Introduction

Brexit is the process of withdrawal of the United Kingdom from the European Union (EU) (Hobolt, 2016). The European Economic Area (EEA) includes many EU member nations and three other nations Iceland, Switzerland, Liechtenstein, and Norway. UK financial services trade with the three EEA members is less than 5% of the trade with the EU. Hence, the EEA trade is not analyzed separately for financial services. The EU was formed in 1975 with the goal of becoming a single, borderless market, with standard and uniform laws that permitted free movement of capital, people, goods, and services (Pinder & Usherwood, 2013). The objective of the EU was to form a unified trading block that would lead to mutual growth and stable economic conditions.

Members of the European Economic Community, made up of 28 European nations had a common currency, the Euro in various denominations (Grinin, Korotayev, & Tausch, 2016). Member states contributed a certain amount to the central corpus, which helped to fund nations with weak economic growth. However, the union was not without trouble and several states such as Greece and Georgia defaulted on their obligations, forcing other EU members to support the weak states (Le Gales & King, 2017). In addition, the free movement of people, flooded immigrants into advanced countries such as the UK, Germany, France stressing local economies and jobs (Gareis, Hauser, & Kernic, 2013). The UK government organized a referendum in 2016 to decide if the UK was to remain in the EU or exit, and the majority decision was to leave the EU (Berend, 2017). Leaving the EU would mean cutting off the economic links and dependencies with other EU nations, and Brexit is expected to have an impact on various sectors of the UK economy (Outhwaite, 2017).

In 2016, the financial services sector contributed £142.7 billion, amounting to 7.2% of the UK GDP, and employed 1.2 million. The financial services sector includes banking, insurance, accounting, pension funds, holding companies, trusts, funds, venture funding, unit trusts, property unit funds, real estate investment funds, financial leasing, credit granting, mortgage finance, security dealing, life insurance, non-life insurance, administration of financial markets, security and commodity contracts, risk and damage evaluation, and fund management activities (Tyler, 2017). With this background, this paper analyses the possible impact of Brexit on the financial services industry made up of banks, financial institutions, insurance, and other agencies.

Theory of Economic Integration

Economic integration is a systematic process where economic policies, markets, finances, and other areas of economic activity are unified. Barriers and restrictions such as cess, taxes, and tariffs at the border are suspended. With discrimination eliminated, economic integration is expected to encourage free trade, allow diffusion of technology, help economically weaker nations to enter the market, and infuse economic stimulation and funds in the market (Scitovsky, 2013). Nations with low growth and stagnating economies are provided the opportunity to benefit from technology transfer that helps them to develop quality products. Advanced nations with higher growth can sell their products in more areas.

Some trade agreements such as NAFTA, ASEAN, and others offer some features of economic integration such as reduced trade barriers (Baier, Bergstrand, & Feng, 2014). Economic integration is facilitated in seven stages and these are setting up preferential trading area, free trade area, customs union, common market, economic union, economic and monetary union with a common currency, and complete economic integration (Novak, 2013). EU integration has reached the final stage, though political union and integration is not possible, since each member nation remains a sovereign state. However, common norms are seen in society, culture, politics, social interactions, and in other areas (Cuadrado-Roura & Parellada, 2013).

The disadvantage of economic integration is that advanced economies are forced to dole out and help weaker member nations support them with bail-outs and trade. In addition, when a member nation faces a financial crisis, the problems are transferred to other nations. Additionally, citizens of lower economic countries consider migrating to advanced countries, where they have better opportunities (Kassim et al., 2013). Hence, the EU sees criticism from some of the member nations who do not want to fund the survival of weaker nations at their own cost. There are further criticisms that low wage cost countries, use cheaper labor to dump lower-priced goods in advanced economies, and some authors argue that the certificate of origin, where a manufacturer certifies that products are manufactured in a specified zone, is flouted (Schaltegger & Wagner, 2017). As a result, advanced countries become receptors for cheap made Chinese goods. There are also arguments that technologically advanced and efficient countries gain an unfair advantage by selling surplus products in countries with lower manufacturing bases (Usherwood & Startin, 2013).

