Introduction

Over the centuries, people demonstrated a need to keep records of their financials and engage in borrowing or lending operations with each other. This necessity laid a foundation for the development of modern-day banks. However, technology advancements present a new outlook on the industry, offering consumers more accessible credit and deposit operations. This chapter will review the banking industry, focusing on the development of these facilities in Saudi Arabia. This includes the future of banks, such as Artificial Intelligence (AI), digital money (DM), Big Data, and other developments.

These technologies are essential for banks because they allow for better precision, the safety of operations, and mitigation of issues connected to fraud or currency exchange. The main questions that will be the focus of this section are the development of private banking services, the establishment of banks in Saudi Arabia, the emergence of credit and documentary credits and financial and commercial securities.

Definition of a Bank and its Development in Saudi Arabia

Banks are institutions that have permission and capability to provide loans and receive deposits. As such, they require permission, usually a license from a state’s government to operate. In order to obtain a license in the Kingdom of Saudi Arabia, banks have to obtain a license from the Council of Ministers, which also takes recommendations from SAMA and the Finance Minister. In Saudi Arabia, the Royal Decree of 1966 is the primary legislation that regulates this sector of the economy (Saudi Arabia – banking systems, 2018). Since then, banks in the country have developed rapidly, promoted by governmental policy.

Considering the fact that Saudi Arabia emerged as a unified state recently, the scope of work conducted by the government for ensuring an adequate fiscal policy and enabling infrastructure as well as the activity of commercial organizations has been remarkable (Saudi Arabian Monetary Agency, no date). At the beginning of the 19th century, the main functions of banks were fulfilled by several international trading organizations. One example is the Algemene Bank Nederland and money exchange facilities. An important factor, which prompted the rapid development of the banking system was the discovery of oil in 1939 that led to an increase in royalties received by the government and overall intensification of economic activity.

Notable banks that established there branched in the Kingdom of Saudi Arabia after the discovery of oil in the area were The Arab Bank, The French Banque de L’Indochine, British Bank of Middle East, Bank Misr of Egypt and National Bank of Pakistan (Saudi Arabian Monetary Agency, no date). The government of Saudi Arabia was engaged in promoting economic activity. In 1952 the Saudi Arabian Monetary Agency (SAMA) was established, which aims to supervise banks and develop new monetary policies.

SAMA also oversees Saudi Arabia’s central bank. Other banking facilities in the state include “licensed retail banks, private investment programs, specialized lending institutions, and the stock market” (Saudi Arabia – banking systems, 2018, para. 1). A government of Saudi Arabia has to have 10% or less stake in each bank operating in the state. Currently, there are 13 banks that have a license allowing them to provide financial services in Saudi Arabia.

History of Banking

In order to understand how the modern banking system operates, it necessary to examine the history, which will allow understanding how banks were established and how the idea of credit emerged. According to Gouge (2017), banking is connected to business and human economic activity, hence, their operations are a necessary component of any society’s functioning. The systems that resemble modern banks exited before contemporary civilization was established since 8000 BC people kept records of their financial operations (Gouge, 2017). While this did not involve the lending and deposit functions of a bank, it is believed that these records were first attempts to establish a system that evolved into banking.

Mesopotamia is considered to be a place where banks in their modern form were first established. These facilities lend money to individuals, although individuals could borrow not only money but also seeds and other necessities (Gouge, 2017). The lending of seeds is connected to a widespread occupation of the era – farming, and by being able to borrow seeds, farmers could grow crops and return them to the bank. This approach resembles the new lending operations, where small businesses or individuals apply for a loan to establish a company or to receive additional funds for operations, which they return after some time with an extra percentage.

Notably, the word “bankruptcy” has Italian origins, which means failure to deliver the promised good or service. Italy and its banking system had an impact on the global development of banks in the Medieval Ages. Moreover, according to Abulafia (2017), modern financial institutions share many standard features with banks that existed in Medieval Italy, where many financial and credit instruments were established. These include deposits, interest lending, letter of credit and others. Therefore, the history of banking suggests that these institutions have transformed over the years, becoming more efficient and offering their clients more services, tailored towards their needs.

Important Notions

In this context, several important aspects of banking must be examined. Firstly, the letter of credit is a contract between three parties – “a bank, a bank’s customer and a beneficiary” (BDC, no date, para. 1). This approach is usually used for the export-import operations, where the importer’s bank guarantees that the exporter will receive the payment. Letter of credit emerged as a necessity with an expansion of international trade. However, according to some scholars, this practice emerged in 3000 BC because some archaeological findings are clay notes promising a return of finances (Alavi, 2016; The circular letter of credit, no date). Similarly to the history of banking, which was explored earlier, this suggests that people long before the establishment of modern civilization were in need of financial services.

