Introduction

The results of the public vote conducted in the United Kingdom (UK) on 24 June 2016 came as a complete shock to the public around the globe. According to the results, a small majority of British people (51.9 percent) voted in favor of leaving the European Union (EU), which was unexpected by the majority of analysts (Hobolt 1260). The process of disintegration of the EU, or Brexit, became a topic of heated discussion as the long-term implication of the matter was unclear. Throughout the long history of the EU, there had been no precedents of withdrawal from the organization.

While long-term implications are difficult to evaluate, the short-term reaction was felt almost immediately. The markets were quick to react to the event, as the British pound dropped to a 31-year minimum against the US dollar, and the global markets responded negatively with a $2 trillion crash (Hobolt 1260). The British Prime Minister David Cameron resigned, and the Scottish Prime Minister warned that Brexit could mean the end to the UK, as Scotland wanted to stay in the EU (Hobolt 1260).

The social consequences were disastrous as well because the nation was split almost in half by the vote. While the supporters of the disintegration emphasized the importance of shaping internal and external policies for the UK, the opposition highlighted the economic risks associated with isolation and distrust (Matti and Zhou 1131). Even though some of the issues have been resolved, the process of disintegration is still progressing, posing new challenges every day.

Even though Brexit had negative implications for the financial market of the UK, the industry has not lost its leading position in the world. Even though the country can lose up to a quarter of its international financial sector, it will remain the second-largest financial center in the world (Allen). In other words, it is unlikely that the disintegration of the EU can change Britain’s position in terms of the strength of the financial market. However, further research is required to acknowledge the implications of Brexit on the financial markets.

There are numerous studies that aim to explain the reasons for the UK leaving the EU. Experts identify at least seven reasons for the UK to become independent from the EU, which can be narrowed down to three. First, the EU threatens British sovereignty since the European Commission can override national laws in terms of competition policy, agriculture, and copyright, and patent law (Lee).

Second, the EU allows too many immigrants and does not let the UK identify its own policy in terms of immigration laws (Lee). This was the matter of most concern among UK citizens (Lee). Third, the EU limited the economic growth of the UK, and after disintegration, Britain will be able to keep £13 billion every year instead of sending it to the European government (Lee). The list of reasons can be continued; however, it remains unclear why the general vote on Brexit had such a narrow outcome.

The present paper aims at providing an in-depth analysis of reasons for the disintegration of the EU from both historical and comparative viewpoints. The paper will discuss how individual characteristics of the country and its unique historical background influenced the decisions of the citizens. Moreover, the political, economic, and social incentives will be evaluated to obtain a more in-depth understanding of the causes of the EU disintegration. At the same time, the paper provides an analysis of the effects Brexit had on all aspects of UK life with particular attention paid to the financial markets of the country.

There are various motivations for conducting research on Brexit. On the one hand, even though numerous studies discuss the disintegration of the EU, only a few of them focus on the implications for the financial markets. The conclusions made by these studies differ, creating uncertainty around the subject. Therefore, the present research is important because it aims at summarizing the current body of knowledge and addressing the uncertainties in the conclusions of previous studies. On the other hand, there are personal reasons for investigating the matter, as the disintegration of the EU and its implication to the financial sector is a matter of increased interest to the author.

The present paper will discuss and analyze the following matters. First, background information about the Brexit will be provided with particular attention paid to the negotiation about the conditions of the UK “divorcing” the EU. Second, the causes of the disintegration of the EU will be analyzed. Third, the political, economic, and social consequences of the event will be discussed. Fourth, the paper will focus on the financial sector, providing a brief overview of the industry and assessing the changes caused by Brexit. Fifth, strategies for mitigating the consequences will be discussed. Finally, the findings will be summarized, and the conclusions will be drawn.

Background Information: Brexit

Brexit is a word used to identify the process initiated by the UK to withdraw from the EU. The term “Brexit” is a blend of two words, “British” and “exit,” which was invented and widely used by the press. The process began in 2016 after a referendum revealed that 17.4 million citizens of the UK preferred to leave the EU (BBC News, Brexit: All You Need to Know). The formal process ended on January 31, 2020, when the UK officially stopped being a member of the EU (BBC News, Brexit: All You Need to Know). The original deadline was on Mar. 29, 2019; however, it was delayed twice because the UK and the EU failed to reach agreements on vital points of the “divorce bill.”

The first deal between the UK and the EU was created by Theresa May, the Prime Minister of the United Kingdom and Leader of the Conservative Party. It was communicated to the EU in November 2018, and the sides did not agree on the deal due to the question with the border of Northern Ireland (Reality Check Team). The central problem was that all parties wanted to escape from returning to “hard borders” between the Republic of Ireland and Northern Ireland (Reality Check Team).

In order to address the problem, Boris Johnson, the current Prime Minister of the UK, offered a new deal concerning customs between the UK and the EU (BBC News, Brexit: All You Need to Know). The new agreement is presented in Figure 1. According to the new deal, some goods entering Northern Ireland from Great Britain will go through checks and will have to pay EU import taxes. However, these tariffs will be refunded if the products stay inside Northern Ireland.