Statistics of UK trade with the EU, EEA

The post-Brexit scenario is mixed with some researchers forecasting that the UK financial services sector could see revenue loss of 20-30% (Ward, 2017), while others indicate that the loss or gain would depend on the terms of the exit (Dhingra, Ottaviano, Sampson, & Reenen, 2016). This section reviews data and statistics to ascertain the volume and extent of a financial services business with EU members. Several graphs and statistics are used to discuss topics such as the UK share of financial services, UK asset management, FDIs, and the banking system. Table 1 presents trade volumes of UK financial services with EU and EAA, for 2017 (Magnus, Margerit, & Mesnard, 2016).

Table 1. UK and EU Financial services for 2016 (Magnus et al., 2016).

From Table 1, it is clear that UK financial service to EU counterparts in the segments of banking, asset management, insurance and reinsurance, and infrastructure is worth 23%, 22%, 26%, 10%, and 44%. In addition, the UK market shares in the EU in these segments are 24%, 26%, 41%, and 22%. These values represent significant investments and volumes, with cross holdings from EU based banks and insurance companies. When the interconnections of these segments with other sectors such as construction, retail, manufacturing, and others are considered, then the volumes and presence of UK financial services are very significant. Given this level of trade by UK financial services and the nature of interlinking, it is doubtful if EU financial services players would severe their relations. All parties will face an unacceptable level of financial distress (Magnus et al., 2016).

Asset management is an important part of financial services. It helps by financing the European firms by routing savings and investments from retail and institutional investors to financial institutions with non-financial corporates, and governments. Asset management is very important in providing funds for the economy. Since the economic recession of 2008, direct market-based financing has stepped in for bank lending channels. Asset management services of the UK have formed the Capital Markets Union and the European Fund and Asset Management Association to reinforce lending to EU and UK markets (Ward, 2017). Table 2 presents a breakdown of asset management investments by the UK and other EU nations in 2015.

Table 2. Asset management investment by UK and EU (Ward, 2017).

From Table 2, it is clear that UK asset management services hold 37% of the EU market share. Comparatively, France has 20%, Germany has 10%, and other nations have a lesser market share. Therefore, the UK dominates the asset management segment. A hard Brexit would mean that fund recipients from the EU would have to repatriate their debt to UK financial services. It is doubtful if EU recipients would take up this step or if they would find investors who would lend them funds.

