Introduction

British Airways (BA) is the leading airline in the United Kingdom (UK). The company’s main operational hubs are Heathrow and Gatwick airports (Heathrow Airport Limited 2019; London Air Travel 2018). Its fleet size is comprised of about 270 aircraft, while its flying routes span across 170 destinations (Routes Online 2019; Jarvis 2017).

BA’s strategic direction is based on a three-pronged strategy, which focuses on expanding its airline fleet, transforming customer experiences and growing its global route network (British Airways PLC 2016; (Burke & Noumair 2015). In line with this strategy, The company’s competitive advantage is linked to four key performance indicators (KPIs): financial performance, customer service, operations and colleagues (British Airways PLC 2019). Its dominance on the transatlantic route and its Heathrow operational base is also key competitive advantages (Burke & Noumair 2015).

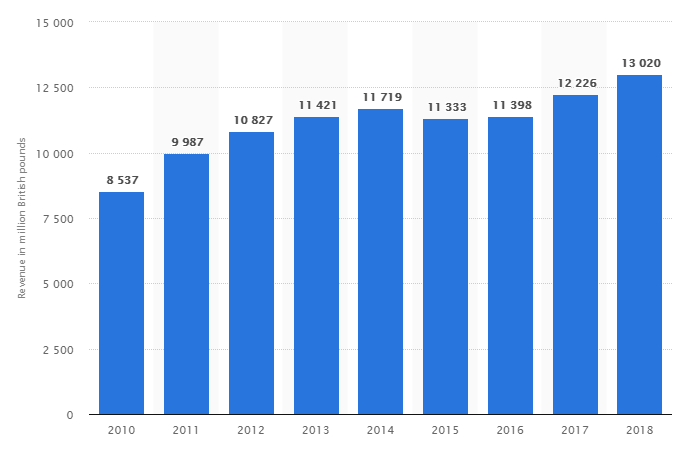

According to figure 1 below, BA’s financial performance within the last eight years has marginally improved from £ 8,537 million to £13,020 million (Statista 2019).

Although the company’s financial performance has steadied throughout the decade, its customer service record has declined. YGR (2018) and Efthymiou et al. (2019) support this view by noting that the public perceptions of the airline’s brand value and quality have decreased by 11.5 and 13.4 points, respectively. In this report, different strategic management tools, such as SWOT analysis, will be relied on to analyse BA’s performance, and they are useful to individuals who would want to invest in the company. An analysis of the company’s key differentiating factors is highlighted below.

Differentiation

In an industry crowded with many competitors, airlines are struggling to differentiate their services and create dominant alliances to stay ahead of their rivals (Sharma & Singh 2017). The concept of market differentiation stems from the need for businesses to provide unique products to selected markets (Airline Trends 2015). Different strategic analysis tools are used to assess a firm’s differentiation strategy. One of them is the Ansoff matrix, and it is used to review BA’s strategy in table 1 below.

Table 1. Ansoff matrix

Although the above Ansoff matrix shows different aspects of BA’s strategic focus, the focus of this review will only be on the airline’s market development strategy.

Market Development

According to the Ansoff matrix described above, BA’s market development strategy has mainly been characterised by customer segmentation (according to classes), the introduction of loyalty programs, diversification, new customer segments and new routes (One World 2019). Customer classification according to income brackets has dominated the airline’s overall marketing development plan because its other strategies are premised on segmentation. For example, the company’s loyalty programs are based on this strategy (One World 2019).

BA’s marketing development plan has been pushed on two fronts: passenger and cargo (Statista 2018). In line with this business model, BA has established a wide transportation network that spans more than 170 destinations spread across 70 countries (Routes Online 2019). This market network is vast, and few airlines can match it. BA has also purchased several aircraft from Airbus, which are equipped with advanced technology for passenger comfort and efficiency (British Airways PLC 2019). It also has a few Boeing planes, which support the current fleet (British Airways PLC 2019).

Broadly, BA had had moderate success in its market development strategy because of its keen focus on customer satisfaction. For example, the multinational analyses customer satisfaction levels to make sure its loyal clients do not have waning interests. Notably, the average age of most BA customers is 48 years, and they frequently fly with the airline (British Airways Media 2017). To achieve high levels of customer satisfaction, the airline has leveraged its technology-based resources (Liu 2018). For example, the use of the internet to make bookings, cancel flights and receive feedback has helped the company to maintain a good reputation with its customers (Liu 2018). This development is highlighted in the SWOT analysis highlighted in Appendix 1.

