Introduction

Saudi Arabia’s financial market is characterized by an endless list of brokerage firms, which actively participate in financial activities in the country.

These firms have played a key role in not only shaping the Saudi Arabian Financial market, but also contributed to the growth of the country’s economy. Importantly, brokerage firms in Saudi Arabia have continued to experience varying performance rates, based on a host of factors, ranging from inflation to government regulation.

This research paper explores brokerage firms in Saudi Arabia with regard to their performance witnessed before and after 2006. Additionally, the paper will discuss Bakheet Investment Group (BIG) in the context of its role in the brokerage market and how it has performed since the market experienced a surge in mid 2000s.

Saudi Stock Market

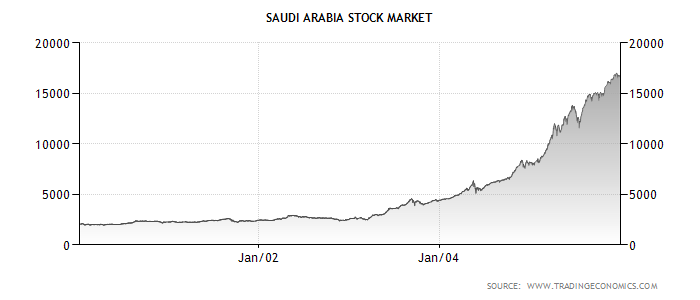

The market is considered to be the largest in the Arab World. From 2005 financial records, the market registered a capitalization value of US$650 billion, a 111% increase from the 2004 value. The Saudi Arabia Market Authority, which was opened in the year 1990, freed the market for foreign investors in 1997.

It is important to note that the market has experienced increased public interest and participation in recent economic boom years (Hertog 28). As a result, financial investment strategies like bonds, initial public offers, mutual funds and stocks have become common in the country.

Additionally, the role of technology and internet remains evident in the financial market since SAMA’s launch of Tadawul in 2001. This is an online tool that allows the access and trading of stocks through the internet. Besides this, the market has been streamlined by the formation of the Capital Law of 2003, which oversees all market activities in Saudis Stock Exchange.

In the understanding of Saudis financial market, it is important to appreciate the fact that the sharp decline witnessed in 2006 after several consecutive years of good performance, affected several sections of the economy including the brokerage industry (Oxford Business Group 73). This was a wake-up call to the government and other private investors to be aware of such possibilities.

Bakheet Investment Group (BIG)

BIG was previously known as Bakheet Financial Advisors and is a closed joint stock company, operating in Saudi Arabia. It’s legality to operate in the financial market is certified by the Capital Market Authority. It is involved in custody, asset advisory and asset management (Bakheet).

BIG aims at becoming the leading Saudi Equity Asset Management Firm. This dream has continued to drive its performance and the desire to achieve higher results than other players in the field. The company has been in operation for more than a decade, having been established in1994.

In 1995, BIG made history in the country by advising the first open-ended mutual fund. Importantly, the year 2006 saw BFA acquired as a private joint stock company with a value of USD16 million. In addition, the company is recognized among firms that were first licensed by the regulator and obtained advisory, management and custody licenses in early 2003 (Bakheet).

Among other services, BIG is actively involved in serving its clients with a wide range of information that is necessary. Through an impartial and transparent system, the company identifies stocks for a given company based on detailed synthesis of basic fundamentals. Moreover, the company has a well nurtured track record, spanning over ten years in active business participation (Bakheet).

As a result, BIG is credited for serving as a fund manager advisor to a host of mutual funds, covering local and international markets. By the fact that most of these funds were successful, BIG was compelled to establish its own funds to serve trusted customers.

For BIG to thrive in such a competitive financial world, it must have had a strong foundation that has enabled it to outshine its rivals. For over twelve years, BIG has concentrated on developing its team of professionals, which focuses on major concerns of the company like management of assets, research and equity management in Saudi Arabia (Bakheet).

Additionally, the company has built a stable and distinct financial propriety database, which turned out to become its major tool in advancing its agenda in Saudis financial market. In its long-term strategies, BIG is determined to continuously offer its professional support to the investment community through regular analysis of the market. This is viewed by the management as its principal goal in advancing awareness level throughout the investors’ community in the country.

Based on the sentiments echoed by the company’s leadership such as Khalid AlSaeed, it is doubtless that BIG has a bigger target and vision compared to what it has done before, since its birth in 1994. Khalid noted that the company was at its initial stage of initiating a more advanced funds program to cater for the needs of ever-increasing number of customers in the country (Bakheet).

In so doing, the fund is equally committed towards improving value-added services and products by outshining main performers and competitors in the market with its reduced degree of risk. Besides this ambitious objective conceived by the management, BIG values its investments in the country’s equity market. To compete favorably, it is aware of the impact of the fees charged for service delivery (Bakheet).

