The June 23, 2016, referendum on the United Kingdom leaving the European Union became a turning point in the British economy. Lack of a proper plan, false information provided by proponents of the so-called ‘Brexit’, and general lack of preparation left the country in a volatile state in both social and economic senses. Although the proposed process of leaving the EU in 2 years has not started yet, it is projected to have a significant impact on foreign investment, immigration and GDP, with uncertainty becoming a real detriment to the economy.

Impact on the Economy

Impact on Foreign Investment

The United Kingdom was one of the top recipients of foreign direct investments from the European Union. More than half of their £1 trillion stock coming from other members of the EU. Usually, FDI is welcomed because it has both direct benefits of rising wages and increased productivity, as well as indirect benefits of new technologies and business know-how being adopted by the domestic companies (Dhingra et al., p. 25). Research shows that being in the EU has a positive effect on inward FDI of an average increase of 28%. Due to “Brexit”, the complex supply chains of multinational companies are going to become harder to manage, and foreign investment would is expected to fall by about 22% (Dhingra et al., p. 26). Due to this decline in FDI, real incomes are expected to fall by 3.4% (Dhingra et al., p. 30). Also, international trade is bound to be affected by the loss of free access to European markets (Goryunov, Kiyutsevskaya & Trunin 2016).

Impact of the Immigration

One of the most important aspects of the referendum that appealed to pro-Brexit voters was the perception of how immigration can affect the labour market. A comprehensive review of the literature suggests that there is no evidence of a statistically significant impact of immigration from EU countries on native employment opportunities. Evidence on wages suggests similar results, with only a 1.5% reduction for native workers in semi/unskilled occupations (Portes & Forte, p. 8). The decrease in immigration can lead to the opposite effect. A study suggests that reduction of worker inflows will reduce overall employment, the wages for low-paid groups can see a small increase, but GDP per capita and productivity would receive significant cuts (Portes & Forte 2016). UK economy is very reliant on the service sector, which makes it responsible for both job creation and export demand. These sectors are almost as important to UK export as manufacturing due to an increase in financial and business service activities. Brexit puts the progress in these services at risk due to loss of access to the single market. However, an increase in job positions in import-competing industries can be possible, because a new trade regime can raise the costs of imports (Begg 2016).

To understand why this kind of evidence was ignored by the voting majority Ann Pettifor relates this situation to a macroeconomic theory of Karl Polanyi. She compares his idea that the self-regulating market cannot be sustained due to opposition from society as a whole. Pettifor’s essay shows that previous missteps by the government and nationalistic attitudes led to this rejection of evidence against leaving EU (Pettifor 2016).

Impact on GDP

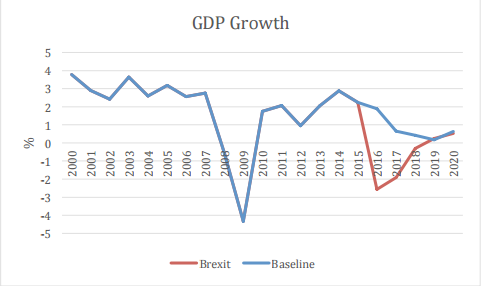

A lot of research was done on the impact of Brexit on UK GDP. While the estimates vary between the studies, all of them predict a significant reduction in GDP after Brexit (Pettifor 2016; Begg 2016; Portes & Forte 2016; Kiyutsevskaya & Trunin 2016; Dhingra et al. 2016; Cozzi & McKinley 2016; Steinberg 2016). One study finds that the economic growth rate of the country is likely to drop to about -2.5% since the end of 2016 and would take at least two years to recover to pre-Brexit levels. However, the same study notes that even before the Brexit vote economy was already projected to stagnate (Cozzi & McKinley, p.4). This decrease of GDP is attributed to a variety of factors including loss of access to the single market, decreased employment, loss of foreign investments and general uncertainty over the future trade policy (Steinberg 2016).