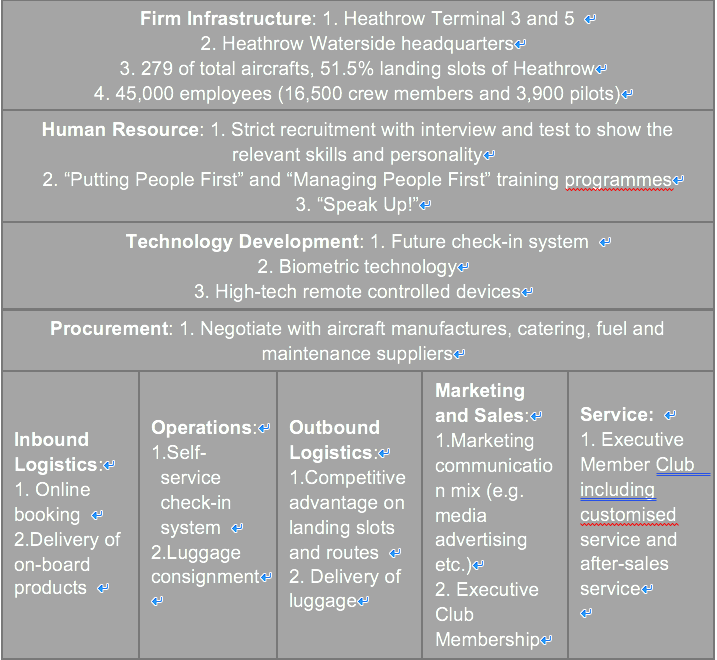

The use of technology to improve BA’s overall strategic performance highlights the high level of organisation of the firm’s value chain system, which considers technology as a valuable part of its service delivery framework. The airline’s value chain system is highlighted in Appendix 2. Indeed, according to the value chain analysis, BA regards technology as the third tenet of its value chain model. The others are infrastructure, human resource, technology development and procurement.

Appendix 1 also suggests that BA is undertaking more market development progress under the IAG, which is its parent company. The airline has secured the services of other players in the industry who are also helping it to achieve its market development goals under the IAG banner. For example, BA City flyer is a subsidiary of the company, which mostly offers exclusive flights within Europe (British Airways PLC 2017). The subsidiary operates from the London airport and serves several destinations on the continent. Such entities have helped to bolster BA’s market development strategy, while its shareholdings in other market subsidiaries have assisted in improving its diversification strategy.

As part of the VRIN findings highlighted in assignment 1, BA’s market development strategy has also been complemented by the development of unique and non-imitable competencies, which have supported its overall corporate plan. For example, the acquisition of landing slots across its transatlantic routes has bolstered its route network. Evidence of this advantage is provided in Appendix 1, which shows that the acquisition of landing slots is a resource advantage for the airline and has significantly contributed to the development of its competitive advantage.

BA’s strong brand image is also another non-imitable competency that the organisation enjoys and that complements its market development strategy. Indeed, the airline is one of the UK’s oldest state-owned enterprises and has dominated Britain’s airline industry for decades (Branding Forum 2019). Therefore, many people are aware of its existence, and some of them regard it as a national flag bearer (Branding Forum 2019). This strong brand image has given BA a “head start” over its rivals because it embodies the national aspirations of the British people. In this regard, it remains one of its most coveted symbols of market dominance not only in the UK but also in Europe. Nonetheless, it is important to note that the challenges facing BA in its market development strategy are political and economic in nature (Ethicist 2015; Byford & Wong 2016). For example, the rise in fuel costs has significantly affected the company’s operating margins because fuel is a significant cost component for the business. The uncertainty surrounding “Brexit” is also another impediment to the actualisation of the airline’s market development strategy. However, these challenges have not detracted the organisation from remaining competitive.

Strategy Analysis

According to the SWOT analysis of BA highlighted in Appendix 1, BA’s main strengths are resource advantages, equipment advantages, heightened competencies (in terms of technology use), a strong brand image, support from the IAG parent company and the airline’s alliance. The SWOT analysis also showed that available opportunities include market expansion in the global market and technology development. The current strategies adopted by BA align with the above-mentioned strengths and opportunities because most of the pivot on the need to leverage current competencies to exploit existing market opportunities. For example, according to the company’s 2018 financial report, BA was seeking to leverage its Heathrow operations to expand its global fleet of Airbuses and exploit emerging opportunities of travel in new routes (International Airlines Group 2019). This strategy aligns with one of the opportunities mentioned in the SWOT analysis – global market expansion.

The development of new runways at Heathrow will increase BA’s capacity to schedule more flights because the airport’s expansion will increase air traffic from 480,000 to 740,000 (International Airlines Group 2019). However, BA recognises that this opportunity can only be beneficial to the company if the current operating costs are maintained or reduced (International Airlines Group 2019). This strategy also aligns with the resource capability strength mentioned in the SWOT analysis because Heathrow is an inimitable resource that BA enjoys. Therefore, the airline seeks to leverage such strengths to improve its market position.

Feasibility

The company’s market expansion strategy is set to expand the company’s presence in developing and local markets. This strategy has been coined by the company’s parent company (IAG) through a new program called “Level” (IAG 2016). One of the main goals of this program is to develop new routes linking some of Europe’s major cities to destinations in America (IAG 2016). These routes have been identified because of the increase in human traffic between the two regions. Some of the routes are also expected to exploit seasonal demands, such as the summer route to Los Angeles, which is currently under development (International Airlines Group 2019).

