If we analyze then we come to know that Netflix is the world’s major online movie leasing service, providing other than six million subscribers access to in excess of 70,000 DVD titles. The corporation offers a diversity of subscription plans, preliminary at $5.99 a month. There are no outstanding dates, no late cost and no delivery fees. DVDs are distribute for gratis by the USPS from provincial shipping centers situated all throughout the United States. Moreover, Netflix present personalized movie proposal to its members and has additional than one billion movie ratings. No doubt, Netflix also allows members to split and advocate movies to one a different throughout its Friends characteristic.

Based on Netflix’s chronological monetary statements and our activist statements, we will do economics study for the company.

What is the value of a new subscriber to Netflix? Assume a discount rate of 20%. Should Netflix be acquiring new subscribers?

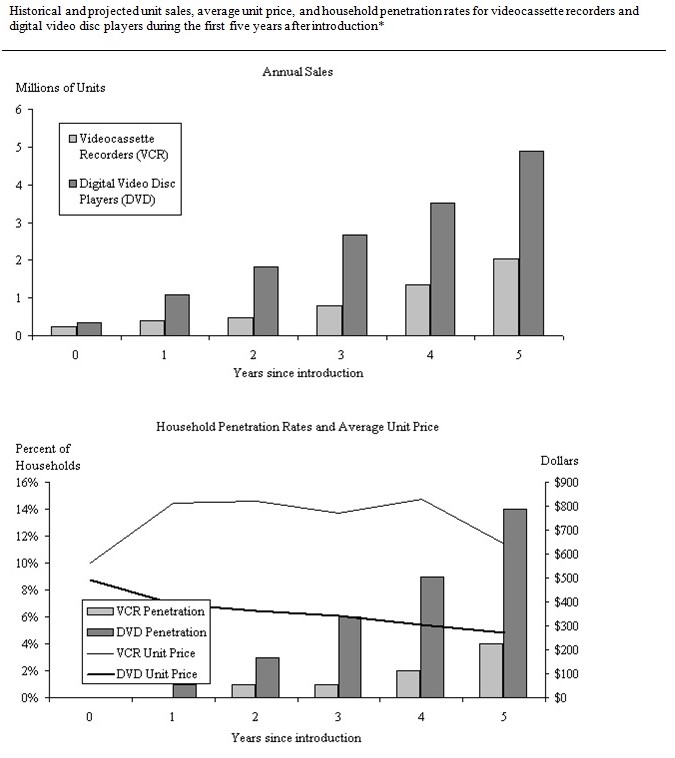

No doubt, Netflix is the ground-breaking Web-based DVD-rental organization. For a smooth monthly fee, subscribers can order as lots of movies as they desire, up to four at an occasion, and stay them as long as they desire. Netflix doesn’t have outstanding dates, late fees, or titles out of accumulation; and movies typically arrive by mail in a day. As well, the Netflix service is additional superior to in-store rentals. In 2004, subscribers produce from 1.5 million to 2.6 million.

