Introduction

The financial services industry in the UK offers three basic services. This includes paying an intermediate role between borrowers and savers. They also provide payment services. Lastly, they offer insurance against risks.

The financial service industry in the UK has a number of players including banks, insurance companies, saving firms, and stock exchange markets. These services are critical in facilitating the functioning of the economy. These different areas of functionality are very important to the proper functioning of the UK economy.

While the financial services mentioned are fairly timeless, the characteristics of the industry and the systems offering them changes endlessly. These changes are guided by both regulatory and economic developments (Amel, Barnes, Panetta and Salleo 2004).

This paper tracks the changes of a core part of the financial services industry in the UK, the banking sector, focusing on one player’s major strategic service marketing variables. The paper also explores the association between these strategic variables and theoretical principles of service marketing.

The paper explores the transformation caused by technology in the economics of banking. Focus will also be directed to the deregulation of the 1970s and 80s, which freed financial institutions to take advantage of the emerging opportunities through financial innovation and globalization (Amel, Barnes, Panetta and Salleo 2004).

This has led to the expansion of the banking groups. This has resulted in public-policy attention targeting the issue of the costs. This aspect has been characterized by huge and intricate institutions appearing to be very stable (Dale 1999).

Banking Sector structure

The structure of the United Kingdom’s banking sector is highly determined by the changing role of banks in the financial system and services industry over the years. By the end of the 1950s, about 100 banks offered information, collected to evaluate the working of the UKs monetary system.

Sixteen clearing banks from Scotland and England controlled about £ 8.3 billion in the form of assets (Dale 1999). This accounted for about 85 percent of the assets held by the UKs banking sector. The amount also accounted for about 30 percent of the GDP of the UK (Piesse, Peasnell and Ward 1995).

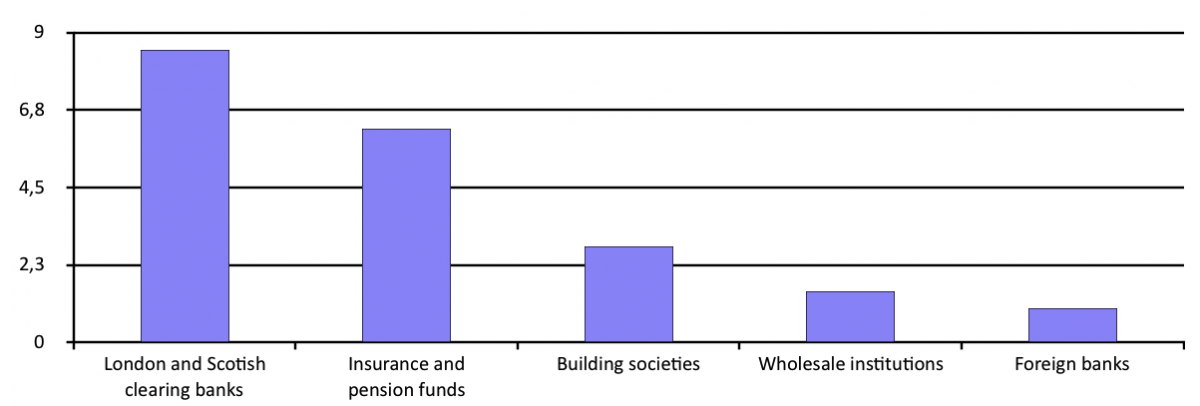

Clearing banks were comparatively focused on commercial lending, deposit taking services, and the provision of payment services (Figure 1). Furthermore, they got funding from customer deposits. This included 60 percent in the form of current accounts, and 35 percent from interest-earning time deposit accounts.

Figure 1: Financial intimidation during 1958 (Figures in £ billions)

These deposits funded liquid and low risk assets (Piesse, Peasnell and Ward 1995). During the 1960s, 35 percent of the assets of the London clearing banks were held in treasury bills, cash, and discounted bills. A further 28 percent went to gilt-edged securities, while customer loans comprised about 30 percent (Buckle and Thompson 2004).

Between the 1960s and 1970s, the assets of banks and building societies grew steadily. This could be associated with the emergence of London as an international financial center. During the same period, banks owned by foreigners experienced growth within the UK.

In the late 1970s, financial establishments in the United Kingdom owned over 170 billion pounds as part of foreign currency assets. This constituted above half of their total assets. The banking institutions by foreigners concentrated on wholesale activities (Piesse, Peasnell and Ward 1995).

