Introduction

The UK Beer market is 15,987 million GBP and is expected to have a negative growth at a CAGR of -0.1%. The beer market is fragmented with many players who fight for their market share using their USPs. This paper provides an analysis of the UK Beer market and analyses the market drivers and market forces that are at work.

Demand and Supply analysis

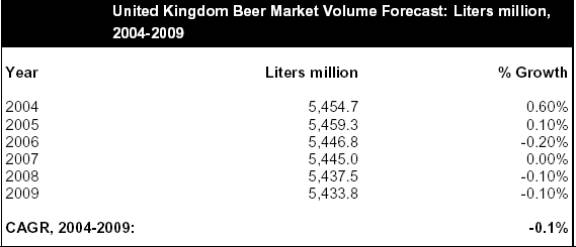

According to Mintel (2007), the beer market in the United Kingdom is made of different types of beers such as stouts ales, bitters, specialty beer, low or no alcohol beers, standard lager and premium lager. The government levies an excise tax on all alcoholic beverages including beer. Table 1 shows the market size, growth and forecast for the years from 2004 to 2009. The value of the market for 2009 is expected to be 5433.8 million liters of beer. The report also states that there are 2000 beer brands selling in the UK and while many brands are locally made and sold in a few outlets and beer pubs, the others are global players and operate in different countries.

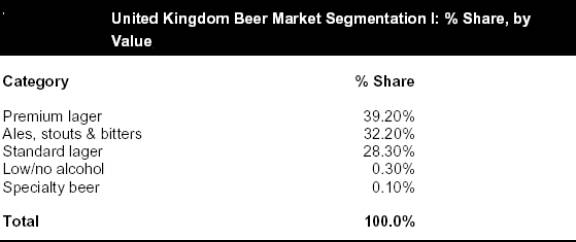

According to Datamonitor (UK Beer 2007), the UK beer market generated total sales of 28.3 billion USD in 2006 The figure represents a CARC(compound annual rate of change) of –1.3% for the years from 2002 to 2006. Germany and France had revenues of 28.1 billion USD and 8.2 billion USD CARC values of -2.3 percent and -1.0 percent for the equivalent years. In the years 2000 – 2004, UK beer consumption decreased at a CARC of 2.8 percent and achieved consumption of 5.5 billion litters. Premium Lager beer forms the leading segment in the market and ot had sales of 11.1 billion USD in 2006 and this is equal to 39.2 percent of the overall beer market value. The market for products such as ales, stouts, bitters was 9.1 billion USD and they had a share of 32.2 percent of the overall market share. Datamonitor has projected an accelerated growth in the UK market and is expected to show better yields. The market is forecasted to have a CADR of 1.1% for the years 2004-2009 and the market is expected to be worth 29.9 billion USD by 2009 end. The total consumption of beer at 2009 is estimated to be 5.4 billion litres and this represents a negative CARC of 0.1%.

According to Mintel (2007), the breweries have excess capacities and this factor leads to excess supply, much more than what the market can consume. The report suggests that when imports are also considered there is an excess supply of about 22 percent and this creates further idle stocks in the market. At a certain point in sales areas such as departmental stores, the retail shelves are overcrowded with multiple brands, and customers are faced with a problem of plenty. The tax rate for beer is the highest in Europe and while the tax on a pint of beer in France is 5 pence, it is 35 pence in UK but in spite of higher tax, the price is lesser than other countries of Europe. The report also says that out of 10 adults, eight are regarded as regular pub visitors and the pub culture is very strong in UK.

Market Structure

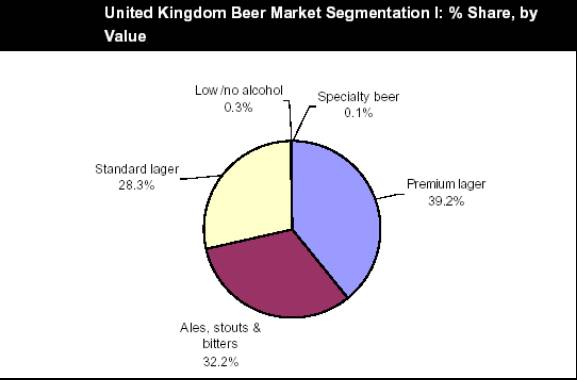

Datamonitor (UK Beer, 2007) has written about the market segmentation and has suggested that the premium Lager segment dominates the market and it has a share of 39.24 percent of the market. About 32.2 percent of the market is covered by Stout and Bitters and Ales while standard Lager beer makes about 28.3 percent of the market. The beer brands with low or no alcohol provides for 0.30 percent while the speciality beer makes up for 0.10 percent of the market. Table 2 provides the market segmentation of different types of beer in the UK market.