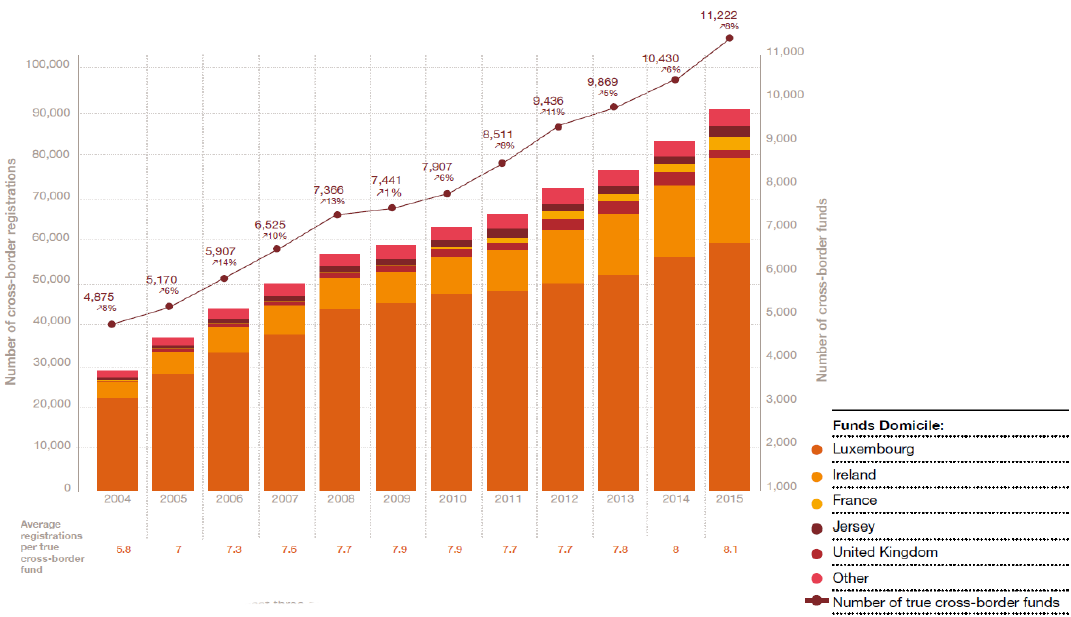

Foreign direct investment (FDI) is an important engine of economic growth. As per this process, foreign investors invest in a parent country with promising growth prospects. Cross-border FDIs happen when agencies from the parent country invest in ventures in a host country, where they feel they will get adequate returns for their investments. FDIs can be made in different sectors such as construction, manufacturing retail, services, share markets, etc. A country may define rules on the maximum holding by an investor from a foreign country in a venture in the parent country. It may even specify industries where investment is required and also indicate the minimum period for investment before the funds can be repatriated (Wyman, 2016). Fig 1 presents the cross-border investments in the UK.

From Figure 1, it’s clear that FDIs in the UK have consistently risen and the number of cross-border transactions and inflows has constantly increased. Kekic (2017), writing for the London School of Economics argues that in the initial years, projections were made that the UK would see a drop of 22% in inward FDI flows. Many leaders and CEOs of Cisco, Hitachi, GE, Airbus, and others also voiced their fears that FDI flows would decrease post-Brexit, leading to a fall in GDP. However, actual figures proved to be contrary. In 2016, the UK GDP grew by 2% and inward FDI rose to $179 billion and out of this, $101 billion was in financial services, acquisitions, and other financial markets. A report by Colliers International shows that London remains the preferred destination for FDI, among the top 20 cities. Several factors have contributed to this process, and these include a stable political climate with a strong government, diversified and skilled workers, weaker pound and low-interest rates, relatively lower real estate costs, and the location advantage. Therefore, the UK financial services do not face any threats in the long-term.

One of the major threats perceived is to the baking segment. Wholesale banking handles large transactions between domestic and international financial institutions and customers such as asset managers, pension funds, and other institutional customers. London based banks network with financial institutions across the world. ‘Passporting’ banking services is a single banking license and allows EU banks to operate anywhere in the EU. UK banks are preferred by 46% of EU funds to raise capital, and 112 EU firms are listed on the London Stock Exchange. About 35% of financial activities and 76% of EU foreign exchange and trading and interest rate derivatives are conducted through UK banks (Magnus et al., 2016). Table 3 gives details of the UK banking system as of 2016.

Table 3. UK banking system (Magnus et al., 2016).

If passporting is not allowed, the researcher points out that post-Brexit if UK banks wish to open branches in EU nations, the cost of transactions will increase by 8% and by 10% if EU banks open branches in the UK.

