Introduction

The 21st century has witnessed numerous developments in the human society, specifically, the growth in technology, which has influenced all other human sectors, including transport, commerce, communication, and industrialization among others. The rise of globalization has also been evident in recent days, which in turn has influenced trade across nations, hence raising new opportunities for business organizations.

In light with these developments, business organizations have been put under pressure, to adopt the most efficient strategies. The online jewelry industry is of great concern as far as contemporary business is concerned.

Significant developments have been realized in this luxurious industry over the last decade, whereby, many players have entered the industry and shifted from the traditional brick and motor operations to innovative business operations, through the use of computer and internet technology.

In this report, Blue Nile, which is a key player in the online jewelry industry, will be reviewed. The business model, competitiveness, opportunities, threats and potentiality in excelling in the industry will be evaluated.

Blue Nile’s background information

Blue Nile Inc is the largest online specialty retailer of fine jewelry, founded in 1999. The company has grown to be the largest online retailer of diamonds. The company has its headquarters in Seattle, Washington, whereby, it deals with customers across all corners of the globe.

The company has been able to withstand pressure from its competitors, mainly Tiffany & Company, as well as James Allen. The efficiency of the company has greatly facilitated its success. Cut, carat weight and clarity among other features, are what has sustained its success and customer loyalty (Thompson 270).

Industry, products, and market of Blue Nile Inc

Blue Nile Inc operates in the larger online jewelry industry, whereby it deals with a variety of jewelry items. This is a lucrative industry in the global economy, whereby, over $340 million worth of engagements rings are sold.

The industry also commands a sale of over $2 billion worth of other types of rings and jewelry items, thus making it a lucrative industry. Blue Nile Inc, which operates in this lucrative industry, has a wide customer base. The company’s target market is wide, ranging from youth, couples, families and the wider population (Thompson 283).

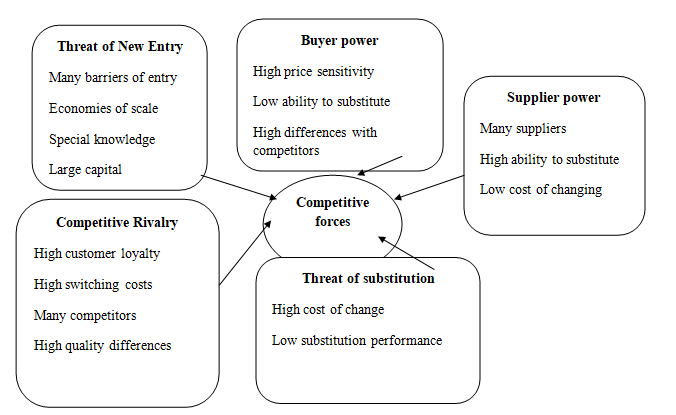

Competitive forces facing Blue Nile Inc and other companies in the industry

Like other industries, the online jewelry industry is very competitive, and puts each of the business in the race to success.

Each of the businesses in the industry is surrounded by competitive pressures from different aspects, including buyer bargaining power, seller-buyer collaboration, substitute products by competitors, supplier bargaining power, threat of new entries and pressures from rivalry of competing sellers (Thompson 282).

Buyer bargaining power

The online jewelry industry has been very challenging over the recent past, whereby, the different players are under high pressure from customers. The need for quality and product differentiation is overwhelming in the industry. This scenario puts the different businesses under pressure to invest in R & D, to come up with the best technologies (Thompson 282).

Pressure from competitors

The online jewelry industry is currently flooded by different players, who are competing for customers. This phenomenon has put undue pressure to Blue Nile Inc, to rethink its strategies in fear of substitute products as well as loss of competitive power. Some of the competitors challenging the leadership of Blue Nile Inc, include Diamonds.com, Whiteflash.com, Ice.com, and Jamesallen.com (Thompson 283).

Supplier bargaining power

Due to the nature of the industry, supply chains have been inevitable. Currently, Blue Nile Inc has its products and services offered by third parties. Despite the high threat of supplier bargaining power, Blue Nile Inc has managed to ensure low operational costs, by ensuring supply of quality products at the lowest prices.

By ensuring that suppliers are selected on a competitive process, Blue Nile Inc has been in a position to counter the forces of supplier bargaining power (Thompson 278).

Threat of new entrants

Like other industries, the online jewelry industry is prone to new entrants. Nevertheless, the high capital requirements and sensitivity of the business, poses a great barrier to new businesses.

At present, the industry has a handful of players, which may or may not easily increase due to the financial and technical barriers of the industry. This is an advantage to Blue Nile Inc and other businesses in the industry, since the threat of new entrants is limited (Thompson 283).

Rivalry among competing sellers

Despite the high similarity of the products being offered in the industry, there are very low chances of conflict between the various players. The issue of product differentiation, customer loyalty, segmentation and price strategy has been a clear cutting line between the players.

For the case of Blue Nile Inc, competitive advantage is attained through pricing strategy, strong brand image, product quality and customer service among others, thus creating a barrier between the company and competitors (Allen et al).