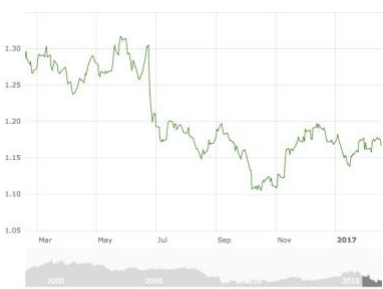

Brexit also had a significant effect on the value of the British Pound Sterling. After the vote, the British Pound fell to the lowest level since 1985, which had a substantial impact on the financial industry. As mentioned previously in the paper, the UK is heavily reliant on the financial services sector. Reportedly International UK banks and non-UK banks were hit the hardest by the vote. The Royal Bank of Scotland losing £6.5 billion from conduct, litigation, and restructuring costs. Some of the affected banks have announced that they will be relocating thousands of jobs to other countries in response to Brexit (Karlsson & Le, p. 6).

Impact of Uncertainty and the Rise of Volatility

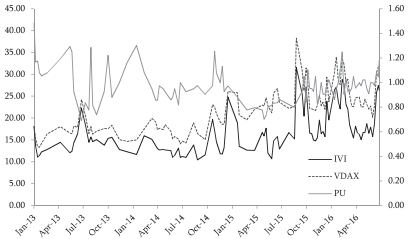

At the time of writing, Brexit created a prevailing atmosphere of uncertainty that not only affects the people but the economy as well. Current government policies lack a clear direction for the future of the country. This issue leads to uncertainty of action from corporate investors, harming growth and reducing employment. Financial markets can be impacted by re reduction in the growth of prospective returns and lack of information for investors about possible changes to the tax regime. A study by Lee Smales shows both economically and statistically significant relationship between the rise of political uncertainty and uncertainty in financial markets (2016). He is also able to connect this event to the increased volatility of the market (Smales 2016).

His study is supported by extensive research by Ansgar Belke, Irina Dubova and Thomas Osowski. Their study confirms the effects of uncertainty on moth uncertainty and volatility of the market. In addition, they find evidence that this issue is not just tied to the UK markets but international markets as well, noting that magnitudes of spillovers this high to financial markets have never before been recorded. They found that the level of uncertainty remained the same during their research, signifying that uncertainty over the development of relationships between UK and EU has been affecting the markets for at least three months (Belke, Dubova & Osowski 2016)

Conclusion

Brexit brought a multitude of macroeconomic issues to the UK. It affected critical service sectors of the economy, can lead to problems with employment, brought down the value of the currency and cut GDB by a significant percentage. Undoubtedly the issue of Brexit is going to stay relevant in the near future and if the uncertainty around it does not clear up there is a risk of continued volatility of the financial market. The British government is torn about this issue at the moment, so perhaps Brexit will not come to fruition after all.

Reference List

Begg, I 2016, The economic impact of Brexit: jobs, growth and the public finances, London School of Economics, London.

Belke, A, Dubova, I & Osowski, T 2016, Policy uncertainty and international financial markets: the case of Brexit, Centre for European Policy Studies, Brussels.

Cozzi, G & McKinley, T 2016, The United Kingdom’s Brexit vote leads to a major economic shock, Greenwich Political Economy Research Center, London.

Dhingra, S, Ottaviano, G, Sampson, T & Reenen, J 2016, BREXIT 2016: Policy analysis from the Centre for Economic Performance, The London School of Economics and Political Science, London.

Goryunov, E, Kiyutsevskaya, AM & Trunin, P 2016, ‘Brexit results: macroeconomic risks’, Russian Economic Developments, vol. 25, no. 7, pp. 51-53.

Karlsson, M & Le, TH 2017, UK post-Brexit; The Service Economy Fallacy, School of Business and Engineering Halmstad University, Halmstad.

Pettifor, A 2016, ‘Brexit and its Consequences’, Globalizations, vol. 14, no. 1, pp. 127-132.

Portes, J & Forte, G 2016, The economic impact of Brexit-induced reductions in migration, National Institute of Economic and Social Research, London.

Smales, LA 2016, ‘Brexit: a case study in the relationship between political and financial market uncertainty’, International Review of Finance, vol. 16, no. 3, pp. 323 -332.

Steinberg, JB 2016, Brexit and the macroeconomic impact of trade policy uncertainty, University of Toronto, Toronto.