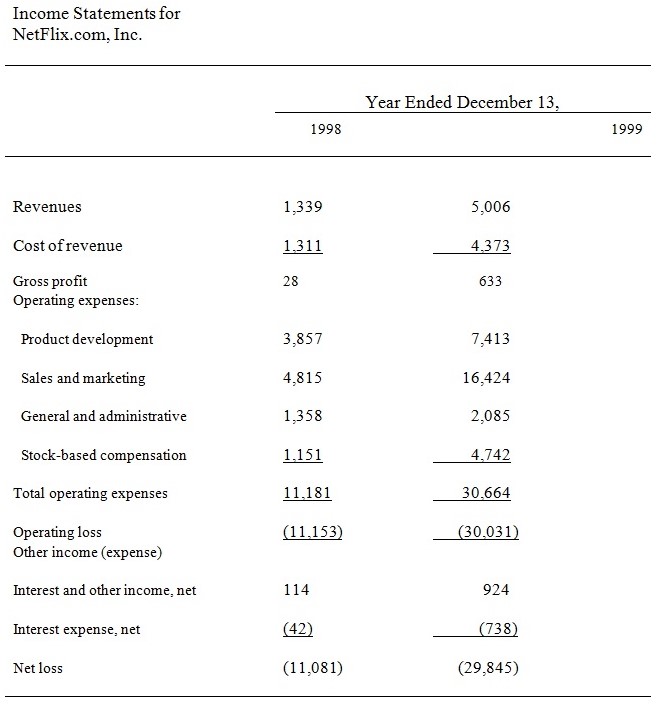

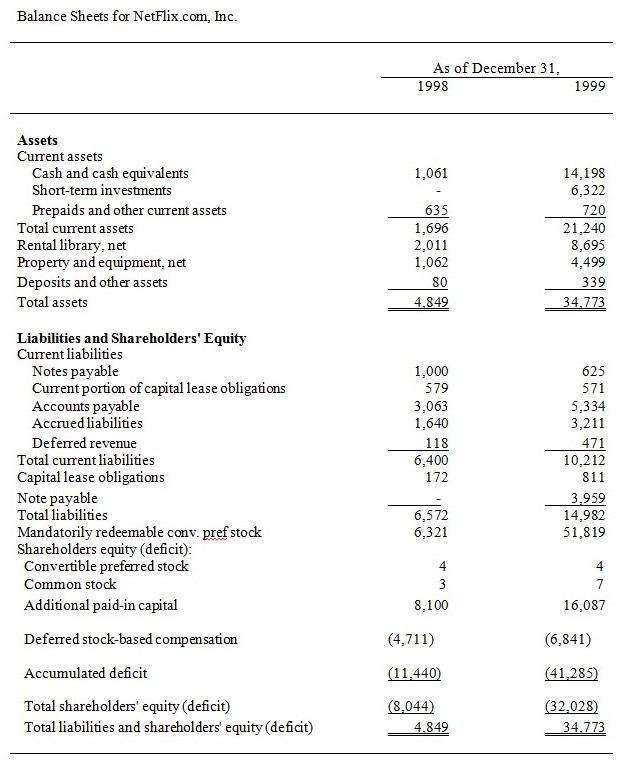

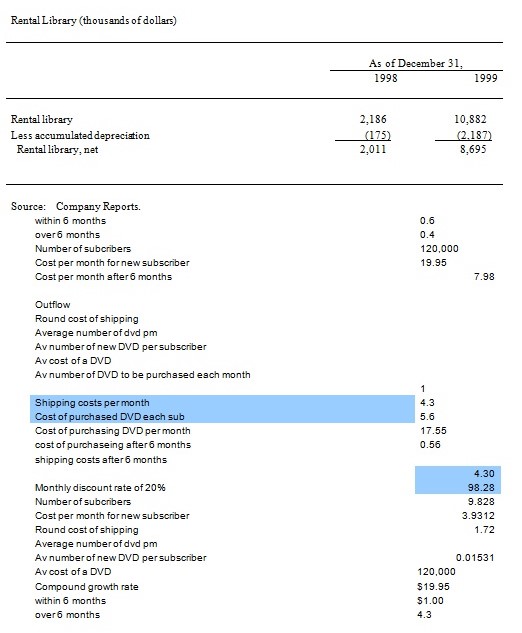

Balance SheetsThe above said Income Statements for NetFlix.com, Inc. shows that how company was generating revenue, profit, sales marketing and interest in other assets during the period of 1998 to 1999.

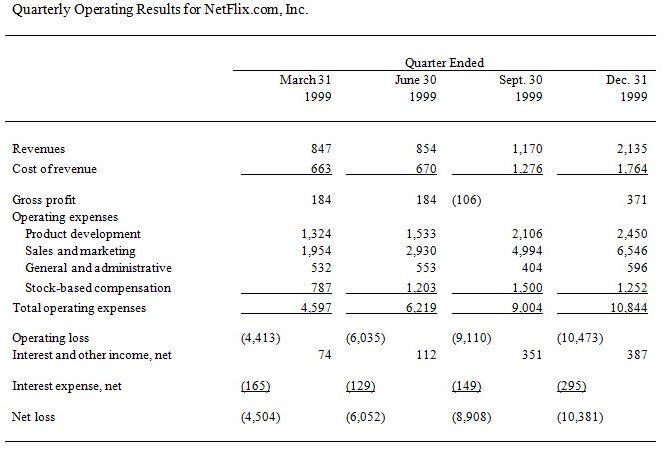

The above said statement shows the quarterly operating results.

