Beer drinking is an essential component of family, social and professional life for many people living in the United Kingdom. The excessive trend of consumption has frequently been reported in the last two decades. High per capita consumption can be traced back to the middle ages.

However, over the last century, beer consumption has varied considerably. According to the UK customs and excise department, per capita consumption of beer in the early 1900s was higher than any other point in time (British Beer and Pub Association, 2007, p. 3).

The consumption sharply declined following the First World War and Second World War due to restrictions in the pub operating hours, and other measures, for instance, reduced alcoholic percentage and proscription of “buying in round” for fear that excessive consumption will weaken the combatants. A small decline was also experienced during the Great depression of the 1930s (British Beer and Pub Association, 2007, p. 3).

Since 1950s, the per capita consumption of beer has increased exponentially. The per capita consumption reached its apex in 2004. However, the consumption started to decline in 2006 because of the new taxation laws and the global financial crisis of 2007/2008. In the last five years, excise duty on beer has increased to nearly 40 percent.

The escalation in excise duty has led to the increase in beer prices and cut-price off-trade trade buying. Strict driving laws, which prohibits excessive alcohol consumption also contributed to the decline. As a result, numerous pubs have been forced out of the business. The aggregate beer production also fell by 22 percent (TCS, 2013, p. 7; British Beer and Pub Association, 2007, p. 3).

Figure 1: Per capital consumption of alcohol in the United Kingdom

Source: Smith and Foxcroft (2009, p. 9)

Despite the dwindling level of per capita consumption, UK is still among the highest beer consumers in Europe with an average per capita consumption of 89 litres. Hence, UK residents are considered to be among the heaviest drinkers in Europe. As a result, UK remains the largest market for beer manufacturers across Europe.

As a matter of fact, 67 percent of the UK beer market is dominated by large multinational companies, for instance, Carlsberg and countless local breweries (IAS Facts Sheet, 2013, p. 5; British Beer and Pub Association, 2007, p. 4).

There is a rising trend of homes being converted into entertainment hubs among UK consumers. In addition, beer is increasingly being sold in off-trade premises, for instance, supermarkets and other retail outlets. This offsets the amount of pubs and clubs being closed due to the escalation in excise duty. For this reason, the UK beer market is still lucrative with abundant opportunities (Smith & Foxcroft, 2009, p. 14).

7 Ps Analysis of the UK Beer Market

Data on the current trends in beer consumption shows that beer volume growth in the UK continues to improve since 2011, though it is still low as compared to pre 2006 levels. The development signifies that the UK beer market is on its way to full recovery. At the moment, customers are looking for real benefits from the products and are buying beer in relatively small quantities due to high prices.

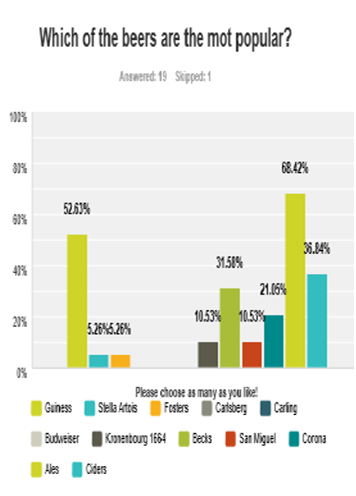

Furthermore, due to changing tastes and increase in household income, consumers are now looking for quality over quantity. As a result, there is a general swing towards premium beers. Stouts (strong dark beer) and ales are the most popular types of beer. This is shown in the survey result below; Guinness and Stella Artois tops the chart.

The per capita consumption is high among adults aged between 15 to 34 years. They are considered to be the heaviest drinkers. This group likes to ramble and party. Therefore, they are the target market for most beer companies. Moreover, studies show that the current designs of beer appeal more to the youths than older people. Adults aged between 35 and 55 are also high alcohol consumers.

They are known to frequent pubs, family get together parties, corporate events and major sporting events where alcohol consumption is rampant. This group of consumers goes to pubs not just for beer, but also for ambience and socializing. Therefore, these consumers do not choose an outlet based on the stocked brand alone.