Models of Economic Relations between the UK, EU-27 and EEA, Post-Brexit

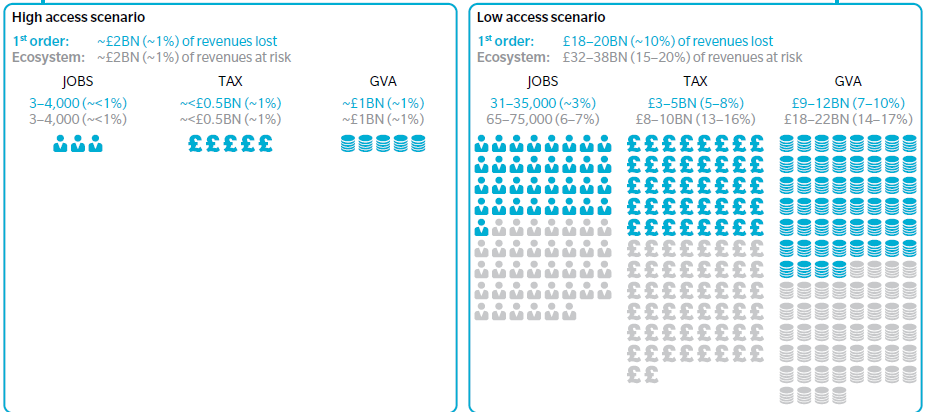

The previous chapter examined the extent of exposure to the UK’s financial services sector to EU markets. As seen in Tables 1, 2, and 3, the UK has a sizeable presence in EU markets. The question to be answered is the extent of losses or gains that the UK will incur in case of a hard exit. Two scenario models are presented in Fig 2, which illustrates the high-access, or open access without restrictions, and low-access restricted access

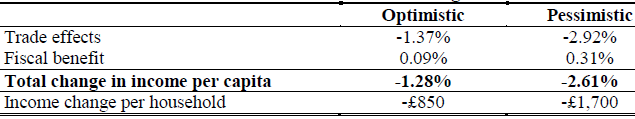

From Figure 2, the high-access scenario places reduced losses of 4 bn GBP with a reduction in jobs, taxes and the gross value added (GVA). The low-access yields high losses of 58 bn GBP or 20% of revenues are placed at risk. Dhingra et al. (2016) made optimistic and pessimistic projections of trade and fiscal benefits and losses. The authors indicate an optimistic increase in benefits of 0.09% and a pessimistic increase of 0.31% pa, in UK financial services, post-Brexit.

Theoretical Opportunities of Brexit

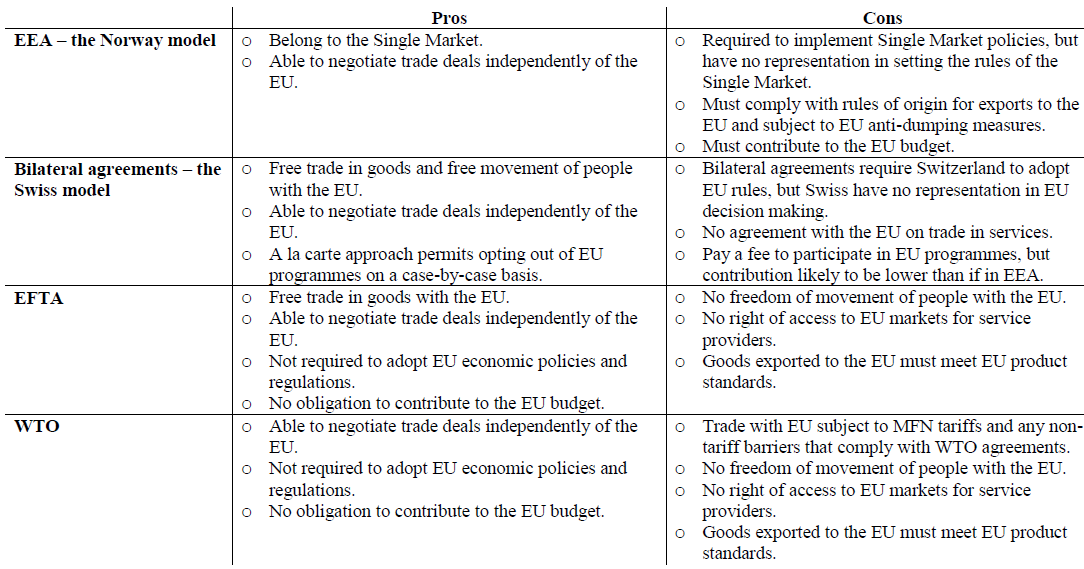

Discussions from the previous sections indicate that the UK financial services will face losses of 58bn in a pessimistic scenario, an unacceptable level of losses. However, several opportunities are available, and these are indicated in Fig 4, along with the advantages and disadvantages.

