Introduction

According to UK’s Companies Act, SMEs definition is seen to constitute the following characteristics, “employing 250 people or less, having a turnover of less than 11.2 million pounds and have a net assts of less that 5.6 million ponds” (Performance and Innovation Unit and Small Business Service 2001, p.1).

Since the integration of European countries, trade barriers have been reduced, an opportunity that has allowed free movement of goods, services, capital, and labor (Mulhern, 1995). Through this, the union body has envisioned to create and facilitate economic potential of Europe.

Small and medium enterprise sector (SME) has been regarded as one of crucial sectors that will result in European competitive development. For instance, in almost all European countries, SME provides employment to many people within the European labor force and commands 75 per cent of sale volume in the private sector (Great Britain: Parliament: House of Commons: Trade and Industry Committee, 2005, p.152).

Despite their increased popularity in the UK, the financial SMEs have faced various challenges over the years that have placed them unfavorably in terms of competition with other larger firms in the country, the most pressing problem being difficulty in access to credit.

However, one bank going by the name HSBC bank has emerged as a success story in the financial SME sector due to its unique product lines that have enabled it be one of the leading banks with the highest number of customers. The bank’s primary goal is to finance micro-finance clients, as well as fund entrepreneurs who would wish to start up new micro-businesses.

This paper will discuss the service marketing issues that are affecting HSBC bank in the UK, as well as the strategies that the bank has adopted or contemplates to adopt in order to gain a competitive advantage in the banking industry.

Financial services for UK SME’s sector

Today, estimates shows that there are over 3.5 million small and medium enterprises (SME) in UK which has been able to provide 55 per cent jobs to people while at the same time contributing 45 per cent of turnover of businesses in the country (Competition Commission 2001).

Despite their immense role to the country’s economy, SME businesses “as a result of their scale of operation have limited financial and managerial resources, and the quality of service they receive from their banks” has also been insufficient and unsatisfactory (Competition Commission 2001).

Financial services in SME sector categorized as reference services is seen to constitute number of relevant markets comprised of: “liquidity management services, which include business current accounts, overdraft facilities and short-term bank deposit accounts; for general purpose business loans to SMEs; other types of business loans to SMEs; and other business deposits held by SMEs” (Competition Commission 2001).

Characteristics of the financial service marketing in SME sector further show that there is wide reluctance on part of most SME operators having banking relationship with a particular bank to switch to another bank.

The main reasons given for this include likelihood of “complexity of switching for little financial benefit; the perceived significance of maintaining relationships with a particular bank or particular relationship manager; and the ability of the existing bank to negotiate lower charges or otherwise respond if there is a threat of switching” (Office of Fair Trading, 2007).

On overall, SME’s environment is further seen to experience limited price sensitivity and prices receive little attention as compared to quality of service provided. Lastly, there is lack of transparency with regard to pricing in SME. Most prevalent practices in the sector and facilitated by financial banks with aim of restricting competition include: overall similarity of pricing among the major banks, differential pricing to customers with free banking being confined to only selected SME’s, and existence of barrier entry (Office of Fair Trading, 2007).

In order to address the concerns, professional advice has outlined that there is need to make switching easier and faster, limit bundling of services, and improvement in price information and transparency to SME’s (Office of Fair Trading, 2007).

According to article by Ideal Solutions Limited titled, “ME banking still under performing” published in 2007, it was identified that SME banking by major banks was still unsatisfactory and below the expectations of the sector (Ideal Finance Solutions Limited 2007). The article postulates that, “a large number of businesses are unhappy with their banks when it comes to switching accounts, overcharging and customer service” (Ideal Finance Solutions Limited 2007, p.1).

Mike Cherry, chairman of FSB financial affairs noted that, “although services had improved slightly since 2002 recommendations, a lot of work still needs to be done since observation shows that banks are offering low quality services to their clients, and there is need for culture change within banks so that they can understand needs of their SME clients” (Ideal Finance Solutions Limited 2007, p.1).

