Introduction

Budgets are made to predict the amount of usage and income that a company is likely to get after putting some resources into projects within a certain period of a year; the futuristic approach leads to variances between the budgeted amount and the actual outcome from the process, department, or activity (Ray, Eric, Brewer, 2009).

Variances may be favorable (which means that the company has done better than the management had expected), or they can be unfavorable, which means that the company has operated at a rate worse than the expected rate. The analysis of variance offers a rich ground through which the management improves operational efficiency and effectiveness. When favorable, the management should be careful and take advantage of the situation to outdo their competitors and improve the situation further. When unfavorable, it indicates high inefficiency rates in either the planners or the actual doing of activities (Horngren, 2009). This paper uses HP Company as a sample company to illustrate the most common variances within manufacturing companies and their possible sources.

Variable costs variances

Variable cost budgets are made to predict the costs expected to be incurred when producing a certain commodity. Under production costs, numerous cost heads can be used to interpolate cost variances, for example:

In the manufacture of laptops, the management of HP had the following budget for the quarter of October, November, and December 2010:

Interpolating the above hypothetical information, the company used more direct labor and direct materials than anticipated or the standard acceptable form. The variances can be interpolated as a percentage as follows:

Direct labor variance = Amount used less budgeted amount/budgeted amount *100 = 200/4000*100 = 5 % (since the actual amount was higher than the budgeted amount, the variance is unfavorable).

Direct material variance = (Amount of materials used less amount of budgeted materials)/Budgeted materials*100 =200/4000*100 = 5 % (since the actual amount was higher than the budgeted amount, then the variance is unfavorable).

Variable production costs overheads variance = amount of materials used less amount of budgeted materials)/Budgeted materials*100 = -300/3000*100 = 10% (since the amount of actual usage is lower than the amount budgeted, the variance is favorable)

Variances are used to understand or interpolate a company’s efficiency rate within a certain period of time; in the above situation, the management should look into the issues that have led to the variance (Jawahar, 2008).

Possible reasons for Variable cost variances

Unfavorable variances within an organization are more likely to be caused by internal inefficient structures where the management fails to procure quality materials and maintain inefficient employees or machinery. The main cause comes since what the management had anticipated, being the situation at an ideal situation fails to be the case. For instance in the case that the management had thought that one unit of labour can be used to make a unit product, however, due to inefficiency or misinformation or lack of experience of the employee the unit does not happen, then there is an outright variance. Even though every business would rather have favorable variances, unfavorable variances are also crucial as an eye opened that the management needs to be doing something more than it is currently doing. They should be taken positively and focus be on improving them rather than condemning that they have occurred (Jiambalvo, 2007)

Favourable variances show efficiency within an organisation, they are caused by having highly trained human capital and procuring materials from quality stokers. Despite the positive show of activities, favourable variances can also show management inefficiency in setting goals; it can show that the management set very easily attainable goals thus the variance (Warren, James and Duchac, 2008).

To remedy variances, management accountants should be at the forefront advising on all aspects of budgeting as well as procuring of commodities; they should ensure that procured products are from reputable organisations and firms to ensure that there is minimal wastage and employees are competent with their tasks. On the other hand, the set goals need to be realistic and attainable; there is a need to match resources, the set goals, the human capital as well as the experience that the organisation have in relation to a certain production (Maher, Stickney and Roman, 2006).

Sales variances

Sales budgets may have some variances either favourable or unfavourable to a company; when favourable it means the company has recorded higher sales than it had predicted, on the other hand, when the sales variance is unfavourable, then the sales recorded are lower than the expected sales. Let’s consider the following hypothetical sales budget case for HP in the quarter of October, November, and December 2010:

The above illustration shows that the company recorded a sale that was lower than the rate that had been predicted or budgeted for; the sales variance in percentage form is:

Sales variance = Actual sales less amount Budgeted/ Amount budgeted = 50000/300000*100 = 16.67%

Since the actual sales are lower than the budgeted sales, then the company has failed to attain its sales expectations thus the variance is negative or unfavourable.

Operating statement that addresses the variances stated above

The above interpolation of the operating statement shows the effect that the variances have on the operation level of the company; it can be seen that the need effect as a result of the variances has been 590,000 currency loss.

There are a number of reasons that might be attributed to the difference and the deficit, they include unrealistic objectives, goals, and expectations as well lack of adequate support from the management to attain the set goals (Don and Mowen, 2006).