Apart from the negotiations about the border of Northern Ireland, the rest of the deal remained unchanged and included the following agreements. First, the UK will leave the EU customs union, which implies that it will be able to initiate new deals with other countries (Reality Check Team). Second, the UK citizens in the EU will retain their rights and residency, and anyone who lives in the EU for five years will be allowed to file for permanent residency (Reality Check Team).

Third, the UK will need to pay to almost £30 billion to the EU to settle the financial disputes between the parties (Reality Check Team). Fourth, after January 31, 2020, the parties enter into the transitional period, during which they will agree upon further relationships. (Reality Check Team). The period is expected to last until July 2020; however, it may be extended until 2022 (Reality Check Team). Finally, the parties agreed in a non-binding declaration that they would work towards a free trade agreement and “keep the same high standards on state aid, competition, social and employment standards, the environment, climate change, and relevant tax matters” (Reality Check Team).

During the transition period, the UK will continue to obey the rules of the EU; however, there will be some felt changes. The UK will no longer participate in the political life of the EU, which implies that members of the European Parliament from the UK will lose their seats, and Prime Minister Boris Johnson will need to be invited to the EU summits (Edgington). The UK will also issue new passports, close the Brexit department, and issue Brexit coins (Edgington). Among legal changes, Germany will not extradite its citizens to the UK if they are suspected of crimes (Edgington). The other changes will come after the transition period.

Until July 2020, some of the matters will remain unchanged until the UK, and the EU decide upon their future relationship. Driving licenses, pet passports, and European Health Insurance Card will continue to be valid during the transition period (Edgington). UK citizens will be allowed to queue in the areas for the EU residents during passport control (Edgington). UK citizens will be eligible for the EU pensions, and trade between the parties will continue without changes until the beginning of 2021.

After the transition period, the parties will need to agree on several matters. For instance, future relationships in terms of law enforcement, data sharing, and security, together with aviation standards and safety, will need to be negotiated (BBC News, Brexit: All You Need to Know). At the same time, the UK and the EU will need to discuss the distribution of natural resources, such as fish, electricity, and gas (BBC News, Brexit: All You Need to Know). Medical services and cooperation is also a crucial matter for future negotiations (BBC News, Brexit: All You Need to Know). However, the central question is the continuation of trade relationships, which will have a considerable impact on the global economy. The timeline for future actions, according to Boris Johnson’s plan is presented in Figure 2.

In summary, the future of the disintegration of the EU is associated with a high degree of uncertainty. Brexit is to be treated as a precedent, which has the potential to be referenced in the future if other member-states decide to withdraw from the EU. From the current point in time, one can be confident that the disintegration will end by 2022. However, the final date will depend upon various factors. Current events, such as pandemic of COVID-19 and Russia-Saudi Arabia oil price war, may influence the deadlines stated by Prime Minister Boris Johnson.

Causes of the Disintegration

Immigration

In 2015, a year before the ominous referendum, Simon Tilford stated that if Brexit were supposed to happen, it would be because of immigration problems (64). Between 2004 and 2014, immigration in some areas of Britain increased by 460%, which caused an adverse reaction from the UK citizens (Cavendish). The central problem with immigration is that it is low skilled, which implies that immigrants will occupy low-skilled vacancies. Immigrant labor is known to be cheap, which means that low-skilled citizens of the UK will need to agree to low wages or surrender their jobs to people from other countries.

At the same time, immigration negatively affected the housing problem in the UK, making the rents go up considerably due to increased demand (Cavendish). Finally, the National Health Service (NHS) is also overwhelmed with an increased number of patients queueing for health care due to migration (Tilford 65). The citizens of Boston, Lincolnshire, who had the highest Leave vote of 76%, complain that “falling wages and rising rents, but also rising crime, altercations between different nationalities who didn’t speak English, and lengthening waits to see the doctor” (Cavendish). Therefore, there is little doubt in the fact that there is a correlation between immigration policies of the EU and Brexit.

However, hostility towards immigration was not caused solely by EU policies. Tilford reports that the UK government contributed to it by focusing the attention of the public on the matter (65). Net immigration in the UK was comparable to that in Germany or France (Tilford 64). However, it is the UK who decided to withdraw from the Union and not any other countries. The fact is that historically, British politicians were unable to address the rising problems of healthcare, housing, and economic recession (Tilford 65).

Instead of dealing with the issues, the UK government decided to blame all the problems on the EU and migration, causing hostility and intolerance (Tilford 65). Therefore, it is not immigration itself, but increased propaganda against it and unwillingness to address the problems convinced the people to vote Leave.

Economic Incentives

Apart from dissatisfaction from low wages and increased cost of healthcare due to immigration, there are other economic incentives that made the UK citizens support disintegration. Due to the development of the British Empire, historically, Britain is known to have more trade relationships outside the EU than inside (Dennison and Carl 6). Therefore, it did not enjoy the same amount of economic benefits that other member-states did. However, the UK was still obliged to pay to the European government £13 billion every year (Lee). At the same time, the EU had a significant influence on the economy of the UK since it could regulate its trading agreements (Lee). Therefore, the UK citizens decided to leave the EU in the promise of increased economic growth after a short recession period.

