Blackstone Hospital | |||

| Module 1: Our Structure | Module 2: Who We Serve | Module 3: Financial Performance | Module 4: Reporting Requirements |

New Employee Training Guide

| |||

Module 1: Our Structure |

| Impacts of financial determinants in health organizations The payment mechanism represents one of the main building blocks of a good health system. The payment strategy is well exhibited by the financial performance in every hospital. It is mainly measured through the net revenue incurred and the operating financial margin. The financial margins are represented through financial account statement analysis that occurs in different periods of the year. According to Zainon S. et al(2014), financial margins are represented in form of a balance sheet, cash flow, and income statements. The financial statements are of great essence in that; they are used by the internal and the external stakeholders to estimate the business performance and value of every health organization. For-profits, and health organizations the financial data or reports are given to the shareholders and investors whereas non-profit health organizations’ financial reports are given to the Board of Directors or other governing authorities. These reports are important in that they help the investors to evaluate and take sustainable economic decisions by comparing the past and present performance of the health organization Blackstone hospital is a profit-making organization. There is a difference in ownership of the profit and non-profit hospitals; that is, the non-profit hospitals belong to either the state or the government while the profit health organizations belong to either the investors or the shareholders of a publicly-traded company. Thus, the government-owned hospitals are managed by a country’s Ministry of Health, while the non-profit hospitals are managed by an appointed or employed management team. However, there are some non-profit hospitals owned by a charitable organizations, especially in a locality of the underserved population in a community. Additionally, there are differences between profit and non-profit health organizations regarding ownership and taxation. Simnett (2017, p 61) insinuates that non-profit hospitals, it is well-known that they act as charitable organizations which provide benefits to the community. Unlike, profit hospitals that only provide services to specific individuals. These private individuals may include the private equity firms registered with the hospital or partners related to the profit hospital. In addition, non-profit hospitals do not pay income or taxes to the state, unlike the profit health organizations that are expected to pay a particular amount of fee to the government to continue with their operations.  |

Module 2: Who We Serve |

| Nevertheless, the population served by the non-profit health organizations usually receives more uncompensated care than those served in profit hospitals. Profit hospitals tend to be located in communities of high incomes earners and with fewer uninsured patients. Non-profit hospitals tend to serve the lower-income populations with the majority of the patients being uninsured. In addition, the profit health organizations allocate most of their funds to marketing and advertising their services. Unlike non-profit organizations, they do not have a target on the minimum number of patients they need to serve to avoid making losses. |