Success factors in the jewelry industry

The competitive nature of the jewelry industry, calls for different players to demonstrate their competitiveness and efficiency, above their competitors (Thompson 282).

Some of the key success factors to determine a company’s success and sustainability in the online jewelry industry include product differentiation, strong brand image and loyalty, customer relationship management, intensive focus on research and development, and strong strategic and financial performance.

Blue Nile’s strategy and business model

The performance and competitiveness of Blue Nile Inc can be attributed to its keen adoption of the generic strategy of differentiation. Blue Nile Inc has been leading success due to its keen concern on product differentiation, by ensuring optimum quality of its products.

Based on its efficient personnel and supply chains, Blue Nile has been able to ensure optimum quality of the products as well as customer satisfaction, through quick delivery.

The concept of product quality has been adequately considered by the company; by ensuring customers get the best value for their money. The pricing strategy has also been prioritized by Blue Nile, whereby, it seeks to offer fine jewelry at the most competitive and attractive prices (Thompson 282).

SWOT analysis

Blue Nile is well positioned in the online jewelry industry, where it has been in a position to demonstrate leadership over the last couple of years. The company is well endowed with financial, human and technical capacity, as well different unexploited opportunities. Nevertheless, various weaknesses and threats face the company, which may compromise its success if not adequately addressed.

Strengths

Strong Market position

Despite the strong competition experienced by Blue Nile from its competitors, it has succeeded in positioning itself to its customers. The pricing strategy adopted by the company as well as the great concern on quality, has helped in positioning the company’s products. Product differentiation has been adequately used by Blue Inc, thus building a good reputation to its customers (Allen et al).

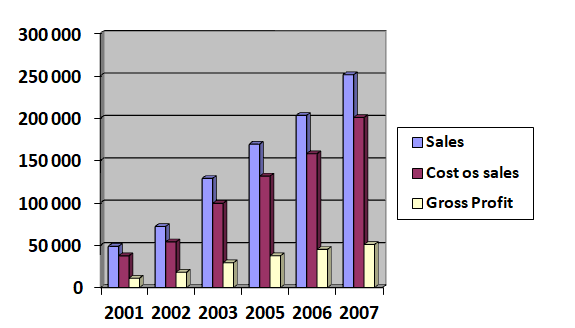

Strong financial performance

Over the last three years, Blue Nile has recorded consistent increase in sales and profits. This is attributed to its strong brand image and customer loyalty. The company’s gross profits were at $11.1 million in 2001, and rose to $50.9 million in 2006. This is robust growth, which demonstrates the commendable financial performance of the company (Thompson 279).

Efficient and extensive production and distribution network

Blue Nile has strong production and distribution networks, which enhances customer service. Its trusted and efficient suppliers have been facilitating quality and efficient supply and distribution of products, thus yielding to customer satisfaction. Cost leadership has also been attained through the efficient supply chains, thus enhancing the pricing strategy (Thompson 278).

Strong Research and Development

The strong financial capacity has enabled the company to support ambitious R & D projects. This helps in enhancing attractive product design as well as administration of intensive market research and analysis (Thompson 278).

Brand Equity

Blue Nile has been leading the end in ensuring strong brand loyalty, based on value and customer satisfaction. This is of great value in enhancing sales and stable customer base.

Proprietary technology and technological; infrastructure

The concept of technology has also been prioritized by Blue Nile, whereby, it has adopted modern technology in marketing, customer relationships, supply chains management and product design and development. By adopting these technologies, the company has been able to realize its cost leadership, as well as efficiency in product development and customer relationship management (Thompson 278).

Weakness

Weak performance in the emerging markets

Despite the rapid growth in emerging markets like China and India, Blue Nile has not taken a step to capitalize on these markets. Its great focus on US and UK markets compromises its future prospects, thus calling for the need of diversification (Allen et al).

Weak turnover ratios

Despite the high financial and strategic performance of Blue Nile Inc, it has weak turnover ratios. In comparison with other players in the industry, like JamesAllen.com and Whiteflash.com, Blue Nile’s financial stability is at stake. The management of the company has been reluctant, in deploying assets profitability (Thompson 279).

Opportunities

Growing demand of diamonds

The global population has over the last decade shown a rapid increase in the demand for diamonds. Based on the average growth of global GDP and population over the last decade, the demand for diamonds and jewelries in particular, is expected to rise. This is a lucrative opportunity, which Blue Nile should capture (Allen et al).

Emerging markets

China and India have over the last three decades demonstrated robust economic growth and development. This has had positive impacts on global demand, thus having positive effects on the demand for diamonds (Allen et al).

Threats

Competition

Blue Nile is not exempted from competition, whereby, new players have entered the industry. At present, Blue Nile is facing stiff competition from Ice.com, JamesAllen.com, Whiteflash.com, and Diamonds.com (Allen et al).

Rising costs of raw materials

The prices of diamonds are ever increasing due to the uncontrolled exploitation. This has adverse impacts on the cost of production for the jewelries, which in this case leads to higher prices, thus limiting the affordability of the products (Allen et al).