Banks are seen to have failed in key areas of their customer service such as banks are violating their commitment to offer free banking to SME, interest rate on business current accounts is still high, and those providing these services were insufficiently carrying out publicity and awareness of the offers (Ideal Finance Solutions Limited, 2007).

Problem with regard to Financing UK’s SME Sector

Information asymmetry has characterized SME sector which led to little desire on the part of customer to move. But in 2001, Competition Commission recommended that there was need for banks to embraces changes revolution has been experienced in the sector. For a start, switching has become easier and today tendency of most SME customer is that they are moving to smaller banks (Office of Fair Trading, 2007); they are more price sensitive, and banking with more than one is increasing (Office of Fair Trading, 2007).

New technology and reduction of entry barriers have ensured information circulation in the sector due to competition is high. Therefore, trust and commitment by clients to a particular bank is an issue that most banks, HSBC included have to fight and cultivate if they aspire to penetrate and succeed in the sector.

Therefore, service marketing issue confronting banks with regard to financial service marketing has to do with how well to cultivate and maintain a committed and trusting portfolio of clients. Credit-based relationships that HSBC should aspire to create and establish with its SME clients can be explained by Commitment-Trust theory developed by Morgan and Hunt in 1994.

The authors identified the main precursors that establish strong commercial banking relationship between suppliers and clients include evaluation of relationship termination costs, which are seen to positively influence commitment to a relationship where clients between costs of ending a relationship and costs of establishing an alternative relationship (Buttle, 1996).

SME clients of most banks consider switching costs too high and this particular fact has resulted into customer loyalty despite existence of some dissatisfaction with the bank (Buttle, 1996). Communication is further seen to oil customer-bank relationship.

Trust in the established relationship will greatly be defined by level and willingness to share both formal and informal information between bank and customer. Literature postulates that bank-customer relationship requires imperfect balance of information since the relationship is founded on grounds of asymmetry of information (Buttle, 1996).

Success in marketing financial services to SME

In 1977, Lynn Shostack, the then Citi Bank Vice President wrote an article titled, “Breaking free from product marketing” (Rao, 2004, p.3). In the article, the bank’s Vice president noted that, “new concepts are necessary if service marketing is to succeed…merely adopting product marketing labels does not resolve the question of whether product marketing can be overlaid on service business” (Rao, 2004, p.3).

For some time, more efforts and energies have been employed to develop new concepts, strategies and techniques for handling marketing problems of service organizations, more so trying to recover satisfaction to the customers (Boshoff, 1997). Research reports that have been done especially with regard to financial SME activities have established that several issues result into the success of service marketing in financial SME sector.

In this case, they include “service quality, customer relationship marketing, internal marketing, designing of service packages, interactive marketing, moments of truth, service encounter management, customer evaluation process, customer perceived service quality, service failures and recovery strategies and rectifying channels of losses of customer defections” (Rao, 2004, p.3).

According to Ennew and Waite (2007), financial services for small-scale clients should naturally be information-based services and easily digitized. But the complexity that is associated with many financial services suggest that interpersonal interaction is often required in their delivery and studies have shown that there is always strong pressure for financial services organizations to have a physical presence in the financial SME’s market in which it is delivering the services (Ennew and Waite, 2007).

Ehrlich and Fanelli (2004) say that segmentation and positioning are the main strategies of marketing and do apply to every product or service especially in financial SME’s sector. The observation of the authors is that the bank, for instance, HSBC has to know its SME’s prospective customers and positioning largely involves the determination of how the bank wants other people or institutions to view it.

Accordingly, positioning is closely related to branding, which in essence defines the bank, what values to communicate, and largely how different the bank is in offering similar services to that of others (Ehrlich and Fanelli, 2004) and why financial SME clients or potentials consumers should demonstrate preference for your services and not the others.

As a result, the authors see differentiation of products and services as the strategy banks can use against their competitors and the differentiation can be tangible in form of price, selection, terms and delivery time while intangible differentiation can take place in terms of quality of service, expertise, image, value, and status (Ehrlich and Fanelli, 2004).