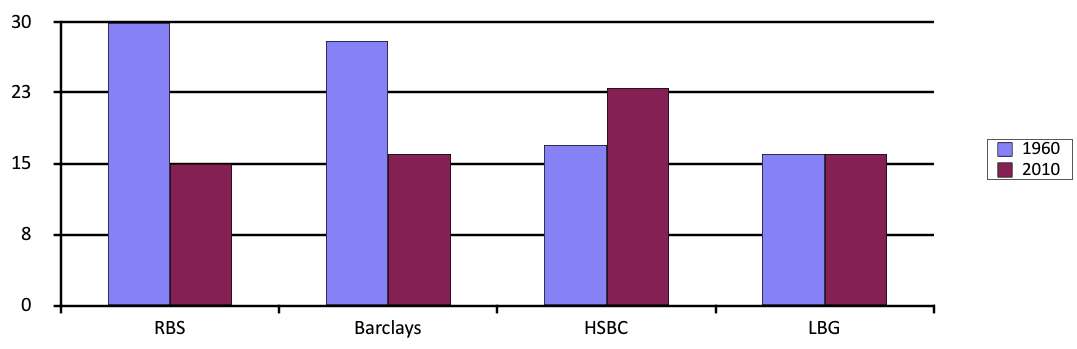

The structure of the UK banking sector was further affected by the consolidation sector between 1960 and 2010. At present, more than 3000 building societies and banks are allowed to accept deposits in the UK.

Most of the clearing banks that were operating in the 1960s have changed ownership, and are now being owned by the largest banks in the UK (Wolgast 2001). Notably, the large banking institutions in the UK account for the largest share of the customer base. This is with respect to the deposits and lending capabilities.

As clearing banks continued consolidation and growth over the years, they have also adopted a wider range of functions. The established banking institutions in the UK have spread to other parts of the world. They have establishments that offer different financial services to other parts of the world (Figure 2).

Figure 2: Lending and Deposit-taking services by clearing banks 1960 and 2010

(Percentages of total deposits and loans)

The UK banks have established themselves as principal international players in these markets (Singh 2007). For example, 3 banking institutions in the United Kingdom were ranked among the best performers in various markets based on various aspects. In this case, they performed better in foreign exchange trading.

They also recorded a good performance in bond underwriting. Furthermore, these banks had a good score in interest rate swaps. The expansion of the banking industry to encompass other parts of the world has been a great achievement (Piesse, Peasnell and Ward 1995).

Table 1: Peer rankings of UK banking groups in selected market segments 2010

Source: Slattery and Nellis (2005)

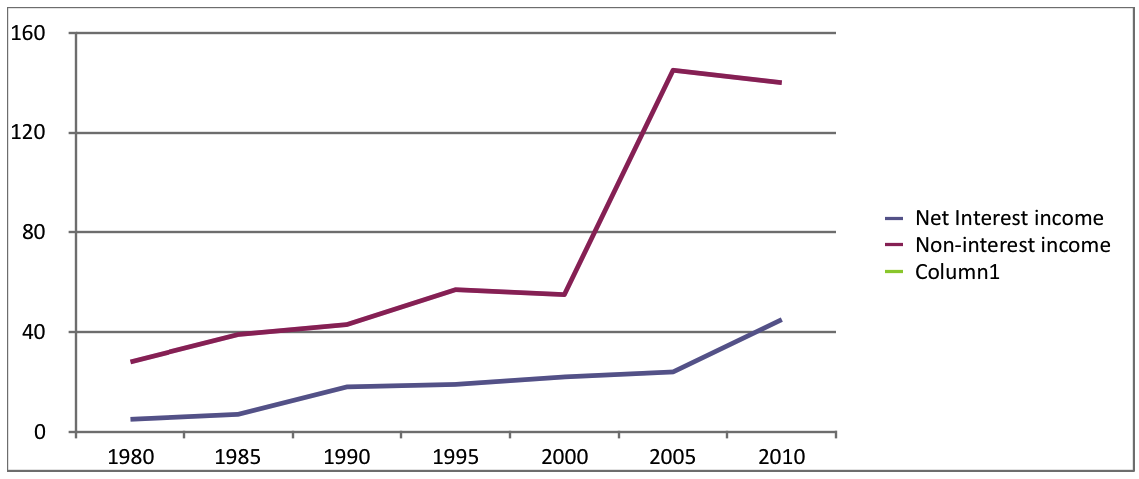

Collectively, the balance sheets of UK banks amount to more than 500 percent of the annual GDP of the UK (Table 1). Much of the growth has taken place during the past one decade. Some of the well established banks had an asset base that was more than the the annual gross domestic product of the United Kingdom (Figure 3).