Another explanation that presents a possible reason for the emergence of letters of credit is the issue faced by merchants in the 12th and 13th centuries in Europe. According to Alavi (2016), the actual amount of money did not satisfy their actual trading needs, and letter of credit served as a substitute. Also, travelling, which was typical for merchants, was more dangerous with substantial amounts of money.

Next, documentary credit allows banks to pay on behalf of their clients. This document allows protecting the interests of both buyers and sellers because it guarantees the transfer of funds and mitigates the non-payment risk (Documentary letter of credit, no date). The two payment methods are similar. However, the latter implies that the bank does not have to pay if the buyer decides to cancel the deal. This financial instrument also emerged as a way of exchanging financials for merchants, which allows postponing the initial payment.

As a result of financial operations between merchants, dept exchange emerged. It is believed that the first trading of securities occurred in the 1300s in Venice, where merchants traded securities with other states (Beattie, 2019). Financial and commercial securities are financial instruments, which allow exchanging stocks that provide them with an absolute guarantee of repayment. The first stock exchange emerged in Belgium in 1500, while the economic activity of the East Indian Companies promoted its development (Beattie, 2019). By using these instruments, people could have a stake at a company that brought goods from India or Asia.

Future of Banking in Saudi Arabia

The future of banking is inevitably linked to the development of modern technology. Currently, mobile banking and bank websites provide easy access to information and bank services for consumers, allowing for new possibilities for the banks. According to Saudi Arabian Monetary Agency (no date, p. 195), currently, banks in the country offer “Point of Sales System and an advanced Electronic Share Trading and Settlement System which boasts same-day settlement.”

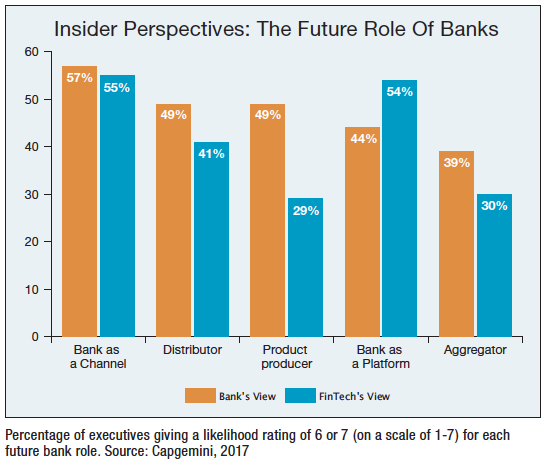

Therefore, these institutions have successfully adopted some of the critical elements of innovational banking, allowing for swift operations. Baabdullah et al. (2019) note that mobile banking services in Saudi Arabia have promising prospects. This technology significantly reduces fees for services and improves accessibility. Picture 1 represents the trends and future development of the banks globally, including Saudi Arabia.

Additionally, the banks of Saudi Arabia manages investment funds and offer stockbroker services. Despite these changes, which make banking services more accessible to consumers, a report by Deloitte (no date) suggests that in the future, banks will have to transform, even more, adopting new technology and basing their strategy with consumers in mind. Cyber risk and financial crime (CyFi) is among the critical challenges of development since traditional methods of preventing financial crime are no longer valid. Advanced analytics and artificial intelligence will become an integral part of banking.

Although the emergence of paper money had an influence on the development of the banking system, its essential continuously decreases. In Saudi Arabia, the establishment and stabilization of local currency were critical was necessary for the banking sector. According to PWC (2018, para. 50), “mobile wallets, USSD banking, AEPS along with credit, debit and prepaid cards targeted towards improving speed and efficiency of payments are enablers for a less-cash economy.” Hence, it can be anticipated that these technologies will become central to banking in the future.

When examining the global development of banking, which will inevitably influence the banks in Saudi Arabia, the approach to lending money and helping people facilitate financial operations has changed. For instance, WhatsApp, a popular messenger application for smartphones, offers its users the ability to send each other money (PWC, 2018). The application, unlike other banking development, offers its users a convenient experience, since they can sign in and use services quickly, and banking is integrated with the messaging system. Moreover, with the features targeting businesses, Whataspp allows small companies to communicate with their customers and receive payments.