Sovereignty

However, the central reason for people voting Leave was not immigration or economic incentives. According to survey data demonstrated in Figure 3, the UK citizens wanted to leave the EU to preserve sovereignty. The people of the UK believed that all powers should be returned to the UK government because it was the central principle of democracy that all decisions are made by the elected representatives.

The EU has enacted several burdensome regulations on its member-states that could be changed on the UK level. Some of them, like children under eight, cannot blow up balloons, sound ludicrous, while others, like better-designed cab windows, cannot be introduced because France is against it, are outrageous (Lee). At the same time, the EU entrenches corporate interests and prevents radical reforms (Lee). In summary, the UK voted that political power should remain inside the country.

Analysis

While the reasons provided above give a general idea of why people voted Leave, there is no certainty why they happened to be the majority. Everyone was aware of the negative impact associated with the disintegration of the EU, including a considerable settlement payment of over £30 billion, restructuring of the trade relationships, lack of free movement around Europe, and problems with law enforcement, data sharing, and security. The UK citizens decided that they agree to these drawbacks in exchange for political and economic freedom. However, the majority was so small that further investigation is required.

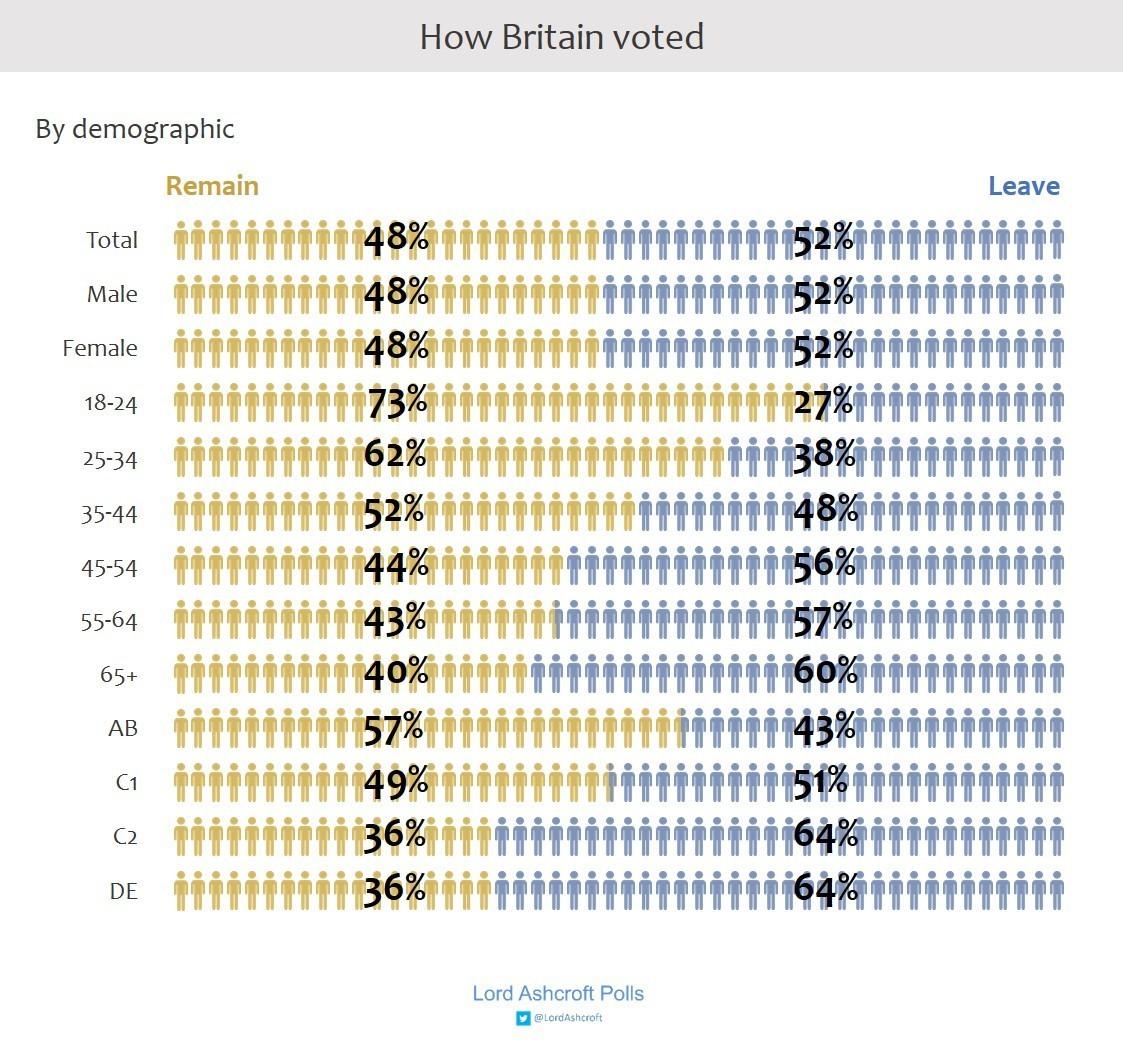

One of the approaches towards answering the question is by analyzing the demographic characteristics of the Leave voters. Figure 4 demonstrates the results of a survey conducted by Lord Ashcroft Polls and published the day after the referendum. The survey indicates that the age of the voters and their social grade had a significant impact on how they voted. For more information about social grades in the UK, refer to Table 1.