Figure 3: UK bank’s sources of earnings

In addition, the capacity of the banking institutions in exploiting the opportunities presented by these economies have been on the rise. For instance, previous restrictions made it impossible for the banking institutions to thrive and adjust when necessary.

Financial deregulation helped break these forces, as well as bringing into operation stronger competitive forces across the UK banking sector. This encouraged them to move to markets presenting higher margins (Christiansen & Baird 1998).

For this study, focus will be directed towards exploring the Barclays group, which is headquartered in London. The bank runs operations internationally, in more than 50 territories and countries across Asia, Europe, Africa, South America and North America. As of 31 December 2010, the bank held assets totaling to USD 2.33 trillion.

It is the fourth largest and the 6th oldest bank in the world. The focus of the bank is split into two: retail and business banking and corporate and investment banking together with investment and wealth management (Barclays Bank PLC 2011). P and (Ferran & Goodhart 2001).

The opportunities available in the UK banking sector

The opportunities available to the banks operating within the UK banking sector of include that banks could increase their base profitability through venturing in international financial markets. This was made possible by the consolidation of the UK banking sector, which made it simpler local banks to venture beyond the local market.

Another opportunity to the players within the UK banking sector is the liberalization of the banking services sector. This allows them to deliver a wider range of banking services. Particularly, in the UK, banks are allowed to offer a range of services ranging from foreign exchange trading, bond underwriting, and interest rate swaps.

The incorporating of new technologies and and banking approaches in the UK banking sector has created areas of business expansion (Slattery and Nellis 2005). Examples include trading in international transfers, which are receiving most usage during the present time of international business transactions.

The UK banking services market is fully developed, which offers different lines of business expansion for banking institutions within the sector (Slattery and Nellis 2005). For instance, the UK banking sector consumers are high financial services performers as compared to the banking industries of other developed nations, as well as the underdeveloped nations.

The recent collapsed of weaker UK banks within the banking sector created space for more market share acquisition among the stable banking groups like Barclays. During the liquidation of collapsed banks also created an avenue for asset acquisition among the banks that remained stable during the economic downturn.

Another opportunity for bankers within the UK banking sector is that they are allowed to impose relatively higher interest rates, which may not be available at other national banking markets.

The threats facing the UK banking sector

The marketing strategy of the Barclays group is primarily based on implementing a product development and market penetration that captures the current account market portion of the banks that have been weakened by the economic crisis. The group’s strategy.

The acquisition of the assets, as well as the business of collapsed banks, which collapsed during the crisis, could prove to be a significant error, despite its positive side, in case the economic downturn prolongs.

In the UK banking sector, bankers face the threat of legal suits, in case they fall victim to the situation of moving loss-making investments related to the sub-prime market of their accounts. There is a threat that customers may opt to move to bankers who are more specialized due to shift to more universal banking service delivery.

Despite that, they are few in the UK. Another UK banking sector threat facing the UK bankers is that banks are in a less strong situation as compared to industry leaders at their overseas operations centers.

PESTEL Analysis

The political structure in the country favors the banking industry. This is because politics in the country do not affect business activities in the country. The country is politically neutral, and accepts people from different political backgrounds.

The economy of the country is vibrant because there is a lot of income from oil. The economy of the country is supported by investors from other countries. The banking industry has grown tremendously because there are many business activities.

Technology in the country is high because the government has encouraged the adoption of modern technologies. The government has established strategies to encourage the use of technologies in all industries.

The social factors encourage the use of banking services. Most businesses are large enterprises and there is need to use banking services to conduct corporate businesses.

The legal systems have supported businesses in the country because businesses are protected against illegal activities.

Commonalities and differences service marketing strategies of the major players within the UK banking sector

The commonalities of service marketing strategies existing between the major players within the UK banking sector include the adoption of a service model that focus on individual banking, as opposed to corporate banking.

Some of the major layers in the industry are HSBC, Royal Bank of Scotland Group, Lloyds Banking Group and Barclays among others. Standard Chartered In this case, the underlying fact is that these players are developing services that are customer-population oriented.

For this reason, the focus of many players is savings products, current and transaction accounts, small business lending, consumer lending, large business lending, and mortgage lending. Among the products that are not offered by many of the major players include security lending and security insurance.