Furthermore, the $500 million market is mounting 100% per year. Any market that large and mounting that fast will pull towards you competitors. As a consequence, Netflix is abruptly facing disturbing competitor such as Blockbuster, Wal-Mart, and Amazon.com. Netflix’s opponents are the largest leasing company – Blockbuster, the main e-commerce corporation, Amazon.com, and the major group, period , Wal-Mart. If moderator by the excellence of its entrant, Netflix have to be doing well. Moreover, the first to take on Netflix was Wal-Mart, which start contribution online DVD rentals in June 2003. Then, came Blockbuster plummeting a huge $100 million into its service. Now, lastly, comes Amazon testing U.K. market and American service will start midyear. Probable, the competitors are going to connect in a cost conflict. In November, Netflix cut the cost of its main subscription graph by $4 to $17.99. A few weeks following, Blockbuster slashed the cost of its major plan by $2.50 to $14.99, and eradicate in-store late cost that drove lots of consumers to Netflix in the first place. Moreover, Netflix doesn’t like cost wars by means of better and improved capitalized companies. Its opponents have size but Netflix has spotlight, and the asset at the back that benefit is the Netflix subscriber base, and word-of-mouth-driven manufacturing. The more satisfied clientele Netflix has the further new ones it will get, and the extra cost-effective it is to spend in new features. The mainly Netflix doubts Blockbuster, since renting videos is the center of their permit. At present, Netflix has 30 distribution centers, which permit it to reach 85% of its clientele while sleeping. Blockbuster has 23 centers and tactics to build more. If Amazon is grave they have to do the similar otherwise, they will not be spirited. Besides, after two years Wal-Mart hasn’t been imposing in the Web-based DVD-rental market. In addition, the model company for Netflix is Dell, which creates money on prices that no one else in the manufacturing can profit from. Netflix is expecting to cultivate quickly aiming 4 million subscribers by the end of the year, and 20 million by 2010. Perhaps Netflix will be compressed or, more probable, bought by Amazon.

Assuming that Netflix does not change its current business model, what is the value of Netflix?

Netflix’s past growth results from its ability to maintain high market share and its efficient business model. Our analysis of its future growth based on its past performance in terms of market share and financial ratios from our projected financial statements over the next five years.

First of all, our estimation of the growth rate of Netflix begins with analysis of the past five years growth rate of online subscribers because Netflix revenue substantially comes from monthly subscription fees. As shown in Figure 1, the total market has grown from 0.9 million subscribers in 2002 to 8.8 million at the end of 2006.

Table 4 shows that Netflix market share from 2002 to 2006. Although Netflix has enjoyed rapid subscriber growth for the 5 years, its market share has decreased from 95% to 75 %. The decrease of market share can be explained by increasing competition. For example, Blockbuster started online service in 2004, and try to eat shares from Netflix announcing their full Access program, which permit online customers to make a selection among returning their DVDs during mail and swap over them at more than 5,000 stores for liberated in-store movie rentals. The fast enlargement of Netflix whips companies through big financial resources into the online rental market, such as Apple, Amazon, Wal-Mart, Google and Yahoo!

Table 4. Netflix Market Share

Although the online rental market is expected to experience increasingly intense competition in the next five years, we assume that Netflix maintains 75% market share. The reason for this assumption is Netflix has successfully gained its reputation for high quality services such as a next-day delivery and its catalog 75,000 titles. It also has proprietary software that swiftly sorts DVDs and a strong relationship with various filmed entertainment providers and the U.S. Postal service. Moreover, it responded quickly to a rapid change of the market by launching a downloading service “Watch Now.” Therefore, we estimated that Netflix would maintain 75 % market share for the next five years.

