Summary

The following paper addresses the problems that are faced by the ABC Bank pertaining to their documentation, storage, and data sharing as well as data integrity issues. The main problem leading to these issues has been identified in this paper. The current changes and requirements of the banking sector around the world have been studied and their strategies have been researched on to provide for similar long term beneficial strategies for the ABC Bank. The international case of Deutsche Bank AG has been taken up to comprehend the reasons behind their success in the documentation and data maintenance field while the case of the Jordanian banking sector has been studies to identify the current bank and office automation tools and system available.

A strategic viewpoint has been taken to develop four alternative solutions for problem statement identified for the ABC Bank. It was identified that according to the nature of the operations of the bank and the current market conditions it was essential for ABC bank to invest in business process modeling and reengineering for the business. This is established in order to make sure that by implementing a new system n tip of an old architecture and business operational structure does not result in inconsistency and wastage of substantial amount of funds in the form low return of return based investment.

The best solution has been chosen and put forward as the recommendation which most aptly addresses the issues being faced by the ABC bank. This solution pertains to using a data ware house as a data repository for the ABC Bank and to implement an ERP system which would centralize the operations of the banks and also make way for online reporting. This solution was most suitable for the issues that were faced by the ABC Bank as it covered all the requirements of the management of the ABC bank relating to the cost and benefits of the solution, the feasibility of the solution and the long term affects that the solution might have fo0r the ABC Bank.

Introduction

The main operations that are conducted in the bank pertain to maintenance of client accounts, cash and monetary instrument transfer, loan dealing, mortgaging, leasing and financing activities, as well as treasury option management and investment profiling. The focus of this paper is basically on retail banking which is part of a banks operation and business activity which pertains to providing services through the different, relatively small scale, branches of the bank. The retail banking services that are provided by Banks usually are specifically designed for individual members of the public and not for bulk accounts or large clients like corporations, businesses or institutions.

The banks around the world are currently facing problems regarding branch management and the storage and accessing of records for customers in a dynamic portal which can be accessed from remote places as well as through international alliances. They are also facing problems regarding the maintenance of customer records which can be forthcoming as well aimed towards the growth of the banks in the future while providing for current investment as well. “Despite their technological prowess, banks have trailed behind other consumer services and product industries in terms of customer satisfaction. The average satisfaction with banking services hovers around the 75-percent level, meaning there is a gap of 15 percent less than the average for leading companies in other industries. Customers now expect dependable, responsive, and high-quality services that are available anytime, anyplace. Oblivious to internal fragmentations along functional, product, and geographic lines, customers have a habit of aggregating all their interactions with a financial institution across all channels, products, and services. Therefore, banks must overcome internal barriers and articulate an integrated flow of business processes and technologies that is consistent with the customers’ unified perspective of the bank.” (Kopp, 2005)

The bank ABC is also facing the same problem. It has multiple branches in the relatively large geographic region which are separated by 3-4 blocks. As a result of the distributed presence of the ABC bank, it is facing problems regarding data integrity and restricted access to client records as well as incompatibility of software in one hosted at one branch with the software hosted in another. As a result the ABC bank is forced to adhere to a more manual oriented system as well as keep their client records specific to one branch. In the long term the bank is unable to keep up with the market requirement for deposit and savings accounts as well as other banking activities as the ABC bank is unable to account for and predict its future revenue, transaction rate as well as provide realistic ratios of revenue and growth for the following years and financial periods.

In order to solve this problem pertaining to discrepancy in data and the lack of access to the records held at other remote branches, banks in the financial sector have started using bank automation devices. These have been implemented since 1980’s however the full potential of these automation tools are just being realized. These benefits pertain to providing the customers with a clerk free environment where they can conduct their banking activities in their own privacy, where as other benefits include integration of the business activities of the bank on a regional and national scale. Complex software can also aid in maintaining the records of a bank in an integrated manner over a global scale as well.