According to Figure 4, age was a significant predictor for the decision in the during the Brexit vote. The younger generation were the supporters of remaining in the EU, while the older generation supported the disintegration of the union. This implies that the older voters outnumbered voters younger than 45. Assuming that voter turnout was similar among all age groups, the central reason for the disintegration of the EU is the growing older population of the UK. Older people are more susceptible to populistic slogans, which made them vote Leave. At the same time, the older generation is less adaptive to changes and new trends.

Therefore, people above 45 were more likely to vote for political and social isolation, while the younger generation supported globalization. In summary, the central reason for the UK leaving the EU is the aging population and its desire to abstain from accepting political, cultural, and religious diversity associated with globalization. After creating several regression models using the demographical data, Matti and Zhou came to a similar conclusion, as the results of their study confirmed that desire to free from EU regulations and membership fees was not statistically significant (1133-1134). Therefore, even though the results of the presented analysis are not consistent with the majority of studies, it has support in current scholarly literature.

Consequences of the Disintegration

The real consequences of the disintegration of the EU are difficult to measure for several reasons. The central issue is that the process has not yet finished, and the final implications will be felt only in 2021, according to Johnson’s timeline (see Figure 2). During the transition period, the majority of policies implemented by the EU are still active in the UK. However, certain preliminary conclusions can be drawn from the analysis of expert opinions, financial data, and emerging policies.

Political Implications

There are several possible political implications for both the UK and the EU, which must be acknowledged. First, according to Rashica, there is a possibility that the UK may dissolve as not all its member-states agree with the decision to leave the EU (31). Immediately after the results of the vote were announced, Scotland announced that it was ready to leave the UK and stay with the EU (Hobolt 1259). Both the Northern Ireland and Scotland voted Stay with 56 and 62 percent, respectively (Hobolt 1273). Second, Brexit made it clear that the power of nationalistic slogans should not be underestimated, and the influence of the EU should not be overstated (Rashica 31)

Third, with the withdrawal of the UK, the EU’s ability to be a global actor is questioned (Rashica 31). Finally, since Brexit created a precedent of leaving the EU, other member-states may also decide to withdraw from the international organization. Currently, the EU is under constant pressure as a consequence of Brexit and the situation with COVID-19 (Alesina and Giavazzi). In summary, both the UK and the EU need to come up with measures to protect the unions from external and internal disturbances.

Social Implications

The Brexit vote led to the emergence of nationalism as the central idea in British society. According to Corbett, the UK experienced “a significant rise in racist and xenophobic attacks in the country, including several racially motivated murders that have been attributed to Brexit” (Corbett 19). In fact, Brexit is associated with a 42% increase in hate crimes against racial minorities, which is a significant social implication (Corbett 19). At the same time, Brexit gave rise to populistic ideas that after the breakup with the EU, the UK will return to its golden era (Corbett 21). Therefore, UK society seems confused with dangerous tendencies in the air.

Brexit vote has split the country into two almost equal halves, which may lead to social tensions inside the society (Hobolt 1272). Moreover, people from the EU leaving in the UK felt significant pressure and betrayal (Mazzilli and King 514-516). For Europeans living in Britain, it was clear that the Brexit vote was not against the EU as an organization, but against the immigrants from the EU and other locations (Mazzilli and King 517). Therefore, Brexit shattered social connections both inside and outside the UK.

Economic Implications

Even though political and social implications are important, the central aim of the present paper is to describe the economic impact of Brexit. Short-term economic consequences for the UK are well-studied and widely discussed in scholarly and professional literature. The short-term implications are connected with increased currency volatility and reaction of financial markets (Hobolt 1259). At the same time, the economy will be affected by the need to pay the “divorce bill” to the EU. However, the long-term implications of the referendum are yet to be seen, as the parties are only in the middle of the disintegration process.

In order to thoroughly analyze the possible consequences of Brexit, it is vital to evaluate all the likely scenarios of future events. Rand Corporation describes eight possible scenarios, which are subdivided into “hard Brexit” and “soft Brexit.” The hard Brexit options are the following (RAND Corporation):

- The UK trade is governed by the World Trade Organization (WTO);

- The UK and the EU ratify a free trade agreement (FTA);

- An FTA between the UK, the US, and the EU is created;

- The UK and the US create a two-sided FTA without the EU;

- The transition period tariffs do not change; however, other barriers come to the effect.

The soft Brexit options are the following (RAND Corporation):

- Membership in the European Economic Area;

- The Swiss model;

- A customs union.

The analysis utilizing the game theory reveals that in the majority of most-plausible scenarios, the economic outcomes will be damaging (RAND Corporation). The “no-deal” option in which the UK trade is governed by WTO will be disadvantageous for all the major stakeholders, which are the UK, the US, and the EU (RAND Corporation). Seven other scenarios will also lead to economic losses; however, the effect will be less significant (RAND Corporation). The most beneficial scenario is the creation of an FTA between three countries, as the UK would get preferential access to markets in the UK and the US (RAND Corporation).