AI in banking is used mainly in managing risks and assessing the unusual activity of clients to prevent fraudulent activities. One of the applications is the detection of fraud or unusual transactions, which can be carried out automatically and with more precision when compared to human-enabled analysis (Baabdullah et al., 2019). Moreover, this can help fulfil regulatory requirements, since, as was mentioned, AI can conduct an analysis of the amount of information that a person can not perceive, with better precision.

A blockchain is a cryptography-based approach that leverages a connection between different blocks or hashes. It is believed that blockchain is much safer than traditional banking operations because each element of the blockchain contains information about previous operations. Hence, the system re-checks itself, eliminating the possibility of fraud or error, making financial operations safe. Currently, in Saudi Arabia, blockchain is not widely used (Clowes, 2017).

It is possible that banks in the future will rely on blockchain-facilitated operations as a safer and more efficient platform. Moreover, these records can be accessed by any user, meaning that blockchain enables transparency of operations, which is another aspect of enhanced security. According to Clowes (2017), the government of Saudi Arabia declared its commitment to developing blockchain technology. This means that the banks of the state can receive support from officials in their efforts towards implementing this technology in their operations.

Big Data is another aspect of development for the banking industry in Saudi Arabia. The idea behind this approach is the massive amounts of information that different organizations, including banks, collect as a part of their interaction with banks (Baabdullah et al., 2019). Through Big Data, banks can collect and analyze enormous amounts of information about their users and make information-driven decisions regarding their development. Through advanced analytics enabled by Big Data, banks in Saudi Arabia will be able to tailor their financial products to the needs of customers with more precision.

Digital currencies, money, or DM are other alternations of the existing banking system that are likely to affect the industry in Saudi Arabia. As opposed to traditional money, which exists physically and is made of paper or other materials, DM is only presented online. The properties of traditional money and DM are similar; they can be used in exchange for goods or services, as well as sent to an individual or a company. However, DM can be transferred from one party to the other more quickly, which is beneficial and more convenient for the sender and receiver.

Currently, the government of Saudi Arabia supports the development of DM and has invested in a cryptocurrency that will be used to facilitate exchanges between the state and United Arab Emirates (Saudi Arabia, 2019). This currency should serve as an alternative to a traditional approach of exchanging currencies to enable payments between different countries. The combination of DM and blockchain allows for an independent system that does not depend on a state’s currency and has many prospects for the banks of Saudi Arabia. Based on this, the central forecast regarding the changes that can happen with the banking industry of Saudi Arabia is connected to technology and innovation will include an enhanced analysis using Big Data and the development of DM.

Summary

Overall, this chapter reviewed the specifics of banking and the development of banking in Saudi Arabia. The history of banking begins approximately 8000 BC since evidence suggests that people used to track their financial and trading operations. Mesopotamia had banks that provided loans in the form of money or seeds to farmers. Saudi Arabia’s banking system undergone a rapid expansion after the oil discovery in the area and establishment of a unified state. In the future, the lending, deposit, and financial transactions will be facilitated through new forms, and the mobile application Whatsapp is an excellent example of that transformation. Banks will have to reform their existing systems to keep up with new demands of consumers and development fo technology to provide better services and detect fraud.

Reference List

Abulafia, D. (2017) Bankers and banking in Medieval Italy. Web.

Alavi, H. (2016) ‘Documentary letters of credit, legal nature and sources of law’, Journal of Legal Studies, 17(31), pp. 106-121.

Baabdullah, A., Alalwan, A., Rana, N., Kizgin, H. and Patil, P. (2019). ‘Consumer use of mobile banking (M-Banking) in Saudi Arabia: towards an integrated model’, International Journal of Information Management, 44, pp.38-52.

BDC (no date) What is a letter of credit? Web.

Beattie, A. (2019) The birth of stock exchange. Web.

Capgemini (2017) World fin tech report. Web.

Clowes, E. (2017). What is blockchain, and why do the UAE and Saudi Arabia want to use it? Web.

The circular letter of credit (no date) Web.

Deloitte (no date) Bank of 2030: transform boldly. Web.

Documentary letter of credit(no date) Web.

Gouge, W. (2017) History of paper money and banking. New York, NY: Lulu.

PWC (2018) WhatsApp payments. Web.

Saudi Arabia – banking systems (2018) Web.

Saudi Arabian Monetary Agency (no date) Development and restructuring of the Saudi banking system. Web.

Saudi Arabia, UAE jointly pilot cross border digital currency (2019) Web.