Organizational Problem and Situation Analysis

The organizational problem that exists in the ABC pertains to basically the lack of integration of the system in place. This is the main problem that is faced by the bank, however due to this problem several others raise pertaining to the compromise of data integrity, the lack of forecasting, the lack of customer relationship development and the obstacles that arise in the day to day operations in the retail banking division.

The following are the specific issues that were identified after studying the operations and the business processes of the ABC bank.

The bank needs a storage entity for storing information and documentation pertaining to account opening at all branches of the ABC bank. Here it needs to be taken into account that information pertaining to account opening is highly sensitive in nature as it contains seals and signatures of the account holders. Moreover this information is stored both in manual format on paper as well as in a virtual format as a soft copy on the computer. However as the information is stored on PC’s currently and other workstations and computers which fall outside the LAN of the bank branch are unable to access the account information making it impossible for the customers to access their account or carry out their banking activities through another branch of the ABC bank where the might not have an account present. This also presents for data inconsistency as well as duplication and redundancy of data.

One of the main products provided by the ABC bank in its retail banking division pertains to the loan and mortgage provision to individual customers. “Commercial loans generally represent the single largest asset group for most banks. Yet loan documentation is one of the least understood aspects of commercial lending. State and federal laws and bank policies and practices can sometimes make documentation phase of a loan closing complicated and onerous. But complete loan documentation is vital for the banks protection. Good documentation depends on five key factors, understanding the differences between secured and unsecured lending and between personal lending; upfront knowledge of the loans purpose and structure of how it affects the documentation needed; correct and accurate use of forms, and review forms by loan officers and the banks attorney when appropriate;”(Wetzel, 1986) This process also needs to take into account the fact that this documentation needs to be uploaded into virtual storage device through an appropriate interface or device so as to enable the documentation to be accessible across anywhere in the branch network of the ABC bank as well as to its alliances where appropriate.

The speed of the process for the acquisition and the processing of a loan and a mortgage also needs to be speeded up in order to increase the time base efficiency of the process and stop queuing in the retail branches of the ABC bank. The current speed of loan processing is very slow which tends to increase the lines queues of people waiting to process their loans and mortgages and also tends to interrupt the atmosphere and the other retail banking operations of the branch. This phenomenon has been seen in almost all the branches of the ABC bank.

Additionally the ABC bank also needs to take into account the customer help desk services which can need to be present to process and respond to the routine queries put forward by the customers as ell as provide customers with technical assistance in the basics of the banking activities that are deemed useful.

The ABC bank also has to be aware of the risks that it is going to take on by conducting business process remodeling and by investing in a system which can aid in decreasing the costs and inefficiencies put forward by the current system. These risks can be accounted for by identifying the actual cost and risks that the bank is currently taking on by continuing on with its current systems and analyzing and comparing them with those presented by a proposed solution system for the ABC banks’ problem.. More over it needs to be taken into account as well that the banks strategic code of operations and the current policy that was set at the time of initiation of the retail division for the bank is against the current process as the policy tends to aim towards increasing customer loyalty and providing the clients with high quality professional services without hassle. The main risk that the ABC bank is taking on by going ahead with the current system pertains to losing the current customer and clients of the bank as well as creating a bad image in terms of service provision, data inconsistency and lack of technology orientation.

The management of the ABC bank as well as its employees are of the opinion that the bank requires there to be more investment in the communications and systems technology at all branches. This issue has come about as other banks in the same sector are becoming information technology savvy and have become proficient entities by investing in information and communicative technology to provide for its customers as well as to reduce costs and remove the discrepancies that were residing in their business operations.

In order to resolve the problems that have been put forward in this section, we need to be able to identify as to what is the centre point of the process for business operations in a retail bank which is focused on providing lending and financing services to individual customers. “Operational errors, lapses in internal controls, manual handoffs, continual workarounds, and reprocessing efforts amount to billions of dollars in wasted performance for the banking industry. These hefty operational expenses add to an already high cost of maintaining fragmented legacy IT systems. Across the industry, the structural cost to produce a dollar of revenue is too high: To earn $1.00, leading banks have to spend about 55 cents. From a technology perspective, the challenge is to carve out holistic system functions that enable streamlined business processes and straight-through transactions.” (Kopp, 2005) The center point of the operations for any retail bank is the customer itself and due to this it can be stated that the operations of the bank are derived from the customer or the query that is put forwards by the customer.