Through Khalid AlSaeed, the company believes that 1.5% fee charged annually is quite competitive compared to the fees charged by different funds. This is the only known fee as clients are excluded from a subscription fee (Bakheet). The aspect of daily valuation adopted by the company is quite beneficial and attractive since it gives its subscribers daily chances of either redemption or subscription.

Above all, the success of BIG’s fund is attributed to its adherence to Sharia law and supervision. This ensures that standards and practices of the company fall within the definitive boundaries of the country’s supreme law.

The cost of launching the fund stands at SAR 1 per unit, payable during subscription time alone. The eligibility of the fund recognizes all Saudi residents and citizens together with all GCC citizens (Ramady 149). Lastly, it is essential to note that the company’s management committee agreed on SAR 100,000 as minimum subscription fee for first-timers (Bakheet).

Brokerage trends in Saudi Arabia

The performance of brokerage firms for the last decade can be used to establish some of the problems facing these companies. This trend has been influenced by a host of factors as discussed below.

Before 2006, most brokerage firms in Saudi Arabia were performing well; they registered high subscription from clients, who were willing invest (Trading Economics). This was attributed to a number of factors. The first was stable economic growth that the country was experiencing, emanating from government support in taming inflation and attractive oil prices for export.

This meant that most people had “spare” or “idle” money that was readily available for investing in the brokerage market (Oxford Business Group 73). By the fact that food, housing and other basic needs were affordable, citizens were easily convinced to invest in the brokerage market; they had hope in the future of the firms based on the economic performance at the moment. The graph below illustrates market trend before 2006:

However, after 2006, the booming business in the brokerage market diminished significantly. Most firms registered a down turn performance, with inevitable loses. During this time, the inflation rate of the country was not as low as in the previous period. Additionally, consumer prices rose by 1.1%, which meant that most citizens were willing to spend on essential products than investing with brokerage firms (Trading Economics).

This was evident through low subscription from the public. Furthermore, 2006 was getting closer to 2007, the time when the world was hit by a financial crisis. The down turn performance of these firms can be attributed to the early effects of the crisis as citizens lost the hope to invest (Ramady 149). The graph below illustrates market trend after 2006:

Between 2008 and 2010, the market dwelt in the stagnation phase, in which no profit was made by these brokerage firms as others opted to pull out of the business. This was the peak of the global financial crisis, which attracted severe effects to almost every economy in the world.

The most hit sector was finance as governments initiated programs to mitigate the effects of the crisis, which were looming (Ramady 149). Due to this, prices of consumable products were too high that people lacked the cash and trust to invest in the brokerage industry. Besides inflation, which was triggered by global economic crisis, regulations and rules significantly affected the sector.

Saudis Capital Market Legislation gives guidance in the entire financial market. In other words, it defines the terms under which business has to be done, depending on existing circumstances like economic growth and inflation (Ramady 149). By the fact the country was counteracting financial effects of the crisis, there was need to tighten some clauses within the financial market.

Restrictions on the mode of operating, high taxes and lack of enough support for the firms, worked against their good performance. The Saudi Market Authorities also moved in to regulate fees charged by brokerage firms. The regulations also limited the opportunities for foreign investors to explore the Saudi market at the peak of the Global Financial Crisis (Ramady 149).

Despite the existence of new rules that were introduced by authorities, they were not strong enough to win the trust of investors; they lost hope in both brokerage firms and the entire financial market. As a result, some of the firms pulled out of the market due to stringent and unfavorable rules and conditions that were being precipitated by the financial crisis around the world.

Like other countries around the world, Saudi Arabia managed to tame the effects of the crisis through regulation of market as a way of guarding against external and internal loopholes that may have exposed the country to detrimental financial effects (AME Info). This renewed the hope of citizens, who got convinced that the market was getting better and safe for investments.

Consequently, a number of firms have reestablished to serve hopeful citizens in the market. With manageable levels of inflation and affordable consumer prices, there is hope for Saudis brokerage firms (Hertog 28). From the above analysis, it is clear that brokerage firms have experienced a series of challenges in the last decade, which immensely affected their overall performance.

Works Cited

AME Info. “Saudi Arabia: Economic boom set to continue.” AME Info, 2006. Web.

Bakheet. “Bakheet Saudi Trading Equity Fund.” Bakheet Investment Group, 2007. Web.

Hertog, Steffen. Princes, brokers, and bureaucrats: oil and the state in Saudi Arabia. New York, NY: Cornell University Press, 2010. Print.

Oxford Business Group. The report: Emerging Saudi Arabia. London: Oxford Business Group, 2010. Print.

Ramady, Mohamed. The Saudi Arabian Economy: Policies, Achievements, and Challenges. New York, NY: Springer. Print.

Trading Economics. “Saudi Arabia Stock Market.” Trading Economics, 2012. Web.