Economic Recovery

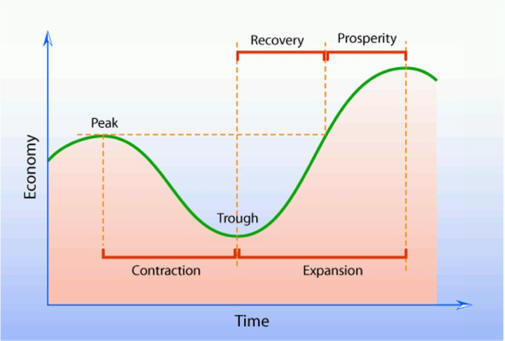

An economy often faces a business cycle that is characterized by four parts. A recovery is experienced in an economy after a recession. During a recovery, an economy regains and exceeds the economic performance before the recession (Mankiw 2012, p. 245). Besides, some economies experience high levels of growth in various indicators such as GDP and employment. The rate of recovery depends on how fast the aggregate demand will grow after the recession. To spark off growth after the recession, the UK implemented stimulus macroeconomic policies between 2009 and 2010. The policies were aimed at ensuring that the aggregate demand and boosting confidence. For instance, the interest rate was reduced by 0.5% in 2008. Secondly, the government increased borrowing.

This measure led to an increase in the budget deficit to more than £140 billion in 2009. This deficit is expected to persist in the future. Thirdly, the Bank of England also increased the money supply in the banking system through a policy known as quantitative easing. This was aimed at increasing the number of loans issued to consumers. Further, the value-added tax was reduced from 17.5% to 15%. However, this was later increased to 20% in 2011. Other measures that were used to stimulate demand are consumer subsidy and the car scrappage scheme among others. These measures and others led to the recovery of the UK after the recession (Mankiw 2016, p. 191). The recovery stage in a business cycle is displayed in the diagram below.

Analysis of Imports

How a fall in the Value of British Pound Affects Imports

If the British Pound weakens, then the imports will be more expensive in the UK. This makes the imports to be less competitive as compared to the goods manufactured in the UK. This will lead to a reduction in the volume of imports. However, the change in the volume of imports highly depends on the price elasticity of the goods.

How a Reduction in the UK Labour Affects Productivity

Generally, labor productivity is measured by evaluating output per worker over a certain period. It is often used as an indicator of the productive potential of an economy. A country with weak labor productivity is likely to experience a low growth rate, high inflation, and low export. Since the beginning of the recession, the UK economy has experienced low labor productivity. It is estimated that it declined by 15% after the recession. A decline in the productivity of labor increases the cost of production. This causes prices to go up. Thus, the imports will be cheaper and competitive in the UK market. This will eventually cause an increase in the quantity and amount spent on imports.

Benefits of a Weak British Pound

There are several ways through which the UK economy can benefit from the weak Pound. The first benefit is that it will improve the current account deficit. A fall in the value of the Pound makes exports more attractive as compared to the imports. The country has experienced a persistent deficit in the current account that worsened after the recession. For instance, the deficit amounted to 7.2% of GDP in 2013. With a weaker pound, exports will be cheaper and competitive in the international markets while imports will be expensive in the UK market. Therefore, it will discourage imports and stimulate exports, thus reducing the current account deficit.

Secondly, a weak British Pound is likely to lead to growth in the tourism industry. The industry is likely to gain because a holiday in Europe is will appear to be more expensive than in the UK. This will encourage the locals to take more holidays in the home country. Besides, other foreign visitors will prefer to take a holiday in the UK than in other regions in Europe. For instance, the country experienced a 5% increase in the number of international visits in 2015. Therefore, the growth of revenue from the tourism industry is likely to cause an increase in GDP. Besides, the economy will also benefit from a reduction in the unemployment rate and an increase in consumer income (Arnold 2015, p. 301).

Thirdly, manufactures, and exporters that are based in the UK will benefit from an increase in sales and profits because foreign buyers will need less British Pounds to buy the goods. However, this may be short-run and it may give the economy a small boost because studies show UK exports are less sensitive to changes in the exchange rate. Considering the international nature of stock markets, companies that have overseas earnings are likely to experience a boost in income. Companies that have domestic focus are unlikely to gain. The growth in income will increase earnings attributable to shareholders and dividends. This will increase consumer spending and overall growth in the economy. Also, local companies that can shift sales to foreign markets can gain when the Pound is weak. However, this depends on the flexibility of the business and the market.

Failure of Depreciation of British Pound to Improve UK Balance of Trade

As mentioned above, the UK can benefit from weaker Pound through increased exports and decreased imports, thus lowering the current account deficit. However, this may be more theoretical than practical. First, the growth in exports may not be realized when other economies in the world are experiencing difficulties. Thus, low prices may not be an adequate incentive to increase the demand for UK commodities in foreign markets. Secondly, UK exports have been proven over time to be less sensitive to changes in the exchange rate as compared to other emerging economies. This is because such exports are perceived to be of high value and costly. Therefore, the demand for such goods is less sensitive to changes in price.