Another issue that needs to be kept in mind while providing a new system for the operations of ABC bank is how expensive and costly is it going to be to maintain the new system at the ABC bank and in the long run or it be more efficient and beneficial for the business or more heavy, hefty, costly and complex for the ABC bank.

Example from the international market

In order to provide an example of a financial institution/ and a bank that have been able to set up a exemplary documentation system at the heart of their operations, the case of Deutsche Bank AG and the Jordanian Banking Industry have been taken up.

In the year 2005 Deutsche Bank AG was voted and declared as the best trade documentation bank in the world. The bank has been able to in this award for the four consecutive years leading to 2005 and the reason for this has been a well thought out system and complete implementation of information technology to support the system at the heart of the bank. The company has been able to show excellence in the kind of reporting and documentation that it initiates on the request and the query of the client which leads to the processing of the operations in the bank and the resultant comprehensive information and documentation that it is able to provide to its clients.

The Deutsche Bank AG uses a web based system for communication and data access and uploading for its operations. This system comprises of trade information tracking system call InfoTrack which is able to provide Deutsche Bank AG with a distinct competitive advantage in terms of access to the market information and the information processing. This platform was installed in 2003in the Asian branches and operations of the Deutsche Bank AG. Later on this system was also implemented in the European and the American operations of the bank as well.

“InfoTr@ck is part of the bank’s ambitious project to revolutionize supply chain management. Its core aim is to reduce the time, expense and stress of cross-border trading. This is achieved by collating trade-related data on one web-based platform — including documentary credits, bankers’ guarantees, documentary collections, open account and shipping details.” (Trade Finance, 2005) This system is integrated with the current system which was in place at the banks making it cost effective for the bank to carry out its investment in the project. Moreover business process remodeling was also performed on the old and legacy systems of the Deutsche Bank AG in order to make the new system more efficient.” However, while the platform dovetails with Deutsche Bank’s Global Trade Management Service, which prepares documentation on behalf of outsourcing clients, it has so far held back from adding a documentary initiation element. This may explain why Deutsche Bank was applauded for InfoTr@ck in this category, rather than as the best online trade finance provider. (Trade Finance, 2005)

On the other hand the Jordanian banking sector has been able to preserve the integrity and the confidentiality of their sensitive data and the computerized information systems by employing the usage of industry wide control system. The “Jordanian domestic banks are using effective fraud and error reduction controls. The study also reveals that these banks lack in the application of other Control System dimensions (Physical access, Logical access, Data security, Documentation standard, Disaster Recovery, Internet, communication and E-Control and Output security controls).” (Hayale & Abu Khadra, 2006) The study by Hayale & Abu Khadra which pertaining to the analysis of the control systems put in place by the Jordanian banks and was published in 2006 depicted that the Jordanian banks could continue to be more effective in reducing fraud and reducing threats to their computer automated information systems by increasing their controls on this system.

Identify and describe alternative solutions/approaches

After analyzing the literature that was available on the issues concerning the documentation in the banking industry as well as the specific problems and issues that being faced by the ABC bank, we have been able to identify some alternative solutions for the problem at hand. These solutions are developed in order to provide for a long term solution for the problem regarding documentation and its storage in the ABC bank.

The essential factor that has been kept in mind is that documentation of the records and information is initiated when a customer joins the ABC bank and either opens an account with the bank carries out operating activities alongside the bank. This makes the customer a party to the bank, and as a result the relevant documentation is drawn up to record the transactions.

One of the options that is available to the company is to invest in a large data repository like a data warehouse where it can store all the information without ever having to delete it. An SQL command interface which is user friendly can either be built in-house or can be outsourced and built in order to aid the business processes of the ABC bank to interact with the data repository and implement queries in the data. This system can be made compatible to the internet or a wide area network Wan. Through this the ABC bank will be able to recall and upload the data into the main depository which it would be accessing through portals on its private extranet.