Global economic slowdown

The global economy is still recovering from the impacts of the just ended global recession. This phenomenon, which has been highly felt in the US and Europe, is negatively affecting the global demand for jewels (Allen 21).

Foreign currency risk

The global economic slow down, as well as the fluctuation in foreign currency, has great effects on the online trade. Since Blue Nile Inc is operating on the global platform, fluctuations in different currencies will definitely have adverse impacts on its business (Allen et al).

Table 2:

Strategic issues and financial performance of Blue Nile

Keen analysis of Blue Nile’s internal and external business environment, demonstrates its strong competitive advantage. The business and corporate level strategies have clearly highlighted its efficiency and competitiveness in the online jewelry industry.

Some of the key strategic issues of Blue Nile Inc, which are enhancing its success and competitiveness, include the lean costs, competitive pricing, supply chain efficiency, customer relationship management, and customer focused marketing (Thompson 279).

In order to attain success, Blue Nile has to focus on the issues of product differentiation, market diversification, product diversification, human resources management and technology leadership. These are key strategic issues, which Blue Nile has not fully addressed. By addressing these issues, Blue Nile will be able to reinforce its competitive edge, thus sustaining its success (Thompson 279).

With regard to financial performance, Blue Nile is leading success in the online jewelry industry. The company has been reporting consistent increase in sales over the last decade.

For instance, the company has attained a compounded growth rate of 35.6%, between the year 2001 and 2006, whereby, it recorded a sales increase of $50.9 million from $11.1 million. The consistent increase in financial performance of the company over the last six years, is a key aspect of concern, which demonstrates the financial strength of the company (Thompson 279).

Financial Ratios

1. Gross profit margin = Sales-cost of goods sold

Sales:

2001 22.8%

2002 25.17%

2003 22.8%

2005 22.24%

2006 22.21%

2007 20.21%

2. Operating profit margin (or net return on sales)= Sales – operating expenses

Sales:

2001 68.3%

2002 80.4%

2003 85.87%

2005 86.82%

2006 86.66%

2007 86.36%

3. Net profit margin (or net return on sales)= Profits after taxes

Sales

2001 -15.2%

2002 2.26%

2003 20.9%

2005 5.9%

2006 6.47%

2007 5.19%

4. Return on stockholders’ equity= Profits after taxes

Total stockholders’ equity

2001 0.13

2002 -0.029

2003 -0.99

2005 0.11

2006 0.16

2007 0.27

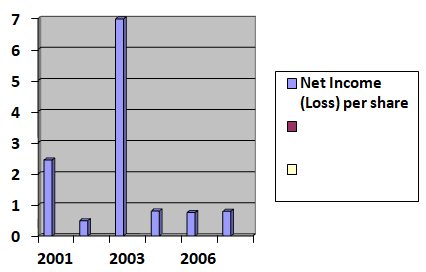

5. Earnings per share= Profits after taxes

Number of shares of common stock outstanding

2001 -2.44

2003 0.49

2003 6.97

2005 0.80

2006 0.75

2007 0.79

Liquidity ratios

1. Current ratio= Current assets

Current liabilities

2001 N/A

2002 N/A

2003 1.5

2005 2.78

2006 2.38

2007 1.56

2. Quick ratio (or acid-test ratio)= Current assets- inventory

Current liabilities

2001 N/A

2002 N/A

2003 1.2

2005 2.55

2006 2.17

2007 1.36

3. Working capital= Current Assets- current liabilities

Leverage ratios

2001 N/A

2002 N/A

2003 -1.47

2005 -2.7

2006 -2.3

2007 -2.7

In light with the financial analysis illustrated by the ratios, the performance of Blue Nile is appealing. The company demonstrated continued improvements between 2001 and 2007. Despite that the gross profit margin has been in a declining trend since 2001, the general profitability of the company has been in an upward trend.

The earning per share has also been in an upward trend, though it has also been fluctuating. The general performance of the company is however appealing, though efficient strategic plans should be executed to save the situation (Thompson 279).

Stock performance

Based on the fluctuating and stock performance of the company, it is not advisable and lucrative to purchase Blue Niles Shares. Over the last 7 years, the company’s financial performance has been in an upward trade, though the stock performance keeps on fluctuating. This demonstrates uncertainties of the company, as a potential opportunity for investment (Thompson 279).

Conclusion and recommendations

In light with the discussion and analysis of Blue Nile’s internal and external situation, the potentiality and success of the company is demonstrated. Blue Nile has been leading success in the industry, and has every potential of sustaining its performance.

Despite the various strategic issues and competition in the industry, the company has managed to sustain its performance over the last 10 years. In order for Blue Nile to boost its performance, the following strategic options should be adopted.

- Product differentiation.

- Market diversification.

- Human resources management.

- Customer relationship management.

- Technology leadership.

Works Cited

Allen, Anthony et al. Blue Nile Case. Web.

Thompson, Arthur. Blue Nile Inc.: World’s Largest Online Diamond Retailer. New York: McGraw Hill Press, 2008. Print.