Besides, even if firms change from selling goods locally to foreign markets, the effects will be felt after a long period. Another reason why the amount of export may not grow is that a majority of entities entered into long term hedging contracts to cushion them against fluctuations in the exchange rate. This eliminates possible gains that may arise from weakened currency or it may take long before the country experiences an increase in revenue from exports. Further, borrowing money to expand the production facilities for local firms may also be a challenge considering the investment atmosphere in the country. This may limit the ability of local firms to expand their capacity to meet increasing demand (if there is any) for local goods. Thus, even if there is an increase in demand, the capacity of local firms may not meet the demand (Carlin & Soskice 2015, p. 291).

Another challenge is that Britain is currently planning to exit the European Union. This may necessitate businesses to draw new contracts with their clients. The political uncertainty may lead to a decline in export sales. Another reason why Britain may fail to realize the gains from a weak Pound is that exports account for about 17% of GDP. This value is too small and may not create a significant effect on the current account deficit. Finally, some sectors in the economy heavily rely on imports. Besides, statistics show that the UK has been importing more than exporting. Thus, the volume of imports cannot be reduced or eliminated overnight and this will cause an increase in the amount that is spent on total imports. Thus, the gains that are realized from the increase in exports may be offset by the effect of a corresponding increase in the price of imports. The analysis above shows that there may be no noticeable change in the current account deficit as a result of the depreciation of the British Pound.

Effect of Rising in Taxation and Cuts in Public Spending on UK Trade Deficit

Taxation

An increase in taxation causes a decline in disposable income. For instance, if the government increases income tax, then consumers will take home a lesser amount of income than before the increase. This will lead to a reduction in consumer spending (Keynes 2016, p. 341). Also, a rise in taxes on commodities (like an increase in VAT by the UK government from 15% to 20% in 2015) will reduce consumption because the prices will grow. Generally, an increase in taxes discourages the consumption of both local and foreign goods. A decrease in imports (foreign goods) is likely to reduce the deficit. An increase in taxes also leads to growth in government revenue. This will eliminate the need for both local and foreign borrowing. The overall effect is a decline in the deficit.

Public Spending

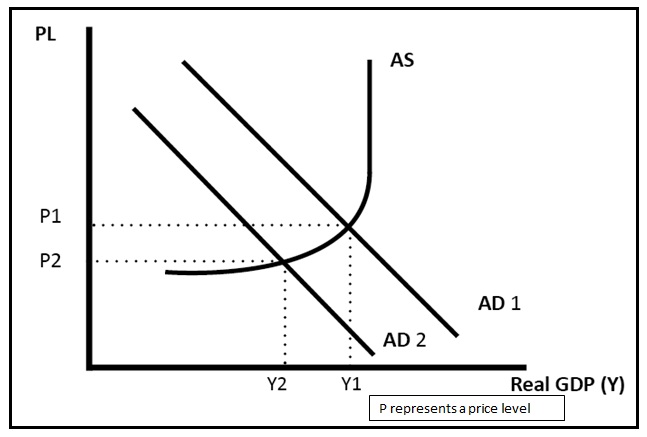

A cut in public spending will have an impact on both the supply and the demand side of the economy. Currently, public spending accounts for about 42% of GDP. A cut in public spending will cause a reduction in aggregate demand because there will be a decline in demand for goods and services. Besides, there will be a cutback in welfare benefits. Thus, disposable income will decrease. This is the income consumers have after excluding taxes, bills, contribution to national insurance, and including welfare benefits. The change in aggregate demand after a reduction in government spending is shown below.

Thus, an increase in government spending will cause the aggregate demand to drop from AD1 to AD2. This will lower inflation as indicated by a decline in price from P1 to P2. GDP will also decline from Y1 to Y2. Thus, a decrease in demand implies a decline in the consumption of both local and foreign commodities. This will reduce imports and in term cause a drop in the deficit. However, this depends on the state of the economy, and the assumption that other factors affecting aggregate demand are constant. Alternatively, a reduction in public spending will cause a decline in government borrowing. This will help lower the amount of public debt, thus lowering the trade deficit (Grauwe 2012, p. 148). The two approaches are aimed at reducing aggregate demand, increasing government revenue, and lowering the need for borrowing. The overall effect is a decline in the deficit.

Reference List

Arnold, R 2015, Macroeconomics, South-Western Cengage Learning, Mason.

Carlin, W & Soskice, D 2015, Macroeconomics institutions, instability, and the financial system, Oxford University Press, New York.

Grauwe, P 2012, Lectures on behavioural macroeconomics, Princeton University Press, New Jersey.

Keynes, J 2016, General theory of employment, interest and money, Atlantic Publishers & Distributors, New Delhi.

Mankiw, G 2012, Principles of macroeconomics, South-Western Cengage Learning, Mason.

Mankiw, G 2016, Principles of economics, South-Western Cengage Learning, Mason.