Another option that is available to the ABC bank is to develop an application service tool on the internet only. This tool will enable the support of the service oriented services in the online market as well as promote inter branch transaction capability for ABC bank. However instead of using a data warehouse the system can make use of simple SQL based databases into which it can put the information regarding the transaction of the clients as well as the client account records.

Alternatively the ABC bank can also make use of the already existent ATM machines and business process automation tools that it has and make them compatible with a new application system in the ABC bank. This will enable the ABC bank to control its costs by using an already set up investment and developing and new service based architecture for the operations of the business. A data repository at the bank end will enable the ABC bank to record all customer and bank transaction into it on which queries can be performed through specific portals and SQL engines. This will be a more customer oriented approach to solving the storage and documentation maintenance problems of the ABC bank as this option will enable the bank to move towards the self service and automation model.

The other alternative option that is available for the bank to resolve its documentation and data integrity problem is to use an enterprise resource planning system which coordinates with a data warehouse at the back end. A CRM software application can be developed in the enterprise wide resource management system and the office and bank automation tools available and already implemented can be made compatible to the system in order to provide for a comprehensive and long term solution for the ABC bank.

Outline & Support Recommendations

After evaluating the options available to the ABC Ban in order to make their retail banking division more up to date with the technology and strategic implementations in the industry while enabling them to take over and tackle the problem regarding the storage and maintenance of their documentation, we have been able to identify that the bank needs to first and foremost conduct business process reengineering modeling for their operations.

Employing business process implementation alongside with customer oriented “cross-functional improvement methods (for example, Lean Six Sigma), BPM provides a consistent enterprise view, facilitates change to existing processes, brings best practice workflows that can be deployed throughout the enterprise, and increases operational efficiency. BPM tools allow their users to specify business logic at a higher level of abstraction that encapsulates common taxonomies and semantics and serves as a highly flexible and reusable foundation. Over the years, BPM has evolved from its role of optimizing vertical and often narrow processes onto a broader dimension of enterprise enablement. Thus, it is high time that banks embraced BPM to adopt, adapt, and roll out best practices embedded in adept vertical processes to the benefit of other company locations and functional groups.” (Kopp, 2005)

The main as to why the ABC bank should invest in BPM is in order to provide a sound background on which to build its operations on. The system that is and can be implemented to solve the problem at the ABC bank can only be functional and beneficial in the long run if it is taken up as a positive change by the users and the employees and management of the ABC bank. More specifically the changes made to the operations and the system can be beneficial only if the operation and processes which it is relating to are efficient themselves. In the past companies as well as banks have implemented CRM solutions for their operation however they faced problems in the long run regarding low rate of return on investment as “Although many banks have implemented integrated IT solutions, these were seldom aligned with valuable business purposes.” (Kopp, 2005)

After conducting business process modeling and reengineering the ABC Bank can invest in an enterprise resource planning system. This system can be customized and outsourced to a company like Oracle or Sap or can be build in-house by a professional dedicated team. This retail banking software can also be bought off the shelf in order to save time and funding however this will not bear the best results. The enterprise resource planning system can incorporate accounting and control systems for the bank, a customer relationship management solution for the bank as well as a strategic developmental and planning unit. This ERP system will be having a user friendly interface that would be compatible wit an SQL query engine. The system will be supported by a wide area satellite based network which will form a private extranet for the company bank.

The ABC bank extranet will be made compatible with the current system at all the branches of the bank where it will now be possible to share information, documentation and records. Through his extranet it will be possible for the ABC bank’s head quarters as well as its different branches to coordinate with each other and share the customer records as well as any relevant documentation enabling the ABC bank to resolve the data integrity and data redundancy problem. More over the data will be available for the for the other branches to access which will make it possible for the ABC bank to add another form of retail banking facility for its clients which would be inter branch compatibility and account access and transfer in real time. The employees of the company will be provided with password protected registration logs which can be accessed through their workstation on the private extranet only. This will provide for security of the information and the system.

