Budget analysis is vital for governments to realize the sources of income and expenditures during a fiscal year. While budgets are evaluated annually, the assessment of trends throughout several years may be ignored. The absence of such an analysis may lead to a failure to recognize internal and external opportunities and challenges. The present report evaluates the past three years of the income distribution of Floyd counties and offers suggestions about possible improvements.

Trends in Revenue Sources and Balances

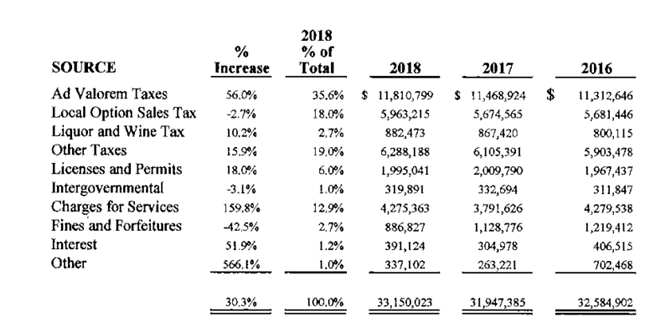

The city of Rome’s government managed to keep a balanced budget during the previous three years with no debt. According to Figure 1, the primary income sources of the city during the three years were Ad Valorem Tax and Local Option Sales Tax, which are attributed to more than 50% of the government’s annual income. At the same time, intergovernmental income and interest are secondary sources of revenue.

The yearly income surpluses the expenditures by more than $1.5 million yearly (Governments of Floyd County and City of Rome, GA., 2019); therefore, the government experiences no shortages in funds and gradually increases its revenues from the bank deposits. The income from all the sources is growing steadily, with the most significant increase in charges and services revenues. At the same time, the income from fines and forfeitures is decreasing, especially if compared to the years before 2016 (Governments of Floyd County, 2019). In short, the analysis demonstrates that the government executes a long-term budgeting strategy that helps the city avoid loans, increase the income from deposits, and save money for future unexpected expenditures.

Ethical Practices

The government of the city of Rome ensures that all the financial policies on taxes, fees, and charges adhere to ethical standards. First, the government discloses all the financial information and reasoning for changes in taxation (City Commission, 2019). Second, the government makes sure to diversify its sources of income in order to prevent the citizens from being overburdened by taxes (City Commission, 2019). Third, the city has set a cap on several taxes in order to avoid exploitation (City Commission, 2019). In short, the adopted policies ensure accountability and openness.

Opportunities and Challenges of Revenue Sources

While the budgeting strategy is adequate, there are several opportunities to improve the outcomes. First, the city can increase liquor and wine tax since the policy can increase the income and decrease the amount of alcohol consumed by citizens. Second, the city can benefit from intergovernmental revenues by offering police and fire department services to the neighboring counties. At the same time, there may be challenges the city will face in the future due to the increase in charges for services. The public may be dissatisfied with the practice. In short, their areas of improvement for the government to ensure the stability of the budgeting strategy.

Conclusion

Historical perspective on budget analysis is of extreme importance for local governments to appreciate the threats and opportunities of the employed practices. The city of Rome has a robust financial policy concerning fees and taxes that helps to ensure a balanced budget. The income from the majority of sources is growing in accordance with the changes in expenditures. The government remains accountable and open by employing practices adherent to ethical standards. While the budgeting strategy is adequate, there are several opportunities and challenges.

References

City Commission. (2019). Code of the city of Rome. Web.

Governments of Floyd County and City of Rome, GA. (2019). Trends. Web.