For this reason, the Great British Banjo Company must cater for this category of consumers. It is also important to note that, in the United Kingdom, men and women drink in equal measure. In addition, there are increasing cases of underage drinking, though illegal (Smith & Foxcroft, 2009, p. 15).

Majority of the beer consumers in the UK are very conservative and loyal to particular brands. The loyalty is brought about by unique taste of certain brands, general corporate social responsibility, and club sponsorships among others.

They also value quality of ingredients that goes to the beer and time after time brewing style. For that reason, brand image and product quality are the most significant aspects. However, product prices are also becoming a significant factor. This is attributed to high cost of living and the current tax regime (British Beer and Pub Association, 2007, p. 5).

Well established brands enjoy the largest market share in the UK market. Some of the most popular brands include Carlsberg, Budweiser, Guinness and Castle Larger. As a matter of fact, they control nearly 80 percent of the market. This is a major barrier to the new entrants in the UK market.

As a result, Shackleton brand will find it very difficult to penetrate the UK market. Hence, they will have to employ all the available promotional tools. The company can also explore the new and untapped UK markets, for instance, home entertainment.

The promotion of beer and other alcoholic beverages in the UK encompasses a wide range of activities, including advertisements, sponsorships, featuring, loyalty schemes and electronic marketing among others. Alcoholic drinks companies have been among the top source of sponsorship in the last one decade.

No wonder, they are very popular among clubs and their fans, for instance, Carlsberg is synonymous with Liverpool football club (TCS, 2013, p. 7). Increasingly, beer brands are being promoted to a greater extent in the internet and online social media. For example, in 2013, Anheuser-Busch signed a multimillion dollar deal with Instagram to popularize Budweiser brand.

The social media enable these companies to interact directly with the existing and prospective customers. In addition, they also help in getting consumer views regarding a product or brand. According to the survey, promotional campaigns, featuring and visual aids are the most dominant channels used to introduce new brands into the UK market.

The UK beer market has all along been known to use discounts and volume-based price promotions as key marketing tools. This was aimed at enhancing the consumption levels. However, with the introduction of minimum price per unit policy (MPU) such practices have been abolished.

The new policy in conjunction with high excise duty on alcoholic products has forced brewers to increase beer prices. So, the two factors (MPU and excise duty) have a significant impact on the level of beer consumption in the UK (IAS Facts Sheet, 2013, p. 5). As indicated by the survey, most pubs and other retail outlets set their price margin at around 30% to 50%.

The margin is not stable and, therefore, varies in accordance with the price set by the brewers. For that reason, the Great British Banjo Company will have to produce low cost beer because it will be more attractive for the pub owners and other retail outlets.

Since most beer consumers frequent pubs not only for a particular beer brand, but also for experience and socialization, serving mode is very important. Some brands, for instance, Stella Artois have set a high bar with regard to their mode of serving. They portray a very expensive image through their exclusive packaging, pint glasses and Draught Barrels (Stella Artois, 2012, p. 9).

In the UK, most pubs serve beer in full pints, half pints and glass bottles. Half pint is increasingly becoming popular among low income segment due to the increase in beer prices. However, middle and high income segment are also embracing it because of strict driving laws, which prohibits excessive alcohol consumption.

References

British Beer and Pub Association 2007, Statistical Handbook: A Compilation of Drinks Industry Statistics, 2007, Brewing Publications, London.

IAS Facts Sheet 2013, Marketing and alcohol, Institute of Alcoholic Studies, London.

Smith, L & Foxcroft, D 2009, Drinking in the UK: An exploration of trends, Joseph Rowntree Foundation, Yorkshire.

Stella Artois 2012, Stella Artois and the Virtue of Consistency: Synopsis. Web.

TCS 2013, Brewery Industry in Transition: Embracing new Markets, Products and Consumers, Tata Consultancy Service Limited, Bombay, India.