These major players are also similar in the area of value delivery to their employees. The services included in this case are employee development, neighborhood improvement projects, and employee retention.

Through these services, the major players seek to create a favorable image among the customer population, as well as offer high value services by keeping their employees motivated (Moran 1991). Among the main players, there was a commonality that all were in pursuit of setting profit levels that were not necessarily exorbitant.

However, this was for those that could enable them to continue service provision and product development. The different players also employed an integrated strategy, where market and non-market components are incorporated into service and product development.

In essence, these banks research both the market, as well as the non-market environment for strategies (corporate social responsibility), implementation coordination and strategy formulation (Moran 1991).

Differences in service marketing strategies among major players within the UK banking sector include that the outlook of investing in international markets is not shared among all. In essence, the international investing outlook of the different major players differs, in that some are more reserved than others.

For example, Barclays and HSBC hold a fairer outlook, have invested more in international diversified than the other major parties (Turner 2010).

This is mainly the case, when focus is placed on investing in developing countries. In the area of diversification through acquisitions, some players like Barclays were more open to acquiring collapsed industry players. That was the case, especially after the crisis, where Barclays as compared to others was more open to acquisition negotiations.

For instance, Barclays ventured in a partial acquisition of Lehman’s despite fears among other major players, that in case the crisis prolonged, the move would prove detrimental.

Another fundamental difference is evident in their price setting outlook, as players like Barclays were more likely to enforce questionable interest rates as compared to the others. The focus of these other major sector players was imposing rates that will allow for service continuity.

For example, Barclays faced the threat of a legal suit, contesting the interest rates it had imposed.

Marketing strategy of Barclays Bank

Then, also, focuses on the development of products that counter non-traditional financial institutions. An example was the group’s launch of a prepaid card service, which marked a milestone in the current account market.

Like before, the group’s strategy entails trying innovative sales and marketing mechanisms at London, which it uses to stage entry into its overseas market. The group has historically identified with the use of a differentiation strategy, which allows it to capture a larger market share from industry players that are weakening.

Key strategic service marketing issues for Barclays Bank, during the next 5 years

In the area of market positioning – which entails imposing the company and its services among the customers – Barclays positions itself in differentiating ways, which enables it to remain a competitive brand within the UK banking sector.

The bank has done this by ensuring that it remains a truly, globally linked bank, which incorporates its international networks in service development. In the area of market segmenting and targeting, Barclays focuses on addressing the needs of customers will similarly pressing needs and wants.

For instance, it recently launched the student card service, which offers value to the segment, and an area which has not been exhausted by its competitors (Devlin 2005).

Regarding the future of Barclay’s positioning and market segment in, the bank will remain a competitive banker as it launches its services and products after duration of effectiveness testing. For example, the student card services were tested at UK alone for over six months before it could be extended to other markets.

From the bank’s market outlook, it has secured its future by capturing the market of collapsed competitors like Lehman’s. By doing that, the bank expands its customer coverage, and it’s more market influence for future competitiveness (Devlin 2005).

Among the key strategic marketing issues of the bank is the area of researched product development. For instance, before developing the student card, the bank sought to encourage prudence in spending, by reducing levels of overspending.

The bank has also capitalized on the strategic development of banking services with unique features (Fletcher 1985). An example is the case of their prepaid cards: budget manager and financial manager, which are designed to enable customers transfer their their spendable money from the bank to the card.

Other banking services that will form part of the future of Barclays banking services is online banking, which allows customers the flexibility to change their standing orders as well as the amounts to be transferred to the spending account. Based on PESTLE analysis, Barclay Banks price setting is guided by a number of factors.

These factors include profit maximization, survival, market share maximization, personal objectives, and social considerations (Fletcher 1985).

These factors help the bank establish the balance between price reduction and ensuring business success, which is a strategic marketing service issue, which is likely to keep the bank ahead of its competition in the future.

In ensuring that it keeps its competitiveness among customers, the bank has invested in the development of its employee-base, to ensure that they attend to customers as the bank would expect. Through these strategies, the bank will be able to reach its customers as well as address their changing, unique needs in the future.

The relationship between the service marketing issues identified and theoretical principles of service marketing

The principle of service marketing place emphasis on the fact that services differ from other products in a number of ways (Lovelock and Wright 2001). These ways include that services are comparatively more heterogeneous and unchangeable in their very nature.

Therefore, due to these characteristics, it is important for a service delivery organization to develop marketing and management approaches that differentiate them from competitors.