Such an arrangement is associated with a 1.7% improvement in GDP growth in ten years in comparison with the world without Brexit (RAND Corporation). However, currently, the scenario is unlikely, and the best-case scenario is the creation of an FTA between the UK and the EU (RAND Corporation). In this case, the GDP will grow by 1% less in ten years in comparison with the world without Brexit (RAND Corporation). However, the actual consequences of Brexit will be measured ten years after the process is finished.

Implications on the Financial Markets

Financial Sector Overview

The size of the global financial sector is difficult to evaluate, as the World Bank collects data only from 189 countries and estimates data from the rest. The sector consists of banks, investment firms, and insurance companies, which are vital for the healthy functioning of any economy. The investment industry is expected to grow to $26.5 trillion by 2022 (Ross). The global market capitalization of the banking sector reached $90 trillion in 2019 and expected to grow further (Ross). The insurance sector also continues its rapid growth, especially in Asia-Pacific, which accounts for more than 40% of global premiums, which reached $5.2 trillion in 2018. Even though the performance of the financial markets before 2020 was fair, the sector was hit considerably by the situation with the Coronavirus.

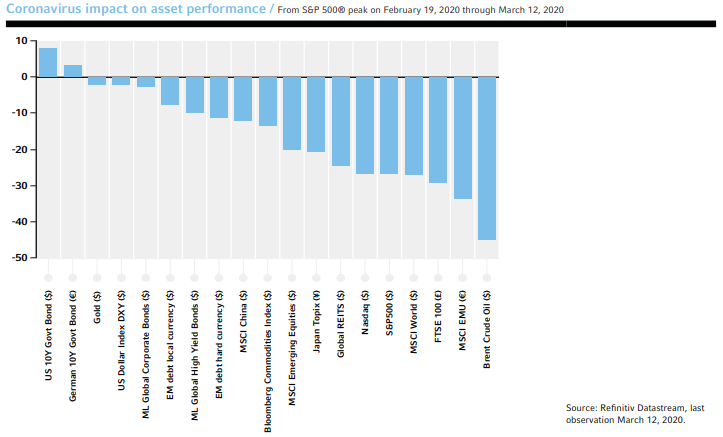

Global financial markets are experiencing a significant recession due to the Coronavirus outbreak. According to the recently published report of Russell Investments, “the COVID-19 virus has stalled the mini-cycle rebound and made a global recession likely” (2). Containment measures around the globe have a significant impact on economic growth. Currently, the Eurozone, Japan, South Korea, and the US shut down economic activity due to the emergence of strict containment measures in these countries (Russel Investments 3). The asset performance experienced a considerable recession between peak activity on February 19 and March 12, 2020 (Russel Investments 3). Figure 5 demonstrates the effect of Coronavirus on asset performance.

In the US implemented considerable virus containment measures, which implies that the GDP growth will be negative during Q1 and Q2. The S&P 500 Index has declined 29% from its 2020 peak by March 19% and can drop further down as the US has become a leader in the number registered cases of COVID-19 (Russel Investments 6). The central risk is that a significant drop in cash flows will cause highly indebted companies to default, triggering a credit crunch in the broader economy (Russel Investments 6). However, when the virus disruptions have cleared, the US government is expected to introduce the most robust stimulus measures in more than a decade to start a rebound (Russel Investments 6).

In Europe, the situation is also challenging due to a growing number of deaths from COVID-19. The Eurozone stock index was hit the hardest, experiencing more than a 35% recession. The rules around the Eurozone and the absence of monetary policy firepower possessed by the European Central Bank (ECB) make it challenging to implement stimulus measures (Russel Investments 6). Therefore, Europe is likely to experience the most considerable recession, which will make the markets more attractive after the situation with the virus is settled. Consequently, it is highly probable that the Eurozone will become the best performer during the recovery stage.

The UK economy has several advantages in comparison with European countries. First, the Bank of England can implement policies relatively fast in contrast with ECB. As a result, by March 19, 2020, the interest rates in the UK were decreased by 65bps, which will facilitate the growth of the economy (Russel Investments 7). Second, the UK government can implement fiscal easing quickly, which allowed the UK to announce over 1% of GDP in stimulus measures (Russel Investments 7). However, the FTSE 100 Index was hit considerably as a result of the COVID-19 situation, Brexit, and the Russia-Saudi Arabia oil price war (Russel Investments 7). However, when the situation with the virus has cleared, the UK financial markets are also ready for a quick rebound.

The Effect of Brexit

The long-term effect of Brexit on the financial markets is expected to be substantial as the stakeholders will need to rearrange partnerships to fit the new model of cooperation between the UK and the EU that will come after the transaction period. The disintegration of the EU has already affected the UK financial market more than its European counterparts. British financial sector represents 12% of the UK’s GDP, with more than 2.2 employees (BBVA).

