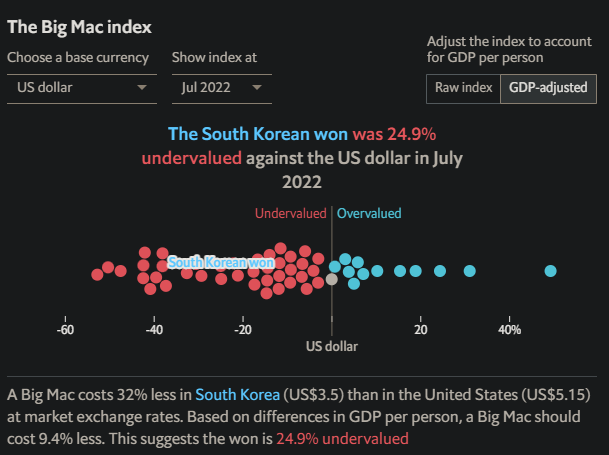

The first country chosen for the analysis is South Korea, an example of an advanced country. Based on the Big Mac index, the won is 24,9% undervalued (The Big Mac index, 2022). The recent rise in the won may be due to the problems of the current pandemic. After the news about the development of several vaccines at once, investors calmed down about the pandemic and stopped buying dollars. Now, on the contrary, they are massively selling the US currency and investing in various other potentially profitable projects. Considering the investment focus on the inner developmental projects, the American product launch can be difficult in South Korea. The significant negative implication is the lack of investment support.

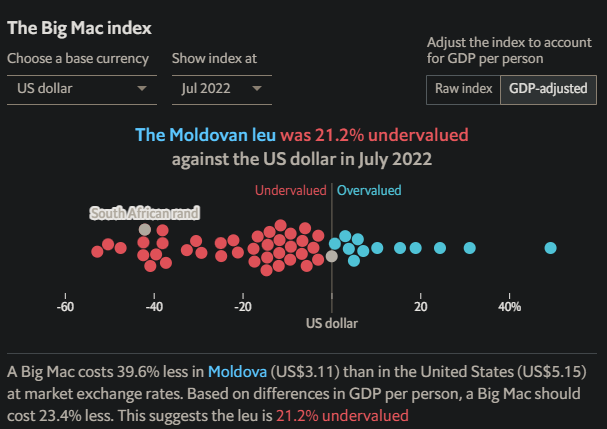

The second country is the developing Moldovia, the currency of which is undervalued at 21.2. % (The Big Mac index, 2022). Every day, the dollar’s exchange rate against the lei is calculated on the basis of information about how many dollars were bought and sold with our lei. At the same time, transactions with an amount of less than $100 are not considered. All volumes are counted, and the arithmetic mean value is displayed. This is the official exchange rate of the leu. The appreciation of the Moldovan leu is due to several reasons. The demand for foreign currency in the foreign exchange market decreased in one year, primarily determined by the decrease in imports due to the pandemic. In Moldova, the National Bank seeks to pay more attention to the interests of domestic producers. Therefore, the mentioned factors can slow down the launch of the American product in Moldova. The negative implication of the valuation can include problems with a short product existence period.

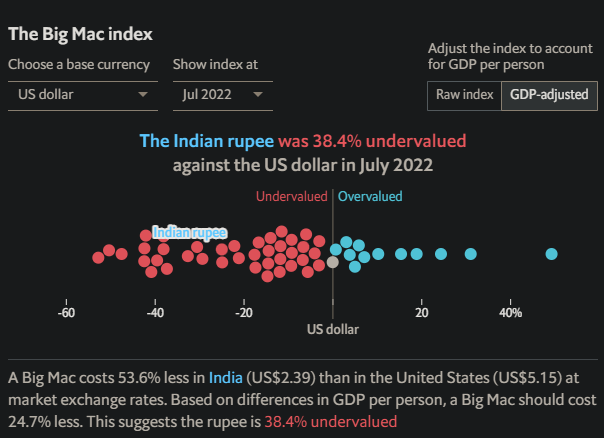

The third country of emerging the IMF is India. The Big Mac Index shows that the rupee is 38,4% undervalued (The Big Mac index, 2022). The exchange rate of the Indian rupee is influenced by the fundamental data of the economy, which give long-term trends in financial instruments. India has a cost-sensitive market, which lowers product prices compared to other countries. In this market, distrust of foreign companies is the norm, while established traditions and cultures do not influence how business is done, ultimately setting the course. Mediation is also a severe problem and a break in the product launch in India. Often, payment in the industry is made not through banks but through the “raja.” This is especially characteristic of the more backward regions of the country, where this is considered quite acceptable.

Reference

The Big Mac index. (2022). The Economist. Web.