Winston (1986) observes that financial winners and losers are precisely determined by the judgments of the individual decision makers regarding environmental uncertainty, which also applies to SME banking.

When institutions fail to identify the actual forces resulting into environmental uncertainty then such institutions become largely unprepared to deal with opportunities and threats as they are presented in the environment. Financial services for both corporations and SME businesses are affected by four major environmental forces: economic, technical, legal-political, and social (Winston, 1986, p.23).

Key questions regarding service markets that financial institutions can explore with regard to SME’s include: “who constitute the present and potential customers, what are their characteristics, what are their opinions and attitudes about the relevant institution and services, where are they located, how do they locate financial services and institutions, is service-market potential increasing, decreasing or staying the same and why, and what factors influence demand” (Winston, 1986, p.23).

Opportunities and Threats for Banks in UK’s SME’s sector

According to 2010 HSBC’s Global Small Business Confidence Monitor report, that was released recently, the bank projects that most UK SME businesses will grow in positive way (Williams, 2010). For instance, the bank estimates that 76 per cent of SMEs are optimistic of economy improving thus enabling them to grow while 25 per cent are determined to increase their capital spending for the next coming six months while 95 per cent remain confidence of operating within the current budgets with fewer cuts (Williams, 2010).

As a result of these prospective economic growths, UK Banks financing SME sector are presented with the following opportunities to exploit:

- as microfinance lenders, the banks can embrace the improving economic growth to increase their lending capital base since SME sector is likely to grow and requires more money to invest in new ventures.

- SME sector has been predicted to greatly grow as a result of formation of European Union; as such, it requires more new and innovative financial products and services, which UK Banks can exploit through market research and institution of effective customer satisfaction practices (Stobbart, 2009).

- The advent of internet/online banking in most UK big banks has opened up opportunity for the banks to extend their services to wide array of SME’s customers within UK, who earlier it was impossible to reach out to.

- Through mergers and acquisitions, most UK’s large banks possess large and adequate capital, which they can use to expand their services and products in the SME sector.

- The big banks enjoy strong established brand names that have enabled them to perform excellently in the market, which in turn they can use to penetrate the SME sector (HSBC SWOT Analysis, n.d, p.1);

- Recommendations by Competition Commission had brought some ‘sanity’ and confidence in financial sector with more SME clients now seeking various financial services available. As a result of this increased SME enthusiasm in banks, banks are presented with an opportunity to design services that are appropriate and readily accessible by the growing number of SME clients (Office of Fair Trading, 2007).

At the same time, banks face certain threats in the SME sector. According to recommendations presented to Competition Commission of 2002, it became apparent that banks in facilitating and providing financial services to SME clients had to initiate behavioral changes that included increasing price transparency, reducing switching costs and limiting the bundling of current accounts (Office of Fair Trading, 2007).

As effect of these recommendations started to take place many banks especially bigger ones started to experience customer switch and as a result percentage of growth reduced drastically (Office of Fair Trading, 2007).

At the same time, due to lessening of entry barriers, several smaller banks have increased their market share in SME sector hence becoming a threat to bigger and established banks. For instance, as a result of smaller banks entry, growth share for bigger banks had fallen from over 90 per cent to around 85 per cent while at the same time, competition continue to be fierce (Office of Fair Trading, 2007).

The increasing adoption of technology in the SME sector, coupled with behavioral undertakings suggested by Competition Commission have resulted into competition that each day continue to constrain the capability of the bigger banks hence reducing their profits margins as opposed to earlier when they could charge highly and obtain greater profits (Office of Fair Trading, 2007).

Commonalities & differences in service marketing: HSBC, Barclays and Lloyd

Commonalities

The three banks are seen to be involved in provision of banking services that include loans and mortgage products. In addition, they are better placed than smaller banks to offer full range of liquidity management services that include business current accounts, which they control with a big percentage. Generally, their banking services have largely been divided into three broad categories, i.e. money transmission, debt, and savings.