Acceptability of Strategy

Some of BA’s route expansion plans have already been successfully implemented before schedule (International Airlines Group 2019). For example, the route expansion to Barcelona was undertaken before schedule, and the market has responded positively (International Airlines Group 2019). Current plans involve expanding the airline’s routes to Paris and Vienna (International Airlines Group 2019).

Achievement of Market Penetration

BA has achieved significant market penetration through the implementation of strategies aimed at improving its brand portfolio. The progress has happened by strengthening its leadership position. For example, there has been a 10% growth of the airline’s market penetration in the North Atlantic routes (International Airlines Group 2019). This development has been achieved through the introduction of new routes between Dublin, Philadelphia, Seattle, Barcelona and Boston. Other new routes that have contributed to the company’s growth in market penetration include Madrid to San Francisco and Heathrow to Nashville (International Airlines Group 2019).

These examples show that BA is still focusing on expanding its transatlantic networks, and it has achieved significant success so far. It is also important to note that away from the transatlantic routes, the company has also reported increased market penetration levels in selected South American markets. For example, it has achieved a 7% growth in Latin American routes (International Airlines Group 2019). Its operational capacity in Europe has also followed the same pattern because the airline has realised a 15% growth in its operating capacity, especially at Gatwick airport (International Airlines Group 2019). The growth is attributed to newly acquired slots in the airport. There has also been a return to profitability in selected European countries such as Italy, France and Spain.

Possible Areas of Strategy Improvement

As explained in this document, BA’s opportunities have been focused on the development of new routes and expansion in the global market. Based on the pieces of evidence provided above, the airline is partly implementing this strategy because it is still focused on cementing its market dominance across the transatlantic route (majorly between European and American cities). More progress could be achieved if the airline focuses its expansion strategy on developing new routes in emerging countries. Particularly, the airline should consider expanding its route network to BRICS (Brazil, Russia, India, China and South Africa) countries. Although the airline has a presence in these countries, its performance is still dismal compared to its well-established markets.

Appendix

Appendix 1: SWOT Analysis

Appendix 2: British Airway’s Value Chain

Reference List

Airline Trends 2015, Differentiation, Web.

Bhasin, A 2019, Marketing strategy of British Airways, Web.

Branding Forum 2019, British Airways, Web.

British Airways Media 2017, British Airways customers, Web.

British Airways PLC 2016,Working with us, Web.

British Airways PLC 2017, Embraer 170 (BA City Flyer), Web.

British Airways PLC 2018, British Airways PLC annual report and accounts year ended 31 December 2017, Web.

British Airways PLC 2019, Our key performance indicators, Web.

Burke, W & Noumair, D 2015, Organization development: a process of learning and changing, 3rd edn, FT Press, New York, NY.

Byford, I & Wong, S 2016, ‘Union formation and worker resistance in a multinational: a personal account of an Asian cabin crew member in UK civil aviation’, Work, Employment and Society, vol. 30, no. 6, pp. 1030-1038.

Efthymiou, M, Njoya, ET, Lo, PL, Papatheodorou, A & Randall, D 2019, ‘The impact of delays on customers’ satisfaction: an empirical analysis of the British Airways on-time performance at Heathrow airport’, Journal of Aerospace Technology Management, vol. 11, no. 1, pp. 1-10.

Ethicist, P 2015, ‘Reducing non-compliance in research: what can we learn from the aviation industry’, Journal of Empirical Research on Human Research Ethics, vol. 10, no. 4, pp. 429-430.

Heathrow Airport Limited 2019, British Airways, Web.

IAG 2016, IAG takes flying to a new level, Web.

International Airlines Group 2019, IAG results presentation, Web.

Jarvis, P 2014, British Airways: an illustrated history, Amberley Publishing Limited, London.

Jarvis, H 2017, Airlines ranked by global market share, Web.

Liu, H 2018, A strategic analysis of the Chinese airline industry under online environment: in the case of China Southern Airlines, Scientific Research Publishing, New York, NY.

London Air Travel 2018, British Airways route moves between Gatwick & Heathrow, Web.

One World 2019, British Airways, Web.

Routes Online 2019, British Airways, Web.

Sharma, MG & Singh, KN 2017, ‘Servitization, competition, and sustainability: an operations perspective in aviation industry’, Vikalpa, vol. 42, no. 3, pp. 145-152.

Statista 2018, British Airways Plc’s passenger cargo uplifted in the United Kingdom (UK) between 2008 and 2017 (in metric tonnes), Web.

Statista 2019, British Airways Plc’s worldwide revenue from FY 2010 to FY 2018 (in million GBP), Web.

YGR 2018,Is British Airways losing altitude, Web.