Bearing in mind that the banking sector is primarily service based, the players within the UK banking sector have sought differentiation based on customer outlook (Brockman and Morgan 2003).

For example, in the case of Barclays bank, the management has continually worked on the development of services that are unique from those of their competitors. An example is the case of the student card, which is designed to limit and control the expenditure of the bank customers.

Through service differentiation, it is clear that the bank will receive familiarity among its customers as well as potential customers. Therefore, the link between service marketing issues and principles of service marketing is the ability to break the homogeneity that is perceived between different services (Lovelock and Wright 2001).

In the case of Barclay bank, they have been able to achieve in many cases, therefore, remaining highly competitive in the UK banking sector (Christiansen and 1998).

Conclusion

The UK financial services industry provides three basic services including intermediation between borrowers and savers, payment services and offering insurance against risks.

These service areas are very important to the effective functioning of the UK economy as they touch on various critical areas, including production.

However, due to technological and regulatory changes, the structure and the nature of the systems offering them changes constantly, which forces industry players to review market approaches.

The UK banking sector, which has changed in structure, market coverage and its contribution to the UK’s GDP are of great importance to the financial services industry are.

The structure of the sector has changed due to technological and regulatory changes, resulting in opportunities and threats among the sector players. The opportunities include the expansion of service sin to the international market, and the collapse of market players, which created further market.

The threats facing the sector include the adverse nature of acquisitions during financial crises and the threat of customer preference for institutions more specialized in their service delivery.

The commonalities existing among major industry players in the areas of service marketing include the imposition of rates that can sustain continuation of service delivery. Among the differences in service marketing strategies evident among major sector players are that some place focus on developing services with the customer in mind.

The marketing strategy of Barclays relies on market positioning and differentiation, to ensure that they keep a major portion of the UK banking services market.

The relationship between service marketing issues and the theoretical principles of service marketing is that – service institutions should ensure that they differentiate their services, so as to overcome the hurdle of service homogeneity.

Reference List

Amel, D Barnes, C Panetta, F and Salleo, C 2004, Consolidation and efficiency in the financial sector: a review of the international evidence, Journal of Banking and Finance, Vol. 28, no. 10, pp. 2,493–5102.

Barclays Bank PLC 2011, Barclays Bank PLC: Annual Report 2011. Web.

Brockman, BK & Morgan RM 2003, The role of existing knowledge in new product innovativeness and performance, Admin. SCI. Quart., vol. 34, no. 2, pp. 385-419.

Buckle, M & Thompson, J 2004, The UK financial system: theory and practice, Manchester Univ. Press, Manchester.

Christiansen, CM & Baird, B 1998, Cultivating capabilities to innovate: Booz-Allen & Hamilton. HBS Case 9-698-027, Harvard Business School, Boston.

Dale, BG 1999, Managing Quality, Blackwell, Boston, MA.

Devlin, J 2005, A Detailed Study of Financial Exclusion in the UK, Journal of Consumer Policy, vol. 28, no. 1. pp. 75-108.

Ferran, E & Goodhart, C 2001, Regulating Financial Services and Markets in the 21st Century, Hart Pub., Oxford.

Fletcher, F 1985, Getting the credit: an analysis of consumer financial services in the UK, Economist Publications, London.

Lovelock, C and Wright, L 2001, Principles of service marketing and management, 2nd edition, Prentice Hall, New Jersey.

Moran, M 1991, The politics of the financial services revolution: the USA, UK, and Japan, Macmillan, Houndmills, Basingstoke, Hampshire.

Piesse, J Peasnell, K and Ward, C 1995, British financial markets and institutions. An international perspective, Prentice Hall, New Jersey.

Singh, D 2007, Banking regulation of UK financial markets, Ashgate, Aldershot.

Slattery, D and Nellis, J 2005, Product development in UK retail banking – Developing a market-oriented approach in a rapidly changing regulatory environment, International Journal of Bank Marketing, vol. 23, no. 1, pp. 90-106.

Stationery Office U.K. 2009, Legislative Scrutiny: Financial Services Bill and the Pre-budget Report Third Report of Session 2009-10 Report, Together With Formal Minutes and Appendices House of Lords Paper 21 Session 2009-10, The Stationery Office/Tso, London.

Turner, A 2010, The future of finance: the LSE report, London School of Economics & Political Science, London.

Wolgast, M 2001, The Cruickshank report on competition in UK banking: Assessment and implications, Journal of Financial Regulation and Compliance, vol. 9, no. 2, pp. 161-170.