However, in the past, financial services of the banks have reflected: increasing money transmission charges, increasing interest rates on loans, and reducing lending rates. Further, the three banks’ financial service marketing strategies have largely been characterized as making it difficult to switch between banks, bundling of services and lack of price information and transparency (Office of Fair Trading, 2007).

Differences

Barclay’s financial services for SME have been categorized into two divisions: retail banking and business banking. With regard to retail banking the bank provides financial services to about 641, 000 SME’s who record an annual turnover of less than 1 million pounds.

On the other hand, business banking specifically serves SME’s who record annual turnover one million pounds (Office of Fair Trading, 2007). For HSBC bank its SME financial services in UK have been grouped into four: Small Business Tariff; Business Direct Tariff; Treasurer Tariff; and Schools and Colleges Tariff.

At the same time, some of HSBC SME customers enjoy individually negotiated charges that are intended to discourage switching ambitions (Office of Fair Trading, 2007). Lloyds TSB financial services for SME are grouped into two: Business Banking, covering those SME with annual turnover of up to two million pounds, and Corporate Banking, serving those SME clients who record annual turnover of more two million pounds (Office of Fair Trading, 2007).

Service marketing

Service marketing is seen to involve better strategies of serving customers and improving financial performance, thus firms need to build bonds with their service delivery in order to satisfy the customers (Miundie and Pirrie, 2006).

Service marketing establishes its ground in resource-advantage theory and core competency theory (Prahalad and Hamel, 1990 cited in Drejer, 2002; Hunt 2002; Sanchez 2008; Christensen, 2001 cited in Sanchez and Heene 2005). Here, core competences are seen to be intangible processes that include bundles of skills and technologies and often they are routines, actions, or operations that are largely tacit, casually ambiguous and idiosyncratic.

Teece and Pisano (1994) observes that, “the competitive advantage of firms stems from dynamic capabilities rooted in high performance routines operating inside the firm, embedded in the firm’s processes and conditioned by history” (cited in Dosi, Nelson and Winter, p.334 ). Hamel and Prahalad (1996) on the other hand talks about, “competition for competence or competitive advantage” which to them constitute “disproportionate contribution to customer-perceived value” (p.30).

Sheth, Sisodia and Sharma (2000) are convinced that service marketing is customer oriented in nature and market driven (cited in Sheth and Shainesh, 2001, p. 352). In this regard, to be customer oriented, the organization is required to be “collaborating with and learning from customers and being adaptive to their individual and dynamic needs” (Lancaster and Massingham, 2010).

Service marketing principles postulate that, “value is rather defined and co-created by customer rather than embedded in output” (Lovelock and Wirtz, 2010). Haeckel (1999) observes that firms that become successful always move from ‘make-and-sell’ strategy to ‘sense-and-respond’ strategy.

According to Day (2000), service marketing involves firms participating in a continual process of generating hypothesis and subsequently testing the hypothesis (cited in Edvardsson, Magnusson, Gustafsson and Kristensson 2006). Further, the author notes that outcomes should not be something to maximize on but rather something to learn from as firms strive to serve customers in the best ways and improve their performance at the same time (cited in Edvardsson, Magnusson, Gustafsson and Kristensson 2006).

HSBC service marketing issues for five years

Service marketing issues at HSBC reflects the overall service marketing issues experienced in the SME sector. On overall, service-marketing issues that have been identified include poor customer service strategies, poor identification of customer needs, inefficiency in delivery of services to customers by the banks, and the general tendency by banks to disseminate asymmetrical information (Ideal Finance Solutions Limited, 2007).

Furthermore, the bank specifically HSBC bank has had issue with regard to customer switching and the biggest problem has been how to maintain loyal customers for long-term commitment and relation (Competition Commission, 2002).