Line manager’s report and recommendations

The variances reported are likely to result in losses in the company, the management can improve future compliance rates by intervening in the system as a whole. The following are the best approach that the company can make:

Divisionalization

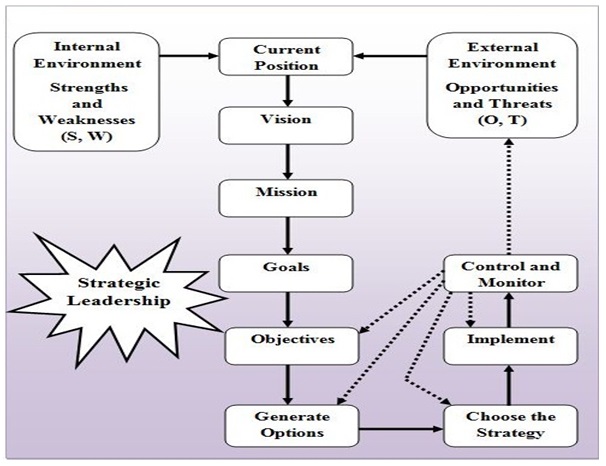

The management should involve expatriates when setting goals and targets; the set targets should be attainable but should not be attained without making use of the company’s strength. The best way to come up with the right standards to follow is using persons who are familiar with the operations of the company as they can make informed decisions than central management who are not fully acquainted with the system. Other than engaging divisional managers in setting targets, they should be allowed greater freedom to make their works encouraging and promote invention and innovativeness. When divisionalization is attained, the company will be able to hold managers responsible for variances that might occur in their areas of management (Weygandt, Kimmel and Kieso,2009). With the new form of coming up with budgetary figures, the management should hold weekly or monthly basis meetings where they discuss any case of disparities; this will allow the management in minimizing budget variances (please see picture below for sample strategic management model that can assist reduce variances).

Engage employees in training and development courses

The management should embark on staff training to improve their experiences and expertise in their areas of deployment; when staffs competence is enhanced further efficiency and effectiveness will be enhanced. The wages that the company pays its employees should be checked to ensure that they are not lower or higher than the prescribed rate (Carter, 2005).

Working on the psychological part of employment is crucial, this is where the management focuses on ensuring that employees are comfortable with the organisation enhancing the development of high motivation; with morale and motivation, the company will be able to grow innovation and invention to its benefit.

Adopt management by exemption approach

The management has the task of ensuring that the actual performance of the firm works per the expected rate; they need to make policies that can assist in the attainment of the set standards. Management by the exemption is a management style where the managers concentrate on focusing on addressing those areas with a high deficit; in the case that there are areas that seem to be working smoothly, then the management should not give much concentration. The focus should be on areas of high deficiencies. The set strategies should be able to foresee chances of deficiencies and interpolate them in absolute size and percentage terms (Bragg, 2001).

Conclusion

Budgets are management tools that interpolate the relationship between the planned and actual expenditure and the income derived from a business engagement. When there is a variance between what has been expected and what has transpired, the management should interpolate the variance and seek possible solutions. When making business operational budgets, companies should seek expert assistance to set goals, targets, and expectations; this enhances setting attainable goals with the available resources.

References

Bragg, M.(2001).Cost accounting: a comprehensive guide. New York: John Wiley and Sons.

Carter, K. (2005). Cost Accounting. New Jersey: Cengage Learning.

Don, R. and Mowen, M. (2006). Managerial Accounting. New Jersey: Cengage Learning.

Horngren, T. (2009). Cost accounting: a managerial emphasis. Pearson Prentice Hall.

Jawahar, L. (2008). Cost Accounting. New Jersey: Tata McGraw-Hill Education.

Jiambalvo, J. (2007). Managerial Accounting. New York: John Wiley and Sons.

Maher, M., Stickney, P. and Roman, L. (2006). Managerial accounting: an introduction to concepts, methods, and uses. New Jersey: Cengage Learning.

Ray, H., Eric, W., Brewer, P.(2009). Managerial Accounting London: McGraw-Hill/Irwin.

Warren, C., James, M. and Duchac, J.(2008). Managerial Accounting. New Jersey: Cengage Learning.

Weygandt, J., Kimmel, P. and Kieso, D. (2009). Managerial Accounting: Tools for Business Decision Making. New York: John Wiley and Sons.