The market segmentation graphical representation is also given as below:

According to Datamonitor (UK Beer, 2007), the largest manufacturers and providers of beer in the US market is Scottish & Newcastle and it has a market share of 27.1 percent. The second largest player in the market is Adoph Coors Company with a market share of 19.7%. Interbrew SA is the third largest player in the UK beer market and it has a market share of 18.8 percent. Table 3 gives the market share of the three leading manufacturers in the UK market.

The top three players have a total share of 65.6 percent of the beer market in US. Mintel (2007) reports that the Carling brand of Adolph Coors is the most popular in the US market and it has a share of 14.2 percent by volume and the brand has continued to maintain its lead in the 5 years since the survey was done. Fosters brand brewed by Scottish & Newcastle is the next most popular brand and it has a market share of 12.1 percent. Mintel reports that the brand is increasing popularity by small percentage points over its rivals. The third largest selling brand in UK is Stella Artois brewed by Interbrew and it has a market share of 10.6 percent. Datamonitor (2007) suggests that the market can be described as competitive. Entry barriers are in the form of a highly fragmented market with about 2000 brands and the competition is intense. While the leading brands are relatively stable, the remaining market is characterised by intense competition.

Pricing and Economic Diagrams

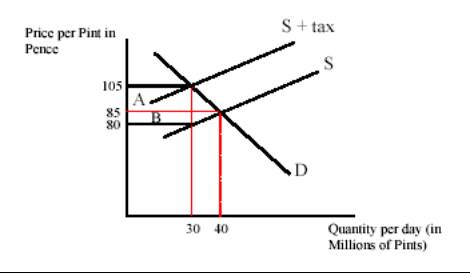

Mintel (2007) has provided an economic diagram that creates a relation between the price and consumption and this is shown in Graph 2. In the graph, D is the market demand curve while S is the beer supply curve. When there was no tax, there was equilibrium and the market consumed 40 million pints. But with the introduction of sales tax of 25 pence, the new price rose to 105 pence and the consumption fell to 30 million pints. This shows the relation between price and consumption.

BBPA (2007) as reported about the excessive tax that the UK government has imposed on the beer industry. The UK government levies a high tax and this effects the profitability of the brewers and they are forced to spread the burden of the tax on the consumer. Table 4 shows the different components of the taxes that are levied by the government on beer products

Table 4. Taxes applied for beer (BBPA 2007).

The total percent tax on beer is about 31 percent and according to BBPA, the major burden of the tax is passed on to the consumers. BBPA further reports that the tax in France of much lower, about 5 percent and this encourages illegal smuggling of beer from France into UK. The high tax component of beer has also resulted in higher prices for the consumer. Again with reference to the economic diagrams, it can be seen that the rising price of beer has an effect on the drinking habits. Mintel (2007) reports that while the population growth of adults who are legally allowed to drink has increased by 8 percent, sales of beer and other alcoholic beverages has not increased proportionally.

Evaluserve (2007) has reported that t the problem of pricing began to become more severe with the European Union Member state introduction and the rules allowed people to buy products for personal consumption and carry it to other countries. Discrepancies in the taxes and effective rates of beer in France and Belgium make these countries as cheap sources for beer and other alcoholic beverages. This has created the phenomena of the ‘booze cruises’ where people go to the European continent and buy large quantities of alcoholic beverages. There are reports about large warehouses that retail cheap drinks and these have severely effected the sales of beers that are brewed in UK.

Business Ethics – Legal Drinking Age

The UK government has introduced severe restrictions and legislations governing the advertisement for beer and alcoholic beverage sale in UK. Evaluserve (2007) has discussed the problems of binge drinking and the law and order problems caused during sporting events such as football matches where a number of fans undergo heavy drinking and then riot violently. Because of the potential of alcohol to cause harm, it is widely viewed that the way drink is packaged and advertised should be subject to some form of regulation. The alcohol by volume content has to be carried on all UK alcoholic drinks packaging under European law, but most of the regulation is through voluntary agreement between manufacturers, retailers, advertising agencies, media regulators and government agencies. Advertising standards guidelines restrict the times at which television advertising should be shown, for example, to avoid children’s schedules. They also put a minimum age limit of 24 on models or actors who appear in commercials, to avoid suggesting that drinks are being targeted at under-18s. Advertising is expected to avoid suggesting sexual success of placing emphasis on heavy consumption.