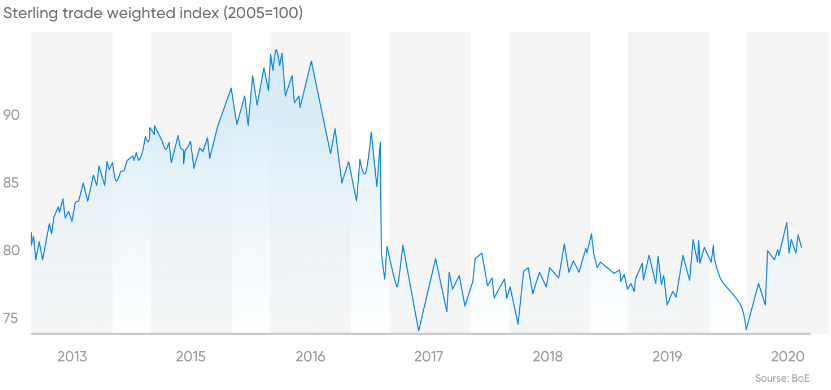

According to Medleva, since 2016, FTSE 100 index “has only gained about 20 percent, while the German DAX 30 and the French CAC 40 have each risen by around 40 percent.” At the same time, the British pound is volatile, demonstrating that it has not recovered from the 2016 election. Figure 6 illustrates the sterling trade-weighted index since 2013. According to the chart, the index has lost more than 15 points since 2016.

After the transaction period, the financial sector in the UK will experience tremendous changes. Currently, the banking sector of the UK is regulated by the Fourth Capital Requirements Directive (CRD) and the Second Capital Requirements Regulation (CRR) (Hohlmeier and Fahrholz 5). These regulations allow the UK banks to offer services to any organization inside the EU and open branches in any members-states without separate approval.

Brexit will make these regulations no longer applicable to the UK banks, which implies the complications in operations will emerge. In particular, after the transaction period, the banks will need to relocate all EU27 business to an existing or a newly established EU subsidiary, which is associated with additional costs (Hohlmeier and Fahrholz 5). However, the matter can be revised if the UK arrives at a comprehensive agreement about the banking sector with the EU.

The insurance market in the UK will also be affected considerably due to changes in policies. Currently, the industry in the UK, the industry is regulated by the rules of the Solvency II Directive (Hohlmeier and Fahrholz 6). The regulation allows firms to offer services across borders, which facilitates the development of UK insurance companies. However, Brexit will make provision of such services impossible, which will make the companies cease selling insurance plans outside the UK and terminate all the current deals with clients in the EU. Therefore, the impact of Brexit on the insurance sector will also be negative.

Due to Brexit, investments in UK-based companies becomes a considerable risk in the majority of industries. The automobile sector will suffer considerably since 58% of automotive industry products are exported to the EU, and it is highly dependent on skilled talents from the EU (Medleva). The airline companies will need to rethink their European routes, which will negatively affect the sector (Medleva). The pharmaceutical companies and the UK energy sector will also experience a significant decline (Medleva). A drop in the industries mentioned above can cause negative growth in the financial markets in the UK, as the country will become less attractive in terms of investment.

However, the EU will also feel the negative impact of the coming changes. According to Deutsche Börse Group, “the UK financial market currently acts as a wholesale hub for the EU and accounts for up to 80 percent of EU activity in financial market segments” (2). Therefore, after the reorganization, the UK will lose considerable part revenue from financial activities when the UK withdraws from the union. At the same time, the EU insurance companies become subject to UK supervision, as they will no longer be subject to home-country authorization and control, according to Solvency II Directive (Hohlmeier and Fahrholz 6). At present, it is unclear what party will experience more significant problems than the other.

When discussing implications for the financial markets, it is also vital to understand the effect on the US-based companies. As was mentioned in the previous sections, the US can become one of the central stakeholders in the disintegration of the EU, as it can improve its relationships with the UK. Therefore, the US will be affected by Brexit, both positively and negatively. In particular, the US may need to resize investment commitments in the region to adapt to the new reality (Deloitte).

The US businesses in the financial sector will need to evaluate the costs of erecting and running business separately in the UK and the EU (Deloitte). Additionally, US-based banks with meaningful revenues from the UK and the EU will experience a negative impact on Brexit (Deloitte). However, it is possible that the regulatory standards in the UK will become less stringent, as London will try to protect its status as one of the leading financial centers (Deloitte).

Therefore, the US financial firms will need to monitor the regulatory policies carefully to catch the opportunity of beneficial investments. The fact that the UK government and the Bank of England are more flexible than their counterparts in the EU will also make the UK financial market more compelling for the US firms (Russel Investments 7). All the implications for the US financial sector can also be applied to the financial sectors of other countries.

In summary, it is impossible to make adequate long-term predictions about how the Brexit will affect global financial markets due to a high degree of uncertainty around future relationships between the UK and the EU. Efficient future relations between the UK and the EU are desirable for both parties. However, the regulatory framework will also need to consider the desire of both parties to “remain in competition with the US and Asia on an equal footing” (Deutsche Börse Group 7). Currently, it is clear that the short-term impact of Brexit on global financial markets will be negative, as all parties will need to revise the current relationships.

The situation will improve after a recession; however, the degree to which the financial markets will rebound is unclear. Current situation with COVID-19 and Russia – Saudi Arabia price war adds to the uncertainty. Therefore, companies in the financial sector need to monitor the situation about emerging policies to adapt to the coming changes as quickly as possible.