However, Netflix may need to decrease its subscription price due to intense competition. It currently offers price packages ranged from $4.99 to $23.99 and the average subscription revenue from a subscriber is $13.60 per month. We approximation the standard price will be decrease to $10 per month.

The following table shows estimated subscribers which Netflix will hold each year and estimated revenue from subscription for the next five years.

Table 5. Estimated Revenues and Growth Rate

Estimated Netflix Subscribers is strong-minded based on a market analysis by professional researchers. According to Adams Media Research and Netflix interior estimates, the entirety market will have additional than 20 million online subscribers in the after that four to six years. We predictable the entirety market would have 20 million subscribers in 2010 and 75 % of the entirety market would be keep by Netflix. Revenue for each year is resolute by increase a price that a subscriber will pay each year and the standard number of subscribers for the year. So our estimated enlargement rates for the after that five years are 46%, 25%, 17%, 13 % and 9% correspondingly.

Subsequently, financial ratios from our predictable monetary statements over the after that five years ought to be examined to see how a financial system of scale is realized by the corporation.

The results are as follows:

Table 6. Projected Key Ratios

Table 6 demonstrates that Netflix productively achieves financial system of scale with its well-organized operation as Netflix claims “Scalable Business Model.” Fixed and sum assets turnover is rising each year, which point to Netflix efficiently manages its assets. Augment in profit margin demonstrate that cost declines family member to revenue. Some of operating costs do not require to produce as revenue augment. Marketing expenses will even reduce in near future when the corporation will have had wide brand recognition. As a consequence, Basic earning authority ratio, ROA, and ROE all add to every year. The corporation may have a trouble since of reduce in current ratio due to large augment in account payable. It has also a unenthusiastic sign in debt ratio; though, its debt consist of all occur from its usual course of business. So, its interest expenditure is kept small.

Based on our supposition discussed above, we forecast that net profits would have full-fledged from $40 million to $126 million in the subsequently five years.

What changes, if any, would you suggest Netflix make to its business model? What are the value implications of those changes?

Since 1999, DVDs have been greatly adopted as a medium for home entertainment. Netflix has grasped this opportunity and finally has established its leadership position in this market. Now Netflix is the largest online movie rental corporation. Its outstanding performance in the market is indicated in its financial statements in the past 5 years. First, we examine its 5 years’ trend of financial ratios, and secondly, we compare those ratios to its competitors. Table 1 is key ratios for the past five years.

Table 1

Above ratios show Netflix’s successful performance just right after the inception of business. Profit margin, basic earning control ratio, return on assets and return on impartiality are all unenthusiastic in the first two years. These negative numbers are typically present in start-up companies such as Netflix. Though, Netflix becomes gainful since 2003, shortly after its inception, which turns all these rations into optimistic. Moreover, they are rising quickly. The decrease in basic earning power ratio in 2005 is not a cause for concern because it is merely the result of the tax credit. Indeed, return on assets and return on equity is 11.52% and 18.58% respectively, increasing by 3.5% from those of 2004.

We also evaluate the standard of these ratios to those of its competitors. The market of film entertainment is full of competition and these companies are subject to the change such as the technology to process deliveries and the price of DVDS. Netflix has a huge range of potential competitors including video rental outlets such as Blockbuster and Movie Gallery, online DVD subscription leasing sites such as smash hit Online, pay-per-view and VOD services plus optional content release methods such as Apple’s video iPod and Movie Beam, movie trade stores such as Beat Buy, Wal-Mart and Amazon.com, subscription activity services, such as HBO and Showtime, Internet movie supplier such as Movie relation, Internet corporations such as Yahoo! and Google, Cable supplier such as AOL Time and straight broadcast satellite supplier such as DirecTV and Echostar. Here we make a contrast among Netflix and its major rivals who confront Netflix straight. from side to side the Table 2 below, we can have a improved idea how it positions in the home activity market.

