companies who directly source from vendors or miners excavating in these countries (Luckerson, 2014).

The potential threat that the company faces is its credibility as a socially responsible and ethical company may be tainted due to the actions of their business partners (Porter & Kramer, 2006).

Therefore the desired steps that the company had to take, adhering to their corporate ethics and values, was to ensure that they have a socially and environmentally responsible value chain. Ensuring that their digital partners do not use conflict minerals in their production process can make their value chain socially responsible.

Value chain analysis

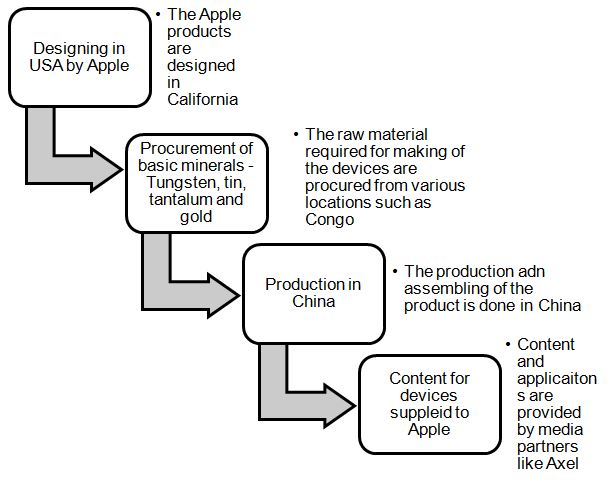

The issue that the SWOT analysis raises regarding the questionable procurement of conflict minerals from Congo by Axel’s digital partners shows that the company may have to take measures to ensure that its credibility as a socially responsible media house remains safe. For this purpose, it is essential for the case analysis to look into the value chain of the digital content providing business of the company.

Table 2 presents a basic structure for the value chain of the digital content provided by Axel to one of its partners. The figure shows that Axel is only the content provider for the devices. It has no participation in the production process of the devices. The production of the devices is solely the responsibility of the electronic company. The procurement and production functions lie solely with the electronic company.

However, Axel becomes a part of the value chain after the products are made and the content is delivered. Axel makes the content that are used as applications in the mobile phones. Axel becomes a stakeholder in the value chain of Apple. However, in Axel’s value chain, Apple, and its production process assumes a large and important position.

However, unlike the paper media, digital media is not under the control of Axel, as it does not have any direct control over the production process of Apple. Further, from this chain it is immensely clear that Axel is not the sole provider of content to Apple. It has other media houses that provide them with the content that are offered to the users. Therefore, it cannot directly exert pressure on its partner not to use conflict minerals for their production.

Table 2: The value chain for digital content to Apple

Solution and recommendations

In the above-delineated situation what could be the possible solution for Axel? The given situation provides a unique dilemma for Axel, as it is not directly involved with the production process of the devices. Nonetheless, they are partners to the companies who use such conflict minerals and therefore are party to the unethical conduct.

The possible solution for Axel if it has to adhere to its ethical and socially responsible behaviour is to join the propaganda against the use of conflict mineral and put pressure on the governments and companies to draw measures and policy that could stop the usage of conflict minerals and adhere to certain code of conduct (Woody, 2012).

Thought this would imply that Axel may have to renounce an increasing portion of their share of digital media initially, but would ensure credibility of the company as an ethical media house. Therefore, the measures recommended for Axel are as follows:

(1) Nehm must write to the CEO outlining his concerns and show how the company may be affected if the issue regarding conflict minerals blows out of proportion, destroying the reliability of Axel as a media brand.

(2) The company must open a dialogue with all its electronic partners to ensure that they too understand Axel’s concerns and align their value chain according to ethical manner (Kemp, Owen, Gotzmann, & Bond, 2011). For this purpose, Axel must try to garner support from its rivals in order to create substantial pressure on the electronic companies. Axel must convince its partners to disclose their procurement policy and standards (Kolk & Lenfant, 2013).

(3) Garner awareness regarding the conflict minerals used in smartphones and other electronic devices in order to raise public support and ultimately government’s support to curb such practices. Enshrining code of conducts that would ensure that the vendors who supply conflict minerals must adhere to the codes of not doing so.

Conclusion

Axel Springer is a media company, which has earned a reputation for its independent and ethical journalism. They had been committed to become a socially responsible company and had willingly published the names of their vendors who supplied them paper in the nineties to counter allegations of exploiting the forest resources for making paper.

This was possible as Axel had direct control over their supply chain. In the digital age, the supply chain or the value chain has scattered with Axel assuming only the role of content making for their device maker such as Apple. Nevertheless, their partners’ use of conflict mineral may compromise the company’s integrity as an ethical media house if they fail to voice their ethical concerns regarding the issue.

References

Axel Springer Sustainability Report. (2013). From which countries does our printing paper come? Web.

Epstein, M. J., & Yuthas, K. (2011). Conflict minerals: Managing an emerging supply‐chain problem. Environmental Quality Management, 21(2), 13-25.

Hofmann, A., Mueller, U., & Bhattacharya, C. (2014). Axel Springer and the quest for the boundaries of corporate responsibility. ESMT, 1-18.

Kemp, D., Owen, J. R., Gotzmann, N., & Bond, C. J. (2011). Just relations and company–community conflict in mining. Journal of Business Ethics, 101(1), 93-109.

Kolk, A., & Lenfant, F. (2013). Multinationals, CSR and partnerships in Central African conflict countries. Corporate Social Responsibility and Environmental Management, 20(1), 43-54.

Luckerson, V. (2014). There May Be Conflict Minerals in Your Smartphone.

Mitchelstein, E., & Boczkowski, P. J. (2009). Between tradition and change: A review of recent research on online news production. Journalism, 10(5), 562-586.

Porter, M. E., & Kramer, M. R. (2006). The link between competitive advantage and corporate social responsibility. Harvard Business Review, 84(12), 78-92.

Woody, K. E. (2012). Conflict Minerals Legislation: The SEC’s New Role as Diplomatic and Humanitarian Watchdog. Fordham Law Review, 81, 1315-1351.

Young, S. B., Fonseca, A., & Dias, G. (2010). Principles for responsible metals supply to electronics. Social Responsibility Journal, 6(1), 126-142.