Mitigating the Consequences

Current Activities

Currently, the financial sector is actively preparing to all possible scenarios of the Brexit deal. Unlike the crisis of 2008, the financial sector has time to prepare for the worst-case scenario, which will help to mitigate the consequences of the disintegration of the EU (BBVA). TheCityUK Chairman states that the financial sector of the country depends on factors that do not depend upon the integration with the EU, which are “the time zone, legal framework, a favorable climate for investment and a society where talented and hard-working people can be successful” (BBVA). Therefore, financial companies inside the UK started creating Brexit transition teams to develop strategies for all the eight most possible scenarios previously mentioned in the present paper.

Similar teams are created in European organizations. For instance, Deutsche Börse Group created a Brexit Readiness Project that aims at staying in contact with relevant authorities in the UK to make sure that all affected entities can offer their infrastructures and services post-Brexit in the UK (Deutsche Börse Group 8). In brief, currently, companies can only make contingency plans to prepare for all possible outcomes. The focus should be made on long-term strategies, as the short-term outcomes depend on the politicians.

Instead of addressing specifically the financial sector, mitigation measures can target the economy at large. For instance, the bank of England implemented several immediate measures to help the economy survive the shock after Brexit vote (BBC News, Mark Carney Says). For instance, a 0.25% cut in interest rates in August 2016 pumped millions of pounds into the economy (BBC News, Mark Carney Says). The Bank of England has also prepared additional measures to mitigate the possible consequences of Brexit (BBC News, Mark Carney Says). Together with fiscal easing from the UK government, the UK financial sector has a chance to transition smoothly to the post-Brexit period.

In summary, current activities aimed at mitigating the consequences of Brexit are limited because the process of disintegration of the EU is not yet finished. During the transaction period, the majority of regulations are still in place in the UK. The shock will come after the transaction period is over; therefore, the financial markets focus on preparing all types of possible Brexit scenarios. However, financial firms need to be aware that COVID-19 pandemic will leave the UK government, the Bank of England, ECB, and the European government with limited firepower.

Therefore, every firm needs to develop their own measures to mitigate the possible effects of Brexit. These measures should prepare the company for an inevitable recession after the process is over. At the same time, they should aim to create long-term strategic plans that utilize the strengths of the financial sectors.

Personal Proposals

Authorities need to understand the strengths and weaknesses of the financial sectors in the UK and the EU and use them while preparing Brexit mitigation measures. For instance, it is common knowledge that British fintech firms are among the strongest in the world. According to BBVA, “One thing experts recommend is strengthening fintech firms, where the U.K. is already in a good position.

British fintech firms have more employees than Singapore, Hong Kong, and Australia combined … and six of the 31 fintech firms worth more than $1 billion are British.” This implies that strengthening fintech firms can help to cushion the financial sector after Brexit. Large firms providing financial services may think of investing in fintech and develop their own projects to stay competitive in comparison with their counterparts from other countries.

Financial companies should also make research and development (R&D) a top priority. Mitigation of immediate problems may not be the correct strategy if it is done by sacrificing R&D. Investments in such technologies as blockchain, the Internet of Things, cognitive analytics, and big data may win companies competitive advantages and improve the performance of financial firms in the long run. However, while the EU will have problems investing in cutting-edge technology, UK firms may experience considerable complications due to the absence of talents from EU27.

One of the central issues for the UK financial firms after the disintegration of the EU will be the lack of access to talents from the EU for effective leadership and R&D. Most companies will experience a shortage of skilled workers, which may lead to a significant decline in the UK economy and the financial sector in particular. During the period between 1995 and 2011, the European immigrants have contributed more than £4 billion to the British government (BBVA).

Without skilled workers, the development of cutting edge technology in the financial sector will be impossible. Therefore, the UK government needs to start to implement measures to address this problem at the highest level. In particular, the UK government needs to invest in higher education and put a specific emphasis on digital skills and math. Even though the effect of such investments will not be felt immediately, the intervention is crucial for helping the financial sector in the long run.

Financial firms should also start developing individual talent raising programs. The companies may consider two directions in this endeavor. First, the firms should develop and implement talent management programs that will help to retain current talents and create new ones from the employees. If a company is dedicated to an effective talent management strategy that will ensure employees’ opportunity to develop professionally, it can attract the best talent.

Second, the companies may consider offering scholarships and future employment opportunities to prospective students from UK schools and higher education institutions. Such programs will attract young talents that will be loyal to the companies, which will improve talent retention rates. Together with the government, the firms will be able to address the problem of the lack of talent.

The companies in the financial sector may also choose to engage in corporate political activity (CPA) to influence Brexit negotiations. The companies can identify the most advantageous scenario for the financial sector and invest in promoting the idea to ensure positive outcomes of disintegration with the EU. All the companies should make it clear to the government that “hard Brexit” options are associated with increased vulnerability of the financial sector, which ensures the economic stability of the UK. Since the current government is weakened by COVID-19 pandemic and recent news about Boris Johnson being infected with Coronavirus (Dewan), the present moment may be the correct time to start aggressive CPA campaigns to push for “soft Brexit” solutions.