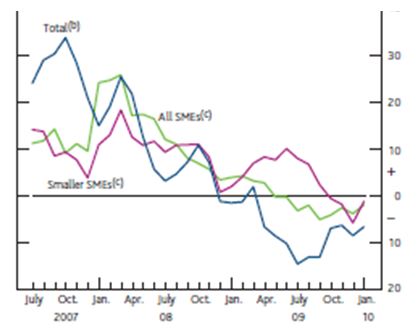

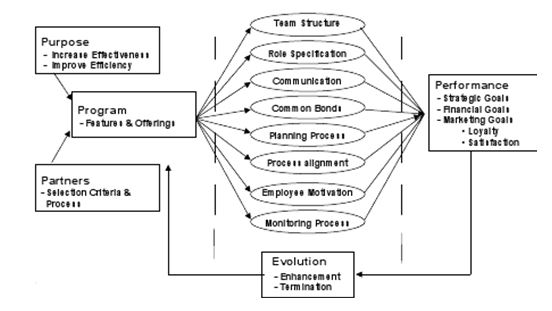

CRM Process Model

Source: Parvatiyar and Sheth 2002.

One of the advice provided for banks if they intend to win or maintain their current customers is the need to address customer complains and issues on time. Basically, majority of SME have expressed dissatisfaction with their current banks and given an opportunity they will be willing to switch to other banks or financial providers.

Therefore it is the role of banks specifically HSBC to address customer issues in the most appropriate way. CRM Process Model base its argument on the fact that given that current environment is characterized by intense competition, it is prudent for banks to establish cooperative relationships with their customers.

The CRM Process Model develops on four-stage CRM process framework and the broad framework suggests that CRM process constitute four important sub-processes that include “a customer relationship formation process; a relationship management and governance process; a relational performance evaluation process, and a CRM evolution or Customer Relationship Management: Emerging Practice, Process, and Discipline” (Sheth and Shainesh, 2001).

The central theme of the model is that banks need to identify and differentiate individual customers. During the formation process of relationship, there are crucial decisions than need to be considered including “selecting parties (or customer partners) for appropriate CRM programs; and developing programs (or relational activity schemes) for relationship engagement with the customer” (Parvatiyar and Sheth 2002).

Recommendations for HSBC

Recommendation for HSBC Bank with regard to service marketing issue is that the bank needs to move forward and formulate an effective service marketing strategy that is composed of four key dimensions of ‘customer-orientedness, competence, tangibles, and convenience.

Customer-orientedness should further constitute functional variables such as extent of prompt service, consistent courtesy, and knowledge to address customers’ questions and concerns, personal attention directed to customers and adequate understanding of specific customers needs (Sheth and Shainesh 2001). Competences to be demonstrated include showing of interest in customer problem solution, providing right services, having error-free records, service-time guarantee and safety of transactions (Sheth and Shainesh 2001).

Tangibles on the other hand should involve variables that express the extent of visual appeal of physical facilities and also information conveyed by published materials (Sheth and Shainesh 2001). Lastly, regarding convenience the bank should institute proper guidance signs and effective timelines of services (Sheth and Shainesh 2001).

Conclusion

Service marketing is gaining popularity, with the main focus being to ensure that customers are satisfied through customized and differentiated products (Palmer, 2008). SME financing therefore is presenting most banks with numerous challenges and it is upon the banks to adopt superior and appropriate service marketing strategies that promise to win customers and retain them at the same time.

Through effective formulation and adoption of service marketing strategies HSBC possess potentials to establish itself in the UK SME’s sector. The bank needs to use its huge financial capabilities to develop effective and efficient service marketing strategies. Such service marketing for instance in the case of HSBC should be to pursue retention strategy which aims to create and possess loyal and committed customers.

In establishing a retention strategy, key steps should be followed that include: defining loyalty, defining objectives of the relationship to be establish, identification of customer needs, developing appropriate approaches to ensure retention strategy succeed, implementing the ability to fulfill the customer needs identified, and lastly, carry out measurement of the strategy to discover if it is succeeding (Stone, Woodcock and Machtynger 2000).