Module 3: Financial Performance |

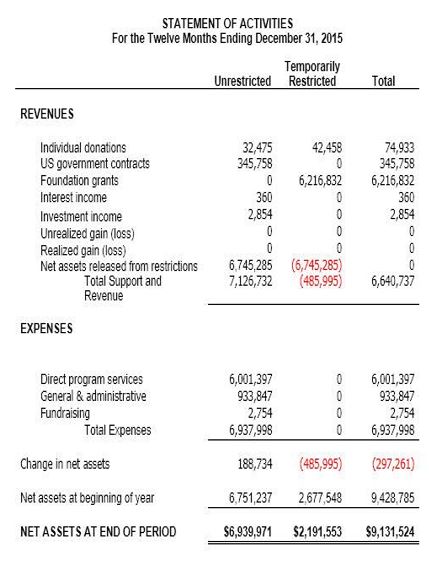

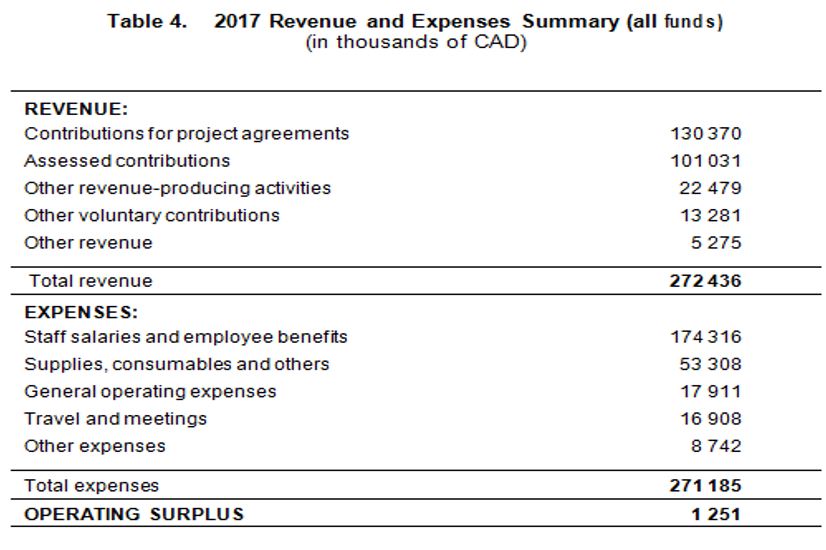

| Despite the laid out differences, both non-profit and profit health organization sectors have similarities. The primary similarity is that their core value is to provide better health care to their population. Their population act as the determinant of their progress. Non-profit health, organizations create free seminars for disease awareness and offer free medical screening. On the other hand, profit health organizations market their services by offering certain discounts on their medical services. They advertise and publish the offered services for easier reach by their population. Nevertheless, there are differences that exist between the two health organizations. For instance, Simnett (2017, p 60) notes that non-profit organization sources their revenues from charitable organizations, donations, and grants from states or governments while profit organizations get their resources from their shareholders. Secondly, the main expense difference between the profit and non-profit organizations is that the profit organizations keep a balance sheet that reflects what the organization owns. For non-profit organizations, a financial statement is kept to reflect the asset on hand that can be used by the organization to further its goals and mission.  Managers in the non-profit health organizations get an easy time while implementing strategies for their source of revenue is not sided; yet, they fully get the support from the government unlike their counterparts in that, the decision made relies on certain individuals.  |

Module 4: Reporting Requirements |

| Roles of financial reporting in organizations Financial reports help non-profit and profit health organizations to reduce errors in their operations, improve the acquisition of vital patient data and help reduce unnecessary expenditure. Also, the information gathered from financial reports is used by managers in decision-making. They should be formal and prepared in each accounting period. However, they should reflect certain basic features and have a fair representation of the ongoing concerns in the profit and non-profit health organizations. Hospitals of both profit and non-profit status face a common challenge of maintaining positive operating margins with the ability to fund new patient services. The ability to increase revenue is limited, even in for-profit hospitals, without sacrificing the quality of care. However, by using up-to-date and comprehensive financial and operational data, leaders can implement actions that would provide close oversight over the greatest cost drivers of labor and supplies. This underlies the need for accurate financial reporting and transparency, as operational leaders can better understand performance and assume greater accountability. With reported data, it allows departments to make the most efficient use of staff hours and supplies while optimizing patient care (HealthCatalyst, 2016). Moreover, health care managers in both profit and non-profit organizations, apply the GAAPS (Generally Accepted Accounting Principles) to record and report financial information in a uniform manner (Chang et al.,2014, p 23). Chang et al. (2014, p 23) also note that it helps health managers ease the burden of comparing a health organization’s financial statements. In addition, GAAPS enables them to establish the creditworthiness of the health organization to earn financial strength. Furthermore, non-profit organizations are typically built on the values of accountability and transparency. Not only does that help to build relationships with donors and maintain public and employee trust, it is also a legal requirement. By law, tax-exempt nonprofits are required upon request to provide copies of the past three years of filed annual information returns (IRS Form 990) and the organization’s application for tax exemption. To maintain its 501(c)(3) non-profit status, the organization must keep records and provide financial reports to the IRS on all donated income and materials and how it is used toward programs, activities, or salaries for the purpose that the organization is registered for (Department of Housing and Urban Development, n.d.). This is a strong reason for health organizations to maintain strong financial reporting practices. Failure to meet the requirements of reporting either to the IRS or by public request can lead to investigation and it is extremely easy to lose the legal non-profit status which brings the benefits of tax exemption and such. Both non-profit and profit health organizations need to meet guidelines and comply with the accounting regulations. This helps to ensure the responsibility of keeping track of the actual services being provided and makes sure that no patient is charged incorrectly. It also provides a good framework for decision-making to profit and non-profit health organizations. Therefore, both categories of health organizations should comply with this cut-out guideline. In conclusion, non-profit and profit health organizations serve the same purpose in society regardless of people’s social status. The two healthcare organizations aim at providing quality health care services in different social and economic status communities. Hence, it is upon diverse individuals to choose the best service being offered according to their backgrounds or social status. |

References

Chang, H., Ittner, C.D. and Paz, M.T., 2014. The multiple roles of the finance organization: Determinants, effectiveness, and the moderating influence of information system integration. Journal of Management Accounting Research, 26(2), pp.1-32.

HealthCatalyst 2016, How hospital financial transparency drives operational and bottom line improvements. Web.

Simnett, R., 2017. Determinants of Financial Information Published by Private Not‐For‐Profit Organisations. Accounting & Finance, 27(2), pp.53-71

U.S. Department of Housing and Urban Development n.d., Maintaining a 501(c)(3). Web.

Zainon, S., Atan, R. and Wah, Y.B., 2014. An empirical study on the determinants of information disclosure of Malaysian non-profit organizations. Asian Review of Accounting