At the backend of the system a large data repository will be set up which would be a collection of multiple databases. This can take the form of a data warehouse which can be implemented by NCR or Oracle siolut9ion providers. This data warehouse would enable the ABC bank to store large amounts of information while making the information accessible as well as computable. Data warehousing is a recent development in data storage picking up favorability in financial sector. “Banks’ data warehouses are expanding the volume of information that is captured and putting it into usable form. The information is also being refreshed, or updated, far more frequently. Most warehousing systems being built these days-very few are in their final form-are refreshed daily. At the end of the day’s posting of transactions, all the most current customer information is updated. Older customer information systems, many of which are still in use, are refreshed monthly, at best, and at some big banks even less frequently because of expense and logistics. Banks may have been among the first institutions to see the light when it comes to data warehousing, but now an ever-increasing number of companies is acknowledging the importance of using these knowledge-based systems for marketing.” (Leach, 1999) The ABC bank can use the data warehouse for multiple purposes and not just for marketing of their brand and business. “Marketing is only one application of data warehousing, the one getting the most attention. A variety of other customer relationship management issues can be addressed by banks and other companies with the help of data warehouses. Baseline customer information can be enhanced by other types of statistical information (most notably demographic) to get a complete picture of what is going on in customer relationships. Of course, data warehouses are expensive, and they take years to build. This can create problems when securities analysts are reviewing a company’s quarterly return on investments. Because financial institutions are graded on how well they perform financially, long-term investments may hurt a bank’s standing on Wall Street.” (Leach, 1999)

However we have to understand that it is not possible for all the information and the documentation to go online or virtual instantaneously. As a result an uploading interface can be included in the application system for the branch operation management system where the printed documentation can be scanned and stored in an online and computerized format. The printed documentation however can be maintained in a storage house outside the location of the bank. A central depositary can be allocated to the different cities where the bank is operating where all documentation of sensitive nature can be stores after attaining and uploading their computerized copies.

The development and implementation of the ERP system and the data warehouse will make way for the centralization of the business operations. As a result all the operations and activities of the ABC bank will be centralized to make way for documentation processing and its storage.

Opinion of the Management

The main concern put forward by the management of the business was that they have to be included in the process of developing a storage and documentation solution for the company. As ERP system and data warehouse implementation requires significant investment of time and information from the employees as well as the management of the corporation and the bank, it would therefore satisfy the ABC Bank management specific requirement.

Aside from this the management for the ABC bank stated that the option of getting a customized developed and outsourced ERP system would be difficult and expensive for the bank. Therefore an option is available for them to buy an off the shelf simple ERP system for banks and implement it through qualified ERP implementation experts.

The centralization of the processes did not raise any questions from the management as they sidled with us in regard that the decision making for hefty and major investments should be centralized. Aside from this the automation of the business operation for the ABC bank were supported by the management of the ABC bank who is looking forward to being more technology oriented in order to make the ABC bank attain a level of competitive advantage in then market that it is operating in. The management of the ABC bank dud have questions regarding the conversion of the legacy system to the new application based resource system and the manual documentation that would be generated. For this it has already been stated that a system conversion option will be linked to the application based system to upload data from the legacy system into the new system and the data warehouse the manual documentation that would physically be existing would be stored at a storage house after being scanned and copied on to the data warehouse for operational and strategic use.

Guide line for the process

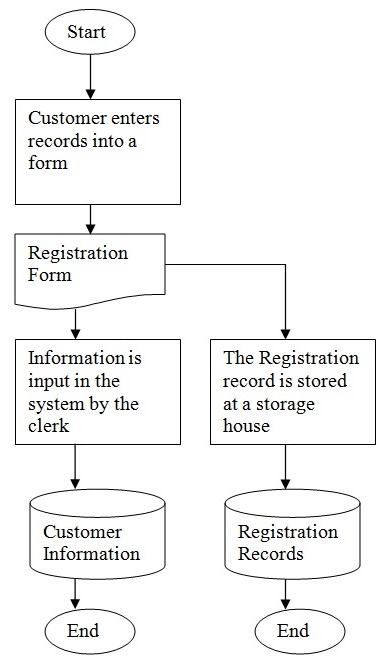

The flow chart for the business process regarding the data storage and documentation generation and storage the under the new system is as follows.