Table 2

Netflix has a advanced present ratio than the average of its manufacturing and it shows Netflix could liquidate existing assets at only 53 percent of book value and still pay off present creditors. Netflix’s fixed assets income ration of 6.1, much higher than the manufacturing average of 3.5, indicates Netflix uses its place and equipment more efficiently than the industry’s average performance. Netflix’s whole assets turnover ratio is fairly above the industry average, but not as far exceeding as the fixed assets turnover. This is due to Netflix has less flat assets in relation to its total assets than the conservative movie leasing companies such as Movie balcony and smash hit. Netflix does not own real estate; instead, it leases the property. It gives Netflix some degree of flexibility because it can reduce or increase the property depends on its needs.

Since its inception, Netflix has established its reputation, attracting more consumers. It has provided more service and these activities greatly improved the revenue, resulting in a positive operating income in 2003. It did even better in 2004 and 2005. Since Netflix has just launched its business, we had better to use the data after 2003 as index to compare with its rivals. Netflix’s profit margin on sales; basic earning power ration; return on total assets are all positive while the industry average level is negative, which indicates Netflix got a higher return as a result of its ability to use its assets effectively. The Price/earnings ratio of 50.3, which is much higher than the manufacturing average of 12.9, indicates Netflix is less risky than its contestant and has a brighter enlargement prospects.

Should netflix go public at this time? What are the costs and benefits?

We assume Netflix’s dividend policy is to maximize a shareholder’s wealth by distributing steady dividends from its residual earning instead of repurchasing stock.

The dividend decision is made in hope of a reduction of investor uncertainty of future free cash flow. We assume that Netflix’s shareholder relatively prefers returns as dividend yield to capital gains. furthermore, Netflix presently does not require to repurchase shares to use for Employee Stock Purchase Plan and Stock Option Plans since it has reserved sufficient shares to cover those plans. Target payout ratio is strong-minded based on Residual Distribution Model exposed in Table 7. Netflix does not have any debt apart from debt arise from its process as of December 31, 2005. It is predictable to preserve its capital structure for the subsequently five years.

Table 7. Distribution Schedule based on Residual Distribution Model (in thousands)

According to the predictable agenda listed above, the average of sharing ratio from 2006 to 2010 is 95.67%. We set a aim payout ratio somewhat lower than the average for prospect indecision: 90%. Table 8 shows predictable bonus payments of 2006-2010 using our predictable monetary statements and that of 2011 – 2020 based on the goal payout ratio.

Table 8. Estimated Dividend payments

Free cash flow can be used to pay interest to debt holders, pay off a few of the debt, pay bonus, repurchase stock, or buy marketable securities. Paying attention and paying off debt are roughly immaterial to Netflix, because it does not have any note owed and long-term debt. Since free cash flow ought to not be keep by management unless it can produce privileged returns than shareholder could earn by devote that money in equivalent risk investments, paying dividends or repurchasing stock is the majority effectual way to maximize a shareholder’s riches. Following Netflix bonus policy talk about in the question 5, we take for granted that paying dividends to its shareholders would be the most excellent way to exploit its stockholder value.

Conclusion

To sum up this discussion we may say that Netflix is operating in the oligopoly since a few large producers of a homogeneous service control the market. It is a all the same oligopoly since the Big Four companies produce consistent Web-based DVD-rental service. Due to a small number of competitors, Netflix has a substantial control over its prices; however, Netflix must consider how each contestant will react to any change in price, production, service individuality, and publicity. Furthermore, economies of scale cause the entry fence in the Web-based DVD-rental marketplace.

Reference

“Financial Forecast Center.” Financial Forecast Center. 2007. Web.

“Netflix Corporate Fact Sheet” Netflix. 2007. Web.

“Netflix, Inc.” Yahoo! Finance.2007. “Ratios.” Returns. Web.

Credits Netflix. Online Website. Homepage. (2006). Cashing in on business. Boston: Little, Brown and Company. Web.

Rosenberg, Y. (2000). Successful internet business. Boston: Harvard Business School Press.