From Fig 4, UK can take one of several routes, and these are the EEA Norway model, the Swiss model or bilateral agreement system, the EFTA, and recourse to WTO. The availability of these routes depends on the terms of negotiation with the EU governing body.

Conclusions

The paper analyzed several parameters and segments for UK financial services and the role they play in the EU system. Statistics for the trade of financial services with EU, asset management services, FDI, and the share of the UK banking system, indicates that the UK has substantial exposure in EU markets. EU financial services have a high level of dependency on the UK. It would not easy for the EU to break these financial networks. However, there is a threat of an 8-10% increase in taxes due to the loss of passporting. It is not clear if the EU government would waive these charges. High and low access scenarios indicate that UK financial services would lose between 4-58 bn GBP, while optimistic and pessimistic scenarios indicate marginal gains. The paper also examined ways in which opportunities can be gained from Brexit. Therefore, the UK must negotiate with the EU for favorable terms.

References

Baier, S. L., Bergstrand, J. H., & Feng, M. (2014). Economic integration agreements and the margins of international trade. Journal of International Economics, 93(2), 339-350.

Berend, I. T. (2017). The contemporary crisis of the European Union: Prospects for the future. New York, NY: Routledge.

Cuadrado-Roura, J. R., & Parellada, M. (2013). Regional convergence in the European Union: Facts, prospects and policies. London, UK: Springer Science & Business Media.

Dhingra, S., Ottaviano, G., Sampson, T., & Van Reenen, J. (2016). The impact of Brexit on foreign investment in the UK. Web.

Gareis, S., Hauser, G. & Kernic, F. (2013). The European Union – a global actor? Leverkusen, Germany: Barbara Budrich Publishers.

Grinin, L., Korotayev, A. & Tausch, A. (2016). Economic cycles, crises, and the global periphery. New York, NY: Springer International Publishing.

Hobolt, S. B. (2016). The Brexit vote: A divided nation, a divided continent. Journal of European Public Policy, 23(9), 1259–1277.

Kassim, H., Peterson, J., Bauer, M.W., Connolly, S., Dehousse, R., Hooghe, L., & Thompson, A. (2013). The European Commission of the twenty first century. Oxford, UK: Oxford University Press.

Kekic, L. (2017). Foreign direct investment will remain robust post-Brexit [Blog Post]. Web.

Le Gales, P., & King, D. (2017). Reconfiguring European states in crisis. Corby, UK: Oxford University Press.

Magnus, M., Margerit, A., & Mesnard, B. (2016). Brexit: the United-Kingdom and EU financial services. Web.

Novak, S. (2013). The silence of ministers: Consensus and blame avoidance in the Council of the European Union. Journal of Common Market Studies, 51(6), 1091-1107.

Outhwaite, W. (2017). Brexit: Sociological responses. London, UK: Anthem Press.

Pinder, J. & Usherwood, S. (2013). The European Union: A very short introduction (3rd ed.). Oxford, UK: Oxford University Press.

Schaltegger, S., & Wagner, M. (2017). Managing the business case for sustainability: The integration of social, environmental and economic performance. London: UK: Routledge.

Scitovsky, T. (2013). Economic theory and western European integration. London, UK: Routledge. (Original work published 1958).

Tyler, G. (2017). The financial sector’s contribution to the UK economy. Web.

Usherwood, S. & Startin, N. (2013) Euroscepticism as a persistent phenomenon. Journal of Common Market Studies, 51(1), 1-16.

Ward, M. (2017).Statistics on UK-EU trade: Brief paper, Number 7851. Web.

Wyman, O. (2016). The impact of UK’s exit from the EU on the UK based financial services sector. Web.