Conclusion

Brexit is a unique event that will affect the political, economic, and social spheres of people’s lives both in the UK and the EU. Three and a half years after the referendum of 2016, the initial shock has faded, and the hopes of reversing the process faded. The disintegration of the EU started as a result of failure to address the problems of NHS, housing, and low-skilled employment. The nationalistic slogans made the older population believe that the reason for all the issues in the UK was the immigrants. As a result, the older generation voted Leave, and, due to the problem of the aging population, a small majority of UK citizens voted in favor of leaving the EU.

The general election put the existence of both the UK and the EU into questioned. Society is driven by xenophobic and racist slogans, which signifies a rise in nationalism in the country. Moreover, the economy of both parties experienced a significant recession. The financial sector also felt the negative consequences of Brexit, which implies that mitigation activities are to be employed to ensure a smooth transition to the post-Brexit period. In order to address the problems associated with the disintegration of the EU, the financial firms need to create contingency plans for any scenario and focus on long-term development by investing in talent management and R&D.

While the COVID-19 pandemic is a disastrous event that has negatively impacted economies worldwide, the political and social changes in the world may influence politicians to change their discourse in terms of Brexit. During the post-pandemic period, nations will need to unite to fight its devastating consequences, which may incline politicians to soften their tone and support “soft Brexit.” Such an outcome will help the financial sector to overcome the consequences of Brexit with minimal damage.

Works Cited

Alesina, Alberto and Francesco Giavazzi. “Will Coronavirus Kill the European Union?” City Journal. 2020. Web.

Allen, Kate. “UK Finance Industry Dominates European Scene.” Financial Times. 2018. Web.

Ashcroft, Lord. “How the United Kingdom voted on Thursday… and why.” Lord Ashcroft Polls. Web.

Barnes, Peter. “Brexit: What Happens Now?” BBC News. 2020. Web.

BBC News. “Brexit: All You Need to Know about the UK Leaving the EU.” BBC News. 2020. Web.

—. “Mark Carney Says Bank Actions Reduced Impact of Brexit.” BBC News. 2016. Web.

BBVA. The U.K. Is Exploring Ways to Mitigate the Impact of Brexit on London. BBVA. Web.

Cavendish, Camila. “Brexit Gives Britain a Chance to Fix Its Immigration Policy.” Financial Times. 2020. Web.

Corbett, Steve. “The Social Consequences of Brexit for the UK and Europe: Euroscepticism, Populism, Nationalism, and Societal Division”. The International Journal of Social Quality, vol. 6, no. 1, 2016. Berghahn Books. Web.

Deloitte. Brexit: Implications for US Banking and Capital Markets. Deloitte. Web.

Dennison, James, and Noah Carl. “The Ultimate Causes of Brexit: History, Culture, and Geography.” British Politics and Policy at LSE. 2016. Web.

Deutsche Börse Group. The Brexit Process and Its Impact on Financial Markets. 2018. Web.

Dewan, Angela. “Coronavirus Strikes UK Prime Minister Boris Johnson, His Health Secretary and His Chief Medical Adviser.” CNN, 2020. Web.

Edgington, Tom. “Brexit: What Will Change after Friday, 31 January?” BBC News. 2020. Web.

Hobolt, Sara B. “The Brexit vote: a divided nation, a divided continent.” Journal of European Public Policy, vol. 23, no. 9, 2016, pp. 1259-1277.

Hohlmeier, Michaela and Christian Fahrholz. “The Impact of Brexit on Financial Markets—Taking Stock.” International Journal of Financial Studies, vol. 6, no. 3, article 65.

Lee, Timothy. “Brexit: The 7 Most Important Arguments for Britain to Leave the EU.” Vox. 2016. Web.

Malcolm, Noel. “Brexit Is about Sovereignty and Parliament Must Respect That.” Financial Times. 2019. Web.

Matti, Joshua, and Yang Zhou. “The political economy of Brexit: Explaining the vote.” Applied Economics Letters, vol. 24, no. 16, 2017, pp. 1131-1134.

Mazzilli, Caterina and Russel King. “”What have I done to deserve this?” Young Italian migrants in Britain narrate their reaction to Brexit and plans to the future.” Rivista Geografica Italiana, vol. 125, no. 4, pp. 507-523.

Medleva, Valerie. “What Happens after Brexit: The Financial Markets Edition.” Capital. Web.

RAND Corporation. After Brexit. RAND. Web.

Rashica, Viona. “The Political Consequences of Brexit for the United Kingdom and the European Union”. SEEU Review, vol. 13, no. 1, 2018, pp. 30-43.

Reality Check Team. “Brexit: What is in Boris Johnson’s New Deal with the EU?” BBC News. 2019. Web.

Ross, Sean. What Percentage of the Global Economy Is the Financial Services Sector? Investopedia, 2020. Web.

Russel Investments. Global Market Outlook – Q2 update. 2020. Web.

Tilford, Simon. “Britain, Immigration and Brexit.” CER Bulletin, vol. 30, pp. 64-65.

Stockemer, Daniel. “The Brexit negotiations: If anywhere, where are we heading? “It is complicated”.” European Political Science, vol. 18, no. 1, 2019, pp. 112-116.

Figures

Tables

Table 1. British Social Grades.