Lastly developing loyal customers, evidence shows that there is need for an overall audit of customer management; through the audit it becomes possible to: identify the specific niche of customers to retain or target for loyalty programs; it becomes possible to identify the re-falling repurchasing rates among the best bank’s best customers; also it becomes possible to identify the falling levels of ‘state of mind’ loyalty; lastly, the audit enable the bank to measure and evaluate the rate of switching from the bank (Stone, Woodcock and Machtynger 2000).

Reference List

Bank of England. 2010. Trends in Lending. Web.

Boshoff, C., 1997. “An experimental study of service recovery options.” International Journal of Service Industry Management, Vol. 8, No. 2, pp.110-130. Web.

Buttle, F., 1996. Relationship marketing: theory and practice. NY, SAGE. Web.

Competition Commission. 2002. The supply of banking services by clearing banks to small and medium-sized enterprises. Web.

Dosi, G., Nelson, R. R., and Winter, S. G., 2000. The nature and dynamics of organizational capabilities. UK, Oxford University Press. Web.

Drejer, A., 2002. Strategic management and core competencies: theory and application. Greenwood Publishing Group. Web.

Edvardsson, B., Magnusson, P Gustafsson, A. and Kristensson, P., 2006. Involving customers in new service development. UK, Imperial College Press. Web.

Ehrlich, E. and Fanelli, D., 2004. The financial services marketing handbook: tactics and techniques that produce results. NJ, Bloomberg Press. Web.

Ennew, C. and, Waite, N., 2007. Financial services marketing: an international guide to principles and practice. MA, Butterworth-Heinemann. Web.

Great Britain: Parliament: House of Commons: Trade and Industry Committee. 2005. UK Employment Regulation: Seventh Report of Session 2004-05. UK, the Stationary Office. Web.

Haeckel, S. H., 1999. Adaptive enterprise: creating and leading sense-and-respond organizations. NY, Harvard Business Press. Web.

Hamel, G. and, Prahalad, C. K., 1996. Competing for the future. NY, Harvard Business Press. Web.

HSBC SWOT Analysis. HSBC Group: HSBC SWOT Analysis. Web.

Hunt, S. D., Arnett, D. B., and Madhavaram., 2006. The explanatory foundations of relationship marketing theory. The Journal of Business and Industrial Marketing, Vol. 21, No. 2. Web.

Ideal Finance Solutions Limited. 2007. SME banking still under performing. Web.

Lancaster, G. and, Massingham, L., 2010. Essentials of Marketing Management. NY, Taylor & Francis. Web.

Miudie, P. and Pirrie, A., 2006. Services marketing management. London, Butterworth-Heinemann.

Mulhern, A., 1995. The SME sector in Europe: a broad perspective. Journal of Small Business Management. Web.

Office of Fair Trading. 2007. SME Banking. Web.

Palmer, A., 2008. Principles of Services Marketing. 5th Edition. London, McGraw-Hill.

Parvatiyar, A. and Sheth, J. N., 2002. Customer Relationship Management: Emerging Practice, Process, and Discipline. Journal of Economic and Social Research. Web.

Performance and Innovation Unit and Small Business Service. 2001. Importance of Small Firms to the UK economy-present day. Web.

Rao, K. M., 2004. Services Marketing. New Delhi, Pearson Education India.

Sanchez, R., 2008. A focused issue on fundamental issues in competence theory development. London, Emerald Group Publishing.

Sanchez, R. and, Heene, A., 2005. Competence perspectives on resources, stakeholders, and renewal. UK, Emerald Group Publishing.

Sheth, J. N. and, Shainesh, G., 2001. Customer relationship management: emerging concepts, tools, and applications. New Delhi, Tata McGraw-Hill. Web.

Stobbart, G., 2009. UK SME’s diversify their business in order to survive the recession. Web.

Stone, M., Woodcock, N., and Machtynger, L, 2000. Customer relationship marketing: get to know your customers and win their loyalty. CT, Kogan Page Publishers. Web.

William, P., 2010. HSBC sees a more confident SME sector. The online resource for SME’s in UK. Web.

Winston, W. J., 1986. Marketing for financial services. NY, Routledge. Web.