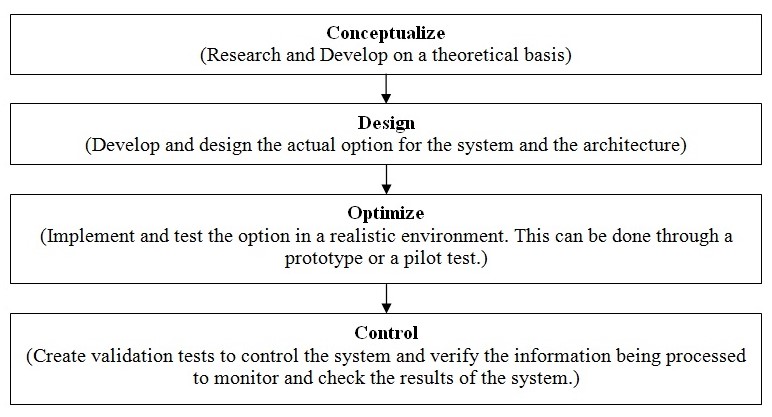

The six sigma option that can be taken up for this project is the one put forward by SBTI as CDOC (Conceptualize, Design, Optimize, and Control).

Conclusion

Though this paper we have been able to identify what are the main issues surrounding the problem of data storage and documentation maintenance by the ABC Bank. We have also been able to determine the current problems related to storage and data integrity as well as the access and the distribution of data in the banking industry around the world. This has provided s with a comprehensive holistic view of the problems that were being faced by the ABC Bank. Therefore by analyzing the current problems and the steps previously taken by the financial institutions to solve these problems w were able to determine a set of alternate solutions for the ABC bank to undertake in order to address its issue of documentation storage.

The case of Deutsche Bank AG and the Jordanian banking industry were depicted and taken up to provide for the measures taken by these specific institutions to control, maintain and store their documentation while automating their business processes and investing in long term growth of the bank as well.

The alternative solutions that were determined for the ABC bank which addresses its documentation issues pertained to development of a data warehouse, the implementation of a web based extranet and application service which would coordinate the business activities of the ABC bank. Aside form this the other options that were set forward related to the implementation of a ERP system and use of automation tools that were already in place to generate online information for documentation which was to be stored in a data repository. The option that was seen as the most feasible option for this project was to use a data ware house as a data repository for the ABC Bank and to implement an ERP system which would centralize the operations of the banks and also make way for online reporting. Through this option the sharing of data was made possible through a satellite based extranet and strategic decision making information systems were put in place to make way for competitive advantaged for the ABC bank and to provide for long term growth through efficient operations.

References

Kopp, Guillermo, 2005, ‘Banks steer through a maze of customer interactions: Business Process Management takes the wheel’, Microsoft Web.

Leach, Tim 1999, ‘Data Warehousing: A flexible tool’, American Banker, Vol. 164, Issue 97, pp8. Web.

Bates, Bruce 2005, ‘The Four Seasons of Loan Documentation.’ Community Banker, Vol. 14, Issue 3, pp32-35. Web.

2005, ‘Deutsche Bank remains on track.’ Trade Finance, Vol. 8, Issue 5, pp28. Web.

Wetzel, Debra A 1986, ‘Improving loan documentation demands a process.’ ABA Banking Journal, Vol. 78, Issue 5, pp61. Web.

2000, ‘Distributed Document Processing.’ Financial Executive, Vol. 16, Issue 6, pp15-16. Web.

Hayale, Talal H., Abu Khadra, Husam A. 2006, ‘Evaluation of The Effectiveness of Control Systems in Computerized Accounting Information Systems: An Empirical Research Applied on Jordanian Banking Sector.’ JABM: Journal of Accounting, Business & Management, Vol. 13, pp39-68. Web.

‘Document Services: Choosing the Right Path.’ National Mortgage News, Vol. 29, Issue 22, pp17, 2005.