For decades after the Second World War, the list of most popular drinks in the UK market remained largely unaltered. Ale and whisky were consumed in vast quantities because historically they are both home-produced beverages. Imports were expensive, so table wine was seen as an exclusive preserve of the middle classes or the rich. Young men going out to pubs were prone to drink what their fathers drank, largely because there were not many alternatives. But gradually, from roughly the 1970s onwards, tastes began to change. The emergence of supermarkets with huge ranges of drinks products started a movement from drinking in pubs to drinking at home. Wine from all corners of the world became more readily available as did exotic spirits. Powerful lager producers from North America and Australia had sufficient muscle to challenge the home-produced ales in the British market causing a transformation in consumer habits. British youth now had alternatives to the tired old products drunk by their older relatives, and vodka and lager became two of the most popular.

Evaluserve (2007) has reported that the government has taken increasing interest in ensuring that underage drinkers are not encouraged to drink and has effect legislation to prevent such occurrences. The Portman Group is an industry body set up by a group of leading drinks companies in 1989. Seven years later, it adopted a code of practice on the responsible marketing of alcohol which further enshrined some of the principles of self-regulation, and extended the scope to cover drinks packaging and naming so that they too should not place emphasis on sexual success, energy-giving properties or high strength.

Market Outlook and Strategy Proposals

The beer market is showing signs of growing and as per the projections for 2008, a CAGR of 1.1 percent is projected. Cheap imports and price differentials between countries of Europe and UK sees a lot of beer and other alcoholic beverages being smuggled inside UK. The UK government wants to see the industry doing more to clean up its own act and says it will review the situation in two to three years’ time. That gives the industry some breathing space, but if the intervening period fails to deliver a substantial improvement in the issues surrounding binge drinking, compulsory measures can be expected. Arguably, the industry needs to reposition its collective stance on the social costs of the product it produces. The Portman Group reflected the political and social mood of the time when it was set up in 1989, but its remit has remained pretty much unchanged since.

Unfortunately for the industry, low-budget campaigns and a regulation policy, which appears to target relatively minor products, are no longer enough to satisfy the trade’s critics. Individual large producers have taken the first steps to improve their image while maintaining the power of their brands. A coherent industry-wide strategy that tackles some of the core issues around pricing and marketing would help contribute to the change in drinking culture that most of those with an interest in the binge drinking debate seem to think is necessary. More emphasis needs to be placed on the responsibility of the individual for their own drinking habits and behaviour, but to achieve this requires honest information about what alcohol is and what it does. As Prime Minster Tony Blair has said: “The one million people employed in the alcohol industry can be a strong force for cultural change. But only if the industry finds a way to harness their talent and ability.” That will clearly require a big commitment: in money, time and moral will. Change is likely to take a very long time

Conclusion

The UK beer market is worth 28.3 billion USD in 2006 and is expected to grow by 1.3 percent over the next few years. The market has three major players who have about 65 percent of the share while the rest is split up between other players in the market. The sale of beer is subject to heavy taxation of 31 percent and this amount of tax is much higher than the tax imposed in other European countries and it has caused illegal import of cheap beer and alcoholic beverages into UK. The government is actively bringing in legislation to prevent underage drinking and has placed restrictions on advertisements for alcoholic products.

References

Annette Felicity (2007). Growth Strategies in Alcoholic Drinks: Emerging trends in beer, wine and spirits. UK: Business Insights Ltd.

BBPA (2007). Tax & Expenditure. Web.

Evaluserve (2007). The Alcoholic Drinks Market Outlook To 2008. UK: Business Insights Ltd. pp: 175 – 180.

Europe Beer (2007). Beer in Europe: Industry Profile. UK: Datamonitor. Reference Code: 0201-0744.

Mintel (2007). Low-alcohol and Alcohol-free Drinks – UK. Mintel International Group Ltd.

UK Beer (2007). Beer in the United Kingdom Industry Profile. UK: Datamonitor Publications. Reference Code: 0183-0744.